FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For

June 20, 2024

Commission

File Number: 001-10306

NatWest

Group plc

Gogarburn,

PO Box 1000

Edinburgh

EH12 1HQ

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F

___

Indicate

by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ___

No X

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82-

________

The following information was issued as Company announcements

in London, England and is furnished pursuant to General Instruction

B to the General Instructions to Form

6-K:

20 June

2024

Purchase of Sainsbury's Bank assets & liabilities

Natwest Group plc ("NatWest Group") today announces that it has

entered into an agreement with Sainsbury's Bank plc ("Sainsbury's

Bank") to acquire the retail banking assets and liabilities of

Sainsbury's Bank which comprises its outstanding credit card,

unsecured personal loan and saving accounts.

NatWest Group expects to acquire approximately £2.5 billion of

gross customer assets, comprising £1.4 billion of unsecured

personal loans and £1.1 billion of credit cards balances,

together with approximately £2.6 billion of customer

deposits.

As part of the transaction NatWest Group also expects to add around

one million customer accounts.

Paul Thwaite, NatWest Group CEO, commented:

"Following today's announcement, we look forward to welcoming

new customers to NatWest Group, where they will benefit from our

expertise and award-winning digital banking offering. This

transaction is a great opportunity to accelerate the growth of our

Retail Banking business at attractive returns, in line with our

strategic priorities. As well as a complementary customer base, the

transaction is expected to add scale to our credit card and

unsecured personal lending business within existing risk

appetite. NatWest Group has a

strong track record of successful integration, and we are focussed

on ensuring a smooth transition for customers."

Simon Roberts, Sainsbury's CEO, commented:

"I am pleased to be announcing this news today. NatWest's values

and customer focus are a close fit with ours and as one of the UK's

leading banks, NatWest's scale and financial services expertise

will ensure our existing financial services customers continue to

be well looked after. There will be no immediate change for our

bank customers as a result of this announcement. Today's news means

we will focus all our time and resources going forward on growing

our core retail business, delivering great quality and value, week

in week out."

This transaction is expected to have a 20 basis point impact on

NatWest Group's CET1 ratio upon completion and be EPS and RoTE

accretive upon completion.

Additional information

●

NatWest

Group is entering into this transaction through its subsidiary,

National Westminster Bank plc.

●

The

transaction will be effected through a banking business transfer

under Part VII of the Financial Services and Markets Act

2000.

●

Completion

of the transaction is conditional on court sanction and regulatory

approval or non-objection. Before completion, customary completion

matters are due to be finalised, including a transitional services

agreement. Subject to this, completion is expected to occur during

the first half of 2025.

●

The

operational infrastructure and commission income businesses of

Sainsbury's Bank including ATMs, insurance and travel money are not

included in this transaction. Argos Financial Services is also not

included in this transaction perimeter.

●

Forecast

balance sheet and account values disclosed are at completion which

is assumed to be 31 March 2025. Under the terms of the

transaction, the gross customer assets and liabilities and

associated cash at completion will transfer to NatWest Group and an

agreed £125M consideration will be payable from Sainsbury's

Bank to NatWest Group. The forecast utilises values which are based

on management information provided by Sainsbury's Bank. Actual

gross customer assets, balances and customer accounts to be

acquired may vary at completion. The final consideration will

reflect the value of assets and liabilities transferred at

completion of the transaction and will be subject to certain

customary adjustments.

●

There

is no immediate change for our new customers and they will be

contacted in due course.

Further information

Investor Relations: + 44 (0)207 672 1758

Media Relations: + 44 (0)131 523 4205

Legal Entity Identifiers

NatWest Group plc: 2138005O9XJIJN4JPN90

National Westminster Bank plc: 213800IBT39XQ9C4CP71

Caution about forward-looking statements

This document contains forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, such as statements that include, without limitation,

the words 'expect', 'estimate', 'project', 'anticipate', 'commit',

'believe', 'should', 'intend', 'will', 'plan', 'could',

'probability', 'risk', EPS (earnings per share) and ROTE (return on

tangible equity), 'target', 'goal', 'objective', 'may',

'endeavour', 'outlook', 'optimistic', 'prospects' and similar

expressions or variations on these expressions. These statements

concern or may affect future matters, such as NatWest Group's

future economic results, business plans and strategies. In

particular, this document includes forward-looking statements

relating to (a) the expected or estimated impact of the acquisition

on NatWest Group, including the number of customer accounts, gross

customer assets, loan, credit card and deposit balances to be

acquired by NatWest Group at expected completion of the

acquisition, the expected impact on Natwest Group's CET 1 ratio

and expectations that the acquisition will be EPS and ROTE

accretive for NatWest Group or (b) NatWest Group in respect

of, but not limited to its economic and political risks, its

financial position, profitability and financial performance

(including financial, capital, cost savings and operational

targets), the implementation of its strategy, its climate and

sustainability-related targets, increasing competition from

incumbents, challengers and new entrants and disruptive

technologies, its access to adequate sources of liquidity and

funding, its regulatory capital position and related requirements,

its exposure to third party risks, its ongoing compliance with the

UK ring-fencing regime and ensuring operational continuity in

resolution, its impairment losses and credit exposures under

certain specified scenarios, substantial regulation and oversight,

ongoing legal, regulatory and governmental actions and

investigations, and NatWest Group's exposure to operational risk,

conduct risk, cyber, data and IT risk, financial crime risk, key

person risk and credit rating risk. Forward-looking statements are

subject to a number of risks and uncertainties that might cause

actual results and performance to differ materially from any

expected future results or performance expressed or implied by the

forward-looking statements. Factors that could cause or contribute

to differences in current expectations include, but are not limited

to, future growth initiatives (including acquisitions, joint

ventures and strategic partnerships), the outcome of legal,

regulatory and governmental actions, processes and investigations,

the level and extent of future impairments and write-downs,

legislative, political, fiscal and regulatory developments,

accounting standards, competitive conditions, technological

developments, interest and exchange rate fluctuations, general

economic and political conditions and the impact of climate-related

risks and the transitioning to a net zero economy. These and other

factors, risks and uncertainties that may impact any

forward-looking statement are discussed in NatWest Group's 2023

Annual Report on Form 20-F, NatWest Group's Interim Management

Statement for Q1 2024 on Form 6-K, and its other public filings.

The forward-looking statements contained in this document speak

only as of the date of this document and NatWest Group does not

assume or undertake any obligation or responsibility to update any

of the forward-looking statements contained in this document,

whether as a result of new information, future events or otherwise,

except to the extent legally required.

Date: 20

June 2024

|

|

NATWEST

GROUP plc (Registrant)

|

|

|

|

|

|

By: /s/

Jan Cargill

|

|

|

|

|

|

Name:

Jan Cargill

|

|

|

Title:

Chief Governance Officer and Company Secretary

|

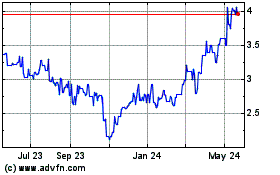

NatWest (PK) (USOTC:RBSPF)

Historical Stock Chart

From May 2024 to Jun 2024

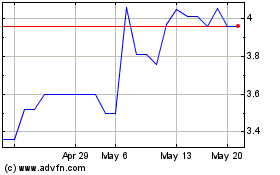

NatWest (PK) (USOTC:RBSPF)

Historical Stock Chart

From Jun 2023 to Jun 2024