UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date: 30 June 2023

Commission File Number: 001-14958

NATIONAL GRID plc

(Translation

of registrant’s name into English)

England and Wales

(Jurisdiction

of Incorporation)

1-3 Strand, London, WC2N 5EH, United Kingdom

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

☒ Form 20-F ☐ Form 40-F

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule

101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule

101(b)(7): ☐

Indicate

by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3- 2(b) under the Securities

Exchange Act of 1934. ☐ Yes ☒ No

If

“Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b):

n/a

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

99.1

|

Exhibit

99.1 Announcement sent to the London Stock Exchange on 01 June

2023 —

Total Voting Rights

|

|

99.2

|

Exhibit

99.2 Announcement sent to the London Stock Exchange on 05 June

2023 —

Director/PDMR Shareholding

|

|

99.3

|

Exhibit

99.3 Announcement sent to the London Stock Exchange on 05 June

2023 —

Holding(s) in Company

|

|

99.4

|

Exhibit

99.4 Announcement sent to the London Stock Exchange on 06 June

2023 —

Holding(s) in Company

|

|

99.5

|

Exhibit

99.5 Announcement sent to the London Stock Exchange on 07 June

2023 —

Holding(s) in Company

|

|

99.6

|

Exhibit

99.6 Announcement sent to the London Stock Exchange on 08 June

2023 —

Director/PDMR Shareholding

|

|

99.7

|

Exhibit

99.7 Announcement sent to the London Stock Exchange on 08 June

2023 —

Scrip Dividend for 2022/23 Final Dividend

|

|

99.8

|

Exhibit

99.8 Announcement sent to the London Stock Exchange on 09 June

2023 —

Director/PDMR Shareholding

|

|

99.9

|

Exhibit

99.9 Announcement sent to the London Stock Exchange on 16 June

2023 —

Director/PDMR Shareholding

|

Exhibit

99.1

1 June 2023

National Grid plc ('National

Grid' or 'Company')

Voting Rights update

National Grid's registered capital as of 31 May 2023 consisted

of 3,930,371,661 ordinary shares, of which, 252,094,533 were

held as treasury shares; leaving a balance of 3,678,277,128 with

voting rights.

The figure of 3,678,277,128 may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to

notify their interest in, or a change to their interest in,

National Grid under the FCA's Disclosure Guidance and Transparency

Rules.

Pritti Patel

General Counsel, Corporate and Deputy Company

Secretary

Exhibit

99.2

5 June 2023

National Grid plc ('National

Grid' or 'Company')

Notification of Transaction of Person Discharging Managerial

Responsibilities ('PDMR')

This announcement is made in accordance with Article

19 of

the Market Abuse Regulation ('MAR') and relates to the National

Grid US Employee Stock Purchase Plan ('ESPP') monthly purchase on

behalf of a PDMR. The relevant FCA notification is set out

below.

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Adriana

Karaboutis

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

Information and Digital Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

American Depository Shares

US 6362744095

|

|

b)

|

Nature of the transaction

|

Monthly purchase of securities under the National Grid US Employee

Stock Purchase Plan

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

$56.870930

|

34.846449

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.02

|

|

f)

|

Place of the transaction

|

Outside

a trading venue

|

Exhibit

99.3

5 June 2023

National Grid plc ('National

Grid' or 'Company')

Notification of Major Interest in National Grid Ordinary

Shares

National Grid has received a notification on Form TR-1 from Bank of

America Corporation that its total interest in National Grid voting

ordinary shares is as shown below.

TR-1: Standard form for notification of major holdings

1. Issuer Details

ISIN

Issuer Name

UK or Non-UK Issuer

2. Reason for Notification

|

An acquisition or disposal of voting rights; An acquisition or

disposal of financial instruments

|

3. Details of person subject to the notification

obligation

Name

|

Bank of America Corporation

|

City of registered office (if applicable)

Country of registered office (if applicable)

4. Details of the shareholder

|

Name

|

City

of registered office

|

Country

of registered office

|

|

Merrill

Lynch International

|

London

|

United

Kingdom

|

5. Date on which the threshold was crossed or reached

6. Date on which Issuer notified

7. Total positions of person(s) subject to the notification

obligation

|

|

%

of voting rights attached to shares (total of 8.A)

|

%

of voting rights through financial instruments (total of 8.B 1 +

8.B 2)

|

Total

of both in % (8.A + 8.B)

|

Total

number of voting rights held in issuer

|

|

Resulting situation

on the date on which threshold was crossed or reached

|

3.592377

|

3.274687

|

6.867064

|

252589720

|

|

Position of

previous notification (if applicable)

|

|

|

|

|

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reached

8A. Voting rights attached to shares

|

Class/Type of shares ISIN code(if possible)

|

Number of direct voting rights (DTR5.1)

|

Number of indirect voting rights (DTR5.2.1)

|

% of direct voting rights (DTR5.1)

|

% of indirect voting rights (DTR5.2.1)

|

|

GB00BDR05C01

|

|

113909919

|

|

3.096828

|

|

US6362744095

|

|

18227657

|

|

0.495549

|

|

Sub

Total 8.A

|

132137576

|

3.592377%

|

8B1. Financial Instruments according to (DTR5.3.1R.(1)

(a))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Number of voting rights that may be acquired if the instrument is

exercised/converted

|

% of voting rights

|

|

Right

to Recall

|

N/A

|

N/A

|

1387794

|

0.037729

|

|

Physical Put

Option

|

16/06/2023

|

N/A

|

385000

|

0.010467

|

|

Sub

Total 8.B1

|

|

1772794

|

0.048196%

|

8B2. Financial Instruments with similar economic effect according

to (DTR5.3.1R.(1) (b))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Physical or cash settlement

|

Number of voting rights

|

% of voting rights

|

|

Swaps

|

13/06/2023

|

N/A

|

Cash

|

135108

|

0.003673

|

|

Swaps

|

10/07/2023

|

N/A

|

Cash

|

26381

|

0.000717

|

|

Swaps

|

17/07/2023

|

N/A

|

Cash

|

32231

|

0.000876

|

|

Swaps

|

29/09/2023

|

N/A

|

Cash

|

24992

|

0.000679

|

|

Swaps

|

30/11/2023

|

N/A

|

Cash

|

38822

|

0.001055

|

|

Swaps

|

15/02/2024

|

N/A

|

Cash

|

49988

|

0.001359

|

|

Swaps

|

01/03/2024

|

N/A

|

Cash

|

5733554

|

0.155876

|

|

Swaps

|

17/04/2024

|

N/A

|

Cash

|

250000

|

0.006797

|

|

Swaps

|

17/05/2024

|

N/A

|

Cash

|

3729

|

0.000101

|

|

Swaps

|

31/05/2024

|

N/A

|

Cash

|

63001707

|

1.712805

|

|

Swaps

|

24/06/2024

|

N/A

|

Cash

|

17684

|

0.000481

|

|

Swaps

|

25/06/2024

|

N/A

|

Cash

|

1675

|

0.000046

|

|

Swaps

|

26/06/2024

|

N/A

|

Cash

|

1170

|

0.000032

|

|

Swaps

|

31/07/2024

|

N/A

|

Cash

|

3475622

|

0.094490

|

|

Swaps

|

08/08/2024

|

N/A

|

Cash

|

143171

|

0.003892

|

|

Swaps

|

30/08/2024

|

N/A

|

Cash

|

116170

|

0.003158

|

|

Swaps

|

18/11/2024

|

N/A

|

Cash

|

2015331

|

0.054790

|

|

Swaps

|

22/11/2024

|

N/A

|

Cash

|

11500000

|

0.312646

|

|

Swaps

|

25/11/2024

|

N/A

|

Cash

|

24000000

|

0.652479

|

|

Swaps

|

29/11/2024

|

N/A

|

Cash

|

2878967

|

0.078269

|

|

Swaps

|

12/12/2024

|

N/A

|

Cash

|

11280

|

0.000307

|

|

Swaps

|

25/02/2025

|

N/A

|

Cash

|

754189

|

0.020504

|

|

Swaps

|

02/05/2025

|

N/A

|

Cash

|

1150

|

0.000031

|

|

Swaps

|

06/05/2025

|

N/A

|

Cash

|

198216

|

0.005389

|

|

Swaps

|

16/03/2026

|

N/A

|

Cash

|

1566829

|

0.042597

|

|

Swaps

|

18/03/2026

|

N/A

|

Cash

|

56823

|

0.001545

|

|

Swaps

|

26/05/2026

|

N/A

|

Cash

|

1006898

|

0.027374

|

|

Swaps

|

15/09/2027

|

N/A

|

Cash

|

5247

|

0.000143

|

|

Swaps

|

15/12/2027

|

N/A

|

Cash

|

470

|

0.000013

|

|

Swaps

|

15/02/2028

|

N/A

|

Cash

|

238946

|

0.006496

|

|

Equity

Options

|

15/12/2023

|

N/A

|

Cash

|

650000

|

0.017671

|

|

Equity

Options

|

21/07/2023

|

N/A

|

Cash

|

743000

|

0.020200

|

|

Sub

Total 8.B2

|

|

118679350

|

3.226491%

|

9. Information in relation to the person subject to the

notification obligation

|

2. Full chain of controlled undertakings through which the voting

rights and/or the financial instruments are effectively held

starting with the ultimate controlling natural person or legal

entities (please add additional rows as necessary)

|

|

Ultimate controlling person

|

Name of controlled undertaking

|

% of voting rights if it equals or is higher than the notifiable

threshold

|

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable

threshold

|

|

Bank of

America Corporation

|

Bank of

America, NA

|

|

|

|

|

Bank of

America Corporation

|

BofA

Securities, Inc.

|

|

|

|

|

Bank of

America Corporation

|

BofA

Securities Europe, SA

|

|

|

|

|

Bank of

America Corporation

|

Managed

Account Advisors, LLC

|

|

|

|

|

Bank of

America Corporation

|

Merrill

Lynch International

|

3.072269

|

3.104430

|

6.176700%

|

|

Bank of

America Corporation

|

Merrill

Lynch, Pierce, Fenner & Smith Inc.

|

|

|

|

|

Bank of

America Corporation

|

U.S.

Trust Co of Delaware

|

|

|

|

10. In case of proxy voting

Name of the proxy holder

The number and % of voting rights held

The date until which the voting rights will be held

11. Additional Information

12. Date of Completion

13. Place Of Completion

This notice is in compliance with National Grid's obligations under

the Disclosure and Transparency Rules.

Pritti Patel

General Counsel, Corporate and Deputy Company

Secretary

Exhibit

99.4

6 June 2023

National Grid plc ('National

Grid' or 'Company')

Notification of Major Interest in National Grid Ordinary

Shares

National Grid has received a notification on Form TR-1 from

BlackRock, Inc. that its total interest in National Grid voting

ordinary shares is as shown below.

TR-1: Standard form for notification of major holdings

1. Issuer Details

ISIN

Issuer Name

UK

or Non-UK Issuer

2. Reason for Notification

|

An acquisition or disposal of voting rights

|

3. Details of person subject to the notification

obligation

Name

City of registered office (if applicable)

Country of registered office (if applicable)

4. Details of the shareholder

Full name of shareholder(s) if different from the person(s) subject

to the notification obligation, above

City of registered office (if applicable)

Country of registered office (if applicable)

5. Date on which the threshold was crossed or reached

6. Date on which Issuer notified

7. Total positions of person(s) subject to the notification

obligation

|

|

%

of voting rights attached to shares (total of 8.A)

|

%

of voting rights through financial instruments (total of 8.B 1 +

8.B 2)

|

Total

of both in % (8.A + 8.B)

|

Total

number of voting rights held in issuer

|

|

Resulting situation

on the date on which threshold was crossed or reached

|

6.370000

|

0.930000

|

7.300000

|

269485379

|

|

Position of

previous notification (if applicable)

|

4.190000

|

3.030000

|

7.220000

|

|

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reached

8A. Voting rights attached to shares

|

Class/Type of shares ISIN code(if possible)

|

Number of direct voting rights (DTR5.1)

|

Number of indirect voting rights (DTR5.2.1)

|

% of direct voting rights (DTR5.1)

|

% of indirect voting rights (DTR5.2.1)

|

|

GB00BDR05C01

|

|

234665239

|

|

6.370000

|

|

Sub

Total 8.A

|

234665239

|

6.370000%

|

8B1. Financial Instruments according to (DTR5.3.1R.(1)

(a))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Number of voting rights that may be acquired if the instrument is

exercised/converted

|

% of voting rights

|

|

American Depository

Receipt

|

|

|

2841507

|

0.070000

|

|

Securities

Lending

|

|

|

31546128

|

0.850000

|

|

Sub

Total 8.B1

|

|

34387635

|

0.920000%

|

8B2. Financial Instruments with similar economic effect according

to (DTR5.3.1R.(1) (b))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Physical or cash settlement

|

Number of voting rights

|

% of voting rights

|

|

CFD

|

|

|

Cash

|

432505

|

0.010000

|

|

Sub

Total 8.B2

|

|

432505

|

0.010000%

|

9. Information in relation to the person subject to the

notification obligation

2. Full chain of controlled undertakings through which the voting

rights and/or the financial instruments are effectively held

starting with the ultimate controlling natural person or legal

entities (please add additional rows as necessary)

|

Ultimate controlling person

|

Name of controlled undertaking

|

% of voting rights if it equals or is higher than the notifiable

threshold

|

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable

threshold

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock

(Singapore) Holdco Pte. Ltd.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock HK Holdco

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock Lux Finco

S.a.r.l.

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock Japan

Holdings GK

|

|

|

|

|

BlackRock, Inc.

(Chain 1)

|

BlackRock Japan

Co., Ltd.

|

|

|

|

|

BlackRock, Inc.

(Chain 2)

|

Trident

Merger, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 2)

|

BlackRock

Investment Management, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Holdco 3,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Cayman 1

LP

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Cayman

West Bay Finco Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Cayman

West Bay IV Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Group

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock Finance

Europe Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 3)

|

BlackRock

Investment Management (UK) Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BlackRock Australia

Holdco Pty. Ltd.

|

|

|

|

|

BlackRock, Inc.

(Chain 4)

|

BlackRock

Investment Management (Australia) Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Holdco 3,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Cayman 1

LP

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Cayman

West Bay Finco Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Cayman

West Bay IV Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock Group

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 5)

|

BlackRock

International Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock Holdco 4,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock Holdco 6,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock Delaware

Holdings Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 6)

|

BlackRock

Institutional Trust Company, National Association

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Holdco 4,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Holdco 6,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Delaware

Holdings Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 7)

|

BlackRock Fund

Advisors

|

|

|

|

|

BlackRock, Inc.

(Chain 8)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 8)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock

(Singapore) Holdco Pte. Ltd.

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock HK Holdco

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 9)

|

BlackRock Asset

Management North Asia Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Holdco 3,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Cayman 1

LP

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Cayman

West Bay Finco Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Cayman

West Bay IV Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Group

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Finance

Europe Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock

(Netherlands) B.V.

|

|

|

|

|

BlackRock, Inc.

(Chain 10)

|

BlackRock Asset

Management Deutschland AG

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Holdco 3,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Canada

Holdings LP

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Canada

Holdings ULC

|

|

|

|

|

BlackRock, Inc.

(Chain 11)

|

BlackRock Asset

Management Canada Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 12)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 12)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 12)

|

BlackRock Capital

Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 12)

|

BlackRock Advisors,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Holdco 3,

LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Cayman 1

LP

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Cayman

West Bay Finco Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Cayman

West Bay IV Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Group

Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Finance

Europe Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 13)

|

BlackRock Advisors

(UK) Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BlackRock Holdco 2,

Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BlackRock Financial

Management, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BlackRock

International Holdings, Inc.

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BR

Jersey International Holdings L.P.

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BlackRock

(Singapore) Holdco Pte. Ltd.

|

|

|

|

|

BlackRock, Inc.

(Chain 14)

|

BlackRock

(Singapore) Limited

|

|

|

|

|

BlackRock, Inc.

(Chain 15)

|

Trident

Merger, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 15)

|

BlackRock

Investment Management, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 15)

|

Amethyst

Intermediate, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 15)

|

Aperio

Holdings, LLC

|

|

|

|

|

BlackRock, Inc.

(Chain 15)

|

Aperio

Group, LLC

|

|

|

|

10. In case of proxy voting

Name of the proxy holder

The number and % of voting rights held

The date until which the voting rights will be held

11. Additional Information

|

BlackRock Regulatory Threshold Reporting TeamJana Blumenstein020

7743 3650

|

12. Date of Completion

13. Place Of Completion

|

12 Throgmorton Avenue, London, EC2N 2DL, U.K.

|

This notice is in compliance with National Grid's obligations under

the Disclosure and Transparency Rules.

Pritti Patel

General Counsel, Corporate and Deputy Company

Secretary

Exhibit

99.5

7 June 2023

National Grid plc ('National

Grid' or 'Company')

Notification of Major Interest in National Grid Ordinary

Shares

National Grid has received a notification on Form TR-1 from Bank of

America Corporation that its total interest in National Grid voting

ordinary shares is as shown below.

TR-1: Standard form for notification of major holdings

1. Issuer Details

ISIN

Issuer Name

UK or Non-UK Issuer

2. Reason for Notification

|

An acquisition or disposal of voting rights

|

3. Details of person subject to the notification

obligation

Name

|

Bank of America Corporation

|

City of registered office (if applicable)

Country of registered office (if applicable)

4. Details of the shareholder

Full name of shareholder(s) if different from the person(s) subject

to the notification obligation, above

City of registered office (if applicable)

Country of registered office (if applicable)

5. Date on which the threshold was crossed or reached

6. Date on which Issuer notified

7. Total positions of person(s) subject to the notification

obligation

|

|

%

of voting rights attached to shares (total of 8.A)

|

%

of voting rights through financial instruments (total of 8.B 1 +

8.B 2)

|

Total

of both in % (8.A + 8.B)

|

Total

number of voting rights held in issuer

|

|

Resulting situation

on the date on which threshold was crossed or reached

|

2.353862

|

3.536233

|

5.890095

|

216654059

|

|

Position of

previous notification (if applicable)

|

2.550385

|

3.534363

|

6.084748

|

|

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reached

8A. Voting rights attached to shares

|

Class/Type of shares ISIN code(if possible)

|

Number of direct voting rights (DTR5.1)

|

Number of indirect voting rights (DTR5.2.1)

|

% of direct voting rights (DTR5.1)

|

% of indirect voting rights (DTR5.2.1)

|

|

GB00BDR05C01

|

|

67755626

|

|

1.842048

|

|

US6362744095

|

|

18825947

|

|

0.511814

|

|

Sub

Total 8.A

|

86581573

|

2.353862%

|

8B1. Financial Instruments according to (DTR5.3.1R.(1)

(a))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Number of voting rights that may be acquired if the instrument is

exercised/converted

|

% of voting rights

|

|

Right

to Recall

|

N/A

|

N/A

|

411118

|

0.011177

|

|

Physical Call

Options

|

15/12/2023

|

N/A

|

650000

|

0.017671

|

|

Physical Call

Options

|

21/07/2023

|

N/A

|

743000

|

0.020200

|

|

Physical

Swap

|

15/06/2023

|

N/A

|

3068740

|

0.083429

|

|

Sub

Total 8.B1

|

|

4872858

|

0.132477%

|

8B2. Financial Instruments with similar economic effect according

to (DTR5.3.1R.(1) (b))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Physical or cash settlement

|

Number of voting rights

|

% of voting rights

|

|

Swaps

|

29/09/2023

|

N/A

|

Cash

|

24992

|

0.000679

|

|

Swaps

|

01/03/2024

|

N/A

|

Cash

|

2866777

|

0.077938

|

|

Swaps

|

03/06/2024

|

N/A

|

Cash

|

3953630

|

0.107486

|

|

Swaps

|

31/07/2024

|

N/A

|

Cash

|

1576449

|

0.042858

|

|

Swaps

|

02/05/2025

|

N/A

|

Cash

|

526

|

0.000014

|

|

Swaps

|

06/05/2025

|

N/A

|

Cash

|

99108

|

0.002694

|

|

Swaps

|

26/05/2026

|

N/A

|

Cash

|

646598

|

0.017579

|

|

Swaps

|

15/02/2028

|

N/A

|

Cash

|

9598

|

0.000261

|

|

Swaps

|

13/06/2023

|

N/A

|

Cash

|

135108

|

0.003673

|

|

Swaps

|

10/07/2023

|

N/A

|

Cash

|

14474

|

0.000393

|

|

Swaps

|

17/07/2023

|

N/A

|

Cash

|

33193

|

0.000902

|

|

Swaps

|

15/02/2024

|

N/A

|

Cash

|

16696

|

0.000454

|

|

Swaps

|

01/03/2024

|

N/A

|

Cash

|

2866777

|

0.077938

|

|

Swaps

|

17/04/2024

|

N/A

|

Cash

|

250000

|

0.006797

|

|

Swaps

|

31/05/2024

|

N/A

|

Cash

|

62962253

|

1.711732

|

|

Swaps

|

03/06/2024

|

N/A

|

Cash

|

3953630

|

0.107486

|

|

Swaps

|

24/06/2024

|

N/A

|

Cash

|

17684

|

0.000481

|

|

Swaps

|

25/06/2024

|

N/A

|

Cash

|

1675

|

0.000046

|

|

Swaps

|

26/06/2024

|

N/A

|

Cash

|

1835

|

0.000050

|

|

Swaps

|

02/07/2024

|

N/A

|

Cash

|

47121

|

0.001281

|

|

Swaps

|

31/07/2024

|

N/A

|

Cash

|

1748729

|

0.047542

|

|

Swaps

|

08/08/2024

|

N/A

|

Cash

|

143171

|

0.003892

|

|

Swaps

|

30/08/2024

|

N/A

|

Cash

|

114574

|

0.003115

|

|

Swaps

|

18/11/2024

|

N/A

|

Cash

|

1204826

|

0.032755

|

|

Swaps

|

22/11/2024

|

N/A

|

Cash

|

11258988

|

0.306094

|

|

Swaps

|

25/11/2024

|

N/A

|

Cash

|

24000000

|

0.652479

|

|

Swaps

|

29/11/2024

|

N/A

|

Cash

|

2997067

|

0.081480

|

|

Swaps

|

02/12/2024

|

N/A

|

Cash

|

119079

|

0.003237

|

|

Swaps

|

12/12/2024

|

N/A

|

Cash

|

14080

|

0.000383

|

|

Swaps

|

24/01/2025

|

N/A

|

Cash

|

2517

|

0.000068

|

|

Swaps

|

25/02/2025

|

N/A

|

Cash

|

754189

|

0.020504

|

|

Swaps

|

02/05/2025

|

N/A

|

Cash

|

526

|

0.000014

|

|

Swaps

|

06/05/2025

|

N/A

|

Cash

|

99108

|

0.002694

|

|

Swaps

|

07/11/2025

|

N/A

|

Cash

|

256440

|

0.006972

|

|

Swaps

|

06/03/2026

|

N/A

|

Cash

|

62992

|

0.001713

|

|

Swaps

|

16/03/2026

|

N/A

|

Cash

|

1622469

|

0.044109

|

|

Swaps

|

18/03/2026

|

N/A

|

Cash

|

56823

|

0.001545

|

|

Swaps

|

26/05/2026

|

N/A

|

Cash

|

646598

|

0.017579

|

|

Swaps

|

15/09/2027

|

N/A

|

Cash

|

5247

|

0.000143

|

|

Swaps

|

15/12/2027

|

N/A

|

Cash

|

470

|

0.000013

|

|

Swaps

|

15/02/2028

|

N/A

|

Cash

|

205663

|

0.005591

|

|

Physical Put

Option

|

16/06/2023

|

N/A

|

Physical

|

385000

|

0.010467

|

|

Cash

Equity Option

|

21/07/2023

|

N/A

|

Cash

|

13262

|

0.000361

|

|

Cash

Equity Option

|

16/06/2023

|

N/A

|

Cash

|

690

|

0.000019

|

|

Cash

Equity Option

|

18/08/2023

|

N/A

|

Cash

|

8996

|

0.000245

|

|

Sub

Total 8.B2

|

|

125199628

|

3.403756%

|

9. Information in relation to the person subject to the

notification obligation

|

2. Full chain of controlled undertakings through which the voting

rights and/or the financial instruments are effectively held

starting with the ultimate controlling natural person or legal

entities (please add additional rows as necessary)

|

|

Ultimate controlling person

|

Name of controlled undertaking

|

% of voting rights if it equals or is higher than the notifiable

threshold

|

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable

threshold

|

|

Bank of

America Corporation

|

Bank of

America, NA

|

|

|

|

|

Bank of

America Corporation

|

BofA

Securities, Inc.

|

|

|

|

|

Bank of

America Corporation

|

BofA

Securities Europe, SA

|

|

|

|

|

Bank of

America Corporation

|

Managed

Account Advisors, LLC

|

|

|

|

|

Bank of

America Corporation

|

Merrill

Lynch International

|

|

3.215681

|

5.033011%

|

|

Bank of

America Corporation

|

Merrill

Lynch, Pierce, Fenner & Smith Inc.

|

|

|

|

|

Bank of

America Corporation

|

U.S.

Trust Co of Delaware

|

|

|

|

10. In case of proxy voting

Name of the proxy holder

The number and % of voting rights held

The date until which the voting rights will be held

11. Additional Information

12. Date of Completion

13. Place Of Completion

This notice is in compliance with National Grid's obligations under

the Disclosure and Transparency Rules.

Pritti Patel

General Counsel, Corporate and Deputy Company

Secretary

Exhibit

99.6

8 June 2023

National Grid plc ('National

Grid' or 'Company')

Notification of Transaction of Person Discharging Managerial

Responsibilities ('PDMR')

This announcement is made in accordance with Article

19 of

the Market Abuse Regulation ('MAR') and relates to the following

PDMR acquiring shares following the partial vesting of an award

under the Company's Retention Award Plan

('RAP').

This vesting relates to a RAP Award made to the PDMR in June 2022.

The award was conditional on continued employment with the Company

and on the satisfaction of the performance conditions approved by

the Remuneration Committee, which

(after tax on the gross award) must be retained until the

shareholding requirement is met. This award is subject to malus and

clawback provisions.

In accordance with MAR the relevant Financial Conduct Authority

modification is set out below.

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Will Serle

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief People & Culture Officer

|

|

b)

|

Initial notification /Amendment

|

Initial notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Vesting of the third tranche of shares in respect of the 1 June

2022 RAP Award.

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

Nil

|

8,026

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.07

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Automatic disposal of shares resulting from RAP Award exercise to

cover tax liabilities.

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP

|

£10.5150

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.07

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

Exhibit

99.7

8 June 2023

National Grid plc ('National

Grid' or 'Company')

Scrip Dividend for 2022/23 Final Dividend

The optional scrip dividend, allowing shareholders to receive new

fully paid ordinary shares in the Company, instead of a cash

dividend, is available to ordinary shareholders on the register on

2 June 2023, the dividend record date. A timetable is provided

below.

For ordinary shareholders, the scrip dividend reference price for

the 2022/23 final dividend is 1,059.00 pence. This is

calculated as the average closing mid-market price of an ordinary

share for the five dealing days commencing with, and including, the

ordinary share ex-dividend date.

For American Depositary Receipt (ADR) holders, the scrip ADR

reference price for the 2022/23 final dividend is US$65.9534. This

is calculated by multiplying the scrip dividend reference price

above by five (as there are five ordinary shares underlying each

ADR) and by the average US$ rate for the equivalent dates.

The current terms and conditions of the scrip dividend scheme are

available in the Investors section on the

Company's website and

from Equiniti (0800 169 7775).

2022/23 final dividend

timetable:

|

|

|

|

18 May 2023

|

2022/23 full year results and final dividend amount announced -

37.60 pence per ordinary share; US$2.3459 per ADR*

|

|

1 June 2023

|

Ordinary shares and ADRs go ex-dividend for 2022/23 final

dividend

|

|

2 June 2023

|

Record date for 2023/23 final dividend

|

|

8 June 2023

|

Scrip reference price announced

|

|

12 July 2023

|

Scrip election date for 2022/23 final dividend (5pm London

time)

|

|

9 August 2023

|

2022/23 final dividend paid to qualifying shareholders

|

|

|

|

*The figure

shown is gross of a $0.02 per ADR interim dividend fee which will

be applied to cash distributions made to ADR holders in relation to

the 2022/23 final dividend. This fee does not apply to ADRs

received through the scrip dividend.

Pritti Patel

Deputy Company Secretary and General Counsel Corporate

National Grid plc

Exhibit

99.8

9 June 2023

National Grid plc ('National

Grid' or 'Company')

Notification of Transactions of Persons Discharging Managerial

Responsibilities ('PDMRs')

This announcement is made in accordance with Article

19 of

the Market Abuse Regulation ('MAR') and relates to the National

Grid Share Incentive Plan ('SIP') monthly purchases on behalf of

PDMRs.

In accordance with MAR the relevant Financial Conduct Authority

('FCA') notifications are set out below.

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Andy

Agg

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

Financial Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Monthly purchase of securities ("partnership

shares") under the Share Incentive Plan

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP 10.6007

|

14

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.07

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

John

Pettigrew

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

Executive Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Monthly purchase of securities ("partnership

shares") under the Share Incentive Plan

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP 10.6007

|

14

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.07

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Will

Serle

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

People & Culture Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Monthly purchase of securities ("partnership

shares") under the Share Incentive Plan

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP 10.6007

|

14

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.07

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Ben Wilson

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Strategy and External Affairs Officer and Interim President,

National Grid Ventures

|

|

b)

|

Initial notification /Amendment

|

Initial notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Monthly purchase of securities ("partnership

shares") under the Share Incentive Plan

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP 10.6007

|

14

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.07

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

Exhibit

99.9

16 June 2023

National Grid plc ('National

Grid' or 'Company')

Notification of Transactions of Persons Discharging Managerial

Responsibilities ('PDMRs')

This announcement is made in accordance with Article

19 of

the Market Abuse Regulation (MAR) and relates to the following

Executive Directors and PDMRs being granted awards under the

Company's Annual Performance Plan (APP) on 15 June

2023, which relates to a percentage of the award for 2022/23 being

paid in shares, and which (after tax on the gross award) must be

retained until the shareholding requirement is met, and in any

event for two years after receipt. This award is subject to

clawback and malus provisions.

For further details of the APP, please see the Company's 2022/23

Annual Report and Accounts.

In accordance with MAR the relevant Financial Conduct Authority

(FCA) notifications are set out below.

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Andy

Agg

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

Financial Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Under the National Grid plc Annual Performance Plan (APP) Ordinary

shares were purchased in the market, which

relates to 50% of the APP for 2022/23 being paid in

shares.

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP

10.347915

|

18,726

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.15

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Justine

Campbell

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Group

General Counsel & Company Secretary

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Under the National Grid plc Annual Performance Plan (APP) Ordinary

shares were purchased in the market, which

relates to 50% of the APP for 2022/23 being paid in

shares.

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP

10.347915

|

5,785

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.15

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Adriana

Karaboutis

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

Information and Digital Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

American Depository Shares

US 6362744095

|

|

b)

|

Nature of the transaction

|

Under the National Grid plc Annual Performance Plan (APP) American

Depositary Shares (ADS)

were purchased in the market, which

relates to 33.33% of the APP for 2022/23 being paid in

shares.

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

USD

66.989

|

2,206

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.15

|

|

f)

|

Place of the transaction

|

Outside

of a Trading Venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

John

Pettigrew

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

Executive

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Under the National Grid plc Annual Performance Plan (APP) Ordinary

shares were purchased in the market, which

relates to 50% of the APP for 2022/23 being paid in

shares.

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP

10.347915

|

28,634

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.15

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Ben

Wilson

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

Strategy and External Affairs Officer & Interim President,

National Grid Ventures

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Under the National Grid plc Annual Performance Plan (APP) Ordinary

shares were purchased in the market, which

relates to 50% of the APP for 2022/23 being paid in

shares.

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP

10.347915

|

5,553

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.15

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Will

Serle

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief

People and Culture Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

notification

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

National

Grid plc

|

|

b)

|

LEI

|

8R95QZMKZLJX5Q2XR704

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary shares of 12 204/473p each

GB00BDR05C01

|

|

b)

|

Nature of the transaction

|

Under the National Grid plc Annual Performance Plan (APP) Ordinary

shares were purchased in the market, which

relates to 50% of the APP for 2022/23 being paid in

shares.

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

GBP

10.347915

|

4,959

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

|

|

e)

|

Date of the transaction

|

2023.06.15

|

|

f)

|

Place of the transaction

|

London

Stock Exchange (XLON)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly

authorized.

|

|

NATIONAL GRID

plc

|

|

|

|

|

|

|

By:

|

/s/Sally Kenward

_______________________

|

|

|

|

Sally Kenward

Senior Assistant Company Secretary

|

Date:

30 June

2023

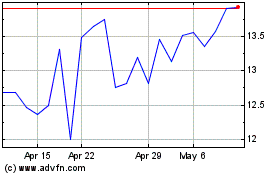

National Grid (PK) (USOTC:NGGTF)

Historical Stock Chart

From Apr 2024 to May 2024

National Grid (PK) (USOTC:NGGTF)

Historical Stock Chart

From May 2023 to May 2024