Microwave Filter Company, Inc.

6743 Kinne Street

East Syracuse, New York 13057

Notice of Annual Meeting of Shareholders

To the Shareholders of Microwave Filter Company, Inc.:

At the direction of the Board of Directors of Microwave Filter Company,

Inc., a New York corporation (the "Company"), notice is hereby given that the

Annual meeting of Shareholders of the Company (the "Meeting") will be held at

10:00 a.m. on Wednesday, April 2, 2008 at the Holiday Inn, Carrier Circle,

East Syracuse, New York 13057 for the purpose of voting on the following

matters:

Proposal 1. The election of 4 directors to hold office until the Annual

Meeting of the Shareholders at which their term expires or until their

successors have been duly elected.

The Board of Directors has fixed the close of business on February 15,

2008 as the record date for the determination of shareholders entitled to

notice of and to vote at the Meeting, or any adjournments thereof.

By order of the Board of Directors

Robert R. Andrews

Chairman of the Board

Dated: March 3, 2008

Syracuse, New York

YOUR VOTE IS IMPORTANT. YOU ARE THEREFORE REQUESTED TO SIGN AND RETURN THE

ENCLOSED PROXY AS PROMPTLY AS POSSIBLE, EVEN IF YOU EXPECT TO BE PRESENT AT

THE MEETING. YOU MAY WITHDRAW YOUR PROXY AT ANY TIME PRIOR TO THE MEETING, OR

IF YOU DO ATTEND THE MEETING, YOU MAY WITHDRAW YOUR PROXY AT THAT TIME AND

VOTE IN PERSON IF YOU WISH.

MICROWAVE FILTER COMPANY, INC.

Proxy Statement for Annual Meeting of Shareholders

General

The enclosed Proxy is solicited on behalf of the Board of Directors of

Microwave Filter Company, Inc. (the "Company") for use at the Company's Annual

Meeting of Shareholders (the "Annual Meeting") to be held on Wednesday, April

2, 2008 at 10:00 a.m. local time or at any adjournment or postponement

thereof, for the purposes set forth herein and in the accompanying Notice of

Annual Meeting of Shareholders. The Annual Meeting will be held at the

Holiday Inn, Carrier Circle, East Syracuse, New York 13057.

The Company's principal executive offices are located at 6743 Kinne

Street, East Syracuse, New York 13057. The telephone number at that address

is (315) 438-4700.

These proxy solicitation materials and the Annual Report to Shareholders

were first mailed on or about March 3, 2008 to all shareholders entitled to

vote at the Annual Meeting.

Record Date and Shares Outstanding

Shareholders of record at the close of business on February 15, 2008 are

entitled to notice of, and to vote at, the Annual Meeting. At the record date

2,894,821 shares of the Company's common stock were issued, outstanding and

entitled to vote at the Annual Meeting.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the

person giving it at any time before its use by delivering to the Secretary of

the Company a written notice of revocation or a duly executed proxy bearing a

later date or by attending the Annual Meeting and voting in person.

Voting and Solicitation

Every shareholder voting for the election for Directors is entitled to

one vote for each share held of record on the record date. Directors are

elected by a plurality of the votes cast at the meeting. Abstentions and

broker non-votes (as defined below) are counted as present for the purpose

of determining the presence or absence of a quorum for the transaction of

business. For the purpose of determining the vote required for approval of

matters to be voted on at the Meeting, shares held by Shareholders who

abstain from voting will be treated as being "present" and "entitled to

vote" on the matter and, thus, an abstention has the same legal effect as a

vote against the matter. However, in the case of a broker non-vote or

where a Shareholder withholds authority from his proxy to vote the

proxy as to a particular matter, such shares will not be treated as "present"

and "entitled to vote" on the matter. Accordingly, a broker non-vote or the

withholding of a proxy's authority will have no effect on the outcome of the

vote on the matter. A "broker non-vote" refers to shares represented at the

Meeting in person or by proxy by a broker or nominee where such broker or

nominee (i) has not received voting instructions on a particular matter from

the beneficial owner or persons entitled to vote; and (ii) the broker or

nominee does not have discretionary voting power on such matter.

The cost of this solicitation will be borne by the Company. The Company

has retained Regan & Associates to assist in the solicitation of proxies at a

fee of $3,750 (which includes expenses.) In addition, the Company may

reimburse brokerage firms and other persons representing beneficial owners of

shares for their expenses in forwarding solicitation material to such

beneficial owners. Proxies also may be solicited by certain of the Company's

directors, officers and regular employees, without additional compensation,

personally or by telephone or by telegram.

Deadline for Receipt of Shareholder Proposals

Proposals of shareholders which are intended to be presented by such

shareholders at the Company's 2009 Annual Meeting must be received by the

Secretary of the Company at the Company's principal executive offices no later

than November 7, 2008 in order to be included in the proxy soliciting material

relating to that meeting. Such proposals should be sent by certified mail,

return receipt requested.

Shareholder Communications with Directors

Shareholders who want to communicate with the Board or an individual

director can write to: Richard Jones, Corporate Secretary, Microwave Filter

Company, Inc., 6743 Kinne Street, East Syracuse, New York 13057. Your letter

should indicate that you are a shareholder of Microwave Filter Company, Inc.

Depending on the subject matter, management will:

Forward the communication to the director or directors to whom it is

addressed; or

Attempt to handle the inquiry directly, for example, requests for

information or stock-related matters.

Board Meetings and Committees

The Board of Directors held a total of six meetings during the fiscal

year ending September 30, 2007. No Director attended fewer than 75% of all

such meetings of the Board of Directors and of the Committees, if any, on

which such Directors served.

The Company's Audit Committee currently consists of Sidney Chong, Chair,

Daniel Galbally, Frank S. Markovich and Robert R. Andrews. All members of the

Audit Committee are independent of management (as independence is defined in

the Nasdaq listing standards). The purpose of the Audit Committee is to assist

the Board of Directors' oversight of the Company's accounting and financial

reporting processes and the audits of the Company's financial statements. The

Audit Committee operates pursuant to a Charter approved by the Company's Board

of Directors. The Audit Committee held four meetings during fiscal year

2007.

The Company's Compensation Committee currently consists of Trudi B.

Artini, Chair, Robert Andrews, Sidney Chong and Daniel Galbally. The

Compensation Committee reviews compensation and benefits for the Company's

executives. The Compensation Committee held one meeting during fiscal year

2007.

The Company's Nominating Committee currently consists of Robert Andrews,

Chair, Trudi B. Artini, Frank S. Markovich and Daniel Galbally. All members of

the Nominating Committee are independent of management ( as independence is

defined in the Nasdaq listing standards). The Nominating Committee operates

pursuant to a Charter approved by the Company's Board of Directors. The

Nominating Committee held one meeting during fiscal year 2007.

When considering a potential candidate for membership on our Board, the

Nominating Committee considers relevant business and industry experience and

demonstrated character and judgement. There are no differences in the manner

in which the Nominating Committee evaluates a candidate that is recommended

for nomination for membership on our Board by a shareholder. The Nominating

Committee has not received any recommended nominations from any of our

shareholders in connection with the Annual Meeting.

The Nominating Committee will consider shareholder nominations for

directors in writing to our corporate secretary prior to the meeting. To be

timely, the notice must be delivered within the time period permitted for

submission of a stockholder proposal as described under "Shareholder

Proposals." Such notice must be accompanied by the nominee's written consent,

contain information relating to the business experience and background of the

nominee and contain information with respect to the nominating shareholder and

persons acting in concert with the nominating shareholder.

The Nominating Committee is responsible for recommending to our full

Board of Directors nominees for election of directors. To fulfill this role,

the committee interviews, evaluates and recommends individuals for membership

on our Board and committees thereof.

Each of the Company's directors is encouraged to attend the annual

meeting of shareholders in person. Last year seven of eight directors attended

the annual shareholders meeting.

The Company also has a standing Executive Committee.

Compensation of Directors

Non-officer Directors currently receive fees of $300.00 per board meeting

and $300.00 per committee meeting. MFC also reimburses Directors for

reasonable expenses incurred in attending meetings. The Chairman of the Board

currently receives fees of $500.00 per board meeting and $500.00 per committee

meeting. Officer members receive no compensation for their attendance at

meetings.

The following table summarizes the compensation paid to non employee

Directors for their service to the Board and its committees in fiscal 2007.

Director Compensation Table

Fees earned or

Name paid in cash

Robert R. Andrews $5,500

Trudi B. Artini $2,100

Sidney Chong $3,300

Daniel Galbally $3,300

Frank S. Markovich $2,700

Milo Peterson $600

|

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial

ownership of the Company's common stock as of February 15, 2008 (i) by each

person who is known by the Company to own beneficially more than 5% of the

Company's common stock, (ii) each Director of the Company and (iii) all

Directors and Executive Officers as a group.

Directors, Officers Shares Beneficially Owned

5% Shareholders Number Percent

Milo Peterson * 42,250 1.5%

Trudi B. Artini * 32,435 1.1%

Carl F. Fahrenkrug * 72,298 2.5%

Frank S. Markovich * 4,340 **

Daniel Galbally * 0 **

Sidney Chong * 335 **

Robert R. Andrews * 1,214 **

Richard L. Jones * 0 **

Perry A. Harvey * 0 **

All Directors and Executive

Officers as a group (ten persons) 152,872 5.3%

|

*Directors of the Company.

**Denotes less than one percent of class.

Frederick A. Dix 244,007 8.4%

and Margorie Dix

209 Watson Road

N. Syracuse, NY 13212

EXECUTIVE COMPENSATION AND OTHER MATTERS

Executive Compensation

The following table sets forth the annual and long-term compensation of

the Company's Chief Executive Officer for services to the Company during the

three fiscal years ended September 30, 2007.

Annual Compensation

Salary Bonus Other

Name and Principal Position Year $ $ $

Carl F. Fahrenkrug 2007 122,534 0 0

President and CEO 2006 116,188 0 0

2005 122,687 0 0

|

Option Grants and Exercises

There were no options granted or exercised by the executive officer

listed in the executive compensation table above during the last fiscal year.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was or is an officer or employee

of the Company or any of its subsidiaries.

Compliance with Section 16(a) of the Securities Exchange Act

Section 16(a) of the Securities Exchange Act of 1934 requires the

Company's executive officers and directors and persons who own more than 10%

of a registered class of the Company's equity securities, to file reports of

ownership and changes of ownership with the Securities and Exchange Commission

and the National Association of Securities Dealers, Inc. Such officers,

directors and 10% shareholders are also required by SEC Rules to furnish the

Company with copies of all Section 16(a) forms that they file. Based solely on

its review of such reports received by it, the Company believes that its

officers, directors and 10% shareholders complied with all Section 16(a)

filing requirements for the fiscal year ended September 30, 2007.

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

Four Directors are to be elected at the Annual Meeting. Unless otherwise

instructed, the proxy holders will vote the proxies received by them for the

four nominees named below, all of whom are presently Directors of the Company.

In the event that any nominee is unable or declines to serve as a Director at

the time of the Annual Meeting, the proxies will be voted for any nominee who

shall be designated by the present Board of Directors to fill the vacancy. A

term of office of three years for each person elected as a Director will

continue to the Annual Meeting of Shareholders at which their term expires or

until his or her successor has been elected and qualified. Perry Harvey, who

replaced Arnold Poltenson as a Director in 2007, will complete his term if

elected and serve until the 2009 Annual Meeting of Shareholders. It is not

expected that any nominee will be unable or will decline to serve as a

Director.

The name of and certain information regarding each nominee are set forth

below.

Director Principal Occupation

CARL F. FAHRENKRUG Mr. Fahrenkrug was appointed President and Chief

Age 65 Executive Officer of MFC on October 7, 1992. He has

Director since 1984 also served served as President and Chief Executive

Officer of NSI since prior to 1986. He served as Vice

President of Engineering at Microwave Systems, Inc.,

Syracuse, N.Y. from 1972 - 1976. Mr. Fahrenkrug has a

B.S. and M.S. in Engineering and an MBA from Syracuse

University.

DANIEL P. GALBALLY Mr. Galbally is an accountant for Nucor Steel Auburn,

Age 60 Inc. in Auburn, N.Y. Prior to joining Nucor Steel

Director since 1995 Auburn, he was the Controller of Diamond Card

Exchange, Inc. in Syracuse, N.Y. He was the

Controller of Evaporated Metal Films (EMF) in Ithaca,

N. Y. Before joining EMF, he worked as Controller and

acting Vice President of Finance at Philips Display

Components Co. He has a B.S. degree in accounting and

an MBA from Syracuse University.

|

FRANK S. MARKOVICH Mr. Markovich is a consultant in the manufacturing

Age 62 operations and training field. Prior to that, he was

Director since 1992 the Director of the Manufacturing Extension

Partnership at UNIPEG Binghamton. He held various

high level positions in operations, quality and

product management in a 20 year career with BF

Goodrich Aerospace, Simmonds Precision Engine Systems

of Norwich, N.Y. He completed US Navy Electronics and

Communications Schools and received an MBA from

Syracuse University.

PERRY A. HARVEY Mr. Harvey is a consultant in global strategic

Age 55 business planning and productivity and process

Director since 2007 improvement. He holds a Master of Science in

Metallurgical Engineering and a Metallurgical

Engineering Degree from the University of Wisconsin.

He served as President of ESCO Turbine Technologies

Group (TTG), Syracuse, New York from 2000 - 2007. He

has served as a board member and president of the

Investment Casting Institute and a board member of the

Manufacturers Association of Central New York and the

Foundry Educational Foundation Board.

|

REPORT OF AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee operates pursuant to a Charter approved by the

Company's Board of Directors. The Audit Committee reports to the Board of

Directors and is responsible for overseeing financial accounting and

reporting, the system of internal controls established by management and the

audit process of the Company. The Audit Committee Charter sets out the

responsibilities, authority and specific duties of the Audit Committee. The

Charter specifies, among other things, the structure and membership

requirements of the Committee, as well as the relationship of the Audit

Committee to the independent accountants and management of the Company.

The Audit Committee consists of four members, all of whom have been

determined by the Board of Directors to be "independent" under the NASDAQ

listing standards as previously in effect and as amended. The Committee

members do not have any relationship to the Company that may interfere with

the exercise of their independence from management and the Company. The Board

of Directors of Microwave Filter Company, Inc. has determined that Mr. Chong

and Mr. Galbally, both members of the Audit Committee, are "audit committee

financial experts" as defined by the SEC's regulations. None of the Committee

members are current officers or employees of the Company or its affiliates.

Audit Committee Report

The Audit Committee of the Company's Board of Directors has issued the

following report with respect to the audited financial statements of the

Company for the fiscal year ended September 30, 2007:

. The Audit Committee has reviewed and discussed with the Company's

management the Company's fiscal 2007 audited financial statements;

. The Audit Committee has discussed with the Company's independent

auditors (Rotenberg & Co. LLP) the matters required to be discussed by

Statement on Auditing Standards No. 61, as amended by SAS No. 90;

. The Audit Committee has received the written disclosures and letter from

the independent auditors required by Independence Standards Board No. 1 (which

relates to the auditor's independence from the Company and its related

entities) and has discussed with the auditors their independence from the

Company; and

. Based on the review and discussions referred to in the three items

above, the Audit Committee recommended to the Board of Directors that the

audited financial statements be included in the Company's Annual Report on

Form 10-KSB for the fiscal year ended September 30, 2007.

Submitted by the Audit Committee of the Company's Board of Directors:

Sidney K. Chong, Robert R. Andrews, Daniel P. Galbally, Frank S. Markovich

FEES PAID TO INDEPENDENT AUDITORS

Set forth below are the aggregate fees billed for professional services

rendered to the Company by its independent auditors for fiscal 2007.

Audit Fees $36,500

Financial Information Systems Design

and Implementation Fees 0

All Other Fees:

Tax Services 4,400

-------

Total fees $40,900

=======

|

Other Matters

The Company knows of no other matters to be submitted at the meeting. If

any other matters properly come before the meeting, it is the intention of the

persons named in the enclosed proxy to vote the shares they represent as the

Board of Directors may recommend.

THE BOARD OF DIRECTORS

Dated: March 3, 2008

PROXY

This proxy is Solicited by The Board of Directors of Microwave Filter

Company, Inc.

Proxy for 2008 Annual Meeting of Shareholders

The undersigned hereby appoints Robert R. Andrews and Carl F. Fahrenkrug

proxies of the undersigned, with full power of substitution, to vote shares of

common stock of the Company which the undersigned is entitled to vote at the

2008 Annual Meeting of the Shareholders to be held on Wednesday, April 2, 2008

at 10:00 a.m. and any adjournments thereof as follows:

(1) ELECTION OF DIRECTORS

Instructions: To vote for all nominees, place an X in box number 1. To

withhold authority to vote for any individual nominee, place an X in box

number 2, and draw a line through his/her name in the list below.

1. [ ] For All Nominees

2. [ ] For All Nominees Except Those With A Line Through Their Name

Carl F. Fahrenkrug Daniel P. Galbally Frank S. Markovich Perry A. Harvey

In their discretion, the proxies are authorized to vote upon other matters

properly coming before the meeting or any adjournments thereof.

This proxy will be voted as directed by the undersigned. IF NO DIRECTION IS

GIVEN, THIS PROXY WILL BE VOTED FOR PROPOSAL (1).

NOTE: Please date and sign exactly as your name or names appear below and

return in the enclosed postage paid envelope.

When signing as an Attorney, Executor, Trustee, Guardian or Officer of a

Corporation, please give title as such.

_______________________ _________

Signature Date

_______________________ _________

Signature if held jointly Date

|

IMPORTANT: To assist the Company in planning the Annual Meeting please check

the following:

I plan to attend the Annual Meeting _____

I do not plan to attend the Annual Meeting _____

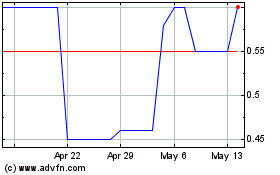

Microwave Filter (PK) (USOTC:MFCO)

Historical Stock Chart

From Oct 2024 to Nov 2024

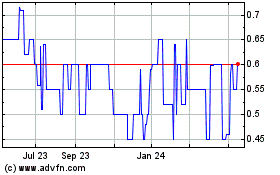

Microwave Filter (PK) (USOTC:MFCO)

Historical Stock Chart

From Nov 2023 to Nov 2024