Current Report Filing (8-k)

March 02 2020 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report: March 2, 2020

(Date of earliest event reported)

ITEM 9 LABS CORP.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

|

000-54730

|

|

96-0665018

|

|

(State of other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

2727 N 3rd Street, Suite

201, Phoenix AZ 85004

(Address of principal executive offices and

zip code)

1-833-867-6337

(Registrant’s telephone number, including

area code)

_______

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company. ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On February 27,

2020, Item 9 Labs Corp., a Delaware corporation (“Company”), and an unnamed wholly owned subsidiary (“Merger

Sub”), entered into an Agreement and Plan of Merger (the “Agreement”) with OCG Inc., a Colorado corporation (“Target”),

pursuant to which the Merger Sub will be merged with and into the Target in a reverse triangular merger with the Target continuing

as the surviving entity as a wholly-owned direct subsidiary of the Company (“Merger”). Effective upon the completion

of the Merger, the Target shareholders shall become stockholders of the Company through the receipt of the Merger Consideration

as defined below. Each of the parties referred to above may be referred to herein as a “Party” and collectively

as the “Parties”.

Merger Consideration

On the terms

and subject to the conditions set forth in the Agreement, upon the completion of the Merger, the Target Shareholders shall become

stockholders of the Company through the receipt of an aggregate 30,000,000 restricted shares of the Common Stock of the Company

(“Merger Consideration”).

Upon closing

of the Merger, and subject to the terms and conditions of the Agreement, the Merger Sub shall be merged with and into the Target

(the Target following the Merger is sometimes referred to in this Agreement as the “Surviving Corporation”),

the separate existence of the Merger Sub shall cease, and the Target shall survive the Merger. The Surviving Corporation will possess

all properties, rights, privileges, powers, and franchises of the Target and Merger Sub, and all of the claims, obligations, liabilities,

debts and duties of the Target and Merger Sub will become the claims, obligations, liabilities, debts and duties of the Surviving

Corporation.

Governance

of the Combined Company

Upon closing

of the Merger, Target may nominate, and the Company agrees to appoint, two persons designated by Target to the Company’s

Board of Directors.

Conditions

to the Merger

The

parties’ obligation to consummate the Merger is subject to the satisfaction or waiver of customary closing

conditions for both parties, including (i) the adoption of the Agreement by the requisite vote of the stockholders of

Target, (ii) the adoption of the Agreement by the requisite vote of the stockholders of Company, (iii) the approval of

the issuance of shares of Company Common Stock as Merger Consideration; (iv) and an appropriate level and Director and

Officers Liability Insurance shall be in place, and (v) certain other customary

conditions relating to the parties’ representations and warranties in the Agreement and the performance of their

respective obligations. The consummation of the Merger is subject to a financing contingency that Company must raise

approximately $2,000,000.

The Company has made customary representations

and warranties in the Agreement. The Agreement also contains customary covenants and agreements, including covenants and agreements

relating to the conduct of the Company’s business between the date of the signing of the Agreement and the closing of the

transactions contemplated under the Agreement. The representations and warranties made by the Company are qualified by disclosures

made in its disclosure schedules and Securities and Exchange Commission (“SEC”) filings.

The Merger

is conditioned on the accuracy and correctness of the representations and warranties made by the other party on the date of the

Agreement and on the Closing Date (as defined in the Agreement) or, if applicable, an earlier date (subject to certain “materiality”

and “material adverse effect” qualifications set forth in the Agreement with respect to such representations and warranties)

and the performance by the other party in all material respects of its obligations under the Merger Agreement.

Under

the Agreement, each of the Company and Target have agreed to use commercially reasonable efforts to consummate the Merger, including

using best efforts to obtain all required regulatory approvals.

A copy

of the Agreement is filed with this Current Report on Form 8-K as Exhibit

2.1 and is incorporated herein by reference, and the foregoing description of the Agreement is qualified in its entirety by reference

thereto.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(c) Exhibits.

|

|

|

|

|

|

|

|

2.1*

|

|

Agreement and Plan of Merger, dated as of February 27, 2020,

by and among Item 9 Labs Corp, OCG Inc., and [Merger Sub] Inc.

|

|

|

|

|

|

|

|

|

*

|

Schedules omitted pursuant to item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule to the SEC upon request, provided, however, that the Company may request confidential treatment pursuant to Rule 24b-2 of the Exchange Act, as amended, for any schedule or exhibit so furnished.

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

ITEM 9 LABS CORP.

|

|

|

|

|

|

Dated: March 2, 2020

|

By:

|

/s/ Andrew Bowden

|

|

|

|

Andrew Bowden

|

|

|

|

Chief Executive Officer

|

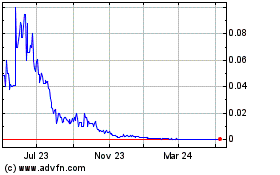

Item 9 Labs (CE) (USOTC:INLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

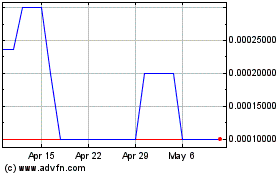

Item 9 Labs (CE) (USOTC:INLB)

Historical Stock Chart

From Apr 2023 to Apr 2024