false

0000867028

0000867028

2023-10-25

2023-10-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 25, 2023

FOMO

WORLDWIDE, INC.

(Exact

name of Registrant as specified in its Charter)

| california |

|

001-13126 |

|

83-3889101 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

831

W North Ave., Pittsburgh, PA 15233

(Address

of principal executive offices)

(630)

708-0750

(Registrant’s

Telephone Number)

(Former

name or address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common |

|

FOMC |

|

OTC

Pink Current |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

FOMO

WORLDWIDE, INC. is referred to in this Current Report on Form 8-K as “FOMO,” the “Company,” “we,”

or “us.”

Item

7.01 Regulation FD Disclosure.

Our

management team provided a corporate update (“FOMO HOUR”) on October 25, 2023. The transcript of the online meeting is

included herein as Exhibit 99.1.

Item

9.01. Exhibits

(a)

Exhibits. The following exhibit is filed with this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

FOMO

WORLDWIDE, INC. |

| |

|

| Date:

October 31, 2023 |

By:

|

/s/

Vikram Grover |

| |

|

Vikram

Grover |

Exhibit

99.1

FOMO

WORLDWIDE, INC. (OTC: FOMC)

www.fomoworldwide.com

Investor

Update Hour aka “FOMO HOUR”

October

25, 2023 5:00pm ET

INTRODUCTION

Good

afternoon, evening, or wherever you are FOMO NATION, thank you for attending FOMO HOUR our investor update session previously held Wednesdays

at 5pm ET here on Discord. We will try to do these more often. It has been a difficult year and quite frankly we wanted to get our arms

around the headwinds of the year before telling you much more than through SEC filings.

FINRA

CORPORATION ACTIONS UPDATE

Several

months ago, we filed five corporate actions with FINRA On the 15c2-11 (restore solicited quotes and market makers), which is being reviewed

by FINRA’s compliance department, today we responded to their six latest comments given Friday. They now border on the surreal,

such as asking why our Shopify ecommerce store at Clean Solution Technologies is down (which we did not renew as we wanted to build our

own store). We have asked for a conference call with the FINRA examiner and our FINRA broker dealer engaged on this process, Glendale

Securities, tomorrow or Thursday if this is not approved this week. On the name change to FOMO WORLDWIDE, INC. which is our legal name

in California, ticker change to IGOT from FOMC, redomicile to WY from CA whose merger paperwork has been reviewed by counsel and sent

yesterday to the WY Secretary of State, and 1-100 reverse split, we believe we have responded in full to all comments and similarly are

asking FINRA’s corporate actions department (another department from compliance) for an update call. Our lawyer is also involved

and knows the Corporate Actions examiner.

I

have spent years dealing with FINRA on corporate actions for FOMC and HMLA, and now we are asking for these corporate actions to be completed

and insisting on a live call for further comments. It’s time to put these behind us.

ACQUISITIONS

UPDATE

With

the exception of the large IT provider to K12 and healthcare in LA, our other 5 acquisition targets identified in our latest presentation

deck are all still “on the table”. The sign tech company in Naples, FL is done with its audit, and we have arranged for them

to obtain $1 million of growth capital. I recently met with the husband and wife owners here in Pittsburgh and they are still on board

and literally could roll into FOMC, or alternatively our affiliate HMLA, when they get their 5/31 audit updated to 09/30. The modular

construction deal has is prepared to get audited in November and its accountants, who audited the sign deal, are standing by. We speak

regularly with that owner, and he remains interested in the rollup and pursuit of growth capital to expand into N Florida and into leasing,

which I always believed was their home run potential generating 10-year recurring revenue contracts with municipal government in FL.

The three LMS and custom enterprise content providers are all still on the table and do not need to be audited given their smaller size

versus FOMO. It all comes down to fixing our capital stack and common stock before we can execute any of these deals. If this goes on

much longer, we will use HMLA for the rollup.

DEALS

ON THE RADAR

We

are ceasing all discussions with additional acquisition targets for FOMO. We don’t need more deals; we need to fix our existing

audio visual business and then the stock, then close the ones we previously signed up and focus. However, there are dozens of targets

out there in solar contracting, disaster restoration and remediation, LPR technology, HVAC contractor businesses, and more.

CONSOLIDATION

OF CST OPERATIONAL PLATFORM

We

consolidated CleanSolution Technologies www.cleansolutiontech.com into our Pittsburgh operations. Saving on overhead every month,

and more importantly we intend to hire a rep or manager to effectively revive this business. I still believe there is substantial pent

up demand for a triple play of air disinfection, LED retrofit, and HVAC energy savings in K12 schools and other. In fact, we recently

met with Pittsburgh’s Mayor Gainey and his staff, and they are very interested in clean tech and green tech. We are scheduling

a delivery of clean air disinfection machines to his office and staff next week. He is also introducing us to his head of Smart Cities

programs, Director of Broadband, and Food Policy Coordinator for indoor agriculture. The door is now open for us to penetrate this potentially

large account. We intend to merge all Clean Solution Technologies (a dba for Energy Intelligence Center LLC) assets into our newly launched

DTS subsidiary (below).

INDOOR

FARMING

We

have ceased discussions with INTAG due to their inability to support a dealer agreement, and now are in discussions with Nelson and Pade,

Inc., a 40-year provider of hydroponics and aquaponics systems with 800 K12 schools and college customers worldwide. We had a call with

the founders yesterday and re editing their dealer/distribution agreement. We expect to sign it in the next several days if not tomorrow.

This is an exciting area of growth blending agriculture with technology to deploy vertical farms indoors and within shipping containers.

To this end, we have signed a reseller agreement with Vertical Crop Consultants provider of the “Cropbox”. For further information,

see the following:

https://aquaponics.com/

https://verticalcropconsultants.com/

https://cropbox.co/

FINANCING

UPDATE

**THIS

IS NOT A SOLICITATION FOR INVESTMENT AND IS SOLELY FOR DISCUSSION PURPOSES**

Today,

we are canceling our Series A Preferred raise due to market conditions. We terminated our placement agent for that PIPE deal and have

received a term sheet from our largest hedge fund investor historically, for up to $5 million of equity over two years subject to the

aforementioned corporate actions being approved. If and when this equity financing is activated, it could allow FOMO to obtain critical

capital for its subsidiaries.

**There

are no assurances we will be able to finance the business using equity or debt in the near-term.**

CONVERTIBLE

DEBT UPDATE

On

or around May 31, 2023, our sole convertible debt lender GS Capital converted $394,000 of two notes into Series A Preferred stock based

on a common stock price of .0005. We also reduced the strike price on warrants from prior fundings to .0005. Since then, the lender has

converted roughly $70,000 of the remaining note into several hundred million common shares. The remaining balance on Note #1 is roughly

$250,000. The lender has not defaulted us and is friendly to the Company. Altogether, with the debt swap into Pref A and conversions,

our corporate debt declined by roughly $464,000.

FINANCIAL

SITUATION

At

the end of May 2023, after paying our main audio visual vendor, SMART Technologies, $1 million to a $0 balance using receivables collections

from our banner 2022, and $650,000 in short-term purchase order and merchant cash advance financing to unlock a credit freeze, SMART

unethically and illogically cut our credit line to $350,000 without even a courtesy email. This action was after recklessly representing

a $1 million credit line on their portal which we expected to turn into $2 million in revenue through our backlog of orders and sales

funnel. SMART’s action broke the business cycle of SST and forced us to default on the short term MCA and PO obligations, and worse,

it put our senior credit line underwater due to the PO line’s failure to deliver. Since then, I have personally made hundreds of

calls to rectify this situation.

In

August 2023, I literally called in the “Pittsburgh card”. We obtained near limitless purchase order financing of up to $20

million per order from Aurous Financial, a firm run by a former Carnegie Mellon graduate now living in L.A. whose father created a new

PO financing model priced by the day not by the month. At the end of August and throughout September, Aurous unlocked all our SMART Technologies

backlog that piled up since the credit lock/cut. What’s more, Aurous has been paying SMART an extra 10% per order to work off the

past due balance which was created by SMART’s own illogical financial decision. The MCA lenders are unhappy, and in fact two have

filed legal complaints in UT and NY courts against us for default. We are engaging lawyers to respond to the complaints and hope to come

to a resolution with these lenders by obtaining new capital, though there can be no assurances. These complaints are directed at the

SMARTSolution Technologies, Inc. subsidiary, FOMO WORLDWIDE, INC., and me personally as I guaranteed the loans used to pay the vendor.

The defaults have made the company unfinanceable with unsecured lenders, making this escape room extremely challenging to solve. Simply

put, we need institutional capital at the FOMO level with an equity component to refinance our capital stack.

LAUNCHED

DIAMOND TECHNOLOGY SOLUTIONS, LLC FOR OUR FUTURE

Due

to the SMART vendor credit decision, we immediately took action. On or around June 15, 2023, we launched a new subsidiary Diamond Technology

Solutions, LLC in order to sell other vendors’ products, new products and services, and grow. Later we activated banking services

for DTS, and two weeks ago cutover insurance for our employees, vehicles, and the entire business from SST. We have assigned all operating

assets to DTS from SST, meaning the trucks, tools, furniture, systems, non-SMART inventory, customer list, and other. DTS is currently

bidding on large contracts in emergency management, audio visual walls for entertainment complexes, and installation and service work

for other companies and new districts that previously did not contract with SST. SMART refers to us as a “Diamond Partner”.

I don’t know about that anymore, but now we really are Diamond. It’s the “smart” thing to do.

BANKER

UPDATE

On

June 1, 2023, we engaged Maxim Group, a top middle market investment bank, for advisory services and introductions to NASDAQ or SPAC

companies for an uplist. Until our corporate actions are approved, they are standing by and ready to get to work when FINRA approves

the 15c2-11 and other corporate actions.

INSIDER

PURCHASES

I

continue to buy regularly, in Pref A B and common. This is conversion of real salary into shares and not “free stock”. As

I say, always bet on yourself.

HIMALAYA

TECHNOLOGIES, INC. (OTC: HMLA)

After

almost two years of working to save formerly Homeland Resources Ltd. including a Form 10-12G with multiple amendments effective 04-05-2022,

and a Form 1A with 8 amendments and multiple information statements, FINRA approved HMLA’s shareholder actions for share increase

and financing and officially recognized me as Chairman and CEO. This has implications for FOMO WORLDWIDE, because FOMC owns 334 million

equivalent shares of the stock in Pref A and Pref B shares. We have proposals in hand for HMLA to take its social media business to the

next level with apps and M&A. Stay tuned for the HMLA 10-K for its 07/31 fiscal year, which is due in a few days. It is 99% done.

BOTTOM

LINE

This

has been a rough year driven by the detrimental credit decision of our subsidiary’s main vendor which broke its 27 year continuous

business cycle. We want to win. We broke out the handheld weapons in a street fight. We’re still here and ready for a new chapter.

This is still FOMO WORLDWIDE, INC. Here we are, still standing, after a tough 2023 ready for a new chapter.

Thank

you to all our employees, service providers, consultants, advisors, and investors. I will now take questions.

g

for you all. We will win. Good night.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

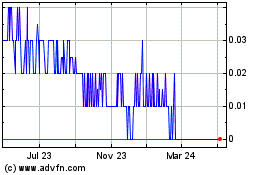

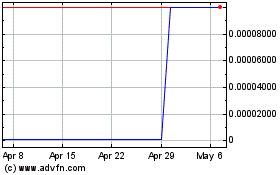

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Jul 2023 to Jul 2024