|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

WASHINGTON, D.C. 20549 |

|

SCHEDULE TO |

|

|

|

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1) |

|

OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

(Amendment No. 1) |

|

California First Leasing Corporation |

|

(Name of Subject Company (Issuer)) |

|

|

|

California First Leasing Corporation |

|

(Name of Filing Person(s) (Issuer)) |

|

|

|

Common Stock, par value $0.01 per share |

|

(Title of Class of Securities) |

|

|

|

130222102 |

|

(CUSIP Number of Class of Securities) |

|

|

|

Patrick E. Paddon |

|

Chief Executive Officer |

|

California First Leasing Corporation |

|

5000 Birch Street, Suite 500 |

|

Newport Beach, CA 92660 |

|

(949) 255-0500 |

|

(Name, Address, and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of the Filing Person(s)) |

|

|

|

|

|

With copies to: |

|

|

|

|

Joshua A. Dean, Esq. |

|

S. Leslie Jewett |

|

|

|

Jason R. Schendel, Esq. |

|

Chief Financial Officer |

|

|

|

Daniel Clausen, Esq. |

|

California First Leasing Corporation |

|

|

|

Sheppard, Mullin, Richter & Hampton LLP |

|

5000 Birch Street, Suite 500 |

|

|

|

650 Town Center Drive, Tenth Floor |

|

Newport Beach, CA 92660 |

|

|

|

Costa Mesa, CA 92626 |

|

|

|

|

☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

|

Check the appropriate boxes below to designate any transactions to which the statement relates: |

|

|

☐ |

third-party tender offer subject to Rule 14d-1. |

|

|

☒ |

issuer tender offer subject to Rule 13e-4. |

|

|

☐ |

going-private transaction subject to Rule 13e-3. |

|

|

☐ |

amendment to Schedule 13D under Rule 13d-2. |

|

|

|

|

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐ |

|

|

|

|

|

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon: |

|

|

☐ |

Rule 13e–4(i) (Cross-Border Issuer Tender Offer) |

|

|

☐ |

Rule 14d–1(d) (Cross-Border Third-Party Tender Offer) |

|

|

This Amendment No. 1 (“Amendment No. 1”) amends and supplements the Tender Offer Statement on Schedule TO (the “Schedule TO”) originally filed with the Securities and Exchange Commission by California First Leasing Corporation, a California corporation (the “Company”), on October 23, 2023 in connection with the offer by the Company to the holders of its Common Stock to purchase up to 200,000 shares of its Common Stock at a purchase price of $16.50 per share in cash, without interest.

The Company’s offer is being made upon the terms and subject to the conditions set forth in the Offer to Purchase, dated October 23, 2023 (the “Original Offer to Purchase”), as amended and supplemented by the Supplement No. 1 to the Offer to Purchase, dated October 31, 2023 (the “Supplement”) and the related Letter of Transmittal and Notice of Guaranteed Delivery.

The information in the Schedule TO, including all exhibits to the Schedule TO, which were previously filed with the Schedule TO, is incorporated herein by reference in response to Items 1 through 11 of the Schedule TO, except that such information is hereby amended and supplemented to the extent specifically provided in this Amendment No. 1. All capitalized terms used but not specifically defined in this Amendment No. 1 shall have the meanings given to such terms in the Original Offer to Purchase. The items of the Schedule TO set forth below are hereby amended and supplemented as follows:

ITEMS 1 – 11

Items 1 – 11 are hereby amended and updated by the Supplement, which is incorporated herein by reference.

Reference is hereby made to the following exhibits which collectively constitute the Offer to Shareholders and are incorporated herein by reference:

|

(a)(1)(A)* |

Offer to Purchase for Cash, dated October 23, 2023 |

|

(a)(1)(B)* |

Letter of Transmittal |

|

(a)(1)(C)* |

Notice of Guaranteed Delivery |

|

(a)(1)(D)* |

Letter to Brokers, Dealers, Banks, Trust Companies and Other Nominees. |

|

(a)(1)(E)* |

Letter to Clients |

|

(a)(1)(F)* |

Press Release, dated October 23, 2023 |

|

(a)(1)(A) |

Supplement No. 1 to Offer to Purchase for Cash, dated October 31, 2023 |

|

(b) |

None |

|

(d) |

None |

|

(g) |

None |

|

(h) |

None |

|

107* |

Calculation of Filing Fee Table |

|

ITEM 13. |

Information Required by Schedule 13e-3 |

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set out in this statement is true, complete, and correct.

| |

|

|

|

California First Leasing Corporation |

| |

|

|

By: |

|

|

|

Name: S. Leslie Jewett |

|

Title: Chief Financial Officer |

|

Date: October 31, 2023 |

|

|

California First Leasing Corporation

‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗ |

Supplement No. 1 to the

Offer to Purchase for Cash

Up to 200,000 shares of its Common Stock

At a Purchase Price of $16.50 Per Share

CUSIP: 130222102

Investment Company Act File Number 811-23782

The date of this Supplement No. 1 to the Offer to Purchase for Cash is October 31, 2023

California First Leasing Corporation, a California corporation (the “Company”), hereby amends and supplements its Offer to Purchase for Cash, dated October 23, 2023 (the “Original Offer to Purchase”, and together with this supplement, as the same may be further amended or supplemented form time to time, the “Offer to Purchase”), up to 200,000 shares of its common stock, par value $0.01 per share (the “shares”), at a price of $16.50 per share, less any applicable withholding taxes and without interest, upon the terms and subject to the conditions set forth in the Offer to Purchase and the related Letter of Transmittal and the other materials filed as exhibits to the Issuer Tender Offer Statement on Schedule TO-I that the Company filed with the U.S. Securities and Exchange Commission on October 23, 2023 (such material, collectively, as they may be amended or supplemented from time to time, the “tender offer materials”). The Original Offer to Purchase is hereby supplemented by this Supplement No. 1 (this “Supplement No. 1”) (which together with the Original Offer to Purchase, Letter of Transmittal and tender offer materials, as they may hereafter be amended or supplemented from time to time, constitute the “tender offer”), which contains a description of certain amendments that are being made hereby. Capitalized terms used in this Supplement No. 1 but not otherwise defined have the meanings ascribed to those terms in the Original Offer to Purchase.

The information, terms and conditions of the tender offer set forth in the Original Offer to Purchase remain applicable in all respects to the tender offer, except to the extent modified by this Supplement No. 1. Where information in the Original Offer to Purchase is in conflict with, is supplemented by or replaced by information in this Supplement No. 1, the information provided in this Supplement No. 1 shall govern.

OFFER TO PURCHASE – COVER PAGES

The information that appears in all capital letters under the section entitled “IMPORTANT” on pages (ii), (iii), and (iv) of the Original Offer to Purchase is hereby amended and restated to read as follows:

“To tender shares properly, other than shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you must properly complete and duly execute the Letter of Transmittal.

This tender offer does not constitute an offer to purchase shares in any jurisdiction in which, or from any person from whom, it is unlawful to make the tender offer under applicable securities or blue-sky laws. Subject to applicable law (including Rule 13E-4(d)(2) under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), which requires that material changes in the tender offer be promptly disseminated to security holders in a manner reasonably designed to inform them of such changes), delivery of this Offer to Purchase shall not under any circumstances create any implication that the information contained in or incorporated by reference in this Offer to Purchase is correct as of any time after the date of this Offer to Purchase or that there has been no change in the information included or incorporated by reference herein or in our affairs since the date hereof.

Our board of directors has approved the tender offer, however, none of the Company, our board of directors, the Information Agent, the Depository or any of their respective affiliates makes any recommendation to you as to whether you should tender or refrain from tendering your shares. You must make your own decision as to whether to tender your shares and, if so, how many shares to tender. In so doing, you should read carefully all of the information in this Offer to Purchase, and in the other tender offer materials, including our reasons for making the tender offer. See Section 2. You are urged to discuss your decision with your tax advisor, financial advisor and/or broker. Our directors and officers are entitled to participate in the tender offer on the same basis as all other shareholders, subject to internal compliance requirements and they have no obligation to inform us whether they plan to participate in the tender offer.

We have not authorized any person to make any recommendation on our behalf as to whether you should tender or refrain from tendering your shares in the tender offer. We have not authorized any person to give any information or to make any representations in connection with the tender offer other than those contained in this Offer to Purchase or incorporated by reference or in the related Letter of Transmittal. If anyone makes any recommendation or representation to you or gives you any information, you must not rely on that recommendation, representation or information as having been authorized by us, the Information Agent, the Depository or any of our or their respective affiliates. You should carefully evaluate all information in this Offer to Purchase, consult your own financial, legal and tax advisors and make your own decision as to whether to participate in the tender offer contemplated by this Offer to Purchase. In reviewing and evaluating this Offer to Purchase, you should bear in mind the risks, disclosures and statements set forth in Section 11 “Certain Risks and Considerations Related to the Tender Offer”.

This Offer to Purchase is not intended to be distributed in any jurisdiction in which the tender offer would violate any securities law, statute or similar regulation, or in which the shareholders would not be permitted to receive payment for the sale of their shares under applicable law or regulation (each, an “Excluded Jurisdiction”). Any person who resides in any Excluded Jurisdiction is not permitted to participate in the tender offer, and any attempt by such a person to participate in the tender offer will be null and void.

This Offer to Purchase contains forward-looking statements within the meaning of the federal securities laws, which statements are subject to substantial risks and uncertainties. These forward-looking statements are made throughout this Offer to Purchase. Forward-looking statements include all statements that are not statements of historical facts and can be identified by words such as “anticipates,” “believes,” “could,” seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those expressions.

The forward-looking statements set forth in, or incorporated by reference in, this Offer to Purchase represent the Company’s management’s current beliefs and assumptions based on information currently available. The Company will not update any information set forth in this Offer to Purchase unless required by applicable law.

Forward-looking statements involve numerous known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements express or implied by the forward-looking statements.

Moreover, the Company operates in an evolving environment. New risks and uncertainties emerge from time to time, and it is not possible for the Company to predict all risks and uncertainties, nor can the Company assess the impact of all factors on the Company’s business, the tender offer or the extent to which any factor, or combination of factors, may cause actual future outcomes to be materially different from those expressed or implied by any forward-looking statements. Given the above-described risks and uncertainties regarding the forward-looking statements set forth in this Offer to Purchase, and in the documents incorporated by reference therein, you should not rely on such forward-looking statements.”

OFFER TO PURCHASE – SUMMARY TERM SHEET

The third bullet point that appears under “Are there any conditions to the tender offer?” on page 2 of the Original Offer to Purchase is hereby amended and restated to read as follows:

“No commencement or escalation of war, armed hostilities, or other international or national calamity (including the conflict between Russia and Ukraine and the conflict in the Middle East, to the extent that there is any material adverse development related thereto on or after October 20, 2023), including, but not limited to, any outbreak of a pandemic or contagious disease (including the COVID-19 pandemic, to the extent that there is any material adverse development related thereto on or after October 20, 2023) or an act of terrorism, directly or indirectly involving the United States shall have occurred on or after October 20, 2023, the last trading day prior to the commencement of the tender offer;”

The information that appears under “Are there any conditions to the tender offer?” on page 2 of the Original Offer to Purchase is hereby further amended by deleting the fourth bullet point from the bottom of page 2 of the Original Offer to Purchase.

The information that appears under “Following the tender offer, will the Company’s common stock continue to be listed on the OTCQX Premier Market” on page 2 of the Original Offer to Purchase is hereby amended and restated to read as follows:

“Yes. We do not believe that your purchase of shares pursuant to the tender offer will negatively impact the eligibility of the remaining shares to continue trading on the OTCQX Premier Market. See Section 2.”

The information that appears under “How will the tender offer affect the number of shares outstanding and the number of record holders?” on page 3 of the Original Offer to Purchase is hereby amended and supplemented by adding the following statement at the end of such Company response:

“The tender offer is expected to result in either a reduction in the number of record holders or no change in the number of record holders.”

OFFER

TO PURCHASE – SECTION 6. CONDITIONS TO THE TENDER OFFER

The

lead-in language that appears just under “6. Conditions of the Tender Offer” on

page 15 of the Original Offer to Purchase is hereby amended and restated to

read as follows:

“Notwithstanding

any other provision of the tender offer, we will not be required to accept for

payment or pay for any shares tendered, and may terminate or amend the tender

offer or may postpone the acceptance for payment of, and the payment for,

shares tendered, subject to the requirements of the Exchange Act for prompt

payment for or return of shares, if at any time on or after the date of this

Offer to Purchase and before the Expiration Time any of the following events

shall have occurred:”

Paragraph

(3) that appears under “6. Conditions of the Tender Offer” on page 16 of the

Original Offer to Purchase is hereby amended and restated to read as follows:

“(3) there

shall have occurred (i) any general suspension of trading in, or limitation on

prices for, securities on any national securities exchange or in the

over-the-counter market in the United States, (ii) the declaration of a banking

moratorium or any suspension of payments in respect of banks in the United

States, (iii) on or after October 20, 2023, the last trading day prior to the

commencement of the tender offer, the commencement or escalation of a war,

armed hostilities or other international or national calamity (including the

conflict between Russia and Ukraine and the conflict in the Middle East)

directly or indirectly involving the United States, including, but not limited

to, any outbreak of a pandemic or contagious disease (including the COVID-19

pandemic, to the extent that there is any material adverse development related

thereto on or after October 20, 2023) or an act of terrorism, (iv) any change

in the general political, market, economic or financial conditions in the

United States or abroad that could, in our reasonable judgment, have a material

adverse effect on our business, condition (financial or otherwise), assets,

income, operations or prospects, taken as a whole, or (v) in the case of any of

the foregoing existing at the time of the commencement of the tender offer, a

material acceleration or worsening thereof;

The Offer

to Purchase and this Supplement contain important information which should be

read carefully before any decision is made with respect to the tender offer.

Any questions or requests for assistance regarding the tender offer, the

Original Offer to Purchase, or this Supplement may be directed to the Information

Agent at the address and telephone number specified below. Shareholders also

may contact their broker, commercial bank, trust company or other nominee for

assistance concerning the tender offer, the Original Offer to Purchase, or this

Supplement. Additional copies of the Original Offer to Purchase and this

Supplement, the Letter of Transmittal and the other tender offer materials may

be obtained from the Information Agent

The Information Agent for the Offer is:

1290 Avenue of the Americas, 9th

Floor

New York, NY 10104

Shareholders, Banks and Brokers

Call Toll Free: 800-509-0957

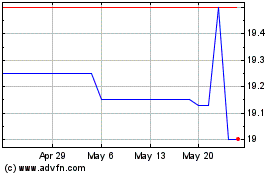

California First Leasing (QX) (USOTC:CFNB)

Historical Stock Chart

From Apr 2024 to May 2024

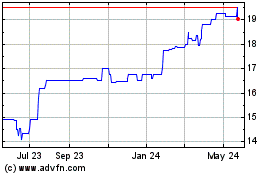

California First Leasing (QX) (USOTC:CFNB)

Historical Stock Chart

From May 2023 to May 2024