Revival Gold

Inc. (TSXV: RVG,

OTCQX: RVLGF) (“Revival Gold” or

the “Company”), announces its intention to complete a non-brokered

private placement of up to 11,000,000 units of the Company (the

“Units”) at a price of C$0.35 per Unit (the “Issue Price”) for

gross proceeds of up to C$3,850,000 (the “Financing”). Each Unit

will be comprised of one (1) common share of the Company (a “Common

Share”) and one half of one (0.5) Common Share purchase warrant

(each whole warrant, a “Warrant”). Each Warrant will entitle the

holder thereof to acquire one (1) Common Share (a “Warrant Share”)

at an exercise price of C$0.45 per Warrant Share at any time for a

period of thirty-six (36) months following the closing of the

Financing.

“Revival Gold has made outstanding progress over

the past year de-risking and advancing the company’s

Beartrack-Arnett gold project. The project stands as one of the

largest new discoveries of gold in the United States in the past

decade. We have a robust Pre-Feasibility Study on our first phase

heap leach re-start plans for the project and we are continuing to

explore with several exciting high-value targets to pursue. Today’s

private placement financing will augment our cash position as we

approach year end and make preparations for the season ahead”, said

Hugh Agro, President & CEO.

The Company reserves the right to increase the

size of the Financing by up to 25% of the size of the Financing

(the “Upsize Option”) pursuant to which the Company may offer for

sale up to an additional 2,750,000 Units at the Issue Price. The

Upsize Option may be exercised in whole or in part in the Company’s

sole discretion at any time up to the closing of the Financing. If

the Financing is fully subscribed and the Upsize Option is

exercised in full, the total gross proceeds of the Financing is

expected to be approximately C$4,812,500. Closing of the Financing

is expected on or about November 30th, 2023, or such other date or

dates that that the Company may determine.

The Company may pay finders fees to eligible

finders in connection with the Financing in accordance with the

policies of the TSX Venture Exchange (the “Exchange”). The net

proceeds of the Financing will be used to fund on-going exploration

and development at the Company’s core Beartrack-Arnett Gold Project

(“Beartrack-Arnett”) located in Lemhi County, Idaho and for general

corporate purposes. The Financing is subject to the receipt of all

required regulatory approvals including the approval of the

Exchange. All securities to be issued and issuable pursuant to the

Financing will be subject to a hold period of four months and one

day from the date of issuance in accordance with applicable

Canadian securities laws.It is expected that certain directors and

officers of the Company (the “Insiders”) may participate in the

Offering. The participation of Insiders in the Offering will

constitute a “related party transaction” within the meaning of

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”). The Company

anticipates relying on exemptions from the minority shareholder

approval and formal valuation requirements applicable to the

related-party transactions under sections 5.5(a) and 5.7(1)(a),

respectively, of MI 61-101, as neither the fair market value of the

Flow-Through Shares to be acquired by the participating Insiders

nor the consideration to be paid by such directors and officers is

anticipated to exceed 25 percent of the Company's market

capitalization.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful.

About Revival Gold Inc.

Revival Gold is a growth-focused gold

exploration and development company. The Company is advancing the

Beartrack-Arnett Gold Project located in Idaho, USA.

Beartrack-Arnett is the largest past-producing

gold mine in Idaho. The Project benefits from extensive existing

infrastructure and is the subject of a recent Preliminary

Feasibility Study for the potential restart of open pit heap leach

gold production operations.

Since reassembling the Beartrack-Arnett land

position in 2017, Revival Gold has made one of the largest new

discoveries of gold in the United States in the past decade. The

mineralized trend at Beartrack extends for over five kilometers and

is open on strike and at depth. Mineralization at Arnett is open in

all directions.

Additional disclosure including the Company’s

financial statements, technical reports, news releases and other

information can be obtained at www.revival-gold.com or on SEDAR+ at

www.sedarplus.ca.

For further information, please contact: Hugh

Agro, President & CEO or Melisa Armand, Manager, Investor

Relations, telephone: (416) 366-4100 or email:

info@revival-gold.com.

Cautionary Statement

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This press release includes certain

"forward-looking information" within the meaning of Canadian

securities legislation and “forward-looking statements” within the

meaning of U.S. securities legislation (collectively

“forward-looking statements”. Forward-looking statements are not

comprised of historical facts. Forward-looking statements include

estimates and statements that describe the Company’s future plans,

objectives or goals, including words to the effect that the Company

or management expects a stated condition or result to occur.

Forward-looking statements may be identified by such terms as

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, or “plan”. Since forward-looking statements are

based on assumptions and address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Although these statements are based on information currently

available to the Company, the Company provides no assurance that

actual results will meet management’s expectations. Risks,

uncertainties, and other factors involved with forward-looking

statements could cause actual events, results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking statements.

Forward-looking statements in this document include, but are not

limited to, statements regarding the anticipated Financing,

including the maximum size thereof, the expected timing to complete

the Financing, the ability to complete the Financing on the terms

provided herein or at all, the anticipated use of the net proceeds

from the Financing, the receipt of all necessary approvals for the

Financing, the Company’s objectives, goals and future plans, and

statements of intent, the implications of exploration results,

mineral resource/reserve estimates and the economic analysis

thereof, exploration and mine development plans, timing of the

commencement of operations, estimates of market conditions, and

statements regarding the results of the pre-feasibility study,

including the anticipated capital and operating costs, sustaining

costs, net present value, internal rate of return, payback period,

process capacity, average annual metal production, average process

recoveries, concession renewal, permitting of the project,

anticipated mining and processing methods, proposed pre-feasibility

study production schedule and metal production profile, anticipated

construction period, anticipated mine life, expected recoveries and

grades, anticipated production rates, infrastructure, social and

environmental impact studies, availability of labour, tax rates and

commodity prices that would support development of the Project.

Factors that could cause actual results to differ materially from

such forward-looking statements include, but are not limited to

failure to identify mineral resources, failure to convert estimated

mineral resources to reserves, the inability to maintain the

modelling and assumptions upon which the interpretation of results

are based after further testing, the inability to complete a

feasibility study which recommends a production decision, the

preliminary nature of metallurgical test results, delays in

obtaining or failures to obtain required governmental,

environmental or other project approvals, changes in regulatory

requirements, political and social risks, uncertainties relating to

the availability and costs of financing needed in the future,

uncertainties or challenges related to mineral title in the

Company’s projects, changes in equity markets, inflation, changes

in exchange rates, fluctuations in commodity and in particular gold

prices, delays in the development of projects, capital, operating

and reclamation costs varying significantly from estimates, the

continued availability of capital, accidents and labour disputes,

and the other risks involved in the mineral exploration and

development industry, an inability to raise additional funding, the

manner the Company uses its cash or the proceeds of an offering of

the Company’s securities, an inability to predict and counteract

the effects of COVID-19 on the business of the Company, including

but not limited to the effects of COVID-19 on the price of

commodities, capital market conditions, restriction on labour and

international travel and supply chains, future climatic conditions,

the discovery of new, large, low-cost mineral deposits, the general

level of global economic activity, disasters or environmental or

climatic events which affect the infrastructure on which the

project is dependent, and those risks set out in the Company’s

public documents filed on SEDAR+. Although the Company believes

that the assumptions and factors used in preparing the

forward-looking statements in this news release are reasonable,

undue reliance should not be placed on such information, which only

applies as of the date of this news release, and no assurance can

be given that such events will occur in the disclosed time frames

or at all. Specific reference is made to the most recent Annual

Information Form filed on SEDAR+ for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect the Company’s ability to achieve the

expectations set forth in the forward-looking statements contained

in this presentation. The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

other than as required by law.

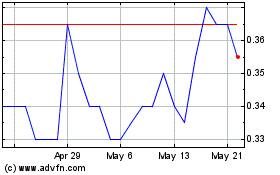

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Apr 2023 to Apr 2024