Revival Gold

Inc. (TSXV: RVG,

OTCQX: RVLGF) (“Revival Gold” or

the “Company”), is pleased to report impressive continued growth in

the Company’s Mineral Resources and the completion of a Preliminary

Feasibility Study (“PFS”) on the potential open pit heap leach

restart of the Beartrack-Arnett Gold Project (“Beartrack-Arnett” or

the “Project”) located in the western United States.

Mineral Resource Update

Highlights

- The updated Mineral

Resource is based on 172,244 meters of drilling through the end of

2022 and contains:

- A Measured &

Indicated Mineral Resource of 86.2 million tonnes at

0.87 g/T gold containing 2.42 million ounces of

gold1, an increase of

14% over the 2022 Measured & Indicated Mineral

Resource2; and,

- An Inferred Mineral

Resource of 50.7 million tonnes at 1.34 g/T gold

containing 2.19 million ounces of gold1, an

increase of 13% over the 2022 Inferred Mineral

Resource2;

- Contained

gold in open pit heap leach Measured & Indicated Resources

increased 142%2 to 42.3 million tonnes at 0.70 g/T gold

containing 959,000 ounces of gold with additional Inferred

Resources of 6.3 million tonnes at 0.53 g/T gold containing 108,000

ounces of gold; and

- Contained gold in

underground mill Inferred Resources increased 180%

to 6.7 million tonnes at 4.0 g/T gold containing 877,000 ounces of

gold with a 33% increase in grade over the 2022

Inferred Mineral Resource2.

Open Pit Heap Leach Restart PFS

Highlights

- Inaugural

Proven & Probable open pit heap leach Mineral

Reserve of 36.2 million tonnes at 0.74 g/T gold for 859,000

ounces of gold3;

- Average

gold production of 65,300 ounces of gold per year, for a

total of 529,100 ounces of gold over an eight-year mine

life;

-

Pre-production capital of $109 million, working

capital of $5 million, and life-of-mine (“LOM”) sustaining capital

of $100 million, reflecting only a modest increase in capital

relative to the 2020 Preliminary Economic Assessment;

- Total cash

cost of $986 per ounce and All-In Sustaining Cost

(“AISC”) of $1,235 per ounce of gold;

- After-tax

NPV at a 5% discount rate

(“NPV5%”) of $105

million and after-tax IRR of 24.3% at $1,800 per

ounce gold increasing to an NPV5% of $138 million and

after-tax IRR of 29.5% at $1,900 per ounce gold;

- After-tax

payback period of 3.4 years at $1,800 per ounce

gold decreasing to 3.1 years at $1,900 per ounce

gold;

- Low

technical and execution risk of a brownfield project with

existing infrastructure, minimal pre-production earthworks and mine

pre-stripping, limited planned disturbance outside the Project’s

current footprint, and a high proportion of low-risk pre-production

capital expenditures on mechanical equipment;

- Excellent

additional exploration potential with exploration drilling

currently underway on high grade open pit oxide opportunities at

Roman’s Trench and Haidee that offer near term opportunities to

extend the open pit heap leach PFS mine life; and,

- Opportunity

to pursue a potential second phase mill operation with

Mineral Resources that provide optionality to begin underground or

with an open pit, or concurrently develop both.

“Completion of this PFS marks a significant

de-risking milestone for Revival Gold,” said Hugh Agro, President

& CEO. “Beartrack-Arnett presents a unique opportunity for

meaningful US gold production from a low-risk, low capital restart

of an established domestic mine site. The project features robust

economics including an attractive 24% after-tax IRR at $1,800 gold

which increases to 30% at current prices,” added Agro.

“Beyond the first phase of open pit heap leach

production addressed in the PFS, potential exists for Revival Gold

to pursue a second phase of underground and open pit mill

operations. The more than doubling in Measured & Indicated open

pit heap leach resources and near tripling of underground Inferred

resources reflected in today’s update speaks to the impressive

ongoing exploration and development potential at Beartrack-Arnett.

With completion of the PFS, Revival Gold is now positioned to

progress environmental and permitting preparations, fine tune

engineering and design plans and advance the proposed

Beartrack-Arnett project schedule. Meanwhile, exploration continues

with drilling having resumed this month,” said Agro.

The Mineral Resource estimate, Mineral Reserve

estimate, and PFS were prepared in accordance with National

Instrument 43-101 (“NI 43-101”) by Kappes, Cassiday &

Associates (“KCA”), Independent Mining Consultants, Inc. (“IMC”),

KC Harvey Environmental (“KC Harvey”) and WSP USA Environmental

& Infrastructure Inc. (“WSP”), collectively the “Study

Authors”, with an effective date of June 30th, 2023. The Company

will file a technical report summarizing the PFS on

www.revival-gold.com and on SEDAR at www.sedar.com in accordance

with NI 43-101 within 45 days.

Conference Call

Management will host a conference call later

this morning to discuss the results of the Mineral Resource update

and PFS. Call-in information below:

| |

Scheduled

Start: |

Tuesday, July

11th, 2023, 10:00 am EST |

| |

Call-In Number: |

416-764-8658 |

| |

Toll Free in North America: |

888-886-7786 |

A replay of the conference call will be

available for one week at 416-764-8691 or toll free in North

America at 877-674-6060. Playback passcode 416972#.

Further Details

Mineral Resource Estimate

The Mineral Resource estimate has been reported

in accordance with NI 43-101 and was prepared by IMC with an

effective date of June 30th, 2023. Table 1 provides the

pit-constrained and underground Beartrack-Arnett Gold Project

Mineral Resource estimate, which includes oxide, transition, and

sulphide material.

Table 2 summarizes the Mineral Resource

definition parameters used to develop the Mineral Resource

estimate. The Measured and Indicated Mineral Resources were

estimated at a gold price of $1,900 per ounce.

Table 1: Beartrack-Arnett Gold

ProjectMineral Resources by Material Type and

Location

|

Resource Type |

Location |

Resource Category |

Mineral Resources |

|

Resource |

Grade |

Contained |

|

(kT) |

(g/T) |

(koz) |

|

Heap LeachMineral Resource |

Open Pit |

Beartrack |

Measured |

6,743 |

1.03 |

224 |

|

Indicated |

18,781 |

0.77 |

466 |

|

Inferred |

2,694 |

0.51 |

45 |

|

Haidee |

Measured |

5,932 |

0.48 |

92 |

|

Indicated |

10,880 |

0.51 |

177 |

|

Inferred |

3,624 |

0.55 |

64 |

|

Open Pit |

Beartrack& Haidee |

Measured |

12,675 |

0.78 |

316 |

|

Indicated |

29,661 |

0.67 |

643 |

|

Measured + Indicated |

42,336 |

0.70 |

959 |

|

Inferred |

6,318 |

0.53 |

108 |

|

MillMineral Resource |

Open Pit |

Beartrack |

Measured |

6,557 |

1.10 |

231 |

|

Indicated |

37,290 |

1.03 |

1,233 |

|

Inferred |

37,666 |

0.99 |

1,204 |

|

Underground |

Beartrack |

Inferred |

6,745 |

4.05 |

877 |

|

Open Pit &Underground |

Beartrack |

Measured |

6,557 |

1.10 |

231 |

|

Indicated |

37,290 |

1.03 |

1,233 |

|

Measured + Indicated |

43,847 |

1.04 |

1,464 |

|

Inferred |

44,411 |

1.46 |

2,082 |

|

TotalMineralResource |

Open Pit &Underground |

Beartrack& Haidee |

Measured |

19,232 |

0.88 |

547 |

|

Indicated |

66,951 |

0.87 |

1,876 |

|

Measured + Indicated |

86,184 |

0.87 |

2,423 |

|

Inferred |

50,728 |

1.34 |

2,190 |

|

|

|

|

Notes: 1) Gold price used for

Mineral Resources:

$1,900/oz. 2) Gold grades are

reported in grams per metric tonne

(g/T). 3) Economic cutoff is

based on Income Net of Process = $0.01/tonne. Income Net of Process

= (Grade x Recovery x ($1,900 - $5)) - (Process Cost + G&A).

Beartrack heap leach process cost and process recovery varies with

CN/FA ratio. 4) Beartrack average

heap leach gold recovery = 51% of FA, which excludes secondary

leach recovery that is included in the PFS recovery calculations.

Beartrack heap leach ore types are: CN/FA > 0.7 = Oxide, 0.2 to

0.7 CN/FA = Transition, CN/FA < 0.2 = Sulphide. Beartrack base

heap leach mining cost and average processing cost including

G&A = $2.04/T and $6.88/T, respectively. Beartrack heap leach

throughput = 12,000 T/d. Beartrack approximate FA cutoff grades for

heap leach resource = Oxide = 0.15 g/T, Transition = 0.29 g/T,

Sulphide = 0.96 g/T. 5) Haidee

heap leach recovery = 86% of FA. Haidee base heap leach open pit

mining cost and average processing cost including G&A = $2.04/T

and $6.78/T, respectively. Haidee heap leach throughput = 12,000

T/d. Haidee heap leach resource cutoff grade = 0.17

g/T. 6) Beartrack mill sulphide

recovery = 94%. Beartrack base mill open pit mining cost and

processing cost including G&A = $2.14/T and $24.83/T,

respectively. Beartrack average mill underground mining cost and

processing cost including G&A = $100.00/T and $35.52/T,

respectively. Beartrack mill open pit throughput = 12,000 T/d.

Standalone underground throughput = 2,500 T/d. Beartrack open pit

mill sulphide resource cutoff = 0.43 g/T. Beartrack underground

mill resource cutoff = 2.37

g/T. 7) Total surface mine

material moved: 449,504

kT. 8) Mineral Resources include

Mineral Reserves. 9) Numbers may

not add exactly due to rounding. |

Table 2: Beartrack-Arnett Gold

ProjectMineral Resource Estimate Definition

Parameters

|

Mineral ResourceDefinition Parameters |

Units |

Mill Parameters |

Heap Leach Parameters |

|

BeartrackUnderground |

BeartrackOpen Pit |

BeartrackOpen Pit |

HaideeOpen Pit |

|

General |

|

Mineral Resource Gold Price |

$/oz |

$1,900 |

|

|

Mining / Processing Rate |

T/d |

2,500 |

12,000 |

|

12,000 |

|

|

Average Process Recovery |

% |

|

94% |

|

51%1 |

|

86% |

|

|

Mining OPEX |

|

Base Mining |

$/T |

$100.00 |

$2.14 |

|

$2.04 |

$2.04 |

|

|

Incremental Bench Mining |

$/T |

- |

|

- |

|

$0.04 |

$0.02 |

|

|

per bench below listed elevation |

ft |

- |

|

- |

|

7,075 |

7,340 |

|

|

Processing OPEX including G&A |

|

Oxide (CN/FA > 0.7) |

$/T |

- |

|

- |

|

$6.62 |

$6.78 |

|

|

Transition (CN/FA > 0.2 < 0.7) |

$/T |

- |

|

- |

|

$7.31 |

|

- |

|

|

Sulphide (CN/FA < 0.2) |

$/T |

$35.52 |

$24.83 |

|

$8.02 |

|

- |

|

|

Incremental Ore Haul |

$/T |

- |

|

- |

|

|

- |

$2.19 |

|

|

Other Costs |

|

Refining & Freight |

$/oz |

$5.00 |

|

$5.00 |

|

|

Open Pit Slope Angles |

|

Tertiary, Dykes, Till, Fill |

degrees |

- |

38 |

|

38 |

|

|

Rapakivi Granite |

degrees |

- |

45 |

|

45 |

|

|

Yellowjacket |

degrees |

- |

45 |

|

45 |

|

|

Economic Cutoff Values |

|

Net of Process Revenue |

$/T |

$100.00 |

$0.01 |

|

$0.01 |

$0.01 |

|

|

Approximate Contained Gold Cutoff Grades |

|

Heap Leach Oxide |

g/T |

- |

|

- |

|

0.15 |

0.17 |

|

|

Heap Leach Transition |

g/T |

- |

|

- |

|

0.29 |

|

- |

|

|

Heap Leach Sulphide |

g/T |

- |

|

- |

|

0.96 |

|

- |

|

|

Mill Sulphide |

g/T |

2.37 |

0.43 |

|

|

- |

|

- |

|

|

Note: 1) This value represents

the average metallurgical recovery of the Beartrack heap leach

Mineral Resource inside the PFS pit; however, the recoveries used

to define the PFS Mineral Resource were calculated on a

block-by-block basis using the following equation: 0.8852 * CN/FA -

0.0612, where CN is the cyanide soluble gold estimate for a given

block and FA is the contained gold estimated for a given block.

This value excludes secondary leach recovery, which is included in

the KCA PFS recovery calculations. |

Table 3 illustrates the sensitivity of the total

Mineral Resource to changes in gold price from $1,800 per ounce up

to $2,000 per ounce.

Table 3: Beartrack-Arnett Gold

ProjectMineral Resources Sensitivity to Gold

Price

|

Mineral Resource Categoryand Gold Price |

ResourceTonnage(kT) |

ContainedGold Grade(g/T) |

ContainedGold(koz) |

|

Mineral Resource Sensitivity at $1,800/oz Gold |

|

Total Measured + Indicated |

83,017 |

0.88 |

2,360 |

|

Total Inferred |

44,674 |

1.39 |

2,003 |

|

Base Case Mineral Resource at $1,900/oz Gold |

|

Total Measured + Indicated |

86,184 |

0.87 |

2,423 |

|

Total Inferred |

50,728 |

1.34 |

2,190 |

|

Mineral Resource Sensitivity at $2,000/oz Gold |

|

Total Measured + Indicated |

97,295 |

0.81 |

2,525 |

|

Total Inferred |

63,597 |

1.19 |

2,441 |

Inferred Mineral Resources include 6.7 million

tonnes of underground material at 4.0 g/T gold containing 877,000

ounces of gold. The increase in underground Inferred Mineral

Resources since 2022 is, in part, derived from a more focused

approach to mining and the elimination of an open pit in the Joss

Target areas. The pit elimination would reduce the environmental

footprint of the potential mill phase and accelerate the expected

permitting and development timelines for the potential mill

production phase to commence.

Underground mining is assumed to utilize an

overhand cut and fill approach on a “stand-alone” basis with a

cut-off grade of 2.37 g/T gold. The underground Mineral

Resource occurs in both the South Pit and Joss areas and vertically

over an elevation of approximately 580 meters. The underground

Inferred Mineral Resource dips at approximately 80-90 degrees and

ranges in thickness from about 3 to 25 meters.

Table 4 summarizes the sensitivity of the

Beartrack underground Mineral Resource to changes in cutoff gold

grade. All underground scenarios in Table 4 are for Mineral

Resources that sit below mill open pit Mineral Resource.

Table 4: Beartrack-Arnett Gold

ProjectUnderground Mineral Resources Sensitivity

to Cutoff Gold Grade

|

CutoffGold Grade(g/T) |

GoldPrice($/oz) |

Inferred MineralResource Tonnage(kT) |

ContainedGold Grade(g/T) |

ContainedGold(koz) |

|

2.00 |

2,250 |

12,470 |

3.22 |

1,292 |

|

2.26 |

2,000 |

8,194 |

3.77 |

994 |

|

2.37 |

1,900 |

6,746 |

4.05 |

877 |

|

2.50 |

1,800 |

5,517 |

4.39 |

778 |

|

2.64 |

1,700 |

4,295 |

4.87 |

672 |

|

2.74 |

1,640 |

3,385 |

5.38 |

586 |

|

Note: A cutoff gold grade of 2.37 g/T defines the Base Case

underground mineral resource. |

Figure 1 presents an overview of the

Beartrack-Arnett Project area and the location of Mineral Resources

on the property.

Figure 1: Beartrack-Arnett Gold

ProjectMineral Resource

Areas1 and Land

Position

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/538fc038-93b9-4a8d-b066-2008b29088ee

Note:

1) See

Revival Gold news release dated July 11th, 2023, for additional

details on Mineral Resources and press releases dated October 2nd,

2017, March 15th, 2022, and September 22nd, 2022, for additional

details on drill results depicted here.

Mineral Reserve Estimate

The PFS and associated Mineral Reserve estimate

was developed based on the open pit heap leach Measured and

Indicated portion of the Beartrack and Haidee Mineral Resource

estimates. The Proven and Probable Mineral Reserves for the Project

were estimated at a gold price of $1,700 per ounce and are

summarized in Table 5.

Table 5: Beartrack-Arnett Gold

ProjectMineral Reserve Estimate by Location and

Category

|

Deposit |

Mineral Reserve Category |

Mineral Reserves |

|

Tonnage |

Gold Grade |

Contained Gold |

|

(kT) |

(g/T) |

(koz) |

|

Beartrack |

Proven |

6,420 |

1.06 |

219 |

|

Probable |

15,600 |

0.82 |

413 |

|

Proven + Probable |

22,020 |

0.89 |

632 |

|

Haidee |

Proven |

5,933 |

0.48 |

92 |

|

Probable |

8,244 |

0.51 |

136 |

|

Proven + Probable |

14,177 |

0.51 |

228 |

|

Total Proven |

12,353 |

0.78 |

311 |

|

Total Probable |

23,844 |

0.72 |

549 |

|

Total Proven + Probable |

36,197 |

0.74 |

859 |

|

Notes: 1) Gold price used for

Mineral Reserves:

$1,700/oz. 2) Gold grades are

reported in grams per metric tonne,

g/T. 3) Cutoff gold grade is

based on Net of Process Revenue =

$0.01/tonne. Net of Process Revenue = (Grade

x Recovery x ($1,700 - $5)) - (Process Cost + G&A).Process cost

varies with CN/FA ratio. Process recovery varies by CN/FA

ratio. 4) Typical FA gold cutoff

grades are: 0.17 g/T oxide, 0.33 g/T transition, 1.07 g/T

sulphide. 5) Total open pit

material: 124,413 kT. 6) Numbers

may not add exactly due to rounding. |

Open Pit Heap Leach PFS

The PFS was developed as an initial phase of

open pit mining with approximately 36.2 million tonnes of heap

leachable ore from the Beartrack and Haidee deposits at an average

rate of 12,000 tonnes/day for a period of 8.1 years. The PFS mine

fleet is conventional with loading accomplished by three 11 m3

front loaders matched to up to thirteen 90-tonne class haul

trucks. Run-of mine ore from the open pits would be

processed in a conventional, mobile crushing circuit to achieve a

particle size of 100% passing 38 mm (1.5 inch). Crushed ore

would be conveyor stacked onto heap leach pads and leached with a

low concentration cyanide solution. The resulting pregnant leach

solution would be processed in an existing, refurbished,

adsorption-desorption-recovery (“ADR”) plant for the recovery of

gold resulting in the production of a final doré product.

During the first five years of mine operations,

ore would be mined from the Beartrack pits (North, South, and

Mason-Dixon pits), then crushed, conveyor stacked, and leached on a

dedicated leach pad at the Beartrack site. During the last three

years of mine operations, mining would transition to the Haidee pit

in the Arnett area. Prior to mining at Haidee, a two-way haul road

between the Haidee and Beartrack sites would be constructed and a

dedicated leach pad for the Haidee ore would also be constructed,

adjacent to the Beartrack leach pad site.

LOM average metallurgical recovery for the

Project is approximately 62% of contained gold and the estimated

average annual gold production would be 65,300 ounces per year.

Economics for the PFS are based on mining and processing the heap

leach Mineral Resources only; mining and processing of mill Mineral

Resources would be a separate second phase project.

Mine and Gold Production

Schedule

The PFS mine plan was developed using

conventional open pit hard rock mining methods. The mining

operation was developed to deliver 4.38 million tonnes of leachable

material to the primary crusher per year (nominally 12,000 tonnes

per day). Table 6 provides the PFS mine schedule.

Table 6: PFS Mine and Gold Production

Schedule

|

Year |

Beartrack |

Haidee |

Life-of Mine Totals |

|

Ore(kT) |

GoldGrade(g/T) |

WasteRock(kT) |

Ore(kT) |

GoldGrade(g/T) |

WasteRock(kT) |

Ore(kT) |

RecoveredGold(oz) |

WasteRock(kT) |

StrippingRatio(w/o) |

|

PP |

1,088 |

0.75 |

3,538 |

|

|

|

1,088 |

|

3,538 |

3.3 |

|

YR01 |

4,379 |

0.62 |

13,490 |

|

|

|

4,379 |

68,350 |

13,490 |

3.1 |

|

YR02 |

4,379 |

0.62 |

13,490 |

|

|

|

4,379 |

56,852 |

13,490 |

3.1 |

|

YR03 |

4,379 |

0.75 |

13,490 |

|

|

|

4,379 |

66,537 |

13,490 |

3.1 |

|

YR04 |

4,379 |

1.03 |

13,519 |

|

|

|

4,379 |

75,692 |

13,519 |

3.1 |

|

YR05 |

3,411 |

1.65 |

3,026 |

604 |

0.51 |

5,684 |

4,015 |

68,402 |

8,710 |

2.2 |

|

YR06 |

|

|

|

4,379 |

0.50 |

8,673 |

4,379 |

67,651 |

8,673 |

2.0 |

|

YR07 |

|

|

|

4,379 |

0.51 |

8,801 |

4,379 |

61,518 |

8,801 |

2.0 |

|

YR08 |

|

|

|

4,379 |

0.47 |

4,031 |

4,379 |

56,470 |

4,031 |

0.9 |

|

YR09 |

|

|

|

433 |

0.52 |

317 |

433 |

7,431 |

317 |

0.7 |

|

YR10 |

|

|

|

|

|

|

|

148 |

|

|

|

Total |

22,017 |

0.89 |

60,552 |

14,175 |

0.51 |

27,506 |

36,191 |

529,051 |

88,058 |

2.4 |

|

Notes:

1) Recovered

Gold includes heap leach and ore processing recovery delay and

secondary leaching per

PFS. 2) Numbers

may not add exactly due to rounding. |

Infrastructure

Much of the infrastructure from the original

Beartrack mining operation remains in serviceable condition.

Wherever possible, refurbishment and reuse of the existing

infrastructure is planned, including the following:

- Site access and

onsite roads;

- Fencing and

gates;

- Fuel and water

tanks;

- Process solution,

overflow (event), and other storm and treated water retention ponds

and process solution channels;

- Groundwater

monitoring and stormwater management systems;

- Water treatment

plant;

- Septic

systems;

- Core

warehouse;

- ADR plant /

laboratory; and,

- Power substation

and overhead power distribution lines.

All other major infrastructure from the previous

operations were removed as part of prior site reclamation efforts

and would need to be replaced for future operations. The primary

new infrastructure that would be required to support the PFS plan

include:

- Ore crushing and

conveyor stacking systems;

- Process solution

distribution and collection systems;

- Heap leach

pads;

- Additional process

solution pond;

- Haidee haul

road;

- Truck shop and

warehouse; and,

- Administration and

office buildings.

Heap Leach Metallurgy and Ore

Processing

The primary source of data that forms the basis

of the PFS heap leach metallurgical recovery estimates include

twelve 6-to-12-month duration column leach tests completed by SGS

Mineral Services in Ontario, Canada, developed from nine bulk

composites from Beartrack and Haidee drill core along with 36

corresponding coarse ore bottle roll tests. Production

statistics from historical Beartrack operations were also used to

supplement the SGS column leach testing results.

Crushing of run-of-mine ore would be

accomplished by a two-stage mobile crushing circuit that includes a

primary jaw crusher and two secondary cone crushers. Crushed ore

would be stockpiled using a fixed stacker and reclaimed using belt

feeders to a reclaim conveyor; pebble lime would be added to the

reclaim conveyor for pH control. During the initial five years of

operations, ore would be conveyed to the heap stacking system at

the Beartrack leach pad. During the final three years of operation,

the mobile crushing circuit and conveyor stacking system would be

relocated on the Beartrack site to serve the Haidee dedicated leach

pad.

Crushed ore would be stacked in 10-meter-high

lifts and leached using a buried drip irrigation system. Gold

bearing pregnant leach solution would drain by gravity to the

existing pregnant solution pond where it would be pumped to the

existing carbon adsorption circuit. Gold-cyanide compounds would be

loaded onto activated carbon in the adsorption circuit; the

resulting barren solution would flow by gravity to the barren

solution tanks then pumped to the heap for additional leaching.

High strength cyanide solution would be injected into the barren

solution to maintain the desired cyanide concentration in the leach

solutions.

Gold would be stripped from the loaded carbon

using a modified pressure Zadra process and recovered by

electrowinning. Cathodes from the electrowinning cells would be

washed and the resulting precious metal sludge treated in a retort

to recover mercury, followed by smelting to produce the final doré

product. Carbon would be acid-washed to remove scale

and other inorganic contaminants, and thermally regenerated using a

rotary kiln.

The estimated average gold recovery from the

heap leach pads based on the PFS mine and ore processing production

schedule is estimated to be 62%. The estimated average recovery

reflects recoveries of 78% for oxide material, 43% for transition

material and 14% for sulphide material.

Capital and Operating Cost

Estimates

Ore processing, infrastructure, and general and

administrative (“G&A”) capital and operating cost estimates for

the Beartrack-Arnett PFS were developed by KCA. Mining equipment,

mining preproduction, and mine operating cost estimates were

developed by IMC. Closure, water treatment, and permitting related

cost estimates were developed by KC Harvey with input from KCA and

IMC. Capital and operating costs were estimated based on first

quarter 2023 US dollars.

Capital costs for all major and most minor

equipment, as well as contractor quotes for major construction

contracts, were estimated from one or more supplier quotes. Where

project specific quotes were unavailable, estimates were developed

from applicable recent analogue project quotes. Table 7 provides a

summary of the PFS capital costs.

Table 7: PFS Capital Cost

Estimate

|

Description |

Costs($,000) |

|

Pre-Production Capital |

|

Process & Infrastructure Capital |

$56,820 |

|

Mining Capital & Pre-Production |

$28,230 |

|

Indirect & Owner's Costs |

$4,258 |

|

EPCM |

$6,704 |

|

Contingency |

$11,067 |

|

Process Pre-Production |

$2,252 |

|

Total Pre-Production Capital |

$109,331 |

|

Working Capital & Initial Fills |

|

Mining Working Capital |

$2,988 |

|

Processing Working Capital |

$1,704 |

|

G&A Working Capital |

$367 |

|

Initial Fills |

$166 |

|

Total Working Capital |

$5,225 |

|

Sustaining Capital |

|

Process & Infrastructure |

$40,663 |

|

Indirect & EPCM |

$7,319 |

|

Mining |

$43,916 |

|

Contingency |

$8,133 |

|

Total Sustaining Capital |

$100,031 |

|

Reclamation & Closure Capital |

|

Direct Costs |

$12,510 |

|

EPCM & Indirect Costs |

$1,877 |

|

Operating Costs |

$6,258 |

|

Heap Leach Rinsing & Neutralization |

$7,009 |

|

Contingency |

$4,148 |

|

Total Reclamation & Closure Capital |

$31,802 |

Ore processing and G&A costs were estimated

by KCA from first principles. Labor costs were estimated using

project specific staffing, salary, wage, and benefit requirements.

Unit consumptions of materials, supplies, power, water and

delivered supply costs were also estimated. The operating costs

presented are based upon the ownership of all process production

equipment and site facilities, including the onsite laboratory.

Revival would employ and direct all process operations,

maintenance, and support personnel for all site activities.

Mining costs provided by IMC are based on owner

mining costs using leased mining equipment. Leases are based on a

four-year term; consequently, all leased equipment would be owned

by Revival before the end of mining operations.

Economic Analysis

Based on the estimated production schedule,

capital costs and operating costs, a cash flow model was prepared

by KCA for the economic analysis of the Project. All information

used in this economic evaluation was derived from work completed by

KCA, IMC and KC Harvey, with support by Revival.

The project economics were evaluated using a

discounted cash flow method that measures the Net Present Value

(“NPV”) of future cash flow streams. The PFS economic model was

based on the following key assumptions:

- A gold price of

$1,800 per ounce.

- The mine production

schedule developed by IMC with a nominal mining and ore processing

rate of 12,000 tonnes per day.

- A period of

analysis of 13 years that includes one year of investment and

pre-production, 8.1 years of production, and 3.9 years for

reclamation and closure.

- Capital and

operating costs as summarized in the preceding section.

The Project economics based on these criteria

from the cash flow model are summarized in Table 8.

Table 8: PFS Economic Analysis

Summary

|

Production Data |

|

Life of Mine |

|

8.1 |

Years |

|

Annual Average Ore Mined and Leached |

|

4,380,000 |

tonnes/year |

|

LOM Average Head Grade |

|

0.74 |

g/T |

|

LOM Gold Recovery |

|

61.6 |

% |

|

Average Annual Gold Production |

|

65,324 |

ounces |

|

Total Gold Produced |

|

529,051 |

ounces |

|

LOM Strip Ratio (Waste:Ore) |

|

2.4 |

|

|

Capital Costs |

|

Initial Capital |

$109 |

million |

|

Working Capital & Initial Fills |

$5 |

million |

|

LOM Sustaining Capital |

$100 |

Million |

|

Reclamation & Closure Capital |

$32 |

Million |

|

LOM Average Operating Costs |

|

Mining |

$8.30 |

/tonne ore |

|

Processing & Support |

$4.73 |

/tonne ore |

|

G&A |

$1.02 |

/tonne ore |

|

Total Cash Cost |

$986 |

/ounce |

|

All-in Sustaining Cost (ASIC) |

$1,235 |

/ounce |

|

Financial Parameters |

|

Gold Price |

$1,800 |

/ounce |

|

Internal Rate of Return, Before Tax |

|

27.7 |

% |

|

Internal Rate of Return, After Tax |

|

24.3 |

% |

|

Average Annual Cashflow, Before Tax |

$41 |

million |

|

Average Annual Cashflow, After Tax |

$37 |

million |

|

Net Present Value @ 5%, Before Tax |

$130 |

million |

|

Net Present Value @ 5%, After Tax |

$105 |

million |

|

Pay-Back Period |

|

3.4 |

years |

Figure 2 presents the annual and cumulative

after-tax cash flow from pre-production through mine closure at

$1,800 per ounce gold.

Figure 2: PFS After-Tax Cash

Flow

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/835b1d57-5227-46fe-a46c-660582e53e46

A sensitivity analysis was performed using the

PFS economic model. Figure 3 and Figure 4 provide the after-tax IRR

and after-tax NPV5% sensitivities to gold price, capital cost, and

operating cost, respectively.

Figure 3: PFS After-Tax IRR Sensitivity

Analysis

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/425b6f59-bb2c-40f0-b343-47916238a050

Figure 4: PFS After-Tax

NPV5% Sensitivity

Analysis

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/85cc6162-b07e-4519-b926-57134d526032

Key Opportunities &

Risks

Key opportunities identified by the Study

Authors for the Beartrack-Arnett Gold Project include:

- Mineralization at

Haidee remains open in all directions providing the opportunity to

expand the existing heap leach Mineral Resource, increase the mine

life and mine throughput, and improve overall project

economics.

- Potential exists to

identify near-surface, higher grade mineral resources on the Arnett

Property, primarily in Roman’s Trench area.

- Ore from Haidee

does not appear to be sensitive to crush size in the range of crush

sizes tested. Therefore, coarser crushing and run-of-mine leaching

may be possible without appreciable changes in recovery.

- Potential to

increase the level of automation, electrification, and emerging

mining and processing technologies, such as ore sorting, in all

areas of the Project.

- Potential to

develop a second phase mill operation to process known mill Mineral

Resources and numerous related exploration expansion opportunities

(Joss, South Pit, Wards Gulch and elsewhere).

Key risks identified by the Study Authors for

the Beartrack-Arnett first phase heap leach restart project

include:

- Risks associated

with potential mine development include sensitivity to gold price

and permit delays.

- The project

considers refurbishing and reusing much of the existing recovery

plant and infrastructure. There is a risk that the refurbishment

costs would exceed budgeted estimates.

- The Beartrack site

is serviced by an existing Idaho Power Co. 69 kV power transmission

line with limited excess capacity and with power available on a

first come, first served basis.

- To account for the

long leach tail observed during historical Beartrack operations,

the metallurgical recovery calculated from column leach testing was

increased by 2.3% of contained gold (approximately 11,000 ounces of

gold in total) for Beartrack oxide and transition ores. Although

the data supports this assumption, there is a risk that this added

recovery may not be realized or may be delayed relative to the

economic model assumptions.

Responsible Mine Development

The historical Beartrack Mine site was

developed, operated, and continues to be managed in a responsible

way. Revival Gold benefits from the Beartrack standard and plans to

reinforce that legacy by developing the Project in a manner

consistent with today’s more stringent best practice standards.

Examples of this commitment from the PFS include:

- Refurbishing and

reusing the appreciable existing site infrastructure, including the

ADR and water treatment plants, while introducing instrumentation

and automation upgrades that improve efficiency, safety, and

reliability;

- Utilizing low

carbon emissions grid hydro power;

- Developing mine and

site infrastructure plans that avoid new stream and riparian area

disturbances and crossing, and, to the maximum possible extent,

staying within existing historical project disturbance areas;

- Developing

reclamation and closure plans that adopt successful historical

reclamation practices and improves-upon post-closure water

management and treatment practices, including incorporating

membrane cover systems into waste rock storage facility designs;

and,

- Prioritizing hiring

locally, building an internal team, and contracting with external

consultants, contractors and suppliers, that are Lemhi County and

Idaho-based, and when those resources are unavailable, looking to

neighboring States to bolster the project team.

Recommended Next Steps

The Study Authors have recommended additional

work to increase the level of detail, improve the PFS economics,

and de-risk aspects of the project. These recommendations

include:

- Additional heap

leach metallurgical test work to verify recoveries and reagent

requirements at Beartrack and assess the potential for run-of-mine

leach at Haidee.

- Additional

hydrogeologic characterization to refine the current estimates on

the site-wide water balance and pit lake modeling.

- Additional

environmental geochemistry characterization to support operational

waste management planning and closure design.

- The current

environmental baseline study program should be maintained to

prepare for permitting and NEPA review of the first phase heap

leach restart project.

- The development of

a Plan of Operations in support of permitting the heap leach

restart project.

- A feasibility study

should be completed on the heap leach restart project once

supporting lab and field studies referenced above have been

sufficiently advanced.

- A scoping level

economic assessment should be completed for mining and processing

sulphide material in a potential second phase mill operation.

- Ongoing exploration

for open pit oxide mineralization at Arnett. The deposit at Haidee

is open in all directions with several other promising untested

near-surface oxide drill targets near the Haidee haul road and

Beartrack ADR plant.

- Further sulphide

exploration on the open +5 km Beartrack trend and a scoping level

assessment for processing sulphide material.

Estimated costs for select discretionary and

core recommendations are provided in Table 9.

Table 9: Estimated Costs for Select Study

Author Recommendations

|

Recommendations |

Estimated Costs |

|

Discretionary($ millions) |

Core Items($ millions) |

|

Heap leach metallurgical testing – crush size optimization |

|

- |

$0.60 |

|

Haidee haul road study |

|

- |

$0.35 |

|

Heap leach geotechnical characterization of ore and liner

assembly |

|

- |

$0.03 |

|

Hydrogeological studies |

|

- |

$3.20 |

|

Geochemical characterization studies |

|

- |

$0.30 |

|

Open pit geotechnical studies |

|

- |

$0.20 |

|

Remaining permitting baseline data collection & studies |

|

- |

$6.50 |

|

Plan of Operations |

|

- |

$0.30 |

|

Phase 1 Heap Leach Restart Project feasibility study |

|

- |

$1.00 |

|

Phase 2 Mill Project scoping level economic study |

$0.30 |

|

- |

|

Mineral resource expansion core drilling (±12,000 m) |

$6.60 |

|

- |

|

Grassroots exploration core (±5,000 m) and RC (±6,000 m)

drilling |

$3.40 |

|

- |

|

Totals |

$10.30 |

$12.48 |

Figure 5 presents a preliminary proposed project

schedule that spans from completion of the PFS through construction

and commissioning.

Figure 5: Preliminary Proposed

Project Schedule

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9c538312-9b75-434f-810a-484b1a16a8d2

Qualified Persons

The following professional engineers were the

Qualified Persons (“QPs”) for the Mineral Resource estimate,

Mineral Reserve estimate, and PFS as defined by NI 43-101:

- Caleb Cook, P.E.,

Technical Director, Processing and Economics; KCA

- John Marek, P.E.,

RM SME, Mineral Resource and Reserve Estimates, Mining; IMC

- David Cameron,

P.E., Environmental, Reclamation & Closure Plan; KC Harvey

- Dr. Haiming (Peter)

Yuan, P.E., Geotechnical; WSP

Mr. Cook visited the site on 16 and 17 of

October 2022 to meet with project personnel and review general site

conditions, especially the area of the heap leach pad and

processing facilities.

Mr. Marek visited the site on August 3-4,

2022.

Mr. Cameron visited the site on May 11, 2021,

inspected all areas of the site, reviewed site conditions, and

collected reports on historical operations. KC Harvey personnel

under Mr. Cameron’s direct supervision attended that site

inspection and subsequently completed environmental monitoring and

field work on the site through 2021 and 2022.

Dr. Yuan visited the site on June 14, 2021. The

focus of Dr. Yuan’s site visit was to assess geotechnical

conditions of major civil works including locations of waste rock

facilities, heap leach pads, and potential borrow sources.

There is no affiliation between Mr. Cook, Mr.

Marek, Mr. Cameron, Dr. Yuan, and Revival except that of an

independent consultant / client relationship and each author is

independent of Revival Gold as described in Section 1.5 of NI

43-101.

John P.W. Meyer, Vice President Engineering and

Development, P.Eng., and Steven T. Priesmeyer, C.P.G., Vice

President Exploration, are the Company’s designated QPs for this

news release within the meaning of NI 43-101 and have reviewed and

approved its scientific and technical content. Mr. Priesmeyer’s

review focused on the geological representativity of the Mineral

Resource numerical models, including review of the laboratory and

field data that support the models, while Mr. Meyer’s review

focused on mine, process and infrastructure designs, capital and

operating costs, and financial modeling.

The Company will file a technical report

summarizing the Mineral Resource and PFS on www.revival-gold.com

and on SEDAR at www.sedar.com in accordance with N43-101 within 45

days.

About Revival Gold

Revival Gold is a growth-focused gold

exploration and development company. The Company is advancing the

Beartrack-Arnett Gold Project located in Idaho, USA.

Beartrack-Arnett is the largest past-producing

gold mine in Idaho. The project benefits from extensive existing

infrastructure and is the subject of a recent Preliminary

Feasibility Study for the potential restart of open pit heap leach

gold production operations.

Since reassembling the Beartrack-Arnett land

position in 2017, Revival Gold has made one of the largest new

discoveries of gold in the United States in the past decade. The

mineralized trend at Beartrack extends for over five kilometers and

is open on strike and at depth. Mineralization at Arnett is open in

all directions.

Additional disclosure including the Company’s

financial statements, technical reports, news releases and other

information can be obtained at www.revival-gold.comor on SEDAR at

www.sedar.com.

For further information, please contact Hugh

Agro, President & CEO or Melisa Armand, Investor Relations.

Telephone (416) 366-4100 or email info@revival-gold.com.

Cautionary Statement

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This news release includes certain

"forward-looking information" within the meaning of Canadian

securities legislation and “forward-looking statements” within the

meaning of U.S. securities legislation (collectively

“forward-looking statements”. Forward-looking statements are not

comprised of historical facts. Forward-looking statements include

estimates and statements that describe the Company’s future plans,

objectives or goals, including words to the effect that the Company

or management expects a stated condition or result to occur.

Forward-looking statements may be identified by such terms as

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, or “plan”. Since forward-looking statements are

based on assumptions and address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Although these statements are based on information currently

available to the Company, the Company provides no assurance that

actual results will meet management’s expectations. Risks,

uncertainties, and other factors involved with forward-looking

statements could cause actual events, results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking statements.

Forward-looking statements in this news release include, but are

not limited to, the Company’s objectives, goals and future plans,

and statements of intent, the implications of exploration results,

mineral resource/reserve estimates and the economic analysis

thereof, exploration and mine development plans, timing of the

commencement of operations, estimates of market conditions, and

statements regarding the results of the pre-feasibility study,

including the anticipated capital and operating costs, sustaining

costs, net present value, internal rate of return, payback period,

process capacity, average annual metal production, average process

recoveries, concession renewal, permitting of the project,

anticipated mining and processing methods, proposed pre-feasibility

study production schedule and metal production profile, anticipated

construction period, anticipated mine life, expected recoveries and

grades, anticipated production rates, infrastructure, social and

environmental impact studies, availability of labour, tax rates and

commodity prices that would support development of the Project.

Factors that could cause actual results to differ materially from

such forward-looking statements include, but are not limited to

failure to identify mineral resources, failure to convert estimated

mineral resources to reserves, the inability to maintain the

modelling and assumptions upon which the interpretation of results

are based after further testing, the inability to complete a

feasibility study which recommends a production decision, the

preliminary nature of metallurgical test results, delays in

obtaining or failures to obtain required governmental,

environmental or other project approvals, changes in regulatory

requirements, political and social risks, uncertainties relating to

the availability and costs of financing needed in the future,

uncertainties or challenges related to mineral title in the

Company’s projects, changes in equity markets, inflation, changes

in exchange rates, fluctuations in commodity and in particular gold

prices, delays in the development of projects, capital, operating

and reclamation costs varying significantly from estimates, the

continued availability of capital, accidents and labour disputes,

and the other risks involved in the mineral exploration and

development industry, an inability to raise additional funding, the

manner the Company uses its cash or the proceeds of an offering of

the Company’s securities, an inability to predict and counteract

the effects of COVID-19 on the business of the Company, including

but not limited to the effects of COVID-19 on the price of

commodities, capital market conditions, restriction on labour and

international travel and supply chains, future climatic conditions,

the discovery of new, large, low-cost mineral deposits, the general

level of global economic activity, disasters or environmental or

climatic events which affect the infrastructure on which the

project is dependent, and those risks set out in the Company’s

public documents filed on SEDAR. Although the Company believes that

the assumptions and factors used in preparing the forward-looking

statements in this news release are reasonable, undue reliance

should not be placed on such information, which only applies as of

the date of this news release, and no assurance can be given that

such events will occur in the disclosed time frames or at all. The

Company disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, other than as required by

law.

______________________1 Estimates based on a

gold price of $1,900 per ounce. See Tables 1 and 2 for additional

assumptions. All figures in this news release are in Metric units

and in $US unless stated otherwise.2 See Revival Gold’s May 16th,

2022, news release and NI 43-101 Technical Report by Wood plc dated

July 13th, 2022.3 Proven and Probable Mineral Reserves were

estimated at a gold price of $1,700 per ounce.

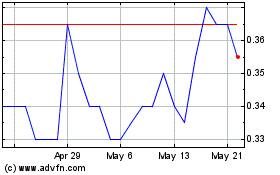

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Apr 2023 to Apr 2024