Tradeweb Markets Files to Go Public

March 07 2019 - 11:41AM

Dow Jones News

By Allison Prang and Bowdeya Tweh

Refinitiv is taking trading-platform operator Tradeweb Markets

Inc. public.

Tradeweb said in its Securities and Exchange Commission filing

Thursday that it expects to raise $100 million in proceeds from the

offering, but that figure is often used as a placeholder to

calculate filing fees.

It didn't give a range for its initial public offering or say

how many shares it expected to sell. The company is expected to be

valued at more than $5.5 billion at the time of the offering,

according to people familiar with the matter, though IPO pricing

can change at the last minute.

Refinitiv will still own the majority of Tradeweb's voting power

after the public offering. Refinitiv is the new name for Thomson

Reuters Corp.'s financial and risk business. Thomson Reuters sold a

55% stake in the business to Blackstone Group LP for $17 billion

last year.

Tradeweb, which counts MarketAxess and Bloomberg among its

largest competitors, operates a marketplace to trade bonds,

derivatives and money-market products.

Tradeweb had $29.3 million in net income for the three months

ended Dec. 31, according to the filing. Net revenue was $178.6

million.

Bloomberg reported in January that the company had

confidentially filed documents with securities regulators for an

IPO, citing people familiar with the matter.

Tradeweb handled its first U.S. Treasury trade in 1998. The

company had more than $549 billion in average daily trading volume

last year, according to its filing. Most of that was in rates

followed by money markets.

Tradeweb said it plans to apply to list its shares on the Nasdaq

market as "TW."

--Maureen Farrell contributed to this article.

Write to Allison Prang at allison.prang@wsj.com and Bowdeya Tweh

at Bowdeya.Tweh@wsj.com

(END) Dow Jones Newswires

March 07, 2019 11:26 ET (16:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

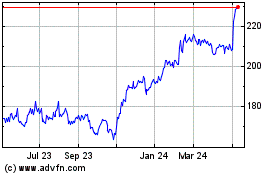

Thomson Reuters (TSX:TRI)

Historical Stock Chart

From Aug 2024 to Sep 2024

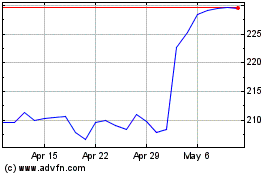

Thomson Reuters (TSX:TRI)

Historical Stock Chart

From Sep 2023 to Sep 2024