TD Expands US Footprint with $13.4 Billion Acquisition of First Horizon

February 28 2022 - 7:18AM

Dow Jones News

By Adriano Marchese

Toronto-Dominion Bank said Monday that it is accelerating its

long-term growth strategy in the U.S. by acquiring Tennessee-based

First Horizon Bank for $13.4 billion.

The Canadian banking and financial services company said it

would pay $25 a share in the all-cash transaction.

TD said the deal is immediately accretive to adjusted per-share

earnings and is expected to result in a fully-synergized return on

invested capital of 10% in 2023.

TD said it expects to incur costs of $1.3 billion in the first

two years following close related to the merger and integration of

the business, and expects to generate around $610 million in pretax

cost-synergies.

"[The acquisition] provides TD with immediate presence and scale

in highly attractive adjacent markets in the U.S. with significant

opportunity for future growth across the Southeast," Group

President and Chief Executive Officer Bharat Masrani said.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

February 28, 2022 07:03 ET (12:03 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

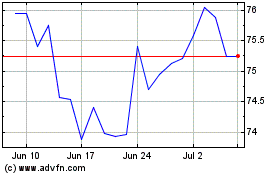

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

From Sep 2023 to Sep 2024