European Advertising Companies See Slowdown Ahead -- At a Glance

August 04 2023 - 10:48AM

Dow Jones News

By Adria Calatayud and Elena Vardon

Some of the biggest European advertising companies have warned

of a slowdown in the industry as marketers tighten their budgets.

WPP cut its 2023 net sales growth guidance on Friday, following in

the footsteps of last week's warning from S4 Capital. WPP and S4

Capital also joined U.S. peers Omnicom Group and Interpublic Group

in reporting weaker growth rates in the second quarter than the

first. While Publicis Groupe is bucking the trend for now,

executives at the French ad giant said clients are taking longer to

decide on projects.

--WPP now expects organic net sales to grow less than it had

previously anticipated in 2023. The London-based group--which owns

agencies including Ogilvy, Wunderman Thompson and VMLY&R, as

well as media-buying business GroupM--has been hurt by lower spend

and delayed projects from technology clients so far this year that

has hit its U.S. performance. "The reasons differ by clients and

actually not all clients are down, but the general trend is one of

cost control, focus on margins after a significant slowdown in

their own rapid rates of growth, and perhaps a different stage of

the innovation cycle" Chief Executive Mark Read said during an

earnings call. As a result, WPP cut its guidance for like-for-like

net sales--or revenue less pass-through costs--to between 1.5% and

3.0% from its previous expectation of 3.0% to 5.0%. The company

reported a 1.3% rise in like-for-like net sales for the second

quarter, down from a 2.9% increase in the first, with the U.S.

decline offset by growth in other markets.

--Publicis upgraded its expectations for 2023, but executives

said they are seeing a slower decision-making process from clients.

The Paris-based group--which houses agencies such as Saatchi &

Saatchi, Leo Burnett and Zenith--now forecasts organic revenue

growth of around 5% for 2023, having previously guided for organic

growth at the top half of the 3% to 5% range. For the second

quarter, Publicis reported organic revenue growth of 7.1%, in line

with its growth rate in the first three months of the year.

However, Publicis Chairman and Chief Executive Arthur Sadoun said

during an earnings call the whole industry is experiencing a

slowdown in the execution of projects.

--S4 Capital cut its 2023 outlook after its second-quarter net

revenue came in below its own budget. The company founded by

industry veteran Martin Sorrell blamed its guidance downgrade on

challenging macroeconomic conditions and caution among its

customers, particularly those in the tech sector. The London-based

digital ad and marketing-services company now expects like-for-like

net revenue growth to be in a range of 2% to 4%, down from 6% to

10% previously. S4 Capital said its like-for-like net revenue

growth for the first half was around 5%, slower than the 6.8% rise

it reported for the first quarter.

--Vivendi's Havas advertising business reported an acceleration

in organic net revenue growth to 6.3% in the second quarter from

1.9% in the first. "We are not sure to be able to deliver such high

growth that we delivered during the second quarter all year long,"

Vivendi Chief Financial Officer Francois Laroze said during an

earnings call. While Laroze said he is cautiously optimistic, he

noted that the performance of some of Havas's agencies has been

weak.

Write to Adria Calatayud at adria.calatayud@dowjones.com and to

Elena Vardon at elena.vardon@wsj.com

(END) Dow Jones Newswires

August 04, 2023 10:33 ET (14:33 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

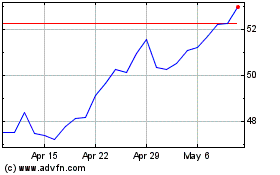

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024