Revenue Down at Williams, But Pipeline Operator Beats Adjust Profit Expectations

July 31 2019 - 5:06PM

Dow Jones News

By Micah Maidenberg

Natural-gas infrastructure firm Williams Cos. (WMB) said profit

rose in the second quarter, but revenue decreased.

Tulsa, Okla.-based Williams reported net income rose to $310

million in the quarter, or 26 cents a share, from $135 million, or

16 cents a share, in the second quarter last year.

The company also reported an adjusted profit of 26 cents a

share. Analysts polled by FactSet predicted 22 cents a share.

Total revenue dropped about 2% to $2.04 billion, just under the

$2.05 billion analysts were targeting.

Cash flow from operations rose 20% from the year earlier to

$1.07 billion, Williams said.

Profit and higher cash flow from operations were helped by

stronger revenue in its Atlantic-Gulf business, which includes the

Transco interstate natural gas pipeline between the Gulf of Mexico

to the eastern seaboard.

But total revenue fell 19% to $952 million in its west business

unit, which includes the Northwest Pipeline in Washington, Colorado

and other states.

The company predicted strong demand for natural gas due to the

current prices for the energy source.

"Low gas prices will continue to incentivize demand growth, and

demand for low cost power generation, LNG exports and new

industrial loads will grow even faster in the second half of the

year," CEO Alan Armstrong said in prepared remarks.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

July 31, 2019 16:51 ET (20:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

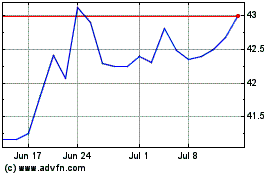

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

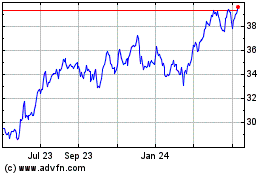

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Apr 2023 to Apr 2024