UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark one)

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2020

OR

|

|

|

|

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number 001-32426

(Full title of the plan and the address of the plan, if different from that of the issuer named below)

WEX Inc. Employee Savings Plan

(Name of issuer of the securities held pursuant to the plan and the address of its principal executive office)

WEX Inc.

1 Hancock Street

Portland, Maine 04101

REQUIRED INFORMATION

The WEX Inc. Employee Savings Plan (Plan) is subject to the Employee Retirement Income Security Act of 1974 (ERISA). Therefore, in lieu of the requirements of Items 1-3 of Form 11-K, the financial statements of the Plan for the fiscal year ended December 31, 2020 and supplemental schedule have been prepared in accordance with the financial reporting requirements of ERISA.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEX Inc. Employee Savings Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: June 25, 2021

|

|

|

|

By:

|

|

/s/ Roberto Simon

|

|

|

|

|

|

|

|

Roberto Simon

|

|

|

|

|

|

|

|

401(k) Committee Member

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEX Inc.

Employee Savings Plan

Form 11-K

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

|

Financial Statements:

|

|

|

|

Statements of Net Assets Available for Benefits - December 31, 2020 and 2019

|

|

|

|

Statement of Changes in Net Assets Available for Benefits - Year ended December 31, 2020

|

|

|

|

Notes to Financial Statements

|

|

|

|

|

|

|

Supplemental Schedule:

|

|

|

|

Form 5500- Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of Year) - December 31, 2020

|

|

|

Note: All other schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Participants and Plan Administrator of

WEX Inc. Employee Savings Plan

Portland, Maine

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of WEX Inc. Employee Savings Plan (the "Plan") as of December 31, 2020 and 2019, the related statement of changes in net assets available for benefits for the year ended December 31, 2020, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020 and 2019, and the changes in net assets available for benefits for the year ended December 31, 2020, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplemental Schedule

The supplemental schedule of assets (held at end of year) as of December 31, 2020 has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental schedule is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in compliance with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, such schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Deloitte & Touche LLP

Boston, Massachusetts

June 25, 2021

We have served as the auditor of the Plan since 2005.

WEX Inc.

Employee Savings Plan

Statements of Net Assets Available for Benefits

December 31, 2020 and 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

Assets

|

|

|

|

|

|

Participant–directed investments

|

|

$

|

318,167,428

|

|

|

$

|

223,527,009

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

|

|

|

|

Securities sold, not settled

|

|

—

|

|

|

225,359,783

|

|

|

Notes receivable from participants

|

|

3,835,739

|

|

|

3,431,682

|

|

|

|

|

|

|

|

|

Accrued investment income

|

|

8,175

|

|

|

1,848

|

|

|

Total receivables

|

|

3,843,914

|

|

|

228,793,313

|

|

|

Total assets

|

|

322,011,342

|

|

|

452,320,322

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

Securities purchased, not settled

|

|

—

|

|

|

196,050,304

|

|

|

Total liabilities

|

|

—

|

|

|

196,050,304

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

322,011,342

|

|

|

$

|

256,270,018

|

|

See accompanying notes to the financial statements.

WEX Inc.

Employee Savings Plan

Statement of Changes in Net Assets Available for Benefits

For the Year Ended December 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

Additions

|

|

|

|

Contributions:

|

|

|

|

Participant contributions

|

|

$

|

21,192,294

|

|

|

Employer matching contributions

|

|

13,486,342

|

|

|

Rollover contributions

|

|

4,810,882

|

|

|

|

|

|

|

|

|

|

|

Total contributions

|

|

39,489,518

|

|

|

Investment income:

|

|

|

|

Net appreciation in fair value of investments

|

|

39,105,902

|

|

|

Dividends and interest

|

|

9,577,084

|

|

|

Net investment income

|

|

48,682,986

|

|

|

Interest income on notes receivable from participants

|

|

182,559

|

|

|

Total additions

|

|

88,355,063

|

|

|

|

|

|

|

Deductions

|

|

|

|

Benefits paid to participants

|

|

22,416,995

|

|

|

|

|

|

|

Administrative expenses

|

|

197,288

|

|

|

Total deductions

|

|

22,614,283

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in net assets before transfers in

|

|

65,740,780

|

|

|

Transfers in due to plan merger (Note 1)

|

|

$

|

544

|

|

|

Net increase in net assets

|

|

65,741,324

|

|

|

Net assets available for benefits:

|

|

|

|

Beginning of year

|

|

256,270,018

|

|

|

End of year

|

|

$

|

322,011,342

|

|

See accompanying notes to the financial statements.

WEX Inc.

Employee Savings Plan

Notes to Financial Statements

|

|

|

|

|

|

|

|

1.

|

DESCRIPTION OF THE PLAN

|

The following description of the WEX Inc. Employee Savings Plan (the “Plan”) is provided for general information purposes only. Participants should refer to the Plan document for more information.

General

The Plan was established on February 23, 2005 under the provisions of Section 401(a) of the Internal Revenue Code (the “Code”). The Plan has been amended and restated by WEX Inc. (the “Company”) on various occasions, including the most recent amendment and restatement effective January 1, 2020 to incorporate into the Plan the former employees of Discovery Benefits, Inc. (“DBI”), which the Company acquired during 2019. In addition, a first amendment to the January 1, 2020 Plan was enacted on October 30, 2020 to make certain changes to the Plan’s distribution methods.

The Plan is a defined contribution profit sharing plan including a qualified, tax exempt trust under Code Sections 401(a) and 501(a) and a qualified cash or deferred arrangement under Code Section 401(k)(2). The portion of the Plan benefiting employees who have completed one year of service is intended to satisfy the safe harbor requirements of Sections 401(k)(12) and 401(m)(11) of the Code. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended. The Plan Administrator is the 401(k) Committee (the “Committee”) as designated by the Company’s Board of Directors. Bank of America Merrill Lynch is the recordkeeper of the Plan and Bank of America N.A. is the trustee of the Plan (the “Trustee”).

During 2019, the Company acquired DBI which, as of the date of acquisition, had its own savings plan (“the DBI Plan”). On December 31, 2019, the DBI Plan was merged into the Plan. As of January 1, 2020, DBI employees became eligible to participate in the Plan.

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) that was signed into law on March 27, 2020 included a number of provisions that a 401(k) plan may choose to make available to its participants. One such provision allows for a new distribution type, Coronavirus-Related Distribution (“CRD”), which allows for coronavirus-related distributions of up to $100,000 per individual across all eligible plans and IRAs. CRD distributions were available through December 31, 2020. A second provision permits a loan repayment delay for up to one year for outstanding loans that have a repayment date from the date of enactment through December 31, 2020. Plans are permitted to implement these provisions immediately provided the Plan document is retroactively amended on or before December 31, 2022. Effective May 22, 2020, the Plan elected to make these two provisions available to its plan participants.

Eligibility

Each employee of the Company and its eligible subsidiaries who has attained the age of eighteen (18) is eligible to participate in the Plan.

Contributions

Each year, participants may contribute up to 75 percent of their compensation, as defined in the Plan, on a pre-tax basis, a Roth after-tax basis, or a combination of both, subject to limitations stipulated by the Code. After one year of service, participants’ contributions to the Plan are matched 100 percent by the Company up to 6 percent of the participant’s eligible compensation subject to any legal restrictions. Participants who are at least 50 years of age before the close of the Plan year may make an additional contribution, subject to limitations stipulated by the Code. Participants may also contribute amounts representing eligible rollover distributions from other types of eligible retirement plans.

Participant Accounts

An individual account is maintained for each Plan participant. Each participant’s account is credited with the participant’s contribution, the Company’s matching contribution and allocations of Plan earnings, and charged with participant withdrawals, allocations of Plan losses, and administrative fees, if applicable. Allocations of Plan earnings and losses are based on account balances. The benefit to which a participant is entitled is equal to the participant’s vested account.

WEX Inc.

Employee Savings Plan

Notes to Financial Statements (continued)

Investments

Participants direct the investment of their contributions and the Company matching contributions made on their behalf into various investment options offered by the Plan. As of December 31, 2020, the Plan offers a common collective trust fund, several open-end mutual funds and WEX Inc. Common Stock as investment options for participants.

Investments in WEX Inc. Common Stock are subject to the restrictions set forth in the Plan document.

Common collective trust funds invest in benefit responsive contracts such as wrap agreements and insurance company separate account agreements, under which the insurance company or other financial institution contract issuer agrees, subject to certain conditions, to make payments from the contract in connection with redemptions from the common collective trust funds for plan participant-initiated benefit payments at contract value. The performance of the other party is not guaranteed, but is dependent on the absence of certain events occurring.

As a result of the changes made to its investment offerings in 2019, there were a large number of investment trades that occurred on December 31, 2019 that were pending settlement as of that date. Pending security sales and purchases of $196,050,304 are reflected as securities sold, not settled and securities purchased, not settled, respectively, on the statement of net assets available for benefits as of December 31, 2019.

Concentrations

As of December 31, 2020, approximately 40% of total assets is comprised of net assets held within four investment funds.

Vesting and Forfeitures

Participants have full and immediate vesting rights in their contributions, Company matching contributions, investment earnings and other amounts allocated to their accounts. Any forfeited matching contributions attributable to an excess deferral or excess contribution, as defined under the Plan, shall be used first to pay administrative expenses of the Plan and then shall be used to reduce employer matching contributions. During 2020, $218,112 of forfeitures were used to fund the Company’s matching obligation pursuant to the terms of the Plan. The balance of forfeited amounts as of December 31, 2020 and 2019 were immaterial and included within participant-directed investments on the statements of net assets available for benefits.

Notes Receivable from Participants

Participants may borrow against their Plan accounts, excluding amounts attributable to Company matching contributions, up to a maximum of $50,000 (reduced by the highest outstanding loan balance for the preceding 12-month period) or 50 percent of their account balances, whichever is less. The term of the loan may not exceed five years, unless for the purchase of a principal residence, in which case the term of the loan may not exceed fifteen years. The interest rate for a loan requested in any month will be equal to the prime rate as listed on the last business day of the preceding month in the Wall Street Journal plus 1 percent. Principal and interest are paid ratably through payroll deductions. If a participant’s employment terminates, he or she may continue to make the scheduled loan payments directly to Bank of America Merrill Lynch.

Benefit Payments

Under the Plan, as amended through December 31, 2020, a participant may elect to receive distribution of the vested portion of his or her account balance as of any valuation date which occurs after his or her retirement or termination of employment. If, however, as of any monthly processing date following the date of retirement or termination of employment the participant's account balance does not exceed $5,000, and the participant does not elect to roll over or receive distribution of his or her account, such account balance shall be mandatorily distributed in a lump sum as soon as practicable after such processing date. In the event of a mandatory distribution greater than $1,000, if the participant does not elect to roll over or receive distribution of his or her account then the Committee shall direct the Trustee to pay the distribution in a direct rollover to an individual retirement plan designated by the Committee.

Unless a participant otherwise elects, distribution to a participant shall be made or commence being made no later than the sixtieth day after the close of the Plan year in which the latest of the following occurs: (i) the participant’s attainment of age 65, (ii) the member’s severance from employment, or (iii) the tenth anniversary of the year which the member commenced

WEX Inc.

Employee Savings Plan

Notes to Financial Statements (continued)

participation in the Plan. Notwithstanding the foregoing to the contrary, distribution of the account balance to a member who is not a five percent owner shall be made or commence not later than April 1 of the calendar year following the later of the calendar year in which such participant attains age 72 (age 70.5 with respect to a participant who attained age 70.5 before January 1, 2020) or the calendar year in which the participant retires. Distribution of the account balance of a five percent owner shall be made or commence not later than April 1 of the calendar year following the calendar year in which the participant attains age 72 (age 70.5 with respect to a participant who attained age 70.5 before January 1, 2020).

Subject to an October 2020 Plan amendment, a participant who is first required to receive or commence receiving distribution of his or her account on or after April 1, 2021, shall receive annual installments of the required minimum amount, as defined in the Plan, unless such participant elects to have his or her entire account balance distributed in a lump sum. Prior to this Plan amendment, lump sum distribution was the default payment method.

Distributions from all investment options are made in cash; provided that participants may elect that distribution of the portion of their account which is invested in WEX Inc. Common Stock be made, in whole or in part, in whole shares of common stock of the Company.

If a participant dies before receiving distribution of his or her account, his or her surviving spouse (or designated beneficiary, if the participant's surviving spouse has provided consent in accordance with the terms of the Plan or if the participant is not married) may elect to receive either (i) a lump sum distribution of the participant's account balance; or (ii) payment of the participant's account balance in installments over a period not exceeding 5 years. If, however, the participant's account balance does not exceed $5,000 as of the first monthly processing date following the participant's death, distribution will be made in a lump sum as soon as practicable after such processing date.

In addition, the Plan permits in-service withdrawals under the circumstances specified in the Plan document, including hardship withdrawals.

|

|

|

|

|

|

|

|

2.

|

SIGNIFICANT ACCOUNTING POLICIES

|

Basis of Accounting

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Risks and Uncertainties

The Plan holds various investment securities, including mutual funds, common stock and common collective trusts. Investment securities, in general, are exposed to various risks, such as interest rate risk, credit risk, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and those changes could materially affect the amounts reported in the financial statements.

In March 2020, the World Health Organization classified the novel strain of coronavirus known as COVID-19, as a pandemic. As a result of COVID-19, there has been increased volatility in global financial markets, which has affected, and may continue to affect participants’ account balances and the amounts reported in the statements of net assets available for benefits and the statement of changes in net assets available for benefits.

WEX Inc.

Employee Savings Plan

Notes to Financial Statements (continued)

Investment Valuation and Income Recognition

The Plan’s investments are stated at fair value. Investments reported at fair value are classified in their entirety within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The three levels of the hierarchy are as follows:

•Level 1, which refers to securities valued using quoted prices from active markets for identical assets;

•Level 2, which refers to securities not traded on an active market but for which other observable market inputs are readily available;

•Level 3, which refers to securities valued based on significant unobservable inputs.

Although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

Purchases and sales of investments are recorded on a trade-date basis. Any material pending settlements from sales and purchases of investments as of calendar year-end are reflected as assets and liabilities, respectively, on the statement of net assets available for benefits. Interest income is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date. Net appreciation in fair value of investments includes the Plan's gains and losses on investments bought and sold as well as held during the year.

Management fees and operating expenses related to investments in the mutual funds and common collective trust funds are charged directly to the mutual funds and common collective trusts. Such fees and expenses are deducted from income earned by the investments on a daily basis, and are not separately reported in the accompanying financial statements.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. A participant’s loan is secured by a portion of his or her vested account balance. Any unpaid loans outstanding at the time when a participant receives distribution of his or her account are recorded as distributions.

Payment of Benefits

Benefit payments to participants are recorded upon distribution. Amounts due to participants who have elected to withdraw from the Plan, but have not yet been paid at December 31, 2020, and 2019 were immaterial.

The following tables set forth a summary of the Plan’s investments measured at fair value on a recurring basis as of December 31, 2020 and 2019, by level within the fair value hierarchy. The Plan had no Level 2 or Level 3 investments as of December 31, 2020 and 2019.

WEX Inc.

Employee Savings Plan

Notes to Financial Statements (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements

at December 31, 2020

|

|

|

Active Markets for

Identical Assets

(Level 1)

|

|

|

|

|

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

|

WEX Inc. Common Stock

|

$

|

7,022,724

|

|

|

|

|

|

|

$

|

7,022,724

|

|

|

Mutual funds

|

|

|

|

|

|

|

|

|

Equity/stock funds

|

182,757,255

|

|

|

|

|

|

|

182,757,255

|

|

|

Bond/fixed income funds

|

40,914,606

|

|

|

|

|

|

|

40,914,606

|

|

|

Target date allocation funds

|

75,444,227

|

|

|

|

|

|

|

75,444,227

|

|

|

Money market funds (cash equivalent)

|

18,227

|

|

|

|

|

|

|

18,227

|

|

|

Total

|

$

|

306,157,039

|

|

|

|

|

|

|

306,157,039

|

|

|

|

|

|

|

|

|

|

|

|

Common collective trust measured at net asset value(1)

|

|

|

|

|

|

|

12,010,389

|

|

|

Total investments at fair value

|

|

|

|

|

|

|

$

|

318,167,428

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements

at December 31, 2019

|

|

|

Active Markets for

Identical Assets

(Level 1)

|

|

|

|

|

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

|

WEX Inc. Common Stock

|

$

|

5,553,395

|

|

|

|

|

|

|

$

|

5,553,395

|

|

|

Mutual funds

|

|

|

|

|

|

|

|

|

Equity/stock funds

|

138,019,763

|

|

|

|

|

|

|

138,019,763

|

|

|

Bond/fixed income funds

|

32,047,543

|

|

|

|

|

|

|

32,047,543

|

|

|

Target date allocation funds

|

35,669,659

|

|

|

|

|

|

|

35,669,659

|

|

|

Money market funds (cash equivalent)

|

41,303

|

|

|

|

|

|

|

41,303

|

|

|

Total

|

$

|

211,331,663

|

|

|

|

|

|

|

211,331,663

|

|

|

|

|

|

|

|

|

|

|

|

Common collective trusts measured at net asset value(1)

|

|

|

|

|

|

|

12,195,346

|

|

|

Total investments at fair value

|

|

|

|

|

|

|

$

|

223,527,009

|

|

(1) Certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the statements of net assets available for benefits.

The availability of observable market data is monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. In such instances, the transfer is reported at the beginning of the reporting period. For the years ended December 31, 2020 and 2019, there were no transfers between levels.

The following tables summarize the Plan’s investments reported at net asset value (NAV) per share (or its equivalent) as a practical expedient at December 31, 2020 and 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Estimate Using Net Asset Value per Share

December 31, 2020

|

|

|

|

Fair Value (1)

|

|

Unfunded

Commitment

|

|

Redemption

Frequency

|

|

Other

Redemption

Restrictions

|

|

Redemption

Notice

Period

|

|

Goldman Sachs Stable Value Collective Trust (a)

|

|

12,010,389

|

|

|

—

|

|

|

N/A

|

|

N/A

|

|

12 months

|

|

Total

|

|

$

|

12,010,389

|

|

|

$

|

—

|

|

|

|

|

|

|

|

WEX Inc.

Employee Savings Plan

Notes to Financial Statements (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Estimate Using Net Asset Value per Share

December 31, 2019

|

|

|

|

Fair Value (1)

|

|

Unfunded

Commitment

|

|

Redemption

Frequency

|

|

Other

Redemption

Restrictions

|

|

Redemption

Notice

Period

|

|

Goldman Sachs Stable Value Collective Trust (a)

|

|

$

|

12,195,346

|

|

|

$

|

—

|

|

|

N/A

|

|

N/A

|

|

12 months

|

|

Total

|

|

$

|

12,195,346

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

The fair value of the investments have been estimated using the NAV of the investment.

|

(a) The Fund's principal objective is to earn income, while seeking to preserve capital and stability of principal. The fund attempts to accomplish its investment objective by investing primarily in stable value investment contracts and seeks to maintain a stable net asset value of $1.00, thereby intending to guarantee contract value to participants who choose it as an investment option. Redemption notice period is for the complete withdrawal by an eligible plan.

The following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2020 and 2019.

Common stocks — Valued at the closing price reported on the active market on which the individual securities are traded.

Mutual funds — Valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-ended mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily NAV and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

Collective trust stable value/return funds — Composed primarily of fully benefit-responsive investment contracts and is reported at fair value using NAV as a practical expedient. This practical expedient is not used when it is determined to be probable that the fund will sell the investment for an amount different than the reported NAV.

The Plan also holds other assets and liabilities not measured at fair value on a recurring basis, including accrued investment income, securities sold, not settled and securities purchased, not settled. The fair value of these assets and liabilities approximate the carrying amounts in the accompanying financial statements due to their short maturity.

The Internal Revenue Service (IRS) has determined and informed the Company by a letter dated March 7, 2014, that the Plan and related trust were designed in accordance with the applicable requirements of the Code. The Plan has since been amended; however, the Company and Plan management believe that the Plan is currently designed and operated in compliance with the applicable requirements of the Code, and the Plan and related trust continue to be tax-exempt. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits in progress for any tax periods.

|

|

|

|

|

|

|

|

5.

|

EXEMPT PARTY-IN-INTEREST TRANSACTION

|

Management fees paid for investment management services are charged directly to the mutual funds, and are reflected as a reduction of the return earned on each fund.

The Plan held 34,505 shares of common stock of the Company with a revalued cost basis of $6,607,019 as of December 31, 2020, and held 26,513 shares of common stock of the Company with a revalued cost basis of $4,120,951 as of December 31, 2019. The Company is the sponsoring employer. During the year ended December 31, 2020, no dividends were earned by the Plan related to Company stock.

Participant loans, which are considered exempt party-in-interest transactions, were granted throughout the year as part of normal Plan operations.

WEX Inc.

Employee Savings Plan

Notes to Financial Statements (continued)

The trustee of the former DBI Plan, the assets of which were merged into the Plan as of December 31, 2019, was Bell Bank Wealth Management, a division of Bell Bank. As of December 31, 2019, Bell Bank held a 4.9 percent equity interest in the Company's U.S. Health business. Included within securities sold, not settled on the statement of net assets available for benefits as of December 31, 2019, was $29,309,479 due from Bell Bank as a result of the plan merger. These amounts were collected by the Plan during 2020.

|

|

|

|

|

|

|

|

6.

|

ADMINISTRATIVE EXPENSES

|

Prior to 2020, certain investment funds available under the Plan returned a portion of their investment fees to the recordkeeper under a revenue sharing arrangement to offset administrative expenses. This revenue share was deposited into an account within the Plan and used to pay quarterly Plan recordkeeping and other administrative expenses, unless such fees were paid for directly by the Company. Effective beginning with the quarter ended December 31, 2020, the quarterly recordkeeping and other administrative fees of the Plan will be paid on a per capita basis by all Plan participants. The expenses paid for directly by the Plan in 2020 totaled $197,288, of which $194,638 was paid out of the revenue share account. As of December 31, 2020 and 2019, the Plan had undistributed revenue share funds of $83,632 and $253,017, respectively.

Although the Company has not expressed any intent to terminate the Plan, it has the right under the Plan to discontinue contributions at any time and to terminate the Plan subject to the provisions set forth in ERISA. In the event of termination of the Plan, the net assets of the Plan are set aside, first, for payment of all Plan expenses and second, for distribution to the participants based upon the balances in their individual accounts.

|

|

|

|

|

|

|

|

8.

|

RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

|

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500 as of December 31, 2020 and 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

Net assets available for benefits per the financial statements

|

|

$

|

322,011,342

|

|

|

$

|

256,270,018

|

|

|

Deemed distributions of participant loans per Form 5500

|

|

(12,997)

|

|

|

(12,997)

|

|

|

Net assets per Form 5500

|

|

$

|

321,998,345

|

|

|

$

|

256,257,021

|

|

The following is a reconciliation of changes in net assets available for plan benefits per the financial statements to the Form 5500 for the year ending December 31, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

Net increase in net assets before transfers in per the financial statements

|

|

$

|

65,740,780

|

|

|

|

|

|

|

Net income per Form 5500

|

|

$

|

65,740,780

|

|

*******************************

SUPPLEMENTAL SCHEDULE

WEX Inc.

Employee Savings Plan

Plan 201729, EIN 01-0526993

Form 5500 - Schedule H, Part IV,

Line 4i - Schedule of Assets (Held at End of Year)

As of December 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Identity of issue, borrower, lessor or similar party

|

Description of Investment

|

Cost

|

Current Value

|

|

|

|

|

|

|

|

|

American Funds

|

Europacific Growth Fund

|

**

|

31,704,906

|

|

|

|

Deutsche Asset & Wealth Management

|

Real Estate Securities Fund

|

**

|

3,481,596

|

|

|

|

|

|

|

|

|

|

Fidelity

|

Extended Market Index

|

**

|

10,606,713

|

|

|

|

Fidelity

|

500 Index Fund

|

**

|

31,151,955

|

|

|

|

Fidelity

|

US Bond Index Fund

|

**

|

3,614,606

|

|

|

|

Fidelity

|

Total Intl Indx Fd

|

**

|

4,673,046

|

|

|

|

Mainstay

|

Large Cap Growth Fund

|

**

|

30,388,245

|

|

|

|

|

|

|

|

|

|

Metropolitan West

|

Total Return Bond Fund Plan Class

|

**

|

34,190,483

|

|

|

|

|

|

|

|

|

|

Invesco

|

Developing Markets Fund

|

**

|

5,021,534

|

|

|

|

MFS

|

Value Fund

|

**

|

17,384,646

|

|

|

|

MFS

|

Mid Cap Value Fund

|

**

|

17,881,747

|

|

|

|

Primecap

|

Odyssey Stock Fund

|

**

|

5,912,573

|

|

|

|

Principal Investors

|

High Yield Fund

|

**

|

3,109,517

|

|

|

|

T. Rowe Price

|

Retirement I 2005 Fund - I Class

|

**

|

23,227

|

|

|

|

T. Rowe Price

|

Retirement I 2010 Fund - I Class

|

**

|

147,641

|

|

|

|

T. Rowe Price

|

Retirement I 2015 Fund - I Class

|

**

|

372,275

|

|

|

|

T. Rowe Price

|

Retirement I 2020 Fund - I Class

|

**

|

1,884,176

|

|

|

|

T. Rowe Price

|

Retirement I 2025 Fund - I Class

|

**

|

6,483,907

|

|

|

|

T. Rowe Price

|

Retirement I 2030 Fund - I Class

|

**

|

8,573,177

|

|

|

|

T. Rowe Price

|

Retirement I 2035 Fund - I Class

|

**

|

7,423,648

|

|

|

|

T. Rowe Price

|

Retirement I 2040 Fund - I Class

|

**

|

14,907,482

|

|

|

|

T. Rowe Price

|

Retirement I 2045 Fund - I Class

|

**

|

13,876,507

|

|

|

|

T. Rowe Price

|

Retirement I 2050 Fund - I Class

|

**

|

9,496,516

|

|

|

|

T. Rowe Price

|

Retirement I 2055 Fund - I Class

|

**

|

7,546,346

|

|

|

|

T. Rowe Price

|

Retirement I 2060 Fund - I Class

|

**

|

1,884,329

|

|

|

|

T. Rowe Price

|

Retirement Balanced I Fund - I Class

|

**

|

2,824,996

|

|

|

|

Wells Fargo

|

Advantage Discovery Fund

|

**

|

24,550,294

|

|

|

|

Total mutual funds

|

|

|

299,116,088

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goldman Sachs

|

Stable Value Collective Trust

|

**

|

12,010,389

|

|

|

|

Total collective fund trusts

|

|

|

12,010,389

|

|

|

|

|

|

|

|

|

*

|

WEX Inc.

|

WEX Inc. Common Stock

|

**

|

7,022,724

|

|

|

|

BlackRock

|

Money Market Funds

|

18,227

|

|

18,227

|

|

|

*

|

Participant loans, less deemed distributions

|

Maturing at various dates through December 2035; Interest rates ranging from 3.50% - 9.50%

|

N/A

|

3,822,742

|

|

|

|

|

|

|

|

|

|

Total assets held for investment

|

|

|

$

|

321,990,170

|

|

|

|

|

|

|

|

|

|

**

|

Cost information is not required for participant-directed investments and therefore is not included.

|

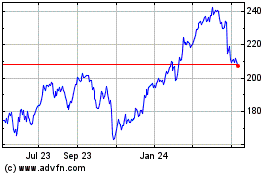

WEX (NYSE:WEX)

Historical Stock Chart

From Aug 2024 to Sep 2024

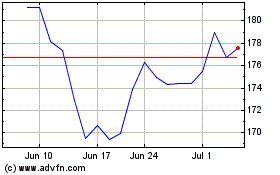

WEX (NYSE:WEX)

Historical Stock Chart

From Sep 2023 to Sep 2024