Waste Management Shares Lower After Earnings Miss

October 26 2021 - 11:26AM

Dow Jones News

By Michael Dabaie

Waste Management Inc. shares were down 3% to $156.50 after

third-quarter adjusted earnings missed analyst views and the

company said it is seeing labor constraints.

Before the market open, the provider of waste management

environmental services reported third-quarter revenue of $4.7

billion, up from $3.9 billion a year earlier and above FactSet

consensus for $4.5 billion.

Adjusted earnings per share of $1.26 fell short of FactSet

consensus of $1.35.

"Like many other companies, we are seeing constraints on labor

availability," said Chief Executive Jim Fish.

During the quarter, the company invested in front-line market

wage adjustments and training for new employees.

"We remain focused on improving operational efficiency and

executing on our disciplined pricing programs to drive margin

growth in the face of these additional labor costs and other

inflationary cost pressures," Mr. Fish said.

Waste Management guided for total company revenue growth in 2021

between 17% and 17.5%. In late July, the company guided for revenue

growth of 15.5% to 16.0%.

"WM reported an adjusted EPS miss blamed on higher costs (labor,

other inflationary cost pressures). However, revenues were better

than expected mainly driven by strong yield; this helped drive

better-than-expected free cash flow," BMO Capital Markets said in a

note after the earnings report.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

October 26, 2021 11:11 ET (15:11 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

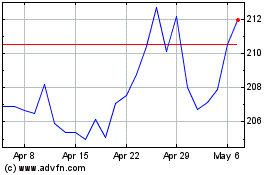

Waste Management (NYSE:WM)

Historical Stock Chart

From Mar 2024 to Apr 2024

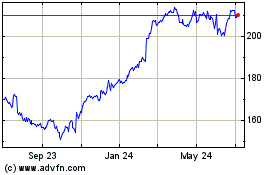

Waste Management (NYSE:WM)

Historical Stock Chart

From Apr 2023 to Apr 2024