UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

July 26, 2023

(Commission File Number: 001-15128)

United Microelectronics Corporation

(Translation of registrant’s name into English)

No.3 Li Hsin Road II

Science Park

Hsinchu, Taiwan, R.O.C.

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

United Microelectronics Corporation |

|

|

|

By: |

Chitung Liu |

Name: |

Chitung Liu |

Title: |

CFO |

Date: July 26, 2023

2

EXHIBIT INDEX

3

www.umc.com

www.umc.com

Exhibit

Exhibit Description

99.1 Announcement on 2023/07/26: Announcement of board meeting approved the consolidated financial statements for the second quarter of 2023

99.2 Announcement on 2023/07/26: The board meeting approved capital budget execution

99.3 Announcement on 2023/07/26: The Board of Directors resolved the issuance of unsecured straight corporate bonds

99.4 Announcement on 2023/07/26: UMC announced its operating results for the second quarter of 2023

Exhibit 99.1

Announcement of board meeting approved the consolidated financial statements for the second quarter of 2023

1. Date of submission to the board of directors or approval by the board of directors: 2023/07/26

2. Date of approval by the audit committee: 2023/07/26

3. Start and end dates of financial reports or annual self-assessed financial information of the reporting period (XXXX/XX/XX~XXXX/XX/XX): 2023/01/01~2023/06/30

4. Operating revenue accumulated from 1/1 to end of the period (thousand NTD): 110,505,855

5. Gross profit (loss) from operations accumulated from 1/1 to end of the period (thousand NTD): 39,476,592

6. Net operating income (loss) accumulated from 1/1 to end of the period (thousand NTD): 30,155,441

7. Profit (loss) before tax accumulated from 1/1 to end of the period (thousand NTD): 37,613,947

8. Profit (loss) accumulated from 1/1 to end of the period (thousand NTD): 32,281,220

9. Profit (loss) during the period attributable to owners of parent accumulated from 1/1 to end of the period (thousand NTD): 31,823,919

10. Basic earnings (loss) per share accumulated from 1/1 to end of the period (NTD): 2.58

11. Total assets end of the period (thousand NTD): 553,195,664

12. Total liabilities end of the period (thousand NTD): 226,307,619

13. Equity attributable to owners of parent end of the period (thousand NTD): 326,545,196

14. Any other matters that need to be specified: NA

Exhibit 99.2

The board meeting approved capital budget execution

1. Date of the resolution of the board of directors or shareholders meeting: 2023/07/26

2. Content of the investment plan: capital budget execution

3. Projected monetary amount of the investment: NT$ 2,920 million

4. Projected date of the investment: by capital budget plan

5. Source of capital funds: working capital

6. Specific purpose: capacity deployment

7. Any other matters that need to be specified: none

Exhibit 99.3

The Board of Directors resolved the issuance of unsecured straight corporate bonds

1. Date of the board of directors’ resolution: 2023/07/26

2. Name [issue no.__ of (secured, unsecured) corporate bonds of ___________ (company)]: United Microelectronics Corporation unsecured straight corporate bonds

3. Whether to adopt shelf registration (Yes/No): No

4. Total amount issued: no more than NT$20,000 million

5. Face value per bond: temporarily set at NT$1 million each

6. Issue price: at par

7. Issuance period: To be decided based on market condition

8. Coupon rate: To be decided based on market condition

9. Types, names, monetary values and stipulations of collaterals: N/A

10. Use of the funds raised by the offering and utilization plan: environmental protection related expenditures and/or purchase of equipment

11. Underwriting method: Public offering

12. Trustees of the corporate bonds: To be decided

13. Underwriter or agent: To be decided

14. Guarantor(s) for the issuance: None

15. Agent for payment of the principal and interest: To be decided

16. Certifying institution: None

17. Where convertible into shares, the rules for conversion: N/A

18. Sell-back conditions: None

19. Buyback conditions: None

20. Reference date for any additional share exchange, stock swap, or subscription: N/A

21. Possible dilution of equity in case of any additional share exchange, stock swap, or subscription: N/A

22. Any other matters that need to be specified:

UMC Chairman, or the person delegated by the UMC Chairman, is authorized to decide or adjust the details about the total issue amount (can be in installments), the issue date, pricing, and other relevant terms.

Exhibit 99.4

UMC announced its operating results for the second quarter of 2023

1. Date of occurrence of the event: 2023/07/26

2. Company name: UNITED MICROELECTRONICS CORPORATION

3. Relationship to the Company (please enter “head office” or “subsidiaries”): head office

4. Reciprocal shareholding ratios: N/A

5. Cause of occurrence:

UMC Reports Second Quarter 2023 Results

Company’s differentiating specialty technologies accounted for 59% of Q2 revenue

Solid 22/28nm business momentum lifted contribution to 29%

Second Quarter 2023 Overview:

‧Revenue: NT$56.30 billion (US$1.81 billion)

‧Gross margin: 36.0%; Operating margin: 27.8%

‧Revenue from 22/28nm: 29%

‧Capacity utilization rate: 71%

‧Net income attributable to shareholders of the parent: NT$15.64 billion (US$502 million)

‧Earnings per share: NT$1.27; earnings per ADS: US$0.204

Taipei, Taiwan, ROC – July 26, 2023 – United Microelectronics Corporation (NYSE: UMC; TWSE: 2303) (“UMC” or “The Company”), a leading global semiconductor foundry, today announced its consolidated operating results for the second quarter of 2023.

Second quarter consolidated revenue was NT$56.30 billion, increasing 3.8% QoQ from NT$54.21 billion in 1Q23. Compared to a year ago, 2Q23 revenue declined 21.9% YoY from NT$72.06 billion in 2Q22. Consolidated gross margin for 2Q23 was 36.0%. Net income attributable to the shareholders of the parent was NT$15.64 billion, with earnings per ordinary share of NT$1.27.

Jason Wang, co-president of UMC, said, “For the second quarter, we reported results in line with guidance, with wafer shipments remaining flat from the previous quarter and utilization rate of 71%. Second-quarter revenue grew 3.8% QoQ, mainly due to improved product mix within our 12-inch portfolio. Revenue from 22/28nm products continued to increase sequentially, representing 29% of second-quarter sales, while contribution from specialty technologies reached 59%. By segment, we saw short-term demand recovery in the consumer space for WiFi, digital TV, and display driver ICs, while demand for computer-related products also moderately rebounded from the previous quarter. We are pleased to share that we have completed the transaction to acquire remaining shares in USCXM, our 12-inch fab in Xiamen, China. As one of UMC’s four 12-inch fabs in geographically diverse locations, USCXM will continue to provide high-quality fabrication services to customers and increase its contribution to UMC’s financial performance as a wholly-owned subsidiary.”

Co-president Wang said: “Looking into the third quarter, wafer demand outlook is uncertain given prolonged inventory correction in the supply chain. While we saw spots of limited recovery in the second quarter, overall end market sentiment remains weak and we expect customers to continue stringent inventory management in the near term. Despite a weaker-than-expected environment going into the second half, we believe our 22/28nm business will remain resilient due to our strong position in leading edge specialty technologies such as embedded high voltage. In addition, we are gearing

up to offer the necessary silicon interposer technology and capacity to fulfill emerging AI market demand from customers.”

“UMC continues to enhance communication of its corporate sustainability efforts to stakeholders. This month, UMC issued its first Climate Action Report, which follows the Task Force on Climate-Related Financial Disclosures (TCFD) framework, providing a detailed overview of how UMC is responding to climate change. In addition, UMC was ranked in the top 5% of listed firms in Taiwan Stock Exchange’s 2022 Corporate Governance Evaluation for the ninth consecutive year, demonstrating the company’s commitment to delivering long-term shareholder value and adhering to sustainable business practices,” Co-president Wang added.

Third Quarter 2023 Outlook & Guidance

‧Wafer Shipments: Will decline by approximately 3-4%

‧ASP in USD: Will increase by 2%

‧Gross Profit Margin: Rising costs will erode GM by low-single digit percentage point

‧Capacity Utilization: mid-60% range

‧2023 CAPEX: US$3.0 billion

6. Countermeasures: N/A

7. Any other matters that need to be specified (the information disclosure also meets the requirements of Article 7, subparagraph 9 of the Securities and Exchange Act Enforcement Rules, which brings forth a significant impact on shareholders rights or the price of the securities on public companies.): N/A

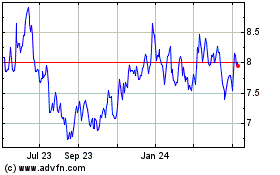

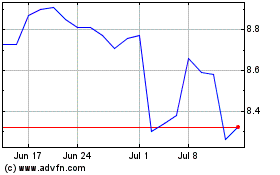

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Apr 2024 to May 2024

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From May 2023 to May 2024