Shares of Casper Sleep Rise 13% on First Trading Day -- WSJ

February 07 2020 - 3:02AM

Dow Jones News

By Allison Prang

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 7, 2020).

Shares of Casper Sleep Inc. closed about 13% higher on their

first day of trading Thursday, a day after the mattress-seller

priced its IPO at the lower end of its expected price range.

Shares closed at $13.50 a share, higher than the company's

public offering price of $12 a share. The stock opened above its

IPO price Thursday at $14.50 a share and reached an intraday high

of $15.85 a share.

Those gains, however, were after the company cut its public

offering price. Casper's public offering price of $12 a share

Wednesday was well below its initial range of $17-to-$19 a share,

and at the low end of the $12-to-$13 a share range it set Wednesday

morning.

The company has a valuation of about $535 million, based on its

number of common shares outstanding before any options were

exercised by the offering underwriters and also on Thursday's

closing price. Casper had been valued at $1.1 billion in a private

funding round early last year.

Co-founder and Chief Executive Philip Krim declined to comment

specifically on the company's price cut in an interview with The

Wall Street Journal Thursday. Mr. Krim said he has watched the

turmoil in the IPO market, but it isn't something the company is

focused on.

"Today's a really exciting milestone," Mr. Krim said.

Casper, founded back in 2014, reported a larger loss for the

first nine months of 2019 versus the comparable period a year

prior, but revenue rose. The company's loss grew almost 5% to $67.4

million, while revenue rose 20% to $312.3 million.

Mr. Krim on Thursday said Casper is focused on profitability and

its operating leverage improved in 2019.

Casper, which sells foam mattresses online and delivers them

through the mail, went public during a touchy time for IPOs.

Investors have grown more tepid toward highly-valued startups that

burn through money, and some companies in 2019 nixed their plans to

go public, including the parent of WeWork, the coworking space

company, and Endeavor Group Holdings Inc., the owner of the Miss

Universe Pageant and the biggest talent agency in Hollywood.

Endeavor pulled its own IPO plans after shares of Peloton

Interactive Inc., the exercise-bike company, struggled on their

first day of trading on public markets. The stocks of ride-share

companies Uber Technologies Inc. and Lyft Inc., which both went

public last year, have also traded below the prices at which they

went public.

Casper was selling 8.35 million common shares in its IPO. The

company said it gave an option for underwriters to buy as many as

1.25 million shares for overallotments.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

February 07, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

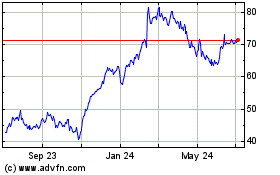

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

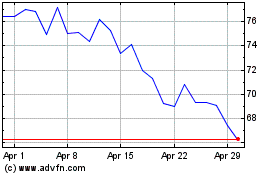

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024