Travel + Leisure Co. (NYSE:TNL), the world’s leading membership

and leisure travel company, today reported fourth quarter and

full-year 2021 financial results for the period ended December 31,

2021.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220223005484/en/

Travel + Leisure Co. (NYSE:TNL) reports

4Q and FY 2021 results

Fourth quarter 2021 highlights:

- Net income from continuing operations of $110 million

(diluted EPS of $1.26) on net revenue of $870 million

- Adjusted EBITDA of $228 million and adjusted diluted EPS of

$1.19 (1)

- Resumed stock repurchase program and increased

dividend

Full-year 2021 highlights:

- Net income from continuing operations of $313 million

(diluted EPS of $3.58) on net revenue of $3.1 billion

- Adjusted EBITDA of $778 million and adjusted diluted EPS of

$3.65

- Net cash provided by operating activities of $568 million

and adjusted free cash flow of $223 million

Outlook:

- First quarter 2022 adjusted EBITDA is expected to range from

$160 million to $170 million

- The Company will recommend a first quarter 2022 dividend of

$0.40 per share for approval by the Board of Directors

“The continued recovery in leisure travel and business

improvements made at the start of the pandemic helped us deliver

full-year adjusted EBITDA and adjusted diluted EPS above our

guidance range,” said Michael D. Brown, president and CEO of Travel

+ Leisure Co. “Based on our strong results in 2021 and optimism for

the year ahead, we increased the dividend and resumed stock

repurchases in the fourth quarter.”

“We anticipate that leisure travel will continue to lead the

broader travel industry, which will support the 2025 growth plan

announced at our Investor Day in September 2021.”

(1) This press release includes adjusted EBITDA, adjusted

diluted EPS, adjusted free cash flow, gross VOI sales and adjusted

net income/(loss), which are metrics that are not calculated in

accordance with Generally Accepted Accounting Principles in the

U.S. (“GAAP”). See "Presentation of Financial Information" and the

tables for the definitions and reconciliations of these non-GAAP

measures. Forward-looking non-GAAP measures are presented in this

press release only on a non-GAAP basis because not all of the

information necessary for a quantitative reconciliation is

available without unreasonable effort.

Business Segment Results

The results of operations during the fourth quarter and

full-year of 2021 and 2020 include impacts related to the COVID-19

global pandemic. Refer to Table 8 for a breakout of COVID-19

related impacts.

Vacation Ownership

$ in millions

Q4 2021

Q4 2020

% change

FY 2021

FY 2020

% change

Revenue

$695

$509

37%

$2,403

$1,625

48%

Adjusted EBITDA

$182

$115

58%

$558

$121

361%

Vacation Ownership revenue increased 37% to $695 million in the

fourth quarter of 2021 compared to the same period in the prior

year. Gross vacation ownership interest (VOI) sales were $432

million in the fourth quarter compared to $281 million in the prior

year period and tours were 129,000 in the fourth quarter compared

to 85,000 in the prior year period. Volume Per Guest (VPG)

increased 10% to $3,222 due to strong close rates and higher

quality tours in the fourth quarter compared to the prior year

period.

Fourth quarter adjusted EBITDA was $182 million compared to $115

million in the prior year period. The increase was driven by higher

Gross VOI sales due to the ongoing recovery of our operations from

COVID-19 and improvement in the provision for loan losses.

Fourth quarter 2021 results include an adjustment to the

COVID-19 related allowance for loan losses, resulting in a $44

million increase to revenue and a $16 million increase to cost of

vacation ownership interests, and yielding a $28 million net

positive impact to Adjusted EBITDA. Fourth quarter 2020 results

also include an adjustment to the COVID-19 related allowance,

resulting in a $20 million increase to revenue and a $7 million

increase to cost of vacation ownership interests, yielding a $13

million net positive impact to Adjusted EBITDA.

Travel and Membership

$ in millions

Q4 2021

Q4 2020

% change

FY 2021

FY 2020

% change

Revenue

$179

$141

27%

$752

$552

36%

Adjusted EBITDA

$64

$50

28%

$282

$191

48%

Travel and Membership revenue increased 27% to $179 million in

the fourth quarter driven by a 30% increase in transactions and 6%

increase in revenue per transaction. Transactions grew year over

year in every quarter of 2021 as we continue to recover from

COVID-19 impacted levels.

Fourth quarter Adjusted EBITDA increased 28% to $64 million

driven by higher revenue, partially offset by increased operational

costs supporting the revenue increase.

Balance Sheet and

Liquidity

Net Debt — As of December 31, 2021, the Company's

leverage ratio for covenant purposes was 3.99x. The Company had

$3.4 billion of corporate debt outstanding as of December 31, 2021,

which excluded $1.9 billion of non-recourse debt related to its

securitized notes receivables portfolio. Additionally, the Company

had cash and cash equivalents of $369 million. At the end of the

fourth quarter, the Company had $1.4 billion of liquidity in cash

and cash equivalents and revolving credit facility

availability.

The Company renewed its $1 billion revolving credit facility on

October 22, 2021 and extended the term through October 2026. This

renewal terminated the relief period and restrictions regarding

share repurchases, dividends and acquisitions under the first

amendment.

During the quarter, the Company issued $650 million senior

secured notes due 2029 with an interest rate of 4.5% and paid off

$650 million senior secured notes due March 2022. The Company's

next long-term debt maturity is $400 million of secured notes due

March 2023.

Timeshare Receivables Financing — The Company closed on a

$350 million term securitization on October 26, 2021 with a

weighted average coupon of 1.82% and a 98% advance rate.

Cash Flow — For the full-year 2021, net cash provided by

operating activities was $568 million compared to $374 million in

the prior year. Adjusted free cash flow was $223 million in 2021

compared to $35 million in the prior year.

Share Repurchases — The Company resumed share repurchase

activity in the fourth quarter of 2021 and repurchased 0.5 million

shares of common stock for $26 million at a weighted average price

of $52.94 per share during the quarter.

Dividend — The Company paid $30 million ($0.35 per share)

in cash dividends on December 30, 2021 to shareholders of record as

of December 15, 2021. For the full-year 2021, Travel + Leisure Co.

paid an aggregate $109 million in dividends to shareholders.

Outlook

For the first quarter of 2022, the Company expects adjusted

EBITDA to range from $160 million to $170 million.

This guidance is presented only on a non-GAAP basis because not

all of the information necessary for a quantitative reconciliation

of forward-looking non-GAAP financial measures to the most directly

comparable GAAP financial measure is available without unreasonable

effort, primarily due to uncertainties relating to the occurrence

or amount of these adjustments that may arise in the future.

Conference Call

Information

Travel + Leisure Co. will hold a conference call with investors

to discuss the Company’s results and outlook today at 8:30 a.m. ET.

Participants may listen to a simultaneous webcast of the conference

call, which may be accessed through the Company's website at

investor.travelandleisureco.com, or by dialing 866-831-8713,

passcode TNL, 10 minutes before the scheduled start time. For those

unable to listen to the live broadcast, an archive of the webcast

will be available on the Company's website for 90 days beginning at

12:00 p.m. ET today. Additionally, a telephone replay will be

available for four days beginning at 12:00 p.m. ET today at

800-753-0348.

Presentation of Financial

Information

Financial information discussed in this press release includes

non-GAAP measures such as adjusted EBITDA, adjusted diluted EPS,

adjusted free cash flow, gross VOI sales and adjusted net

income/(loss), which include or exclude certain items, as well as

non-GAAP guidance. The Company utilizes non-GAAP measures, defined

in Table 9, on a regular basis to assess performance of its

reportable segments and allocate resources. These non-GAAP measures

differ from reported GAAP results and are intended to illustrate

what management believes are relevant period-over-period

comparisons and are helpful to investors when considered with GAAP

measures as an additional tool for further understanding and

assessing the Company’s ongoing operating performance by adjusting

for items which in our view do not necessarily reflect ongoing

performance. Management also internally uses these measures to

assess our operating performance, both absolutely and in comparison

to other companies, and in evaluating or making selected

compensation decisions. Exclusion of items in the Company’s

non-GAAP presentation should not be considered an inference that

these items are unusual, infrequent or non-recurring. Full

reconciliations of non-GAAP financial measures to the most directly

comparable GAAP financial measures for the reported periods appear

in the financial tables section of the press release. See

definitions on Table 9 for an explanation of our non-GAAP

measures.

About Travel + Leisure

Co.

Travel + Leisure Co. (NYSE:TNL) is the world’s leading

membership and leisure travel company, with nearly 20 travel brands

across its resort, travel club, and lifestyle portfolio. The

company provides outstanding vacation experiences and travel

inspiration to millions of owners, members, and subscribers every

year through its products and services: Wyndham Destinations, the

largest vacation ownership company with more than 245 vacation club

resort locations across the globe; Panorama, the world’s foremost

membership travel business that includes the largest vacation

exchange company and subscription travel brands; and Travel +

Leisure Group, featuring top travel content and travel services

including the brand’s eponymous travel club. At Travel + Leisure

Co., our global team of associates brings hospitality to millions

each year, turning vacation inspiration into exceptional travel

experiences. We put the world on vacation. Learn more at

travelandleisureco.com.

Forward-Looking

Statements

This press release includes “forward-looking statements” as that

term is defined by the Securities and Exchange Commission (“SEC”).

Forward-looking statements are any statements other than statements

of historical fact, including statements regarding our

expectations, beliefs, hopes, intentions or strategies regarding

the future. In some cases, forward-looking statements can be

identified by the use of words such as “may,” “will,” “expects,”

“should,” “believes,” “plans,” “anticipates,” “estimates,”

“predicts,” “potential,” “continue,” “future” or other words of

similar meaning. Forward-looking statements are subject to risks

and uncertainties that could cause actual results of Travel +

Leisure Co. and its subsidiaries (“Travel + Leisure Co.” or “we”)

to differ materially from those discussed in, or implied by, the

forward-looking statements. Factors that might cause such a

difference include, but are not limited to, risks associated with:

the acquisition of the Travel + Leisure brand and the future

prospects and plans for Travel + Leisure Co., including our ability

to execute our strategies to grow our cornerstone timeshare and

exchange businesses and expand into the broader leisure travel

industry through new business extensions; our ability to compete in

the highly competitive timeshare and leisure travel industries;

uncertainties related to acquisitions, dispositions and other

strategic transactions; the health of the travel industry and

declines or disruptions caused by adverse economic conditions and

unemployment rates, terrorism or acts of gun violence, political

strife, war, pandemics, and severe weather events and other natural

disasters; adverse changes in consumer travel and vacation

patterns, consumer preferences and demand for our products;

increased or unanticipated operating costs and other inherent

business risks; our ability to comply with financial and

restrictive covenants under our indebtedness and our ability to

access capital markets on reasonable terms, at a reasonable cost or

at all; maintaining the integrity of internal or customer data and

protecting our systems from cyber-attacks; uncertainty with respect

to the scope, impact and duration of the novel coronavirus global

pandemic (“COVID-19”), including resurgences, the pace of recovery,

distribution and adoption of vaccines and treatments, and actions

in response to the evolving pandemic by governments, businesses and

individuals; the timing and amount of future dividends and share

repurchases, if any; and those other factors disclosed as risks

under “Risk Factors” in documents we have filed with the SEC,

including in Part I, Item 1A of our Annual Report on Form 10-K most

recently filed with the SEC. We caution readers that any such

statements are based on currently available operational, financial

and competitive information, and they should not place undue

reliance on these forward-looking statements, which reflect

management’s opinion only as of the date on which they were made.

Except as required by law, we undertake no obligation to review or

update these forward-looking statements to reflect events or

circumstances as they occur.

Travel + Leisure Co. Table of Contents

Table Number

- Consolidated Statements of Income/(Loss) (Unaudited)

- Summary Data Sheet

- Operating Statistics

- Revenue by Reportable Segment

- Non-GAAP Measure: Reconciliation of Net Income/(Loss) to

Adjusted Net Income/(Loss) to Adjusted EBITDA

- Non-GAAP Measure: Reconciliation of Net VOI Sales to Gross VOI

Sales

- Non-GAAP Measure: Reconciliation of Net Cash Provided by

Operating Activities to Adjusted Free Cash Flow

- COVID-19 Related Impacts

- Definitions

Table 1

Travel + Leisure Co.

Consolidated Statements of

Income/(Loss) (Unaudited)

(in millions, except per share

amounts)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2021

2020

2021

2020

Net revenues

Service and membership fees

$

388

$

293

$

1,502

$

1,139

Net VOI sales

366

231

1,176

505

Consumer financing

100

107

404

467

Other

16

14

52

49

Net revenues

870

645

3,134

2,160

Expenses

Operating

367

269

1,359

1,130

Cost of vacation ownership interests

52

29

157

2

Consumer financing interest

18

26

81

101

General and administrative

110

102

434

398

Marketing

102

82

363

329

Depreciation and amortization

31

32

124

126

COVID-19 related costs

—

6

4

88

Restructuring

—

12

(1

)

39

Asset impairments/(recovery)

(5

)

2

(5

)

52

Total expenses

675

560

2,516

2,265

Operating income/(loss)

195

85

618

(105

)

Other (income), net

(4

)

(3

)

(6

)

(14

)

Interest expense

50

54

198

192

Interest (income)

(1

)

(1

)

(3

)

(7

)

Income/(loss) before income

taxes

150

35

429

(276

)

Provision for/(benefit from) income

taxes

40

31

116

(23

)

Net income/(loss) from continuing

operations

110

4

313

(253

)

Loss on disposal of discontinued business,

net of income taxes

(3

)

(2

)

(5

)

(2

)

Net income/(loss) attributable to TNL

shareholders

$

107

$

2

$

308

$

(255

)

Basic earnings/(loss) per share

Continuing operations

$

1.27

$

0.05

$

3.62

$

(2.95

)

Discontinued operations

(0.04

)

(0.02

)

(0.06

)

(0.02

)

$

1.23

$

0.03

$

3.56

$

(2.97

)

Diluted earnings/(loss) per

share

Continuing operations

$

1.26

$

0.05

$

3.58

$

(2.95

)

Discontinued operations

(0.04

)

(0.02

)

(0.06

)

(0.02

)

$

1.22

$

0.03

$

3.52

$

(2.97

)

Weighted average shares

outstanding

Basic

86.5

86.1

86.5

86.1

Diluted

87.4

86.6

87.3

86.1

Table 2

Travel + Leisure Co.

Summary Data Sheet

(in millions, except per share

amounts, unless otherwise indicated)

Three Months Ended December

31,

Twelve Months Ended December

31,

2021

2020

Change

2021

2020

Change

Consolidated

Results

Net income/(loss) attributable to TNL

shareholders

$

107

$

2

NM

$

308

$

(255

)

221

%

Diluted earnings/(loss) per share

$

1.22

$

0.03

NM

$

3.52

$

(2.97

)

219

%

Net income/(loss) from continuing

operations

$

110

$

4

NM

$

313

$

(253

)

224

%

Diluted earnings/(loss) per share from

continuing operations

$

1.26

$

0.05

NM

$

3.58

$

(2.95

)

221

%

Net income/(loss) margin

12.3

%

0.3

%

9.8

%

(11.8

) %

Adjusted Earnings/(Loss)

Adjusted EBITDA

$

228

$

148

54

%

$

778

$

259

200

%

Adjusted net income/(loss)

$

104

$

28

271

%

$

319

$

(80

)

499

%

Adjusted diluted earnings/(loss) per

share

$

1.19

$

0.32

272

%

$

3.65

$

(0.94

)

488

%

Segment

Results

Net Revenues

Vacation Ownership

$

695

$

509

37

%

$

2,403

$

1,625

48

%

Travel and Membership

179

141

27

%

752

552

36

%

Corporate and other

(4

)

(5

)

(21

)

(17

)

Total

$

870

$

645

35

%

$

3,134

$

2,160

45

%

Adjusted EBITDA

Vacation Ownership

$

182

$

115

58

%

$

558

$

121

361

%

Travel and Membership

64

50

28

%

282

191

48

%

Segment Adjusted EBITDA

246

165

840

312

Corporate and other

(18

)

(17

)

(62

)

(53

)

Total Adjusted EBITDA

$

228

$

148

54

%

$

778

$

259

200

%

Adjusted EBITDA Margin

26.2

%

22.9

%

24.8

%

12.0

%

Key Operating

Statistics

Vacation Ownership

Gross VOI sales

$

432

$

281

54

%

$

1,491

$

967

54

%

Tours (in thousands)

129

85

52

%

451

333

35

%

VPG (in dollars)

$

3,222

$

2,938

10

%

$

3,143

$

2,486

26

%

New owner sales, volume mix

25.3

%

25.3

%

28.0

%

27.3

%

New owner sales, transaction mix

24.7

%

24.8

%

27.8

%

28.9

%

Travel and Membership

Transactions (in thousands)

452

348

30

%

1,960

1,220

61

%

Revenue per transaction (in dollars)

$

270

$

254

6

%

$

275

$

258

7

%

Avg. number of exchange members (in

thousands)

3,831

3,652

5

%

3,721

3,749

(1

) %

NM is defined as Not Meaningful

Note: Amounts may not calculate due to

rounding. See Table 9 for definitions. For a full reconciliation of

non-GAAP financial measures to the most directly comparable GAAP

financial measures, refer to Table 5 and Table 6. See "Presentation

of Financial Information" and the tables for the definitions and

reconciliations of these non-GAAP measures in accordance with

GAAP.

In connection with the Travel + Leisure

brand acquisition we updated the names and composition of our

reportable segments to better align with how they are managed. We

created the Travel + Leisure Group which falls under the Travel and

Membership segment along with the Panorama business line. With the

formation of Travel + Leisure Group, we decided that the operations

of our Extra Holidays business, which focuses on direct to consumer

bookings, better aligns with the operations of this new business

line and therefore transitioned the management of our Extra

Holidays business to the Travel and Membership segment. As such, we

reclassified the results of our Extra Holidays business, which were

previously reported within the Vacation Ownership segment, into the

Travel and Membership segment.

Table 3

Travel + Leisure Co.

Operating Statistics: Travel and

Membership

The following operating statistics

are the significant drivers of the Company's revenues and therefore

provide an enhanced understanding of the Company's businesses:

(a)

Year

Q1

Q2

Q3

Q4

Full Year

Gross VOI Sales (in millions) (a)

2021

$

236

$

383

$

440

$

432

$

1,491

2020

$

413

$

18

$

256

$

281

$

967

2019

$

484

$

626

$

663

$

582

$

2,355

Tours (in thousands)

2021

76

117

129

129

451

2020

162

6

80

85

333

2019

192

249

269

234

945

VPG

2021

$

2,847

$

3,151

$

3,233

$

3,222

$

3,143

2020

$

2,128

NM

$

3,039

$

2,938

$

2,486

2019

$

2,405

$

2,425

$

2,332

$

2,373

$

2,381

Provision for Loan Losses

(in millions) (b)

2021

$

(38

)

$

(33

)

$

(49

)

$

(9

)

$

(129

)

2020

$

(315

)

$

(30

)

$

(45

)

$

(25

)

$

(415

)

2019

$

(109

)

$

(129

)

$

(135

)

$

(106

)

$

(479

)

Provision for Loan Loss as a

Percentage of Gross VOI Sales,

net of Fee-for-Service sales

2021

18.1

%

10.1% (c)

12.4% (d)

2.4% (e)

9.9% (f)

2020

NM

NM

18.8

%

9.5% (g)

NM

2019

22.5

%

21.2

%

20.3

%

18.6

%

20.6

%

Allowance for Loan Losses

(in millions)

2021

$

622

$

573

$

565

$

510

$

510

2020

$

930

$

846

$

788

$

693

$

693

2019

$

721

$

735

$

767

$

747

$

747

Gross Vacation Ownership

Contract Receivables (in millions)

2021

$

2,975

$

2,892

$

2,857

$

2,819

$

2,819

2020

$

3,722

$

3,461

$

3,309

$

3,175

$

3,175

2019

$

3,741

$

3,783

$

3,885

$

3,867

$

3,867

Allowance for Loan Loss as a

Percentage of Gross Vacation

Ownership Contract Receivables

2021

20.9

%

19.8

%

19.8

%

18.1

%

18.1

%

2020

25.0

%

24.4

%

23.8

%

21.8

%

21.8

%

2019

19.3

%

19.4

%

19.7

%

19.3

%

19.3

%

Note: Full year amounts and percentages may not compute due to

rounding. NM Not Meaningful

(a)

Includes Gross VOI sales under

the Company's Fee-for-Service sales. (See Table 6 for a

reconciliation of Net VOI sales to Gross VOI sales).

(b)

Represents provision for

estimated losses on vacation ownership contract receivables, which

is recorded as contra revenue to vacation ownership interest sales

on the Consolidated Statements of Income/(Loss).

(c)

The percentage was 18.0%,

excluding the release of $26 million of the COVID-19 related

provision during the period.

(d)

The percentage was 17.8%,

excluding the release of $21 million of the COVID-19 related

provision during the period.

(e)

The percentage was 14.1%,

excluding the release of $44 million of the COVID-19 related

provision during the period.

(f)

The percentage was 16.8%,

excluding the release of $91 million of the COVID-19 related

provision during the period.

(g)

The percentage was 17.3%,

excluding the release of $20 million of the COVID-19 related

provision during the period.

Table 3

(continued)

Travel + Leisure Co.

Operating Statistics: Travel and

Membership

The following operating statistics are the

significant drivers of the Company's revenues and therefore provide

an enhanced understanding of the Company's businesses: (a)

Year

Q1

Q2

Q3

Q4

Full Year

Transactions (in thousands)

Exchange

2021

354

314

256

257

1,182

Non-Exchange

2021

159

210

214

195

778

Total Transactions

2021

513

524

470

452

1,960

Exchange

2020

260

72

214

217

762

Non-Exchange

2020

141

44

142

131

458

Total Transactions

2020

401

116

356

348

1,220

Exchange

2019

444

377

367

304

1,493

Non-Exchange

2019

52

63

138

153

405

Total Transactions

2019

496

440

505

457

1,898

Revenue per transaction (in

dollars)

Exchange

2021

$

292

$

331

$

339

$

335

$

322

Non-Exchange

2021

$

182

$

231

$

214

$

184

$

205

Total Revenue per transaction

2021

$

258

$

291

$

282

$

270

$

275

Exchange

2020

$

279

$

540

$

300

$

330

$

324

Non-Exchange

2020

$

164

$

133

$

157

$

128

$

148

Total Revenue per transaction

2020

$

239

$

384

$

243

$

254

$

258

Exchange

2019

$

275

$

276

$

276

$

307

$

282

Non-Exchange

2019

$

216

$

185

$

172

$

165

$

177

Total Revenue per transaction

2019

$

269

$

263

$

247

$

259

$

259

Avg. Number of Exchange Members

(in thousands)

2021

3,576

3,582

3,895

3,831

3,721

2020

3,864

3,799

3,680

3,652

3,749

2019

3,875

3,893

3,895

3,884

3,887

Note: Full year amounts and percentages may not compute due to

rounding.

(a)

Includes the impact of

acquisitions from the acquisition dates forward.

Table 4

Travel + Leisure Co.

Revenue by Reportable Segment

(in millions)

2021

Q1

Q2

Q3

Q4

Full Year

Vacation Ownership

Net VOI Sales

$

172

$

294

$

344

$

366

$

1,176

Property Management Fees and Reimbursable

Revenues

157

161

171

182

671

Consumer Financing

98

102

103

100

404

Other Revenues

22

42

42

47

152

Total Vacation Ownership

449

599

660

695

2,403

Travel and Membership

Transaction Revenues

132

153

133

122

540

Subscription Revenues

41

43

43

48

176

Other Revenues

10

8

9

9

36

Total Travel and Membership

183

204

185

179

752

Total Reportable Segments

$

632

$

803

$

845

$

874

$

3,155

2020

Q1

Q2

Q3

Q4

Full Year

Vacation Ownership

Net VOI Sales

$

90

$

(13

)

$

196

$

231

$

505

Property Management Fees and Reimbursable

Revenues

170

122

146

145

583

Consumer Financing

127

119

115

107

467

Other Revenues

16

10

18

26

70

Total Vacation Ownership

403

238

475

509

1,625

Travel and Membership

Transaction Revenues

96

44

86

88

315

Subscription Revenues

44

33

43

40

160

Other Revenues

19

29

16

13

77

Total Travel and Membership

159

106

145

141

552

Total Reportable Segments

$

562

$

344

$

620

$

650

$

2,177

2019

Q1

Q2

Q3

Q4

Full Year

Vacation Ownership

Net VOI Sales

$

375

$

481

$

528

$

464

$

1,848

Property Management Fees and Reimbursable

Revenues

163

162

170

176

672

Consumer Financing

125

128

132

130

515

Other Revenues

12

31

20

24

87

Total Vacation Ownership

675

802

850

794

3,122

Travel and Membership

Transaction Revenues

133

116

125

118

492

Subscription Revenues

55

54

54

53

216

Vacation Rental Revenue

38

48

60

7

153

Other Revenues

22

24

24

14

83

Total Travel and Membership

248

242

263

192

944

Total Reportable Segments

$

923

$

1,044

$

1,113

$

986

$

4,066

Note: Full year amounts may not add across

due to rounding.

Table 5

Travel + Leisure Co.

Non-GAAP Measure: Reconciliation

of Net Income/(Loss) to

Adjusted Net Income/(Loss) to

Adjusted EBITDA

(in millions, except diluted per

share amounts)

Three Months Ended December

31,

2021

EPS

Margin %

2020

EPS

Margin %

Net income attributable to TNL

shareholders

$

107

$

1.22

12.3

%

$

2

$

0.03

0.3

%

Loss on disposal of discontinued business,

net of income taxes

(3

)

(2

)

Net income from continuing

operations

$

110

$

1.26

12.6

%

$

4

$

0.05

0.6

%

Amortization of acquired intangibles

(a)

2

2

Restructuring costs

—

12

COVID-19 related costs (b)

—

6

Legacy items

(2

)

2

Unrealized gain on equity investment

(c)

(3

)

—

Impairments/(recovery) (d)

(5

)

2

Taxes (e)

2

—

Adjusted net income

$

104

$

1.19

12.0

%

$

28

$

0.32

4.3

%

Income taxes on adjusted net income

38

31

Interest expense

50

54

Depreciation

29

30

Stock-based compensation expense (f)

8

6

Interest income

(1

)

(1

)

Adjusted EBITDA

$

228

26.2

%

$

148

22.9

%

Diluted Shares Outstanding

87.4

86.6

Table 5

(continued)

Twelve Months Ended December

31,

2021

EPS

Margin %

2020

EPS

Margin %

Net income/(loss) attributable to TNL

shareholders

$

308

$

3.52

9.8

%

$

(255

)

$

(2.97

)

(11.8

) %

Loss on disposal of discontinued business,

net of income taxes

(5

)

(2

)

Net income/(loss) from continuing

operations

$

313

$

3.58

10.0

%

$

(253

)

$

(2.95

)

(11.7

) %

Amortization of acquired intangibles

(a)

9

9

Legacy items

4

4

COVID-19 related costs (b)

3

56

Exchange inventory write-off

—

48

Restructuring costs

(1

)

39

Unrealized gain on equity investment

(c)

(3

)

—

Impairments/(recovery) (d)

(5

)

57

Taxes (e)

(1

)

(40

)

Adjusted net income/(loss)

$

319

$

3.65

10.2

%

$

(80

)

$

(0.94

)

(3.7

) %

Income taxes on adjusted net

income/(loss)

117

17

Interest expense

198

192

Depreciation

115

117

Stock-based compensation expense (f)

32

20

Interest income

(3

)

(7

)

Adjusted EBITDA

$

778

24.8

%

$

259

12.0

%

Diluted Shares Outstanding

87.3

86.1

Amounts may not calculate due to rounding. The table above

reconciles certain non-GAAP financial measures to their closest

GAAP measure. The presentation of these adjustments is intended to

permit the comparison of particular adjustments as they appear in

the income statement in order to assist investors' understanding of

the overall impact of such adjustments. In addition to GAAP

financial measures, the Company provides adjusted net

income/(loss), adjusted EBITDA, adjusted EBITDA margin, and

adjusted diluted EPS to assist our investors in evaluating our

ongoing operating performance for the current reporting period and,

where provided, over different reporting periods, by adjusting for

certain items which in our view do not necessarily reflect ongoing

performance. We also internally use these measures to assess our

operating performance, both absolutely and in comparison to other

companies, and in evaluating or making selected compensation

decisions. These supplemental disclosures are in addition to GAAP

reported measures. Non-GAAP measures should not be considered a

substitute for, nor superior to, financial results and measures

determined or calculated in accordance with GAAP. Our presentation

of adjusted measures may not be comparable to similarly-titled

measures used by other companies. See "Presentation of Financial

Information" and table 9 for the definitions of these non-GAAP

measures.

(a)

Amortization of acquisition-related

intangible assets is excluded from adjusted net income/(loss) and

adjusted EBITDA.

(b)

Reflects severance and other employee

costs associated with layoffs due to the COVID-19 workforce

reduction offset in part by employee retention credits received in

connection with the U.S. CARES Act, ARPA and similar international

programs for wages paid to certain employees despite having

operations suspended. This amount does not include costs associated

with idle pay.

(c)

Represents the unrealized gain associated

with Vacasa equity acquired as part of the consideration for the

sale of North America vacation rentals. The total amount of

unrealized gain on this investment was $9 million for the year

ended December 31, 2021, of which $6 million is included in Asset

Impairments/(recovery) on the Consolidated Statements of

Income/(Loss) to offset the 2020 impairment recognized on this

investment.

(d)

Includes $5 million of bad debt expense

related to a note receivable for the twelve months ended December

31, 2020, included in Operating expenses on the Consolidated

Statements of Income/(Loss).

(e)

The amounts represent the tax effects on

the adjustments. In addition, during the three months ended

December 31, 2020, the amounts are partially offset by $3 million

of non-cash tax expense associated with COVID-19 related increases

to valuation allowances and $5 million of additional tax related to

the Company's former rentals businesses. In the twelve months ended

December 31, 2020, the amounts are partially offset by $9 million

of non-cash tax expense associated with COVID-19 related increases

to valuation allowances and $5 million of additional tax related to

the Company's former rentals businesses.

(f)

All stock-based compensation is excluded

from adjusted EBITDA.

Table 6

Travel + Leisure Co.

Non-GAAP Measure: Reconciliation

of Net VOI Sales to Gross VOI Sales

(in millions)

The Company believes gross VOI sales

provide an enhanced understanding of the performance of its

vacation ownership business because it directly measures the sales

volume of this business during a given reporting period.

The following table provides a

reconciliation of Net VOI sales (see Table 4) to Gross VOI sales

(see Table 3):

Year

2021

Q1

Q2

Q3

Q4

Full Year

Net VOI sales

$

172

$

294

$

344

$

366

$

1,176

Loan loss provision

38

33

49

9

129

Gross VOI sales, net of Fee-for-Service

sales

210

327

393

375

1,305

Fee-for-Service sales

26

56

47

57

186

Gross VOI sales

$

236

$

383

$

440

$

432

$

1,491

2020

Net VOI sales

$

90

$

(13

)

$

196

$

231

$

505

Loan loss provision

315

30

45

25

415

Gross VOI sales, net of Fee-for-Service

sales

405

17

241

256

920

Fee-for-Service sales

8

1

15

25

47

Gross VOI sales

$

413

$

18

$

256

$

281

$

967

2019

Net VOI sales

$

375

$

481

$

528

$

464

$

1,848

Loan loss provision

109

129

135

106

479

Gross VOI sales, net of Fee-for-Service

sales

484

610

663

570

2,327

Fee-for-Service sales

—

16

—

12

28

Gross VOI sales

$

484

$

626

$

663

$

582

$

2,355

Note: Amounts may not add due to

rounding.

Table 7

Travel + Leisure Co.

Non-GAAP Measure: Reconciliation

of Net Cash Provided by Operating Activities to Adjusted Free Cash

Flow

(in millions)

Twelve Months

Ended December 31,

2021

2020

Net cash provided by operating

activities

$

568

$

374

Property and equipment additions

(57

)

(69

)

Sum of proceeds and principal payments of

non-recourse vacation ownership debt

(294

)

(333

)

Free cash flow

$

217

$

(28

)

Separation and other adjustments (a)

—

16

COVID-19 related adjustments (b)

6

47

Adjusted free cash flow (c)

$

223

$

35

(a)

Includes cash paid for separation-related

activities and transaction costs for acquisitions and

divestitures.

(b)

Includes cash paid for COVID-19 expenses

factored into the calculation of Adjusted EBITDA.

(c)

The Company had $93 million of net cash

used in investing and $1.29 billion of net cash used in financing

activities for the year ended December 31, 2021, and $65

million of net cash used in investing activities and $502 million

of net cash provided by financing activities for the year ended

December 31, 2020.

Table 8

Travel + Leisure Co.

COVID-19 Related Impacts

(in millions)

The tables below present the COVID-19

related impacts to our results of operations for three and twelve

months ended December 31, 2021, and the related classification

on the Consolidated Statements of Income/(Loss):

Three Months Ended

Vacation Ownership

Travel and Membership

Corporate

& Other

Consolidated

Non-GAAP

Adjustments

Income Statement

Classification

December 31, 2021

Allowance for loan losses:

Provision

$

(44

)

$

—

$

—

$

(44

)

$

—

Vacation ownership interest sales

Recoveries

16

—

—

16

—

Cost of vacation ownership interests

Asset impairment recovery

—

(6

)

—

(6

)

(6

)

Asset impairments/(recovery)

Total COVID-19

$

(28

)

$

(6

)

$

—

$

(34

)

$

(6

)

Twelve Months Ended

Vacation Ownership

Travel and Membership

Corporate

& Other

Consolidated

Non-GAAP

Adjustments

Income Statement

Classification

December 31, 2021

Allowance for loan losses:

Provision

$

(91

)

$

—

$

—

$

(91

)

$

—

Vacation ownership interest sales

Recoveries

33

—

—

33

—

Cost of vacation ownership interests

Employee compensation related and

other

3

—

1

4

3

COVID-19 related costs

Asset impairment recovery

—

(6

)

—

(6

)

(6

)

Asset impairments/(recovery)

Lease-related

(1

)

—

—

(1

)

(1

)

Restructuring

Total COVID-19

$

(56

)

$

(6

)

$

1

$

(61

)

$

(4

)

Table 8

(continued)

The tables below present the COVID-19

related impacts to our results of operations for three and twelve

months ended December 31, 2020, and the related classification

on the Consolidated Statements of Income/(Loss):

Three Months Ended

Vacation Ownership

Travel and Membership

Corporate

& Other

Consolidated

Non-GAAP

Adjustments

Income Statement

Classification

December 31, 2020

Allowance for loan losses:

Provision

$

(20

)

$

—

$

—

$

(20

)

$

—

Vacation ownership interest sales

Recoveries

7

—

—

7

—

Cost of vacation ownership interests

Employee compensation related and

other

3

2

2

7

6

COVID-19 related costs

Asset impairments

1

—

1

2

2

Asset impairments/(recovery)

Lease-related

12

—

—

12

12

Restructuring

Total COVID-19

$

3

$

2

$

3

$

8

$

20

Twelve Months Ended

Vacation Ownership

Travel and Membership

Corporate

& Other

Consolidated

Non-GAAP

Adjustments

Income Statement

Classification

December 31, 2020

Allowance for loan losses:

Provision

$

205

$

—

$

—

$

205

$

—

Vacation ownership interest sales

Recoveries

(48

)

—

—

(48

)

—

Cost of vacation ownership interests

Employee compensation related and

other

65

9

14

88

56

COVID-19 related costs

Asset impairments

21

34

1

56

56

Asset impairments/(recovery) and Operating

expenses

Exchange inventory write-off

—

48

—

48

48

Operating expenses

Lease-related

14

22

—

36

36

Restructuring

Total COVID-19

$

257

$

113

$

15

$

385

$

196

Table 9

Definitions

Adjusted Diluted

Earnings/(Loss) per Share: A non-GAAP measure, defined by

the Company as Adjusted net income/(loss) divided by the diluted

weighted average number of common shares.

Adjusted

EBITDA: A non-GAAP measure, defined by the Company as net

income/(loss) from continuing operations before depreciation and

amortization, interest expense (excluding consumer financing

interest), early extinguishment of debt, interest income (excluding

consumer financing revenues) and income taxes, each of which is

presented on the Consolidated Statements of Income. Adjusted EBITDA

also excludes stock-based compensation costs, separation and

restructuring costs, legacy items, transaction costs for

acquisitions and divestitures, impairments, gains and losses on

sale/disposition of business, and items that meet the conditions of

unusual and/or infrequent. Legacy items include the resolution of

and adjustments to certain contingent assets and liabilities

related to acquisitions of continuing businesses and dispositions,

including the separation of Wyndham Hotels and Cendant, and the

sale of the vacation rentals businesses. We believe that when

considered with GAAP measures, Adjusted EBITDA is useful to assist

our investors in evaluating our ongoing operating performance for

the current reporting period and, where provided, over different

reporting periods. We also internally use these measures to assess

our operating performance, both absolutely and in comparison to

other companies, and in evaluating or making selected compensation

decisions. Adjusted EBITDA should not be considered in isolation or

as a substitute for net income/(loss) or other income statement

data prepared in accordance with GAAP and our presentation of

Adjusted EBITDA may not be comparable to similarly-titled measures

used by other companies.

Adjusted EBITDA

Margin: A non-GAAP measure, represents Adjusted EBITDA as a

percentage of revenue.

Adjusted Free Cash

Flow: A non-GAAP measure, defined by the Company as net cash

provided by operating activities from continuing operations less

property and equipment additions (capital expenditures) plus the

sum of proceeds and principal payments of non-recourse vacation

ownership debt, while also adding back cash paid for transaction

costs for acquisitions and divestitures, separation adjustments

associated with the spin-off of Wyndham Hotels, and certain

adjustments related to COVID-19. A limitation of using Adjusted

free cash flow versus the GAAP measure of net cash provided by

operating activities as a means for evaluating TNL is that Adjusted

free cash flow does not represent the total cash movement for the

period as detailed in the consolidated statement of cash flows.

Adjusted Net

Income/(Loss): A non-GAAP measure, defined by the Company as

net income/(loss) from continuing operations adjusted to exclude

separation and restructuring costs, legacy items, transaction costs

for acquisitions and divestitures, amortization of

acquisition-related assets, debt modification costs, impairments,

gains and losses on sale/disposition of business, and items that

meet the conditions of unusual and/or infrequent and the tax effect

of such adjustments. Legacy items include the resolution of and

adjustments to certain contingent assets and liabilities related to

acquisitions of continuing businesses and dispositions, including

the separation of Wyndham Hotels and Cendant, and the sale of the

vacation rentals businesses.

Average Number of

Exchange Members: Represents paid members in our vacation

exchange programs who are considered to be in good standing.

Free Cash Flow

(FCF): A non-GAAP measure, defined by TNL as net cash

provided by operating activities from continuing operations less

property and equipment additions (capital expenditures) plus the

sum of proceeds and principal payments of non-recourse vacation

ownership debt. TNL believes FCF to be a useful operating

performance measure to evaluate the ability of its operations to

generate cash for uses other than capital expenditures and, after

debt service and other obligations, its ability to grow its

business through acquisitions and equity investments, as well as

its ability to return cash to shareholders through dividends and

share repurchases. A limitation of using FCF versus the GAAP

measure of net cash provided by operating activities as a means for

evaluating TNL is that FCF does not represent the total cash

movement for the period as detailed in the consolidated statement

of cash flows.

Gross Vacation

Ownership Interest Sales: A non-GAAP measure, represents

sales of vacation ownership interests (VOIs), including sales under

the fee-for-service program before the effect of loan loss

provisions. We believe that Gross VOI sales provide an enhanced

understanding of the performance of our vacation ownership business

because it directly measures the sales volume of this business

during a given reporting period.

Leverage

Ratio: The Company calculates leverage ratio as net debt

divided by Adjusted EBITDA as defined in the credit agreement.

Net Debt: Net

debt equals total debt outstanding, less non-recourse vacation

ownership debt and cash and cash equivalents.

New owner sales,

volume mix: Represents VOI sales (tour generated plus

telephonic) to first time buyers as a percentage of total VOI

sales.

New owner sales,

transactions mix: Represents the number of first time buyer

transactions as a percentage of the total number of VOIs sold

during the period.

Tours:

Represents the number of tours taken by guests in our efforts to

sell VOIs.

Travel and

Membership Revenue per Transaction: Represents transactional

revenue divided by transactions, provided in two categories;

Exchange, which is primarily RCI, and non-Exchange.

Travel and

Membership Transactions: Represents the number of vacation

bookings recognized as revenue during the period, net of

cancellations, provided in two categories; Exchange, which is

primarily RCI, and non-Exchange.

Volume Per Guest

(VPG): Represents Gross VOI sales (excluding tele-sales

upgrades, which are non-tour upgrade sales) divided by the number

of tours. The Company has excluded non-tour upgrade sales in the

calculation of VPG because non-tour upgrade sales are generated by

a different marketing channel.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220223005484/en/

Investors: Christopher Agnew Senior Vice President,

FP&A and Investor Relations (407) 626-4050

Christopher.Agnew@travelandleisure.com Media: Steven

Goldsmith Corporate Communications (407) 626-5882

Steven.Goldsmith@travelandleisure.com

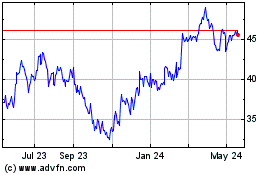

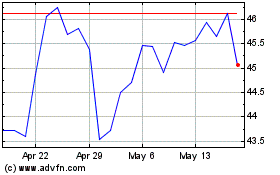

Travel plus Leisure (NYSE:TNL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Travel plus Leisure (NYSE:TNL)

Historical Stock Chart

From Nov 2023 to Nov 2024