Technitrol, Inc. (NYSE:TNL) announced results for its first

fiscal quarter ended March 27, 2009. First-quarter results

include:

- consolidated revenues of $182.2

million, compared with $212.8 million in the previous quarter and

$274.0 million in the first quarter of 2008;

- very weak end-product demand and

significant customer inventory reductions principally during

January and February in the electronics and electrical businesses,

partly offset by:

- a March rebound in electronic

component shipments; and

- stable demand in

military/aerospace electronics markets and quarter-over-quarter

revenue growth in automotive electronic components, driven by the

progressive ramp-up of ignition coil production in China;

- reductions in SG&A and

indirect manufacturing expenses amounting to approximately $30

million per year compared with the first quarter of 2008. Because

of timing issues, the first quarter of 2009 did not reflect the

full benefit of the most recent cost reductions;

- adjusted EBITDA (see non-GAAP

table) of $12.3 million;

- earnings per diluted share

included approximately $0.18 from foreign-exchange gains and

approximately $0.03 resulting from insurance proceeds related to

the May 2008 earthquake in Mianyang, China;

- a $2.5 million repayment of

long-term debt. In future quarters, increasing amounts of debt

repayment are expected from:

- an absence of significant cash

restructuring expense after the second quarter;

- lower shareholder dividend

payments (in keeping with the recently reduced declarations);

- non-recurrence of one-time first

quarter expenses related to amending the credit agreement; and

- non-recurrence of a $2.1 million

outlay to fund retirement plan obligations in the first

quarter;

- working capital reductions

totaling $25.1 million (principally inventory reductions), or

approximately 14%, from the end of the fourth quarter, due mainly

to aggressive inventory management and correspondingly little

purchasing to replace consumed inventory; and

- capital spending of only $3.2

million, in line with the company�s conservation budget run rate

for 2009.

Technitrol�s first-quarter GAAP operating loss included the

following items:

- pre-tax severance expenses

amounting to approximately $2.9 million, mainly related to

previously announced work force reductions necessary to match

anticipated future business levels; and

- pre-tax non-cash charges, none

of which affect non-GAAP financial results or the company�s

compliance with debt covenants, of:

- approximately $5.6 million,

related to impairment of fixed assets in certain divisions of the

Electronic Components Group. The impairments relate to reduced

customer demand forecasts and also production equipment dedicated

to end-of-life customer products; and

- approximately $68.9 million for

the impairment of goodwill at our wireless product division, based

on an analysis of Technitrol�s equity market value and internal

demand forecasts as of March 27, 2009. If the analysis were done

under current market conditions, a different result would ensue.

The final amount of the impairment will be recorded upon completion

of third-party appraisals.

Excluding the above items, operating profit was $2.6 million in

the first quarter (see non-GAAP table).

Based on industry reports, customer input and internal analysis,

the company expects second-quarter revenues to be roughly

comparable to first-quarter levels, as electronics supply chain

inventory bottoming is offset by softer electrical markets,

particularly in Europe. Excluding severance, asset-impairment and

other associated costs, second-quarter adjusted EBITDA is expected

to improve from first-quarter levels, due to the full realization

of savings from recent cost-reduction efforts, plus additional

benefit from the transfer of acoustical components to Vietnam and

automotive components to China and overall improved plant

loading.

For the foreseeable future, Technitrol believes it will continue

producing sufficient EBITDA and/or free cash flows to remain

compliant with the covenants of its amended debt agreement. To

reduce its indebtedness as expediently as possible, the company

will continue:

- consolidating both electronic

and electrical component production into locations where it can be

done most efficiently;

- committing capital to product

lines serving markets with high growth potential;

- divesting assets, where

appropriate, such as the microelectromechanical systems (MEMS)

business and possibly the Electrical Contact Products Group (AMI

Doduco);

- completing the transfer of

automotive electronics and former Sonion operations to low-cost

production locations in China and Vietnam; and

- rigorously managing working

capital.

Separately, Technitrol announced that its board of directors has

declared a quarterly shareholder dividend to $0.025 per common

share, an amount equal to that declared in the previous quarter,

payable July 17, 2009 to shareholders of record on July 3,

2009.

Cautionary Note

Statements in the above report are �forward-looking� within the

meaning of the Private Securities Litigation Reform Act of 1995 and

involve a number of risks and uncertainties. Actual results may

differ materially due to the risk factors listed from time to time

in Technitrol�s SEC reports including, but not limited to, those

discussed in the company�s 10-K report for the year ended December

26, 2008 in Item 1a under the caption �Factors That May Affect

Our Future Results (Cautionary Statements for Purposes of the �Safe

Harbor� Provisions of the Private Securities Litigation Reform Act

of 1995).� All such risk factors are incorporated into this

report by reference as though set forth in full. This report should

be read in conjunction with item 1a of the 10-K report.

Based in Philadelphia, Technitrol is a worldwide producer of

electronic components, electrical contacts and assemblies and other

precision-engineered parts and materials for manufacturers in the

wireless and wireline communications, hearing, medical,

military/aerospace, automotive and electrical equipment industries.

For more information, visit Technitrol�s Web site at

http://www.technitrol.com.

Investors: Technitrol�s quarterly conference call will take

place on Monday, May 4, 2009 at 5:00 p.m. Eastern Time. The dial-in

number is (412) 858-4600. Also, the call will be broadcast live

over the Internet. Visit www.technitrol.com. On-demand Internet and

telephone replay will be available beginning at 7:00 p.m. on May 4,

2009 and concluding at midnight, May 11, 2009. For telephone

replay, dial (412) 317-0088 and enter access code 374010#. For

Internet replay, use the link from our home page mentioned

above.

� �

CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)

(in thousands, except per-share amounts) Quarter Ended

3/27/2009 3/28/2008 � Net sales $ 182,207

$ 274,004 Cost of goods sold �

146,741 � �

217,789 � Gross profit 35,466 56,215 Selling, general

and administrative expenses 32,899 40,373 Severance, impairment and

other associated costs �

77,315 � �

1,965

� Operating (loss) profit (74,748 ) 13,877 � Interest (expense),

net (4,985 ) (2,086 ) Other income, net �

8,914 � �

3,977 �

(Loss) earnings from continuing

operations before income taxes and non-controlling interest

(70,819 ) 15,768 Income taxes �

(129 ) �

521 �

Net (loss) earnings from

continuing operations before non-controlling interest

(70,690 ) 15,247 Net loss from discontinued operations �

(3,870 ) �

(429

)

Net (loss) earnings before

non-controlling interest

(74,560 ) 14,818

Net (loss) earnings attributable

to non- controlling interest

�

(12 ) �

81 � Net (loss)

earnings attributable to Technitrol, Inc. (74,548 ) 14,737 � �

AMOUNTS ATTRIBUTABLE TO TECHNITROL, INC. � Net (loss) earnings from

continuing operations (70,678 ) 15,166 Net loss from discontinued

operations �

(3,870 ) �

(429

) Net (loss) earnings attributable to Technitrol, Inc.

(74,548 ) 14,737 � �

Basic (loss) earnings per share

from continuing operations

(1.73 ) 0.37

Basic (loss) per share from

discontinued operations

�

(0.10 ) �

(0.01

) Basic (loss) earnings per share (1.83 ) 0.36 �

Diluted (loss) earnings per share

from continuing operations

(1.73 ) 0.37

Diluted (loss) per share from

discontinued operations

�

(0.10 ) �

(0.01

) Diluted (loss) earnings per share (1.83 ) 0.36 �

Weighted average common and

equivalent shares outstanding

40,809 40,836 � � � BUSINESS SEGMENT INFORMATION (UNAUDITED) (in

thousands) Quarter Ended

3/27/2009

3/28/2008 Net sales Electronic components

$

123,583

$ 170,016 Electrical contact products �

58,624 � �

103,988 Total net sales 182,207 274,004 � Operating

(loss) profit Electronic components (73,218 ) 8,067 Electrical

contact products �

(1,530 ) �

5,810 Total operating (loss) profit (74,748 ) 13,877 �

� � FINANCIAL POSITION (UNAUDITED) (in thousands, except per-share

amounts)

3/27/2009 12/26/2008 � � Cash

and equivalents $ 32,870 $ 41,401 Trade receivables, net 123,731

128,010 Inventories 104,422 127,074 Other current assets 45,368

58,568 Fixed assets 129,741 152,731 Other assets �

186,507 � �

262,127 Total assets 622,639

769,911 Current position of long-term debt 21,800 17,189 Accounts

payable 58,125 75,511 Accrued expenses 75,641 86,477 Long-term debt

318,500 326,000 Other long-term liabilities �

55,803 �

�

56,602 Total liabilities 529,869 561,779 Equity

92,770 208,132 � � NON-GAAP MEASURES (UNAUDITED) (in thousands

except per-share amounts) � � 1. Adjusted EBITDA

Quarter

Ended 3/27/09 12/26/08

3/28/08 � Net (loss) earnings attributable to

Technitrol, Inc. $ (74,548 ) $ (295,321 ) $ 14,737 Net loss from

discontinued operations 3,870 171 429

Net (loss) earnings attributable

to non-controlling interest

(12

)

140

81

Income taxes (129 ) (16,881 ) 521 Interest expense, net 4,985 4,291

2,086 Other income (8,914 ) (411 ) (3,977 ) Depreciation and

amortization �

9,764 � �

11,648 � �

10,013 � EBITDA (64,984 ) (296,363 ) 23,890

Severance, impairment and other

associated costs

77,315

315,910

1,965

Other adjustments: impact of

purchase accounting adjustments

�

--

� �

--

� �

1,875

� Adjusted EBITDA 12,331 19,547 27,730 � � 2. Net (loss) earnings

per diluted share excluding severance, impairment and other

associated costs and other adjustments

Quarter Ended

3/27/09 �

12/26/08 �

3/28/08

� Net (loss) earnings per diluted share $ (1.83 ) $ (7.24 ) $ 0.36

Diluted loss per share from

discontinued operations

0.10 0.00 0.01

After-tax severance, impairment

and other associated costs, per share

1.86 7.29 0.04

Other adjustments: amortization of

an amended credit facility�s fees, purchase accounting adjustments,

accelerated depreciation and impact of settlement of foreign

exchange forward contracts, per share

�

0.02 � �

-- � �

(0.05

)

Net earnings per diluted share

excluding severance, impairment and other associated costs and

other adjustments

0.15 0.05 0.36 � � 3. Segment (loss) operating profit excluding

severance, impairment and other associated costs, purchase

accounting adjustments and accelerated depreciation �

Quarter

Ended 3/27/09 �

12/26/08 �

3/28/08 � Electronic components operating (loss)

profit $ (73,218 ) $ (306,712 ) $ 8,067

Pre-tax severance, impairment and

other associated costs

77,035 314,290 1,965

Pre-tax impact of purchase

accounting adjustments and accelerated depreciation

�

--

� �

--

� �

2,110

Electronic components operating

profit, excluding severance, impairment and other associated costs,

purchase accounting adjustments and accelerated depreciation

3,817 7,578 12,142 �

Electrical contact products

operating (loss) profit

(1,530 ) (1,299 ) 5,810

Pre-tax severance, impairment and

other associated costs

�

281

� �

1,620

� �

--

Electrical contact products

operating (loss) profit, excluding severance, impairment and other

associated costs

(1,249 ) 321 5,810 �

1. Adjusted EBITDA (net income plus income taxes, depreciation

and amortization, excluding interest and other expense/income and

excluding severance, impairment and other associated costs and

other adjustments), is not a measure of performance under

accounting principles generally accepted in the United States.

Adjusted EBITDA should not be considered a substitute for, and an

investor should also consider, net income, cash flow from

operations and other measures of performance as defined by

accounting principles generally accepted in the United States as

indicators of our profitability or liquidity. EBITDA is often used

by shareholders and analysts as an indicator of a company�s ability

to service debt and fund capital expenditures. We believe it

enhances a reader�s understanding of our financial condition,

results of operations and cash flow because it is unaffected by

capital structure and, therefore, enables investors to compare our

operating performance to that of other companies. We understand

that our presentation of adjusted EBITDA may not be comparable to

other similarly titled captions of other companies due to

differences in the method of calculation.

2,3. Based on discussions with investors and equity analysts, we

believe that a reader�s understanding of Technitrol�s operating

performance is enhanced by references to these non-GAAP measures.

Removing charges for severance, impairment and other associated

costs facilitates comparisons of operating performance among

financial periods and peer companies. These charges result

exclusively from production relocations and capacity reductions and

/ or restructuring of overhead and operating expenses to enhance or

maintain profitability in an increasingly competitive environment.

Impairment charges represent adjustments to asset values and are

not part of the normal operating expense structure of the relevant

business in the period in which the charge is recorded.

Copyright � 2009 Technitrol, Inc. All rights reserved. All brand

names and trademarks are properties of their respective

holders.

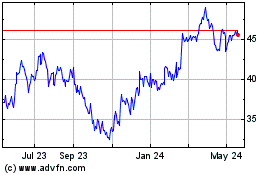

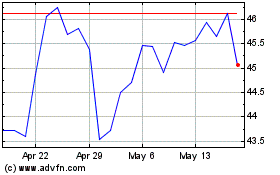

Travel plus Leisure (NYSE:TNL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Travel plus Leisure (NYSE:TNL)

Historical Stock Chart

From Jul 2023 to Jul 2024