0001260221false00012602212023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2023

TransDigm Group Incorporated

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-32833 | | 41-2101738 | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

| | | | | | | | | | | | | | | | | |

| 1301 East 9th Street, | Suite 3000, | Cleveland, | Ohio | | 44114 |

| (Address of principal executive offices) | | (Zip Code) |

(216) 706-2960

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol: | | Name of each exchange on which registered: |

| Common Stock, $0.01 par value | | TDG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On November 9, 2023, TransDigm Group Incorporated (“TransDigm Group”) issued a press release (the “Press Release”) announcing its definitive agreement to acquire the Electron Device Business (“the Company”) of Communications & Power Industries, a portfolio company of TJC, L.P., for approximately $1.385 billion in cash. A copy of this press release is filed with this Current Report as Exhibit 99.1 and is incorporated herein by reference.

The Company is a leading global manufacturer of electronic components and subsystems primarily serving the aerospace and defense market. The Company’s products are highly-engineered, proprietary components with significant aftermarket content and a strong presence across major aerospace and defense platforms. Approximately 70% of its revenue is derived from the aftermarket, and nearly all of its revenue is generated from proprietary products. The Company generated approximately $300 million in revenue for its fiscal year ended September 30, 2023. The acquisition is expected to close by the end of TransDigm Group’s third fiscal quarter of 2024, subject to the receipt of regulatory approvals in the United States and United Kingdom and the satisfaction of customary closing conditions. The acquisition is expected to be financed through existing cash on hand as well as new long-term debt.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are being filed with this Current Report of Form 8-K:

| | | | | | | | | | | | | | | | | |

Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| TRANSDIGM GROUP INCORPORATED |

| |

| By: | | /s/ Sarah Wynne |

| Name: | | Sarah Wynne |

| Title: | | Chief Financial Officer

(Principal Financial Officer) |

| | |

Dated: November 9, 2023

TransDigm Announces Acquisition of the Electron Device Business of

Communications & Power Industries (“CPI”)

Cleveland, Ohio, November 9, 2023 /PRNewswire/ -- TransDigm Group Incorporated (NYSE: TDG) today announced it has entered into a definitive agreement to acquire the Electron Device Business (“the Company”) of Communications & Power Industries, a portfolio company of TJC, L.P., for approximately $1.385 billion in cash.

CPI’s Electron Device Business is a leading global manufacturer of electronic components and subsystems primarily serving the aerospace and defense market. The Company’s products are highly-engineered, proprietary components with significant aftermarket content and a strong presence across major aerospace and defense platforms. Approximately 70% of its revenue is derived from the aftermarket and nearly all of its revenue is generated from proprietary products. CPI’s Electron Device Business generated approximately $300 million in revenue for its fiscal year ended September 30, 2023. The Company has manufacturing locations in Palo Alto, California; Beverly, Massachusetts; Middlesex, UK; and Woodland, California. The Company employs approximately 900 people.

Kevin Stein, TransDigm’s President and Chief Executive Officer, stated, “We are excited about the acquisition of the Electron Device Business of CPI. This business fits well with our long-standing strategy. The vast majority of the Company’s revenues come from highly engineered, proprietary products with substantial aftermarket content. The Company has established positions across a diverse range of new and existing platforms within the broader aerospace and defense industry. As with all TransDigm acquisitions, we expect this acquisition to create equity value in-line with our long-term private equity-like return objectives.”

The acquisition, which is expected to close by the end of TransDigm’s third fiscal quarter of 2024, is subject to regulatory approvals in the United States and United Kingdom and customary closing conditions. The acquisition is expected to be financed through existing cash on hand as well as new long-term debt.

About TransDigm Group

TransDigm Group, through its wholly-owned subsidiaries, is a leading global designer, producer and supplier of highly engineered aircraft components for use on nearly all commercial and military aircraft in service today. Major product offerings, substantially all of which are ultimately provided to end-users in the aerospace industry, include mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric motors and generators, batteries and chargers, engineered latching and locking devices, engineered rods, engineered connectors and elastomer sealing solutions, databus and power controls, cockpit security components and systems, specialized and advanced cockpit displays, engineered audio, radio and antenna systems, specialized lavatory components, seat belts and safety restraints, engineered and customized interior surfaces and related components, advanced sensor products, switches and relay panels, thermal protection and insulation, lighting and control technology, parachutes, high performance hoists, winches and lifting devices, and cargo loading, handling and delivery systems and specialized flight, wind tunnel and jet engine testing services and equipment.

Forward-Looking Statements

Statements in this press release that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "believe," "may," "will," "should," "expect," "intend," "plan," "predict," "anticipate," "estimate," or "continue" and other words and terms of similar meaning may identify forward-looking statements. All forward-looking statements involve risks and uncertainties that could cause TransDigm Group's actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, TransDigm Group. These risks and uncertainties include but are not limited to: the sensitivity of our business to the number of flight hours that our customers’ planes spend aloft and our customers’ profitability, both of which are affected by general economic conditions; supply chain constraints; increases in raw material costs, taxes and labor costs that cannot be recovered in product pricing; failure to complete or successfully integrate acquisitions; our indebtedness; current and future geopolitical or other worldwide events, including, without limitation, wars or conflicts and public health crises; cybersecurity threats; risks related to the transition or physical impacts of climate change and other natural disasters or meeting sustainability-related voluntary goals or regulatory requirements; our reliance on certain customers; the United States (“U.S.”) defense budget and risks associated with being a government supplier including government audits and investigations; failure to maintain government or industry approvals; risks related to changes in laws and regulations, including increases in compliance costs; potential environmental liabilities; liabilities arising in connection with litigation; risks and costs associated with our international sales and operations; and other factors. Further information regarding the important factors that could cause actual results to differ materially from projected results can be found in TransDigm Group's most recent Annual Report on Form 10-K and other reports that TransDigm Group or its subsidiaries have filed with the Securities and Exchange Commission. Except as required by law, TransDigm Group undertakes no obligation to revise or update the forward-looking statements contained in this press release.

| | | | | | | | |

| Contact: | | Investor Relations |

| | 216-706-2945 |

| | ir@transdigm.com |

| | |

v3.23.3

Document and Entity Information

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

TransDigm Group Incorporated

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-32833

|

| Entity Tax Identification Number |

41-2101738

|

| Entity Address, Address Line One |

1301 East 9th Street,

|

| Entity Address, Address Line Two |

Suite 3000,

|

| Entity Address, City or Town |

Cleveland,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44114

|

| City Area Code |

216

|

| Local Phone Number |

706-2960

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

TDG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001260221

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

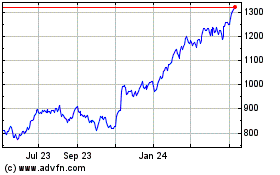

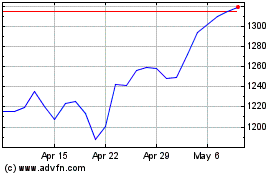

Transdigm (NYSE:TDG)

Historical Stock Chart

From Apr 2024 to May 2024

Transdigm (NYSE:TDG)

Historical Stock Chart

From May 2023 to May 2024