Report of Independent Registered Public Accounting Firm

To the Participants and Administrator of

The Timken Company Savings and Investment Retirement Plan

North Canton, Ohio

Opinion on the Financial Statements

We have audited the accompanying Statements of Net Assets Available for Benefits of The Timken Company Savings and Investment Retirement Plan (formerly The Timken Company Savings and Investment Pension Plan) (the “Plan”) as of December 31, 2018 and 2017, the related Statement of Changes in Net Assets for the year ended December 31, 2018, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2018 and 2017, and the changes in net assets available for benefits for the year ended December 31, 2018, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the accompanying Schedule of Assets (Held at End of Year) as of December 31, 2018 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

We have served as the Plan’s auditor since 2016.

BOBER, MARKEY, FEDOROVICH & COMPANY

Akron, Ohio

June 25, 2019

The Timken Company

Savings and Investment Retirement Plan

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

Assets

|

2018

|

2017

|

|

Investments, at fair value:

|

|

|

|

Interest in The Master Trust Agreement for The Timken Company Defined Contribution Plans

|

$

|

945,972,809

|

|

$

|

1,064,129,764

|

|

|

Receivables:

|

|

|

|

Contributions receivable from participants

|

3,920,413

|

|

3,147,443

|

|

|

Contributions receivable from The Timken Company

|

3,560,667

|

|

3,174,868

|

|

|

Notes receivable from participants

|

18,823,815

|

|

18,711,744

|

|

|

Total receivables

|

26,304,895

|

|

25,034,055

|

|

|

Net assets available for benefits

|

$

|

972,277,704

|

|

$

|

1,089,163,819

|

|

|

|

|

|

|

See accompanying Notes to Financial Statements.

|

|

|

The Timken Company

Savings and Investment Retirement Plan

Statement of Changes in Net Assets Available for Benefits

Year Ended

December 31, 2018

|

|

|

|

|

|

|

|

Additions

|

|

|

Interest income on notes receivable from participants

|

$

|

896,645

|

|

|

Participant rollovers

|

7,126,832

|

|

|

Contributions:

|

|

|

Participants

|

29,770,650

|

|

|

The Timken Company

|

23,590,825

|

|

|

Total contributions

|

53,361,475

|

|

|

Total additions

|

61,384,952

|

|

|

|

|

|

Deductions

|

|

|

Investment loss:

|

|

|

Net depreciation from The Master Trust Agreement for The Timken Company

Defined Contribution Plans

|

68,000,109

|

|

|

Benefits paid directly to participants

|

109,174,073

|

|

|

Administrative expenses

|

1,096,885

|

|

|

Total deductions

|

178,271,067

|

|

|

|

|

|

Net decrease

|

(116,886,115

|

)

|

|

|

|

|

Net assets available for benefits:

|

|

|

Beginning of year

|

1,089,163,819

|

|

|

End of year

|

$

|

972,277,704

|

|

|

|

|

|

See accompanying Notes to Financial Statements.

|

|

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements

1. Description of the Plan

The following description of The Timken Company Savings and Investment Retirement Plan (the "Plan") provides only general information. Participants should refer to the Summary Plan Description (posted on MyTotalRewards Portal) for a more complete description of the Plan’s provisions. Copies of the Summary Plan Description are available from the Plan Administrator, The Timken Company (the "Company"). Effective January 1, 2018, the name of the Plan was changed from The Timken Company Savings and Investment Pension Plan to The Timken Company Savings and Investment Retirement Plan.

General

Participation in this Plan shall be available to (1) full-time salaried Employees of The Timken Company; The Timken Corporation; Interlube USA, Inc.; Timken Motor & Crane Services LLC; Timken Gears & Services Inc.; Timken Drives, LLC; MPB Corporation; Bearing Inspection, Inc.; Timken Industrial Services, LLC; Timken Aerospace Drive Systems, LLC, PT Tech LLC, and effective January 1, 2019, Cone Drive Operatins, Inc.; Timken SMO LLC; (2) non-bargaining hourly employees of The Timken Company and The Timken Corporation at its facilities in Gaffney, Honea Path, and Tyger River, South Carolina; Pulaski and Mascot, Tennessee; Lincolnton and Rutherfordton, North Carolina; Carlyle, Illinois; Ogden, Utah; Lenexa, Kansas; Carolina Service Center and Duncan, South Carolina; Bucyrus, Ohio; and in Timken Housed Units business; and (3) non-bargaining hourly employees of Interlube USA, Inc.; Timken Gears & Services Inc.; Timken Drives, LLC; MPB Corporation; Bearing Inspection, Inc.; Timken Motor & Crane Services LLC; Timken Aerospace Drive Systems, LLC; PT Tech LLC; and Torsion Control Products, Inc. Employees of these entities become eligible to participate in the Plan the first of the month following the completion of one full calendar month of full-time service. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA").

Contributions

Under the provisions of the Plan, participants may elect to contribute between 1% and 75% of their gross earnings directly to the Plan, depending on their monthly wages and subject to Internal Revenue Service ("IRS") limitations. The Company matches such employee contributions, “Matching Contributions,” at an amount equal to 100% of the first 3% of the participant’s gross earnings deferred to the Plan, and 50% of the next 3% of gross earnings deferred to the Plan. Matching Contributions are allocated based on the participant's investment election. Participants may also roll over amounts representing distributions from other qualified defined benefit or defined contribution plans. The Plan froze future investments in the Timken Company Common Stock Fund effective December 31, 2018. In addition, on May 1, 2018, the Plan was amended to eliminate the Timken Company Common Stock Fund as an investment option effective December 31, 2022.

The Plan provides for a quarterly “Core Contribution” by the Company for all plan participants except (1) employees of the Timken Housed Units business, Timken Drives, LLC, Timken Motor & Crane Services LLC, Timken SMO LLC, PT Tech LLC, Torsion Control Products, Inc; (2) those accruing service under a defined benefit pension plan sponsored by the Company, and (3) salaried employees eligible for a 401(k) Plus Contribution. This contribution is based on the participant’s full years of service and age as of December 31 of the previous calendar year. Core Contribution amounts range from 1.0% to 4.5% of the participant’s eligible compensation.

The Plan provides for a quarterly “401(k) Plus Contribution” by the Company for employees at the Company’s facilities in Asheboro, North Carolina; and the Indiana Services Center, who were hired prior to January 1, 2004, and as of December 31, 2003, had less than 5 years of Continuous Service or less than 50 points (age plus years of Continuous Service) or had 5 years of Continuous Service or 50 points (age plus years of Continuous Service) but do not accrue benefit under service defined benefit pension plan sponsored by the Company. This contribution is based on the participant’s full years of service at amounts ranging from 2.5% to 8.0% of the participant’s eligible compensation.

The Plan provides for a quarterly “Timken Drives 401(k) Plus Contribution” by the Company for employees of Timken Drives, LLC that do not accrue benefit service under a defined benefit pension plan sponsored by the Company. This contribution is based on the participant’s full years of service in amounts of 1.0% (for those with 25-29 years of services) or 2.0% (for those with 30 or more years of service) of the participant’s eligible compensation.

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

Newly eligible employees who do not make an affirmative contribution or opt out election are automatically enrolled in the Plan at a 3% deferral rate. If the participant makes no further changes to his/her deferral rate, then each year following the year in which the participant was automatically enrolled in the Plan the participant’s deferral rate will be increased by 1% until a deferral rate of 6% has been attained. Effective January 1, 2019, newly eligible associates are automatically enrolled in the Plan at a 6% deferral rate.

Core Contributions, 401(k) Plus Contributions and Timken Drives 401(k) Plus Contributions are invested based on the participant’s investment election. If a participant fails to make investment elections, his/her deferrals will default to an appropriate Vanguard Target Retirement Fund, based on the participant’s age. As disclosed above, the Plan will not permit future contributions to the Timken Company Common Stock Fund after December 31, 2022.

Participants have access to their account information and the ability to make account transfers and contribution changes daily through an automated telecommunications system and through the Internet.

Participant Accounts

Each participant’s account is credited with the participant’s contributions and allocations of (a) the Company’s contributions and (b) Plan earnings, and is charged administrative expenses, as appropriate. Plan earnings are allocated based on the participant’s share of net earnings or losses of their respective elected investment options. Allocations of investment management fees and expenses are based on participant’s account balances, as defined. Allocation of participant account maintenance fees are charged per participant account. Forfeited balances of terminated participants’ unvested accounts are used to reduce future Company contributions. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting

Participants are immediately vested in their contributions. Certain employer contributions are immediately vested plus actual earnings thereon. Participants vest in 401(k) Plus Contributions and Timken Drives 401(k) Plus Contributions after the completion of three years of service.

Forfeitures

Under the provisions of the Plan, if a participant leaves the Company with less than three years of Continuous Service, all 401(k) Plus Contributions and Timken Drives 401(k) Plus Contributions and any earnings on those contributions are forfeited and used to fund other Company contributions for eligible associates. Forfeiture balances as of

December 31, 2018

and

2017

were approximately $110,844 and $140,347, respectively.

Notes Receivable from Participants

Participants may borrow from their accounts a minimum of $1,000 up to a maximum equal to the lesser of $50,000 minus participants highest outstanding loan balance during the past 12 months or 50% of their vested account balance, excluding after-tax contributions to the Plan (other than Timken US After-Tax Contribution Accounts) and earnings on after-tax contributions, if any. Loan terms generally cannot exceed five years for general purpose loans, and 30 years for residential loans. The loans bear interest at an interest rate of 1% in excess of the prime rate, as published in the

Wall Street Journal

on the first business day of the month in which the loan is granted. Principal and interest are paid ratably through payroll deductions. Effective January 1, 2016, new loans are limited to active employees.

Payment of Benefits

Upon disability or termination of service with the Company, participants having a vested account balance greater than $1,000 are given the option of (i) transferring their account balance to another plan, (ii) receiving a lump-sum amount equal to the vested balance of their account, (iii) receiving installment payments of their vested assets over a fixed period of time not to exceed their estimated life expectancy, or (iv) leaving their vested account balance in the Plan (if vested account balance was greater than $5,000). Participants having a vested account balance less than $1,000 receive a lump-sum amount equal to their vested account balance. Participants with a vested account balance between $1,000 and $5,000 and who did not elect a distribution, are paid in a direct rollover to an individual retirement plan. Participants electing to leave their vested assets in the Plan may do so until age 70-1/2, after which time the lump-sum or installment distribution options would apply.

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

Hardship withdrawals are allowed for participants incurring an immediate and severe financial need, as defined by the Plan. Hardship withdrawals are strictly regulated by the IRS and a participant must exhaust all available loan options and distributions prior to requesting a hardship withdrawal.

Participants may elect to have their vested dividends in the Timken Company Common Stock Fund distributed to them in cash rather than automatically reinvested in common shares of the Company.

Transfers between Plans

Certain participants who change job positions within the Company and, as a result, are covered under a different defined contribution plan offered by the Company may be eligible to transfer his or her account balance between plans.

Administrative Expenses

The Plan's administrative expenses are paid by either the Plan or the Company. Administrative expenses paid by the Plan include advisory, recordkeeping and trustee fees. Expenses relating to purchases, sales or transfers of the Plan's investments are charged to the particular investment fund to which the expenses relate. All other administrative expenses of the Plan are paid by the Company. Expenses that are paid by the Company are excluded from these financial statements.

Plan Termination

Although it has not expressed any interest to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, the Plan’s trustee, Great-West Trust Company, LLC ("Trustee"), shall distribute to each participant the vested balance in their separate account.

2. Accounting Policies

Basis of Accounting

The financial statements have been prepared on the accrual basis of accounting.

Payment of Benefits

Benefits are recorded when paid.

Investment Valuation and Income Recognition

The Plan’s investments are stated at fair value and are invested in The Master Trust Agreement for The Timken Company Defined Contribution Plans ("Master Trust"), which was established for the investment of assets of the Plan and the two other defined contribution plans sponsored by the Company.

The Trustee maintains a collective investment trust of common shares of The Timken Company within the Master Trust in which the Company’s defined contribution plans participate on a unit basis. Common shares of the Timken Company are traded on a national securities exchange and participation units in The Timken Company Common Stock Fund are valued at the last reported sales price on the last business day of the plan year.

Purchases and sales of securities are recorded on a trade-date basis. Dividends are recorded on the ex-dividend date.

Notes Receivable from Participants

Participant notes receivable represents participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of

December 31, 2018

or

2017

. If a participant ceases to make loan repayments and the Plan Administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles ("U.S. GAAP") requires management to make estimates that affect the amounts reported in the financial statements and accompanying notes and supplemental schedules. Actual results could differ from those estimates.

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

New Accounting Pronouncements

In February 2017, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2017-06,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting

. For each master trust in which a plan holds an interest, ASU 2017-06 requires that a plan's interest in each master trust and any change in the interest in each master trust be presented in separate line items in the statement of net assets available for benefits and in the statement of changes in net assets available for benefits. ASU 2017-06 also removes the requirement to disclose the percentage interest in the master trust for plans with divided interests and requires that all plans disclose the dollar amount of their interest in each of those general types of investments, which supplements the existing requirement to disclose the master trusts balances in each general type of investments. In addition, ASU 2017-06 requires all plans to disclose (1) their master trust's other asset and liability balances and (2) the dollar amount of the plan's interest in each of those balances. ASU 2017-06 is effective for fiscal years beginning after December 15, 2018, with retrospective application to all periods presented. Early application is permitted. Management is currently evaluating the effect that the provisions of ASU 2017-06 will have on the Plan’s financial statements.

In August 2018, the FASB issued ASU 2018-13, "Fair Value Measurement (Topic 820): Disclosure Framework - Changes to the Disclosure Requirement for Fair Value Measurement," which is part of the FASB disclosure framework project to improve the effectiveness of disclosures in the notes to the financial statements. The amendments in the new guidance remove, modify and add certain disclosure requirements related to fair value measurements covered in Topic 820, "Fair Value Measurement." The new standard is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is permitted for either the entire standard or only the requirements that modify or eliminate the disclosure requirements, with certain requirements applied prospectively, and all other requirements applied retrospectively to all periods presented. Management is currently evaluating the impact of adopting this guidance.

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

3. Investments

The Plan’s assets are held in the Master Trust, commingled with assets of other Company-sponsored benefit plans.

Each participating plan’s interest in the investment funds (i.e., separate accounts) of the Master Trust is based on account balances of the participants and their elected investment funds. The Master Trust assets are allocated among the participating plans by assigning to each plan those transactions (primarily contributions, benefit payments, and plan-specific expenses) that can be specifically identified and by allocating among all plans, in proportion to the fair value of the assets assigned to each plan, income and expenses resulting from the collective investment of the assets of the Master Trust. The Plan’s ownership percentage in the Master Trust as of

December 31, 2018

and

2017

was

97.44%

and

97.35%

, respectively.

The following tables present the value of investments in the Master Trust and the Plan’s ownership percentage in each investment fund of the Master Trust:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2018

|

|

|

Cash and Cash Equivalents

|

|

Company Stock Funds

|

|

Registered Investment Companies

|

|

Common Collective Funds

|

|

Total Assets

|

|

Plan's Ownership Percentage

|

|

Investment, at Fair Value:

|

|

|

|

|

|

|

|

|

|

|

|

|

The Timken Company Common Stock Fund

|

$

|

1,483,875

|

|

|

$

|

98,341,405

|

|

—

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

99,825,280

|

|

|

96.97

|

%

|

|

TimkenSteel Common Stock Fund

|

1,053

|

|

|

112,079

|

|

|

—

|

|

|

—

|

|

|

113,132

|

|

|

—

|

%

|

|

American Beacon Small Cap Value

|

—

|

|

|

—

|

|

|

14,782,869

|

|

|

—

|

|

|

14,782,869

|

|

|

98.80

|

%

|

|

American Funds EuroPacific Growth

|

—

|

|

|

—

|

|

|

91,142,641

|

|

|

—

|

|

|

91,142,641

|

|

|

99.37

|

%

|

|

American Funds Washington Mutual Investors

|

—

|

|

|

—

|

|

|

32,943,428

|

|

|

—

|

|

|

32,943,428

|

|

|

98.90

|

%

|

|

Eagle Small Cap Value

|

—

|

|

|

—

|

|

|

14,139,170

|

|

|

—

|

|

|

14,139,170

|

|

|

97.94

|

%

|

|

Vanguard Target Retirement Income Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

11,357,465

|

|

|

11,357,465

|

|

|

91.29

|

%

|

|

Vanguard Target Retirement 2015 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

33,859,002

|

|

|

33,859,002

|

|

|

95.59

|

%

|

|

Vanguard Target Retirement 2020 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

30,795,997

|

|

|

30,795,997

|

|

|

97.22

|

%

|

|

Vanguard Target Retirement 2025 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

64,335,412

|

|

|

64,335,412

|

|

|

98.39

|

%

|

|

Vanguard Target Retirement 2030 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

22,101,249

|

|

|

22,101,249

|

|

|

95.80

|

%

|

|

Vanguard Target Retirement 2035 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

49,151,223

|

|

|

49,151,223

|

|

|

99.03

|

%

|

|

Vanguard Target Retirement 2040 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

10,557,348

|

|

|

10,557,348

|

|

|

99.31

|

%

|

|

Vanguard Target Retirement 2045 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

20,559,267

|

|

|

20,559,267

|

|

|

99.40

|

%

|

|

Vanguard Target Retirement 2050 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

7,290,972

|

|

|

7,290,972

|

|

|

98.90

|

%

|

|

Vanguard Target Retirement 2055 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

3,606,633

|

|

|

3,606,633

|

|

|

99.62

|

%

|

|

Vanguard Target Retirement 2060 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

2,908,795

|

|

|

2,908,795

|

|

|

99.89

|

%

|

|

Vanguard Target Retirement 2065 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

71,508

|

|

|

71,508

|

|

|

99.94

|

%

|

|

JPMCB Core Bond

|

—

|

|

|

—

|

|

|

—

|

|

|

89,990,452

|

|

|

89,990,452

|

|

|

97.83

|

%

|

|

JPMorgan Equity Index

|

—

|

|

|

—

|

|

|

—

|

|

|

146,606,639

|

|

|

146,606,639

|

|

|

100.00

|

%

|

|

JPMorgan S&P 500 Index

|

—

|

|

|

—

|

|

|

—

|

|

|

6,561,143

|

|

|

6,561,143

|

|

|

—

|

%

|

|

SSgA Russell 200-A Index

|

—

|

|

|

—

|

|

|

—

|

|

|

44,955,325

|

|

|

44,955,325

|

|

|

98.52

|

%

|

|

T. Rowe Price Blue Chip Growth Trust

|

—

|

|

|

—

|

|

|

—

|

|

|

61,469,606

|

|

|

61,469,606

|

|

|

97.52

|

%

|

|

Wells Fargo Stable Return

|

—

|

|

|

—

|

|

|

—

|

|

|

2,724,514

|

|

|

2,724,514

|

|

|

—

|

%

|

|

Wells Fargo Stable Value

|

—

|

|

|

—

|

|

|

—

|

|

|

106,774,666

|

|

|

106,774,666

|

|

|

99.21

|

%

|

|

Western Asset Core Plus Bond

|

—

|

|

|

—

|

|

|

—

|

|

|

2,239,963

|

|

|

2,239,963

|

|

|

100.00

|

%

|

|

Net Assets of Master Trust

|

$

|

1,484,928

|

|

|

$

|

98,453,484

|

|

|

$

|

153,008,108

|

|

|

$

|

717,917,179

|

|

|

$

|

970,863,699

|

|

|

97.44

|

%

|

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2017

|

|

|

Cash and Cash Equivalents

|

|

Company Stock

|

|

Registered Investment Companies

|

|

Common Collective Funds

|

|

Total Assets

|

|

Plan's Ownership Percentage

|

|

Investment, at Fair Value:

|

|

|

|

|

|

|

|

|

|

|

|

|

The Timken Company Common Stock Fund

|

$

|

1,383,411

|

|

|

$

|

129,614,104

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

130,997,515

|

|

|

96.97

|

%

|

|

TimkenSteel Common Stock Fund

|

1,370

|

|

|

241,671

|

|

|

—

|

|

|

—

|

|

|

243,041

|

|

|

—

|

%

|

|

American Beacon Small Cap Value

|

—

|

|

|

—

|

|

|

20,015,933

|

|

|

—

|

|

|

20,015,933

|

|

|

98.83

|

%

|

|

American Funds EuroPacific Growth

|

—

|

|

|

—

|

|

|

110,466,003

|

|

|

—

|

|

|

110,466,003

|

|

|

99.25

|

%

|

|

American Funds Washington Mutual Investors

|

—

|

|

|

—

|

|

|

37,414,183

|

|

|

—

|

|

|

37,414,183

|

|

|

98.62

|

%

|

|

Eagle Small Cap Value

|

—

|

|

|

—

|

|

|

15,657,534

|

|

|

—

|

|

|

15,657,534

|

|

|

98.54

|

%

|

|

Putnam Government Money Market

|

—

|

|

|

—

|

|

|

48,002

|

|

|

—

|

|

|

48,002

|

|

|

100.00

|

%

|

|

Vanguard Target Retirement Income Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

13,817,345

|

|

|

13,817,345

|

|

|

92.12

|

%

|

|

Vanguard Target Retirement 2015 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

40,535,641

|

|

|

40,535,641

|

|

|

96.41

|

%

|

|

Vanguard Target Retirement 2020 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

30,544,012

|

|

|

30,544,012

|

|

|

99.34

|

%

|

|

Vanguard Target Retirement 2025 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

68,784,886

|

|

|

68,784,886

|

|

|

97.02

|

%

|

|

Vanguard Target Retirement 2030 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

20,504,947

|

|

|

20,504,947

|

|

|

99.29

|

%

|

|

Vanguard Target Retirement 2035 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

52,379,549

|

|

|

52,379,549

|

|

|

98.45

|

%

|

|

Vanguard Target Retirement 2040 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

10,713,528

|

|

|

10,713,528

|

|

|

98.53

|

%

|

|

Vanguard Target Retirement 2045 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

23,580,550

|

|

|

23,580,550

|

|

|

94.94

|

%

|

|

Vanguard Target Retirement 2050 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

7,032,919

|

|

|

7,032,919

|

|

|

98.97

|

%

|

|

Vanguard Target Retirement 2055 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

2,869,923

|

|

|

2,869,923

|

|

|

98.95

|

%

|

|

Vanguard Target Retirement 2060 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

2,704,391

|

|

|

2,704,391

|

|

|

98.05

|

%

|

|

Vanguard Target Retirement 2065 Trust II

|

—

|

|

|

—

|

|

|

—

|

|

|

217,827

|

|

|

217,827

|

|

|

100.00

|

%

|

|

JPMCB Core Bond

|

—

|

|

|

—

|

|

|

—

|

|

|

93,722,113

|

|

|

93,722,113

|

|

|

97.62

|

%

|

|

JPMorgan Equity Index

|

—

|

|

|

—

|

|

|

—

|

|

|

170,596,622

|

|

|

170,596,622

|

|

|

100.00

|

%

|

|

JPMorgan S&P 500 Index

|

—

|

|

|

—

|

|

|

—

|

|

|

8,337,617

|

|

|

8,337,617

|

|

|

—

|

%

|

|

Nuveen Winslow Large-Cap Growth

|

—

|

|

|

—

|

|

|

—

|

|

|

9

|

|

|

9

|

|

|

100.00

|

%

|

|

SSgA Russell 2000-A Index

|

—

|

|

|

—

|

|

|

—

|

|

|

52,662,480

|

|

|

52,662,480

|

|

|

98.31

|

%

|

|

T. Rowe Price Blue Chip Growth Trust

|

—

|

|

|

—

|

|

|

—

|

|

|

58,680,338

|

|

|

58,680,338

|

|

|

97.87

|

%

|

|

Wells Fargo Stable Return

|

—

|

|

|

—

|

|

|

—

|

|

|

2,755,918

|

|

|

2,755,918

|

|

|

—

|

%

|

|

Wells Fargo Stable Value

|

—

|

|

|

—

|

|

|

—

|

|

|

117,780,153

|

|

|

117,780,153

|

|

|

99.22

|

%

|

|

Net Assets of Master Trust

|

$

|

1,384,781

|

|

|

$

|

129,855,775

|

|

|

$

|

183,601,655

|

|

|

$

|

778,220,768

|

|

|

$

|

1,093,062,979

|

|

|

97.35

|

%

|

Effective January 3, 2017, the Plan was amended to eliminate the TimkenSteel Common Stock Fund from the Plan. Participants were asked to transfer their balance in the TimkenSteel Common Stock Fund to another investment election by January 3, 2017. Any balances not transferred by January 3, 2017 were liquidated between January 3, 2017 and January 23, 2017 and reinvested in an appropriate Vangaurd Target Retirement Fund, based on the participant's age.

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

Changes in net assets for the Master Trust are as follows:

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2018

|

|

Net transfers (contributions, transfers and benefit payments for the participating plans)

|

$

|

(51,435,629

|

)

|

|

Net depreciation in fair value of instruments:

|

|

|

Company stock funds

|

(27,704,455

|

)

|

|

Registered investment companies

|

(34,823,892

|

)

|

|

Common collective funds

|

(23,502,902

|

)

|

|

Interest

|

26,927

|

|

|

Dividends

|

16,339,274

|

|

|

Total investment loss (net of transfers)

|

(121,100,677

|

)

|

|

Administrative expenses

|

(1,098,603

|

)

|

|

Net decrease

|

(122,199,280

|

)

|

|

Net assets:

|

|

|

Beginning of the year

|

1,093,062,979

|

|

|

End of the year

|

$

|

970,863,699

|

|

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

4. Fair Value

The fair value framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1) and the lowest priority to unobservable inputs (level 3). The three levels of the fair value hierarchy under Accounting Standards Codification ("ASC") 820, Fair Value Measurements and Disclosures, are described as follows:

Level 1 - Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

Level 2 - Inputs to the valuation methodology include:

•

quoted prices for similar assets or liabilities in active markets;

•

quoted prices for identical or similar assets or liabilities in inactive markets;

•

inputs other than quoted prices that are observable for the asset or liability;

•

inputs that are derived principally from or corroborated by observable market data by correlation or other means.

If the asset or liability has a specified (contractual) term, the level 2 input must be observable for substantially the full term of the asset or liability.

Level 3 - Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques maximize the use of relevant observable inputs and minimize the use of unobservable inputs.

The following tables present the fair value hierarchy for those investments of the Master Trust measured at fair value on a recurring basis as of

December 31, 2018

and

2017

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of

|

|

|

December 31, 2018

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents

|

$

|

1,484,928

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

1,484,928

|

|

|

Company Stock

|

98,453,484

|

|

|

—

|

|

|

—

|

|

|

98,453,484

|

|

|

Registered Investment Companies

|

153,008,108

|

|

|

—

|

|

|

—

|

|

|

153,008,108

|

|

|

|

$

|

252,946,520

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

252,946,520

|

|

|

Investment measured using NAV per share as practical expedient:

|

|

|

|

|

|

|

|

|

Common Collective Funds

|

|

|

|

|

|

|

717,917,179

|

|

|

Total Assets

|

|

|

|

|

|

|

$

|

970,863,699

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of

|

|

|

December 31, 2017

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents

|

$

|

1,384,781

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

1,384,781

|

|

|

Company Stock

|

129,855,775

|

|

|

—

|

|

|

—

|

|

|

129,855,775

|

|

|

Registered Investment Companies

|

183,601,655

|

|

|

—

|

|

|

—

|

|

|

183,601,655

|

|

|

|

$

|

314,842,211

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

314,842,211

|

|

|

Investment measured using NAV per share as practical expedient:

|

|

|

|

|

|

|

|

|

Common Collective Funds:

|

|

|

|

|

|

|

778,220,768

|

|

|

Total Assets

|

|

|

|

|

|

|

$

|

1,093,062,979

|

|

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

The Timken Company and TimkenSteel Common Stock Funds participate in units and are valued based on the closing price of each company's common shares traded on a national securities exchange. Cash and cash equivalents and registered investment companies are valued based on quoted market prices reported on the active market on which the individual securities are traded.

The T. Rowe Price Blue Chip Growth Trust seeks long-term growth of capital by investing primarily in common stocks of well-established large and medium-sized companies. Income is a secondary objective of the trust.

In 2017, the Vanguard Target Retirement Trust II Funds replaced the Vanguard Institutional Target Retirement Funds. The Vanguard Target Retirement Trust II Funds invest in broad index funds of U.S. and international stocks and bonds. The asset allocation of each fund is managed in accordance with the designated strategy for each fund’s target retirement year. The funds are automatically rebalanced to designated glide paths.

The JPMorgan S&P 500 Index Fund and the JPMorgan Equity Index Fund include investments that provide exposure to a broad equity market and are designed to mirror the aggregate price and dividend performance of the S&P 500 Index.

The JPMCB Core Bond Fund invests primarily in a diversified portfolio of intermediate and long-term debt securities.

The SSgA Russell 2000-A Index Fund includes investments seeking an investment return that approximates as closely as practicable, before expenses, the performance of the Russell 2000 Index over the long term. The fund includes exposure to stocks of small U.S. companies.

The Nuveen Winslow Large-Cap Growth Fund is a portfolio that invests at least 80% of its net assets in equity securities of U.S. companies with market capitalization in excess of $4 billion at the time of purchase.

The Wells Fargo Stable Return Fund and Wells Fargo Stable Value Fund primarily invests in security backed investment contracts.

The Western Asset Core Plus Bond strategy seeks to maximize total return through a well-diversified, long-term value based core fixed-income portfolio that includes limited opportunistic exposure to the “plus” sectors: high-yield, non-U.S. and emerging market debt. The strategy seeks to approximate the risk of the Bloomberg Barclays U.S. Aggregate Index.

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

The following tables summarize investments measured at fair value using the net asset value ("NAV") per share practical expedient as of

December 31, 2018

and

2017

, respectively:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2018

|

|

Fair Value

|

|

Unfunded Commitments

|

|

Redemption Frequency

|

|

Redemption Notice Period

|

|

Vanguard Target Retirement Income Trust II

|

|

$

|

11,357,465

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2015 Trust II

|

|

$

|

33,859,002

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2020 Trust II

|

|

$

|

30,795,997

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2025 Trust II

|

|

$

|

64,335,412

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2030 Trust II

|

|

$

|

22,101,249

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2035 Trust II

|

|

$

|

49,151,223

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2040 Trust II

|

|

$

|

10,557,348

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2045 Trust II

|

|

$

|

20,559,267

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2050 Trust II

|

|

$

|

7,290,972

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2055 Trust II

|

|

$

|

3,606,633

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2060 Trust II

|

|

$

|

2,908,795

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2065 Trust II

|

|

$

|

71,508

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

JPMCB Core Bond

|

|

$

|

89,990,452

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

JPMorgan Equity Index

|

|

$

|

146,606,639

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day + 1 day

|

|

JPMorgan S&P 500 Index

|

|

$

|

6,561,143

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

SSgA Russell 200-A Index

|

|

$

|

44,955,325

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

T. Rowe Price Blue Chip Growth Trust

|

|

$

|

61,469,606

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Wells Fargo Stable Return

|

|

$

|

2,724,514

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Wells Fargo Stable Value

|

|

$

|

106,774,666

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Western Asset Core Plus Bond

|

|

$

|

2,239,963

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2017

|

|

Fair Value

|

|

Unfunded Commitments

|

|

Redemption Frequency

|

|

Redemption Notice Period

|

|

Vanguard Target Retirement Income Trust II

|

|

$

|

13,817,345

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2015 Trust II

|

|

$

|

40,535,641

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2020 Trust II

|

|

$

|

68,784,886

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2025 Trust II

|

|

$

|

52,379,549

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2030 Trust II

|

|

$

|

23,580,550

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2035 Trust II

|

|

$

|

2,869,923

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2040 Trust II

|

|

$

|

30,544,012

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2045 Trust II

|

|

$

|

20,504,947

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2050 Trust II

|

|

$

|

10,713,528

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2055 Trust II

|

|

$

|

7,032,919

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2060 Trust II

|

|

$

|

2,704,391

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Vanguard Target Retirement 2065 Trust II

|

|

$

|

217,827

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

JPMCB Core Bond

|

|

$

|

93,722,113

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

JPMorgan Equity Index

|

|

$

|

170,596,622

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day + 1 day

|

|

JPMorgan S&P 500 Index

|

|

$

|

8,337,617

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Nuveen Winslow Large-Cap Growth

|

|

$

|

9

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

SSgA Russell 200-A Index

|

|

$

|

52,662,480

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

T. Rowe Price Blue Chip Growth Trust

|

|

$

|

58,680,338

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Wells Fargo Stable Return

|

|

$

|

2,755,918

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

|

Wells Fargo Stable Value

|

|

$

|

117,780,153

|

|

|

Not applicable

|

|

Daily

|

|

Trade Day

|

5. Risks and Uncertainties

The Master Trust invests in various investment securities in line with participants' investment elections. Investment securities are exposed to various risks such as interest rate, market volatility, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

6. Income Tax Status

The Plan has received a determination letter from the IRS dated April 5, 2017, stating that the Plan is qualified under Section 401(a) of the Internal Revenue Code (the "Code"), and therefore, the related trust is exempt from taxation. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. Subsequent to this determination by the Internal Revenue Service, the Plan was amended. The Plan Administrator believes that the Plan, as amended, is qualified and the related trust is tax-exempt. The Plan Administrator will take steps to ensure that the Plan's operations remain in compliance with the Code, including taking appropriate action, when necessary, to bring the Plan's operations into compliance.

Accounting principles generally accepted in the United States require plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of

December 31, 2018

and

2017

, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to

2015

.

The Timken Company Savings and Investment Retirement Plan

Notes to Financial Statements (continued)

7. Related-Party Transactions

Related-party transactions included the investments in the common stock of the Company and the investment funds of the Trustee. Such transactions are exempt from being prohibited transactions.

The following is a summary of transactions in Timken common shares with the Plan for the year ended

December 31, 2018

:

|

|

|

|

|

|

|

|

Purchased

|

$

|

1,974,913

|

|

|

Issued to participants for payment of benefits

|

$

|

9,859,356

|

|

Purchases and benefits paid to participants include Timken common shares valued at quoted market prices at the date of purchase or distribution.

Certain legal and accounting fees and certain administrative expenses relating to the maintenance of participant records are paid by the Company. Fees paid during the year for services rendered by parties in interest were based on customary and reasonable rates for such services.

8. Subsequent Events

Management evaluates subsequent events and transactions occurring subsequent to the date of the financial statements through the financial statement issuance date that affect recognition or disclosure to the financial statements. Other than the item described below, no subsequent events were identified.

Effective April 1, 2019, salaried employees of Diamond Chain Company, Inc. will participate in the Plan.

The Timken Company

Savings and Investment Retirement Plan

Supplemental Schedule

The Timken Company

Savings and Investment Retirement Plan

EIN #34-0577130 Plan #011

Schedule H, Line 4i - Schedule of Assets

(Held at End of Year)

Year Ended

December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Identity of Issuer, Borrower, Lessor, or

Similar Party

|

|

Description of Investment,

Including Maturity Date, Rate of Interest,

Collateral, Par, or Maturity Value

|

|

Cost

|

|

Current Value

|

|

Participant notes receivable*

|

|

Interest rates ranging from 4.25% to 11.00% with various maturity dates

|

|

$

|

—

|

|

|

$

|

18,823,815

|

|

* Indicates party in interest to the Plan

SIGNATURES

The Plan.

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other person who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

THE TIMKEN COMPANY SAVINGS AND INVESTMENT RETIREMENT PLAN

|

|

|

|

|

|

|

|

|

|

Date: June 25, 2019

|

By:

|

/s/ Shelly M. Chadwick

|

|

|

|

Shelly M. Chadwick

|

|

|

|

Vice President - Finance and Chief Accounting Officer

|

|

|

|

(Principal Accounting Officer)

|

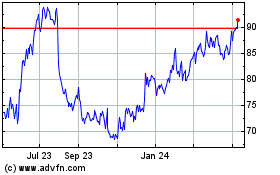

Timken (NYSE:TKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

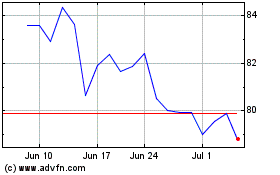

Timken (NYSE:TKR)

Historical Stock Chart

From Apr 2023 to Apr 2024