Report of Foreign Issuer (6-k)

July 30 2020 - 6:10AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities

Exchange Act of 1934

For

the month of July, 2020

Commission

File Number 001-14491

TIM

PARTICIPAÇÕES S.A.

(Exact

name of registrant as specified in its charter)

TIM

PARTICIPAÇÕES S.A.

(Translation

of Registrant's name into English)

Avenida

João Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

_______ No ___X____

TIM PARTICIPAÇÕES S.A.

Publicly-held Company

CNPJ/MF nº 02.558.115/0001-21

NIRE 33 300 276 963

MATERIAL FACT

Closing of a Share Buyback Program and Approval

of a New Program

TIM Participações

S.A. (“Company”) (B3: TIMP3 e NYSE: TSU) in compliance with Section 157 of Law No. 6,404/76 and the provisions of CVM

Instruction No. 358, hereby informs its shareholders, the market in general and other interested parties that the Company’s

Board of Directors approved on the date hereof, what follows:

|

|

1.

|

The closing of the Share Buyback Program

approved by the Board of Directors of the Company in June 26th, 2019 (“Program 3”). During the Program 3

930,466 (nine hundred and thirty thousand, four hundred and sixty-six) common shares were acquired by an average price of R$15.48

(fifteen reais and forty-eight centavos), in order to fulfill the obligations regarding the stock-based Long-Term Incentive Plan

addressed to the Company's executives;

|

|

|

2.

|

The approval of a new Share Buyback Program

(“Program 4”), of its own issuance, pursuant to Section 22, V, of the Company's By-laws and of Section 5 of CVM Instruction

No. 567, with the following conditions:

|

|

|

(i)

|

Objective: The purpose of the program is

to support the stock-based compensation of the Long Term Incentive Plan – LTI or for eventual cancellation, without reducing

the capital stock.

|

|

|

(ii)

|

Number of Shares that may be acquired during

the Program 4: Up to 397,331 (three hundred and ninety-seven thousand, three hundred and thirty-one) common shares of the Company

(“Shares”) may be acquired, without reduction of the capital stock, corresponding to 0.02% of the total common shares

of the Company or 0.05% of the free float shares. The Company’s Management may decide the best moment, within the Program

Term, to carry out the acquisitions of the Shares, and may make one or several acquisitions.

|

|

|

(iii)

|

Deadline: The Program 4 will start as of

the date of the Board of Directors’ resolution, remaining in force until July 29th, 2021, the acquisitions being

made at the Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão), at market prices, in compliance with the applicable

legal and regulatory limits.

|

|

|

(iv)

|

Intermediary Financial Institutions: The

acquisition of shares will be performed through GENIAL INVESTIMENTOS CORRETORA DE VALORES MOBILIÁRIOS S.A. (ex-Brasil Plural

CCTVM S/A).

|

|

|

(v)

|

Resources to be used: The resources of

the capital and profit reserves, which total R$ 11,510,310,661,26 (eleven billion, five hundred and ten million, three hundred

and ten thousand, six hundred and sixty-one reais and twenty-six centavos), net of funding costs, will be used according to the

Interim Financial Statements as of June 30th, 2020, except for the reserves referred to in Section 7, paragraph 1, of

CVM Instruction No. 567.

|

|

|

(vi)

|

The Minutes of the Board of Directors’

Meeting that approved the Program are available at the Company's Investor Relations website www.tim.com.br/ir, as well as at the

electronic addresses of the Brazilian Securities and Exchange Commission (CVM) and B3, www.cvm.gov.br and www.b3.com.br, where

the information required by Appendix 30-XXXVI of CVM Instruction No. 480 is available.

|

The Company will keep its shareholders

and the market informed about the progress of the Program, in accordance with the applicable regulations.

Rio de Janeiro, July 29th, 2020

TIM Participações S.A.

Adrian Calaza

Chief Financial Officer and

Investor Relations Officer

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date: July 29, 2020

|

By:

|

/s/ Adrian Calaza

|

|

|

|

|

|

|

|

|

|

Name: Adrian Calaza

|

|

|

|

|

Title: Chief Financial Officer and Investor Relations Officer

TIM Participações S.A.

|

|

FORWARD-LOOKING

STATEMENTS

This

press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based

on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial

results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company,

are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation

of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors

or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements

reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the

expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general

economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause

actual results to differ materially from current expectations.

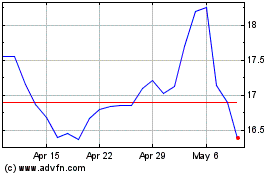

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

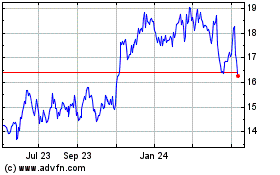

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024