SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2019

Commission File Number 001-14491

TIM PARTICIPAÇÕES S.A.

(Exact name of registrant as specified in its charter)

TIM PARTICIPAÇÕES S.A.

(Translation of Registrant's name into English)

Avenida João Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

TIM PARTICIPAÇÕES S.A.

Publicly-Held Company

CNPJ/MF 02.558.115/0001-21

NIRE 33.300.276.963

MINUTES OF THE BOARD OF DIRECTORS’ MEETING

HELD ON OCTOBER 28TH, 2019

DATE, TIME AND PLACE: October 28th, 2019, at 1.00 p.m., at the head office of TIM Participações S.A. (“Company”), domiciled at Avenida João Cabral de Mello Neto, 850, Torre Norte, 12° floor, room 1212, Barra da Tijuca, in the city and State of Rio de Janeiro.

PRESENCE: The Board of Directors’ Meeting of the Company was held at the date, time and place mentioned above, with the presence of Messrs. Nicandro Durante, Carlo Nardello, Gesner José de Oliveira Filho, Flavia Maria Bittencourt, Herculano Aníbal Alves and Pietro Labriola, either in person or by means of audio or videoconference, as provided in paragraph 2nd, Article 25 of the Company’s By-laws. Justified absence of Messrs. Elisabetta Romano, Agostino Nuzzolo, Piergiorgio Peluso and Raimondo Zizza.

BOARD: Mr. Nicandro Durante - Chairman; and Mr. Jaques Horn – Secretary.

AGENDA: (1) To resolve on the Company’s corporate project.

RESOLUTIONS: Upon the review of the material presented and filed at the Company’s head office, and based on the information provided and discussions of the subjects included on the Agenda, the Board Members, unanimously by those present and with the abstention of the legally restricted, decided to register the discussions as follows:

(1.1) Approved the opening of the capital of the Company’s wholly-owned subsidiary, TIM S.A., and the TIM S.A.’s publicly-held company registration requirement, “A” category, before the Comissão de Valores Mobiliários (“CVM”), without a securities offer, pursuant to CVM instruction nº 480/2009. TIM Participações S.A. will remain as the only listed company on stock exchanges.

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM PARTICIPAÇÕES S.A.

OCTOBER 28TH, 2019

(1.2) As the resolution mentioned above, approved the financial statements specially made for the opening of the Company’s wholly-owned subsidiary capital, TIM S.A., regarding the fiscal year ended on December 31st, 2018, based on the independent Auditors’ favorable assessment, PricewaterhouseCoopers (“PwC”), who have analyzed the regularity of the documents and have stated, in all material aspects, the TIM S.A.’s patrimonial and financial position.

(1.3) Subsequently, acknowledged on the Company’s wholly-owned subsidiary’s, TIM S.A., Quartely Financial Report (“ITR’s”) for the 1st quarter of 2019, dated as of March 31st, 2019 and for the 2nd quarter of 2019, dated as June 30th, 2019 made to compose the registration as a publicly-held company in category “A” before the Securities and Exchange Commission of Brazil (“CVM”), according the information provided by the Company’s Administration and Independent Auditors, PricewaterhouseCooper (“PwC”). The referred report was subject to limited review by the Independent Auditors.

(1.4) In view of the resolution mentioned above, approved the amendment and consolidation of the Company’s wholly-owned subsidiary By-Laws, TIM S.A., after the Company’s competent corporate body resolution, due to this minute’s resolutions, including the adjustment to the minimum requirements by the Comissão de Valores Mobiliários (“CVM”).

(1.5) In the view of the necessary amendment mentioned above, appointed, according to the Article 22, item XXIV of the Company’s By-laws, Mr. Carlo Nardello, Mr. Pietro Labriola and Mr. Raimondo Zizza to be designated as members of Board of Directors, as well as Mr. Adrian Calaza to be designated as Diretor de Relações com Investidores (Investors Relations Officer) which shall be created and the members herein appointed shall be elected by the Company’s wholly-owned subsidiary, TIM S.A., competent corporate body.

(1.6) In view of the above mentioned resolution, approved the amendment of the designation of the position held by Mr. Leonardo de Carvalho Capdeville, renamed to Chief Technology Information Officer, and the designation of the position held by Mr. Adrian Calaza, renamed to Diretor Financeiro (Chief Financial Officer), as well as suggested the amendment herein approved to the Company’s

wholly-owned subsidiary, TIM S.A., which shall be implemented after its competent corporate body resolution. In view thereof, the new composition of the Board of Officers of the Company and of the Company’s wholly-owned subsidiary, TIM S.A., shall be comprised of the following positions: Diretor Presidente (Chief Executive Officer), Diretor Financeiro (Chief Financial Officer), Diretor de Relações com Investidores (Investor Relations Officer), Business Support Officer, Regulatory and Institutional Affairs Officer, Diretor Jurídico (Legal Officer), Chief Technology Information Officer and Chief Revenue Officer.

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM PARTICIPAÇÕES S.A.

OCTOBER 28TH, 2019

(1.7) In view of the above resolution, the Board of Officers of the Company shall, from now on, be composed by the following Officers herein identified: (i) Pietro Labriola, Diretor Presidente (Chief Executive Officer); (ii) Adrian Calaza, Diretor Financeiro (Chief Financial Officer) and Diretor de Relações com Investidores (Investor Relations Officer); (iii) Bruno Mutzenbecher Gentil, Business Support Officer; (iv) Mario Girasole, Regulatory and Institutional Affairs Officer; (v) Jaques Horn, Diretor Jurídico (Legal Officer); (vi) Leonardo de Carvalho Capdeville, Chief Technology Information Officer; and (vii) Alberto Mario Griselli, Chief Revenue Officer. The Board of Officers will remain in office until the first Board of Directors’ meeting to be held after the Annual Shareholders’ Meeting of the year 2020.

(1.8) On this occasion, the Board Members ratified the limits of authority of the Company’s Officers, as follows: (i) Diretor Presidente (Chief Executive Officer): full power to, acting individually, carry out, sign and represent the Company in any and all acts, documents or before any public authority up to the amount of R$30,000,000.00 (thirty million Reais) per operation or series of operations related; (ii) Diretor Financeiro (Chief Financial Officer): full power to, acting individually, carry out, sign and represent the Company in relation to activities of the financial area, including without limitation, financial and treasury operations contracts, guarantee agreements in general, including borrowing and lending, assignment and discount of securities, up to the amount of R$30,000,000.00 (thirty million Reais) per operation or series of operations related, and to carry out the other acts and sign any all documents on behalf of the Company, within its area of activities, up to the amount of R$5,000,000.00 (five million Reais) per operation or series of operations related; and (iii) the other Officers of the Company, namely Diretor de Relações com Investidores (Investor Relations Officer); Business Support Officer; Regulatory and Institutional Affairs Officer; Diretor Jurídico (Legal Officer),

Chief Technology Information Officer and Chief Revenue Officer, full power and the authority to, acting individually, carry out, sign and represent the Company in any and all acts, documents or before any public authority, within their respective areas of activity, up to the maximum amount of R$5,000,000.00 (five million Reais) per operation or series of operations related. The financial limits approved herein must be observed solely and exclusively for the implementation of the transaction and/or for the execution of legal transaction that results in the assumption of obligations and/or in the waiver of rights by the Company. In this sense, such limits will not be applied in the following situations, among others: (i) in the execution of agreements for the sale of goods and services that represent revenues; (ii) in the practice of acts of simple administrative routines before legal entities of internal public law, public companies or companies that make up the indirect administration, and others of the same nature; and (iii) in the execution of acts of the Company’s financial operational routine, such as the authorization and/or payment of taxes or any obligations, transfers of funds between accounts of the same ownership, applications and redemptions of financial resources of the Company, opening or closing of current accounts, and request and cancellation of access to any systems made available by financial institutions in general. Finally, all Officers may perform any acts and sign any and all documents, on behalf of the Company, that have been previously approved by the competent corporate bodies, regardless of the financial limits established herein.

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM PARTICIPAÇÕES S.A.

OCTOBER 28TH, 2019

(1.9) Finally, authorized the members of the Board of Officers and/or the attorneys-in-fact of the Company and of TIM S.A., the latter upon approval by its competent corporate body, to carry out any and all actions and to execute any and all instruments, contracts, letters, notifications and any other documents related that may be necessary and/or convenient, at any time, for the constitution, validity, effectiveness, formalization, consumption, exercise and ratification of the above resolutions, including, to participate and vote in any TIM S.A.’s General Shareholders Meeting, held aiming the approval of the resolutions mentioned in these minutes.

CLOSING: With no further issues to discuss, the meeting was adjourned and these minutes drafted as summary, read, approved and signed by all attendees Board Members: Nicandro Durante, Carlo Nardello, Flavia Maria Bittencourt, Gesner José de Oliveira Filho, Herculano Aníbal Alves and Pietro Labriola.

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM PARTICIPAÇÕES S.A.

OCTOBER 28TH, 2019

I herein certify that these minutes are the faithful copy of the original version duly recorded in the respective corporate book.

Rio de Janeiro (RJ), October, 28th, 2019.

JAQUES HORN

Secretary

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date: October 28, 2019

|

By:

|

/s/ Adrian Calaza

|

|

|

|

|

|

|

|

|

|

Name: Adrian Calaza

|

|

|

|

|

Title: Chief Financial Officer and Investor Relations Officer

TIM Participações S.A.

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

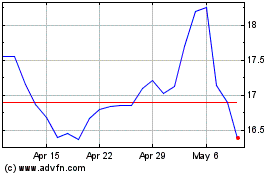

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

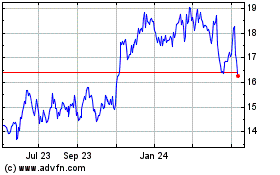

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024