Current Report Filing (8-k)

August 13 2019 - 6:04AM

Edgar (US Regulatory)

TENET HEALTHCARE CORP 2019-08-12 false 0000070318 0000070318 2019-08-12 2019-08-12 0000070318 us-gaap:CommonStockMember 2019-08-12 2019-08-12 0000070318 us-gaap:SeniorNotesMember 2019-08-12 2019-08-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report:

August 12, 2019

(Date of earliest event reported)

TENET HEALTHCARE CORPORATION

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Nevada

|

|

1-7293

|

|

95-2557091

|

|

(State or other jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

1445 Ross Avenue, Suite 1400

Dallas, Texas 75202

(Address of principal executive offices, including zip code)

(469)

893-2200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol

|

|

Name of each exchange

on which registered

|

|

Common stock $0.05 par value

|

|

THC

|

|

New York Stock Exchange

|

|

6.875% Senior Notes due 2031

|

|

THC31

|

|

New York Stock Exchange

|

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934 (§

240.12b-2

of this chapter).

Emerging Growth Company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

Item 7.01

|

Regulation FD Disclosure

|

On August 12, 2019, Tenet Healthcare Corporation (the “Company”) issued a press release announcing the pricing of the previously announced private placement offering of $4.2 billion in aggregate principal amount of newly issued notes (the “Notes Offering”), which consists of $600 million in aggregate principal amount of senior secured first lien notes due September 1, 2024, $2.1 billion in aggregate principal amount of senior secured first lien notes due January 1, 2026, and $1.5 billion in aggregate principal amount of senior secured first lien notes due November 1, 2027, of the Company. A copy of the press release is attached to this report as Exhibit 99.1 and incorporated herein by reference.

The Company intends to use the net proceeds from the Notes Offering, after payment of fees and expenses, together with cash on hand and/or any borrowings under its senior secured revolving credit facility, to fund the redemption and discharge of (i) $500 million aggregate principal amount of the Company’s outstanding 4.750% Senior Secured Notes due 2020; (ii) $1,800 million aggregate principal amount of the Company’s outstanding 6.000% Senior Secured Notes due 2020; (iii) $850 million aggregate principal amount of the Company’s outstanding 4.500% Senior Secured Notes due 2021; and (iv) $1,050 million outstanding aggregate principal amount of the Company’s 4.375% Senior Secured Notes due 2021 (together with the Notes Offering, the “Refinancing”).

Upon completion of the Refinancing, the Company will not have any senior notes maturing until April 1, 2022, but will have approximately $3.8 billion of senior notes that may be redeemed, at the Company’s option, over the following year. Total transaction costs for the Refinancing, including make-whole premiums on the $4.2 billion of notes to be redeemed, are expected to be approximately $200 million and will be funded by cash on hand and/or borrowings under the Company’s senior secured revolving credit facility. During the three months ending September 30, 2019, the Company expects to record a loss on the early extinguishment of debt of approximately $175 million, primarily related to the difference between the redemption prices and the par values of the notes redeemed pursuant to the Refinancing, as well as the

write-off

of the associated unamortized issuance costs. The annualized cash interest payments associated with the newly issued notes in the Notes Offering are expected to be approximately $9 million lower than the annualized cash interest payments associated with the outstanding notes being redeemed in the Refinancing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

TENET HEALTHCARE CORPORATION

|

|

|

|

|

|

|

|

|

|

Date: August 12, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Anthony Shoemaker

|

|

|

|

|

|

Name:

|

|

Anthony Shoemaker

|

|

|

|

|

|

Title:

|

|

Vice President, Assistant General Counsel and Corporate Secretary

|

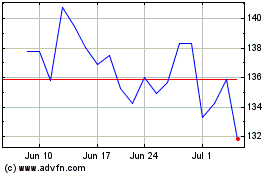

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Mar 2024 to Apr 2024

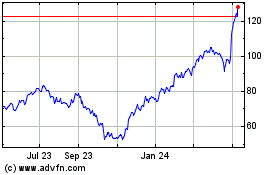

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Apr 2023 to Apr 2024