Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

March 26 2021 - 6:04AM

Edgar (US Regulatory)

Filed

Pursuant to Rule 433 under the Securities Act of 1933

Issuer

Free Writing Prospectus dated March 25, 2021

Registration

Statement No. 333-238061

A

registration statement on Form F-10 containing important information relating to the Common Shares (as defined below) described in this

document has been filed with the Securities and Exchange Commission (the “SEC”). A final base shelf prospectus dated May

13, 2020 containing important information relating to the Common Shares has been filed with the securities regulatory authorities in

each of the provinces of Canada. A preliminary prospectus supplement will be filed with the securities regulatory authorities in each

of the provinces of Canada and the SEC. A copy of the final short form base shelf prospectus, any amendment to the short form base shelf

prospectus and any applicable shelf prospectus supplement that has been filed, is required to be delivered with this document. You may

get these documents for free by visiting SEDAR at www.sedar.com and at EDGAR at www.sec.gov.

You

may also obtain copies of the final base shelf prospectus and the prospectus supplement in the United States from: RBC Capital Markets,

LLC, 200 Vesey Street, 8th Floor, New York, NY 10281-8098, Attention: Equity Syndicate, phone: 877-822-4089, Email: equityprospectus@rbccm.com

or from CIBC Capital Markets, 161 Bay Street, 5th Floor, Toronto, ON M5J 2S8 by telephone at 1-416-956-6378 or by email at

Mailbox.USProspectus@cibc.com, or in Canada from: RBC Dominion Securities Inc., 180 Wellington Street West, 8th Floor, Toronto, ON M5J

0C2, Attention: Distribution Centre, or via telephone: 1-416-842-5349, or via email at Distribution.RBCDS@rbccm.com, or from CIBC Capital

Markets, 161 Bay Street, 5th Floor, Toronto, ON M5J 2S8 by telephone at 1-416-956-6378 or by email at Mailbox.CanadianProspectus@cibc.com.

This document does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final

base shelf prospectus, any amendment and any applicable shelf prospectus supplement TELUS has filed with the securities regulatory authorities

in each of the provinces of Canada and the SEC for disclosure of those facts, especially risk factors relating to the securities offered,

before making an investment decision.

The

information in this communication supersedes the information in the preliminary prospectus supplement to the extent it updates such information.

March 25, 2021

Term Sheet

|

Issuer:

|

TELUS Corporation (“TELUS” or the “Company”)

|

|

|

|

|

Offering:

|

Treasury offering of 51,300,000 common shares of TELUS (“Common Shares”), before giving effect to the over-allotment option.

|

|

|

|

|

Offering Price:

|

C$25.35 per Common Share.

|

|

|

|

|

Offering Size:

|

C$1,300,455,000 (C$1,495,523,250 to the extent the over-allotment option is exercised in full).

|

|

|

|

|

Over-Allotment Option:

|

The Company has granted the Underwriters an option, exercisable at the Offering Price at any time until 30 days following the closing of the Offering, to purchase up to an additional 15% of the Offering to cover over-allotments, if any and for market stabilization purposes.

|

|

|

|

|

Use of Proceeds:

|

TELUS intends to use the net proceeds from this Offering to further strengthen the Company’s balance sheet and, principally, to capitalize on a unique strategic opportunity to accelerate its broadband capital investment program, including the substantial advancement of the build-out of TELUS PureFibre infrastructure in Alberta, British Columbia and Eastern Quebec, as well as an accelerated roll-out of the Company’s national 5G network.

|

|

|

|

|

Dividends:

|

The Company currently pays a quarterly dividend of C$0.3112 per Common Share. On February 10, 2021, the board of directors of the Company declared a dividend of C$0.3112 per Common Share, which will be paid on April 1, 2021 to holders of record on March 11, 2021.

|

|

|

|

|

Form of Offering:

|

Bought deal by way of a prospectus supplement to the Company’s short form base shelf prospectus dated May 13, 2020 to be filed in all provinces of Canada and in the United States pursuant to the multi-jurisdictional disclosure system.

|

|

|

|

|

Listing:

|

The Common Shares are listed on the TSX under the symbol “T” and the NYSE under the symbol “TU”.

|

|

|

|

|

Eligibility:

|

The Common Shares will be eligible for Canadian RRSPs, RRIFs, RESPs, TFSAs, RDSPs and DPSPs.

|

|

|

|

|

Joint Bookrunners:

|

RBC Capital Markets, CIBC Capital Markets, BMO Capital Markets, Scotiabank, TD Securities Inc.

|

|

|

|

|

Commission:

|

3.50%, payable on the Closing Date.

|

|

|

|

|

Closing Date:

|

Expected to be on or about March 31, 2021.

|

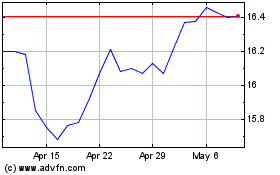

Telus (NYSE:TU)

Historical Stock Chart

From Mar 2024 to Apr 2024

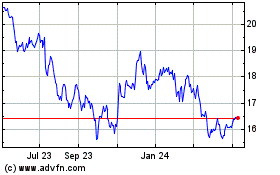

Telus (NYSE:TU)

Historical Stock Chart

From Apr 2023 to Apr 2024