0001094285false00010942852024-01-232024-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 23, 2024

Teledyne Technologies Incorporated

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-15295 | | 25-1843385 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | 1049 Camino Dos Rios Thousand Oaks, California | | 91360-2362 |

| | (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (805) 373-4545

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. 13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name on each exchange on which registered |

| Common Stock, par value $.01 per share | TDY | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers

(e) At its meeting on January 23, 2024, the Personnel and Compensation Committee (the "Committee") of the Board of Directors of Teledyne Technologies Incorporated ("Teledyne") took the following actions, which actions were ratified by Teledyne's Board of Directors:

(1) The Committee authorized payment of Annual Incentive Plan (“AIP”) cash bonus awards with respect to the 2023 fiscal year under the Amended and Restated Teledyne Technologies Incorporated 2014 Incentive Award Plan (the “Plan”) to each of the Named Executive Officers set forth below identified in Teledyne’s 2023 Proxy Statement.

The following table sets forth the AIP cash bonus payments for the 2023 fiscal year to the following Named Executive Officers identified in Teledyne’s 2023 Proxy Statement:

| | | | | | | | | | | | | | | | | |

| Name | | Current Position | | 2023 AIP Award | |

| Robert Mehrabian | | Executive Chairman | | $1,352,500 | | | |

| Susan L. Main | | Former Senior Vice President and Chief Financial Officer | | $362,000 | | | |

| Edwin Roks | | Chief Executive Officer | | $335,700 | | | |

| George C. Bobb III | | President and Chief Operating Officer | | $429,100 | | | |

| Jason VanWees | | Vice Chairman | | $365,300 | | | |

(2) The Committee authorized payment of awards under the cash Performance Plan for the 2021-2023 Performance Period. The Committee determined that the applicable performance goals were achieved at 118.9% of target.

The following table sets forth the Performance Plan award payments for the 2021-2023 performance period to the following Named Executive Officers identified in Teledyne’s 2023 Proxy Statement:

| | | | | | | | | | | | | | | | | |

| Name | | Current Position | | Performance Plan Award Payments 2021-2023 Performance Period | |

| Robert Mehrabian | | Executive Chairman | | $1,823,896 | | | |

| Susan L. Main | | Former Senior Vice President and Chief Financial Officer | | $271,415 | | | |

| Edwin Roks | | Chief Executive Officer | | $357,336 | | | |

| George C. Bobb III | | President and Chief Operating Officer | | $237,894 | | | |

| Jason VanWees | | Vice Chairman | | $269,455 | | | |

(3) The Committee approved the 2024 goals for the AIP cash bonus awards to each of Teledyne’s Named Executive Officers currently employed by Teledyne under the Plan. AIP award opportunities are expressed as a percentage of a participant’s base salary and are based on the achievement of pre-defined performance measures, with up to 200% of the target award eligible to be paid in the case of significant over-achievement. The majority of the award is based on Teledyne’s achievement of certain financial performance goals, with a smaller portion tied to the achievement of pre-established individual goals. Generally, 40% of the awards are tied to the achievement of predetermined levels of operating profit, 25% to the achievement of predetermined levels of revenue, 15% to the achievement of predetermined levels of managed working capital as a percentage of revenue and 20% to the achievement of specified individual performance objectives. In addition, per the Committee's policy, downward (but not upward) discretionary adjustments are allowed with respect to awards to Named Executive Officers identified in the proxy statement filed in the award year. AIP awards are generally paid from a pool not to exceed 11% of operating profit, subject to modification by the Committee. No AIP bonus will be earned in any year unless operating profit is positive, after accruing for bonus payments, and operating profit is at least 75% of the operating plan, subject in each case to modification by the Committee.

For 2024, subject to the performance measures and discretion of the Committee, as noted above, the following Named Executive Officers identified in Teledyne’s 2023 Proxy Statement are eligible for a target AIP cash bonus based on the following percentage of their annual base salary:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Current Position | | 2024 AIP Award

Eligibility as a Percentage of Base Salary |

| Robert Mehrabian | | Executive Chairman | | 150 | % |

| Edwin Roks | | Chief Executive Officer | | | 120 | % |

| George C. Bobb III | | President and Chief Operating Officer | | 100 | % |

| Jason VanWees | | Vice Chairman | | | 100 | % |

(4) The Committee established a Performance-Based Restricted Stock Unit Award Program under the Plan for key employees, including the Named Executive Officers currently employed by Teledyne. This program provides grants of restricted stock units, generally each calendar year, to key employees at an aggregate fair market value equal to a specified percentage of each recipient’s annual base salary as of the date of the grant, unless otherwise determined by the Committee. The restrictions are subject to both a time-based and performance-based component. In general, the restricted period for each grant of restricted stock extends from the date of the grant to the third anniversary of such date, with the restrictions lapsing on the third anniversary. However, unless the Committee determines otherwise, if Teledyne fails to meet certain minimum performance goals for a multi-year performance cycle (typically three years) established by the Committee as applicable to a restricted stock unit award, then all of the restricted stock units are forfeited. If Teledyne achieves the minimum established performance goals, but fails to attain an aggregate level of 100% of the targeted performance goals, then a portion of the restricted stock would be forfeited. The performance goal for the 2024-2026 restricted stock award is the total shareholder return of Teledyne’s common stock as compared to the S&P 500 Index. In order for a participant to retain the restricted stock units, Teledyne’s three-year aggregate total shareholder return (as measured by Teledyne’s stock price) must be at the 25th percentile of the three-year aggregate total shareholder return of the companies comprising the S&P 500 Index at the beginning of the performance period. If Teledyne’s total shareholder return is less than the 25th percentile of the companies comprising the S&P 500 Index , all restricted stock units would be forfeited; if it equals the 25% percentile, 50% of the restricted stock units will be forfeited; if it ranges from the 25th percentile to the 50th percentile, a portion of the restricted stock units will be forfeited; and if it is greater than the 50th percentile, no restricted stock units are forfeited but the participant does not receive additional shares. The calculation of total shareholder return assumes that all dividends are reinvested.

For the 2024-2026 Restricted Stock Unit Award, the percentage of base salary used to determine the amount of the grant for the following Named Executive Officers identified in Teledyne’s 2023 Proxy Statement is set forth below:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Current Position | | 2024 Restricted Stock Award

as a Percentage of Base Salary |

| Robert Mehrabian | | Executive Chairman | | 100 | % |

| Edwin Roks | | Chief Executive Officer | | | 120 | % |

| George C. Bobb III | | President and Chief Operating Officer | | | 100 | % |

| Jason VanWees | | Vice Chairman | | 100 | % |

A copy of the form of the Performance-Based Restricted Stock Unit Award Agreement is attached hereto as Exhibit 10.1 and incorporated herein by reference.

(5) The Committee established under the Plan a three-year cycle of Teledyne’s Performance Plan for key employees, including the Named Executive Officers.

Performance Plan awards are intended to reward executives to the extent Teledyne achieves specific pre-established financial performance goals and provides a greater long-term return to shareholders relative to a broader market index. The 2024-2026 performance plan awards are based on the following goals: 40% of the award is based on the achievement of specified levels of operating profit, 30% on the achievement

of specified levels of revenue and 30% on the achievement of specified levels of total shareholder return. No awards are made if the three-year aggregate operating profit is less than 75% of target, unless the Committee determines otherwise. For the operating profit and revenue components, a maximum of 200% can be earned if 120% of the target is achieved. For the total shareholder return component, a maximum of 200% can be earned if Teledyne's aggregate total shareholder return is at or above the 75th percentile compared to the companies in the benchmark index. For the 2024-2026 performance cycle, the S&P 500 Index is the benchmark for the total shareholder return component.

Awards are paid in cash to the participants as soon as practicable after the end of the performance cycle.

For the 2024-2026 performance cycle, the following Named Executive Officers identified in Teledyne’s 2023 Proxy Statement are eligible for a target award based on the following percentage of their annual base salary:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Current Position | | 2024-2026 Performance Plan Award Eligibility as a Percentage of Base Salary |

| Robert Mehrabian | | Executive Chairman | | 100 | % |

| Edwin Roks | | Chief Executive Officer | | | 120 | % |

| George C. Bobb III | | President and Chief Operating Officer | | | 100 | % |

| Jason VanWees | | Vice Chairman | | 100 | % |

A copy of the form of the Summary Plan Description for the Performance Plan is attached hereto as Exhibit 10.2 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

|

| | |

| Exhibit 10.1 | | |

| Exhibit 10.2 | | |

| | |

| | |

| Exhibit 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

† Denotes management contract or compensatory plan or arrangement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

|

| | | | |

| | | | | TELEDYNE TECHNOLOGIES INCORPORATED |

| | | |

| | | By: | | /s/ Melanie S. Cibik |

| | | | | Melanie S. Cibik |

| | | | | Executive Vice President, General Counsel, Chief Compliance Officer and Secretary |

| | | | Dated: January 25, 2024 |

EXHIBIT INDEX

Description

| | | | | | | | |

|

| | |

| Exhibit 10.1 | | |

| Exhibit 10.2 | | |

| | |

| | |

| Exhibit 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

† Denotes management contract or compensatory plan or arrangement

| | |

Participant Name (“Executive”): #ParticipantName# Performance-Based Restricted Stock Units Awarded: #QuantityGranted# Date of Grant: January 23, 2024 |

Grant Name: [insert performance period dates] Performance-Based Restricted Stock Unit Award |

|

|

GLOBAL PERFORMANCE-BASED RESTRICTED STOCK UNIT AGREEMENT

[Insert Date of Grant]

The parties to this Global Performance-Based Restricted Stock Unit Agreement, including any additional terms and conditions for the jurisdictions in the appendix hereto (the “Appendix” and collectively with this Global Performance-Based Restricted Stock Unit Agreement, the “Agreement”) are Teledyne Technologies Incorporated, a Delaware corporation (the “Company”) and the Executive named at the top of the Agreement (the “Executive”). Capitalized terms used but not defined in this Agreement shall have the meanings ascribed to them in the Amended and Restated Teledyne Technologies Incorporated 2014 Incentive Award Plan (the “Plan”).

WITNESSETH:

WHEREAS, the Company has adopted the Plan, which is administered by the Personnel and Compensation Committee (the “Committee”) of the Board of Directors of the Company;

WHEREAS, the Executive is employed by the Company or a Subsidiary (the "Employer"); and

WHEREAS, pursuant to Article 9 of the Plan, the Committee has determined to grant to the Executive an Award of Restricted Stock Units as provided herein (the “Award”) to encourage the Executive’s efforts toward the continuing long-term success of the Employer, the Company and its Subsidiaries;

NOW, THEREFORE, the parties, by their electronic acceptance or authentication in a form authorized by the Company, intending to be legally bound, agree as follows:

1. RESTRICTED STOCK UNITS

1.1 Grant of Restricted Stock Units.

(a) Effective as of the Date of Grant set forth at the top of this Agreement, the Company hereby grants to the Executive, an Award of Restricted Stock Units in an amount as set forth at the top of this Agreement. The Restricted Stock Units granted pursuant to the Award shall be subject to the Executive providing evidence of the Executive’s acceptance of this Agreement (or the Executive’s estate, if applicable) to the Company. Subject to Section 1.4 of this Agreement, each Restricted Stock Unit represents the right to receive one (1) share of Common Stock at the time and in the manner set forth in Section 1.5 hereof.

(b) This Agreement shall be construed in accordance and consistent with, and is subject to, the provisions of the Plan (the provisions of which are hereby incorporated by

reference), as well as any and all determinations, policies, instructions, interpretations, rules, etc., of the Committee in connection with the Plan, including the Administrative Rules adopted with respect to the restricted stock and restricted stock unit program (the “Rules”). The Company reserves the right to amend the Plan and any Rules at any time in its sole discretion, subject to the approval of the Committee. The Executive hereby acknowledges receipt of a copy of the Plan and agrees to be bound by all the terms and provisions thereof. The Restricted Stock Units will be subject to the terms and conditions of this Agreement and the Plan, whether or not such provisions are agreed to in writing or acknowledged electronically by the Executive or the Company. Notwithstanding anything herein to the contrary, Executive will be deemed to accept such terms unless the Executive affirmatively rejects the grant of Restricted Stock Units, in which case the Award will be cancelled.

1.2 Restrictions.

The Restricted Stock Units granted pursuant to this Agreement may not be sold, transferred or otherwise disposed of and may not be pledged or otherwise hypothecated except as specifically provided hereunder or pursuant to the Plan. Any attempt to dispose of Restricted Stock Units or any interest therein in a manner contrary to the restrictions set forth in this Agreement or the Plan shall be null, void and ineffective.

1.3 Vesting.

(a) Except as otherwise provided in this Agreement, 100% of the Restricted Stock Units granted pursuant to the Award shall vest on [insert vesting date].

(b) Notwithstanding Section 1.3(a) above, vesting shall be subject to the performance criteria as set forth on Annex A.

(c) Notwithstanding Section 1.3(a) or (b) above, if during the applicable Performance Cycle, (i) the Executive’s employment with the Employer terminates for any reason, whether the Executive’s employment is terminated by the Executive or the Employer, with or without just cause, except as otherwise provided in Paragraph 1.3(d), (ii) there occurs a material breach of this Agreement by the Executive or (iii) the Executive fails to meet the tax withholding obligations described in Paragraph 1.6, none of the unvested Restricted Stock Units granted under this Agreement shall vest. For clarity, for purposes of this Agreement, the date of such termination or cessation of the Executive’s employment with the Employer will be determined in accordance with Section 10(k) hereof.

(d) If, during the applicable Performance Cycle, the Executive’s employment with the Employer terminates due to the Executive’s death, disability (as determined in the sole discretion of the Committee) or retirement pursuant to the applicable retirement policy (if any) of the Employer or the Company (as applicable) prior to the expiration of the Performance Cycle, the Executive (or the Executive’s beneficiaries) shall continue to hold the Restricted Stock Units through the expiration of the Performance Cycle. At that time, a portion of the Restricted Stock Units shall vest equal to (i) the number of Restricted Stock Units that would have otherwise vested under Section 1.3 had the Executive remained employed by the Employer through the end of the Performance Cycle multiplied by (ii) a fraction, the numerator of which is the number of full months during which the Executive was employed by the Employer from the beginning of the Performance Cycle until the date of the Executive’s termination of employment and the denominator of which is the total number of months in the Performance Cycle (any fractional share of Common Stock resulting from this calculation shall be rounded up to the next whole share).

(e) For purposes of this Section 1.3 only, “Employer” shall mean, in addition to the Company or Subsidiary which employs Executive on the date hereof, the Company and any Subsidiary.

1.4 Forfeiture of Award

Except as otherwise provided in this Agreement, any and all Restricted Stock Units that do not vest in accordance with Section 1.3 shall be forfeited and shall revert to the Company.

1.5 Satisfaction of Award

(a) In order to satisfy Restricted Stock Units upon the vesting of any portion of the Award pursuant to this Agreement, the Company shall deliver to the Executive the number of shares of Common Stock to which the Executive is entitled pursuant to this Agreement, subject to any applicable withholding of Tax-Related Items.

(b) The aggregate number of shares of Common Stock issued by the Company at any particular time pursuant to this Agreement shall correspond to the number of Restricted Stock Units that become vested on the vesting date, with one (1) Restricted Stock Unit corresponding to one (1) share of Common Stock, subject to any withholding of Tax-Related Items as may be required under this Agreement, notwithstanding any delay between the vesting date and the settlement date. Fractional shares of Common Stock will not be issued and will be rounded up to the nearest whole share of Common Stock. The number and kind of shares to be issued pursuant to this Agreement shall be appropriately adjusted to prevent dilution or enlargement of rights by reason of any stock dividend, stock split, combination or exchange of shares, recapitalization, merger, consolidation or other change in capitalization with a similar substantive effect upon each Restricted Stock Unit or the shares issuable in satisfaction of each Restricted Stock Unit. Until such time as shares of Common Stock are issued in satisfaction of a Restricted Stock Unit, as provided hereunder, the Executive shall not be deemed for any purpose to be a stockholder of the Company in respect of any shares as to which the Restricted Stock Unit relates.

(c) The Company will satisfy its obligations to deliver Common Stock under this Agreement on the applicable vesting date hereunder or as soon as administratively practicable but no later than thirty (30) days after such vesting date. Notwithstanding the foregoing, with respect to Restricted Stock Units that become vested (other than as a result of the Executive’s death), if the Executive is a “specified employee” within the meaning of Section 409A of the Code as of the date upon which the Executive’s employment with the Employer terminates and settlement of such Restricted Stock Units is required to be delayed pursuant to Section 409A(a)(2)(B)(i) of the Code, then the Company shall satisfy its obligations to deliver Common Stock under this Agreement by the later of (i) the date otherwise required by this Agreement or (ii) the first business day of the calendar month following the date which is six (6) months after the date upon which the Executive incurs a ”separation from service” within the meaning of Section 409A of the Code.

1.6 Withholding/Responsibility for Taxes.

(a)Regardless of any action taken by the Company or the Employer, the ultimate liability for all income tax (including, without limitation, foreign, federal, state and local taxes), social insurance, payroll tax, fringe benefits tax, payment on account or any other tax-related items related to the Executive’s participation in the Plan and legally applicable to him or her (“Tax-Related Items”) is and remains Executive’s responsibility and may exceed the amount, if any, actually withheld by the Company and/or the Employer. The Executive further

acknowledges that the Company and/or the Employer (i) make no representations or undertakings regarding the treatment of any Tax-Related Items in connection with any aspect of the Restricted Stock Units, including, without limitation, the grant of the Restricted Stock Units, the vesting of the Restricted Stock Units, the conversion of the Restricted Stock Units into shares of Common Stock or the receipt of a cash payment, the subsequent sale of any shares of Common Stock acquired at vesting and the receipt of any dividends or dividend equivalents; and (ii) do not commit to structure the terms of the grant or any aspect of the Restricted Stock Units to reduce or eliminate the Executive’s liability for the Tax-Related Items or achieve any particular tax result. Further, if the Executive is subject to Tax-Related Items in more than one jurisdiction, the Executive acknowledges that the Company and/or the Employer (or former employer, as applicable) may be required to withhold or account for Tax-Related Items in more than one jurisdiction.

(b)In connection with any relevant taxable or tax withholding event, as applicable, the Executive agrees to make adequate arrangements satisfactory to the Company and/or the Employer to satisfy any withholding obligations the Company or the Employer may have for Tax-Related Items. To satisfy any withholding obligations of the Company and/or the Employer with respect to Tax-Related Items, the Company or the Employer will generally withhold whole shares of Common Stock which would otherwise be delivered to the Executive having an aggregate Fair Market Value sufficient to cover the withholding obligation for Tax Related Items. Alternatively, or in addition, the Executive authorizes the Company and/or the Employer, as applicable, and their respective agents, at their discretion, to satisfy any withholding obligation for Tax-Related Items by one or a combination of the following:

(i)withholding from the Executive’s wages or other cash compensation payable to the Executive by the Company and/or the Employer, including from any equivalent cash payment received upon vesting of the Restricted Stock Units;

(ii)withholding from proceeds of the sale of shares of Common Stock acquired upon vesting, either through a voluntary sale or a mandatory sale arranged by the Company on the Executive’s behalf and without further consent;

(iii)requiring the Executive to tender a cash payment to the Company or the Employer; or

(iv)any other method acceptable to the Company and permitted under the Plan and applicable law;

provided, however, that if the Executive is subject to Section 16 of the Exchange Act, the Company will withhold shares of Common Stock which would otherwise be delivered to the Executive as provided above in this Section 1.6(b), unless otherwise determined by the Board or the Committee.

(a)The Company may withhold or account for Tax-Related Items by considering statutory or other withholding rates, including minimum or maximum rates applicable in the Executive’s jurisdiction(s). In the event of over-withholding, the Executive may receive a refund of any over-withheld amount in cash (with no entitlement to the equivalent in shares of Common Stock), or if not refunded, the Executive may seek a refund from the local tax authorities. In the event of under-withholding, the Executive may be required to pay any additional Tax-Related Items directly to the applicable tax authority or to the Company and/or the Employer. If the obligation for Tax-Related Items is satisfied by withholding in shares of Common Stock, for tax purposes, the Executive will be deemed to have been issued the full number of shares of Common Stock subject to the vested Award, notwithstanding that a number of the shares of Common Stock is held back solely for the purpose of paying the Tax-Related Items.

The Company may refuse to deliver the shares of Common Stock or the proceeds of the sale of shares of Common Stock to the Executive if the Executive fails to comply with Executive’s obligations for Tax-Related Items.

1.7 Change in Control. Notwithstanding any provision of this Agreement to the contrary, in the event of a Change in Control of the Company during the Performance Cycle, all of the Restricted Stock Units (not otherwise forfeited prior to the Change in Control) shall immediately vest.

1.8 Committee’s Discretion. Notwithstanding any provision of this Agreement to the contrary, the Committee shall have discretion to adjust the Performance Cycle or waive any restrictions or conditions with respect to all or a portion of the Restricted Stock Units at any time.

1.9 Defined Terms. Except as expressly elsewhere in this Agreement, for purposes of this Agreement, the capitalized terms set forth below shall have the following meanings:

(a) “Fair Market Value” means, on any date, the closing sales price of a share of Common Stock, as reported on the Composite Tape for the New York Stock Exchange Listed Companies on such date or, if there were no sales on such date, on the last date preceding such date on which a sale was reported.

(b) “Performance Cycle” shall specifically refer to the period commencing [insert start date] through [insert end date], including any adjustments to such Cycle made by the Committee.

2. REPRESENTATION OF THE EXECUTIVE

The Executive hereby represents to the Employer and the Company that the Executive has read and fully understands the provisions of this Agreement and the Plan and his or her decision to receive the Award is completely voluntary.

3. NOTICES

All notices or communications under this Agreement shall be in writing, addressed as follows:

To the Company:

Teledyne Technologies Incorporated

1049 Camino Dos Rios

Thousand Oaks, CA 91360

Attention: Executive Vice President, General Counsel, Chief Compliance Officer

and Secretary

To the Executive: at the address on file with the Company, unless the Executive, in writing, provides the Company with a different address.

Any such notice or communication shall be (a) delivered by hand (with written confirmation of receipt) or sent by a nationally recognized overnight delivery service (receipt requested) or (b) be sent certified or registered mail, return receipt requested, postage prepaid, addressed as above (or

to such other address as such party may designate in writing from time to time), and the actual date of receipt shall determine the time at which notice was given.

4. ASSIGNMENT; BINDING AGREEMENT

The Company may assign any of its rights and obligations under this Agreement without the consent of the Executive. This Agreement shall inure to the benefit of and be binding upon any successors and assigns of the Company. This Agreement shall inure to the benefit of the Executive’s legal representatives. All obligations imposed upon the Executive and all rights granted to the Company under this Agreement shall be binding upon the Executive’s heirs, executors, administrators and successors.

5. ENTIRE AGREEMENT

This Agreement represents the entire agreement of the parties with respect to the subject matter hereof. The provisions of the Plan and any Rules, and as they may be amended from time to time, are incorporated in this Agreement in their entirety. In the event of any conflict between the provisions of this Agreement and the Plan or any Rules, the provisions of the Plan or the Rules, as the case may be, shall control. The Agreement may be amended at any time by written agreement of the parties hereto; provided, however, that the Committee shall have the authority to amend this Agreement in any respect that it deems appropriate in its sole discretion.

6. GOVERNING LAW AND VENUE

The Plan and the Agreement hereunder shall be administered, interpreted and enforced under the internal laws of the State of Delaware without regard to conflicts of laws thereof. For purposes of litigating any dispute concerning this Agreement or the Plan, the Executive consents to the jurisdiction of the State of California and agrees that such litigation shall be conducted in the courts of Ventura County, California, or the federal courts for the United States for the Central District of California, and no other courts, where this grant is made and/or to be performed.

7. SEVERABILITY

If, for any reason, any provision of this Agreement is held to be prohibited or invalid, such invalidity shall not affect any other provision of this Agreement not held so invalid, but such provision shall be interpreted to accomplish the objectives of such provision as originally written to the fullest extent permitted by law, and each such other provision shall to the full extent consistent with law continue in full force and effect. If any provision of this Agreement shall be held invalid in part, such invalidity shall in no way affect the rest of such provision not held so invalid, and the rest of such provision, together with all other provisions of this Agreement, shall to the full extent consistent with law continue in full force and effect.

8. NO RIGHT TO CONTINUED EMPLOYMENT OR PARTICIPATION; EFFECT ON OTHER PLANS

This Agreement shall not confer or be deemed to confer upon the Executive employment with any of the Company or any of its Subsidiaries. Further, this Agreement shall not confer upon the Executive any right with respect to continuance of employment with the Employer or continuance of participation under the Plan, nor shall it interfere in any way with the right of the Employer to terminate the Executive’s employment at any time. Income realized by the Executive pursuant to this Agreement shall not be included in the determination of

benefits under any benefit plan of the Employer or the Company in which the Executive may be enrolled or for which the Executive may become eligible unless otherwise specifically determined by resolution of the Board. Participation in the Plan during the Performance Cycle shall not entitle the Executive to participate in the Plan during any other Performance Cycle.

9. EXECUTIVE DATA PRIVACY

(a) Authorization to Release and Transfer Certain Personal Information. The Company is located at 1049 Camino Dos Rios, Thousand Oaks, California, USA and offers eligible individuals the opportunity to participate in the Plan, at the Company’s sole discretion. If the Executive would like to participate in the Plan, the Executive understands that the Executive will need to review the information provided in Section 11.7 of the Plan and this Section 9 of the Agreement and, where applicable, declare consent to the processing and/or transfer of personal data as described therein and herein.

(b) Data Collection and Usage. The Company and its Subsidiaries may collect, process and use the Executive’s personal data, including but not limited to, the Executive’s name, home address and telephone number, date of birth, social security or insurance number or other identification number, salary, nationality, job title(s), any shares of Common Stock held in the Company or any of its Subsidiaries, details of all rights to purchase shares of Common Stock or any other entitlement to shares of Common Stock awarded, canceled, exercised, vested, unvested or outstanding in the Executive’s favor, which the Company receives from the Executive or the Employer, for the purpose of implementing, administering and managing the Plan (the “Data”). The Company’s legal basis for the processing of the Data is the Executive’s consent.

(c) Stock Plan Administration Service Providers. The Company and its Subsidiaries may transfer Data to Fidelity Investments (Fidelity), an independent service provider based in the United States, which assists the Company with the implementation, administration and management of the Plan. In the future, the Company may select a different service provider and share the Data with another company that serves in a similar manner. The Company’s service provider will open an account for the Executive. The Executive will be asked to agree on separate terms and data processing practices with the service provider, which is a condition to the Executive’s ability to participate in the Plan. The Company’s legal basis, where required, for the transfer of the Data is the Executive’s consent.

(d) International Data Transfers. The Company and its service providers are based in the United States. If the Executive is outside of the United States, the Executive should note that his or her country may have enacted data privacy laws that are different from the United States. However, the Company’s legal basis for the transfer of the Data is the Executive’s consent.

(e) Data Retention. The Company will hold and use the Data only as long as is necessary to implement, administer, and manage the Executive’s participation in the Plan.

(f) Voluntariness and Consequences of Consent Denial or Withdrawal. The Executive’s participation in the Plan and the Executive’s grant of consent is purely voluntary. The Executive may refuse or withdraw his or her consent at any time. If the Executive does not consent, or if the Executive withdraws his or her consent, the Executive cannot participate in the Plan. This would not affect the Executive’s salary as an Executive; the Executive would merely forfeit the opportunities associated with the Plan.

(g) Data Subject Rights. The Executive has a number of rights under data privacy laws in the Executive’s country. Depending on where the Executive is based, his or her rights

may include the right to (i) request access or copies of Data the Company processes, (ii) rectification of incorrect Data, (iii) deletion of Data, (iv) restrictions on processing, (v) portability of Data, (vi) lodge complaints with competent authorities in the Executive’s country, and/or (vii) review a list with the names and addresses of any potential recipients of the Data. To receive clarification regarding the Executive’s rights or to exercise the Executive’s rights, the Executive may contact his or her local human resources representative.

(h) The Executive also understands that the Company may rely on a different legal basis for the processing or transfer of Data in the future and/or request the Executive to provide another data privacy consent. If applicable and upon request of the Company, the Executive agrees to provide an executed acknowledgement or data privacy consent form to the Company or the Employer (or any other acknowledgements, agreements or consents) that the Company and/or the Employer may deem necessary to obtain under the data privacy laws in the Executive’s country, either now or in the future. The Executive understands that he or she will not be able to participate in the Plan if the Executive fails to execute any such acknowledgement, agreement or consent requested by the Company and/or the Employer.

Executive hereby consents to the transfer and processing of Data in furtherance of this Agreement.

If the Executive agrees with the data processing practices described in this notice, the Executive will confirm his or her consent by accepting this Award by following and clicking on the acceptance prompts on the Fidelity website.

10. NATURE OF GRANT

In accepting the grant of this Award, Executive acknowledges the following:

(a)the Plan is established voluntarily by the Company, it is discretionary in nature and it may be modified, amended, suspended or terminated by the Company at any time, to the extent permitted by the Plan;

(b)The Award is non-transferrable and non-assignable;

(c)the Award is exceptional, voluntary and occasional and does not create any contractual or other right to receive future awards of Restricted Stock Units, or benefits in lieu of Restricted Stock Units, even if Restricted Stock Units have been awarded in the past;

(d)all decisions with respect to future Restricted Stock Units or other awards, if any, will be at the sole discretion of the Company;

(e)the Executive is voluntarily participating in the Plan;

(f)the Award and the shares of Common Stock subject to the Restricted Stock Units, and the income from and value of same, are not intended to replace any pension rights or compensation;

(g)the Award and the shares of Common Stock subject to the Restricted Stock Units, and the income from and value of same, are not part of normal or expected compensation for purposes of calculating any severance, resignation, termination, redundancy, dismissal, end-of-service payments, bonuses, long-service awards, holiday pay, pension or retirement or welfare benefits or similar mandatory payments;

(h)unless otherwise agreed with the Company, the Restricted Stock Units and the underlying shares of Common Stock, and the income from and value of same, are not granted as consideration for, or in connection with, the service the Executive may provide as a director of a subsidiary of the Company;

(i)the future value of the underlying shares of Common Stock is unknown, indeterminable and cannot be predicted with certainty;

(j)no claim or entitlement to compensation or damages shall arise from forfeiture of the Restricted Stock Units resulting from the termination of the Executive’s employment (for any reason whatsoever whether or not later found to be invalid or in breach of employment laws in the jurisdiction where the Executive is employed or the terms of the Executive’s employment agreement, if any) or enforcement of any applicable recoupment or clawback of such Restricted Stock Units or any shares of Common Stock or other benefits or payments relating to such Restricted Stock Units;

(k)for purposes of participation in the Plan, the Executive’s employment will be considered terminated as of the date the Executive is no longer actively providing services to the Company, the Employer or any other Subsidiary (regardless of the reason for such termination and whether or not later to be found invalid or in breach of employment laws in the jurisdiction where the Executive is employed or the terms of the Executive’s employment agreement, if any), and unless otherwise expressly provided in this Agreement or determined by the Committee, the Executive’s right to participate in the Plan will terminate as of such date and will not be extended by any notice period (e.g., the Executive’s period of service would not include any contractual notice period or any period of “garden leave” or similar period mandated under employment laws in the jurisdiction where the Executive is employed or the terms of the Executive’s employment agreement, if any); the Committee shall have the exclusive discretion to determine when the Executive is no longer actively providing services for purposes of the Plan (including whether the Executive may still be considered to be providing services while on a leave of absence); and

(l)neither the Company, the Employer nor any subsidiary of the Company shall be liable for any foreign exchange rate fluctuation between the Executive’s local currency and the United States Dollar that may affect the value of the Restricted Stock Units or of any amounts due to the Executive pursuant to the settlement of the Restricted Stock Units or the subsequent sale of any shares of Common Stock acquired upon settlement.

11. EFFECTIVE DATE

This Award Agreement shall be deemed to be effective as of the date executed.

12. IMPOSITION OF OTHER REQUIREMENTS

The Company reserves the right to impose other requirements on Executive’s participation in the Plan, on the Award and on any shares of Common Stock acquired under the Plan, to the extent the Company determines it is necessary or advisable in order to comply with any applicable law or facilitate the administration of the Plan. Executive agrees to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing. Furthermore, Executive acknowledges that the laws of the country in which Executive is working at the time of grant, vesting or the sale of shares of Common Stock received pursuant to this Award (including any rules or regulations governing securities, foreign exchange, tax, labor,

or other matters) may subject Executive to additional procedural or regulatory requirements that Executive is and will be solely responsible for and must fulfill.

13. APPENDIX

Notwithstanding any provisions in this Agreement, the Award shall be subject to any different or additional terms and conditions set forth in any appendix to this Agreement (the “Appendix”) for Executive’s country. Moreover, if Executive relocates to one of the countries included in the Appendix, the different or additional terms and conditions for such country will apply to Executive, to the extent the Company determines that the application of such terms and conditions is necessary or advisable in order to comply with local law or facilitate the administration of the Plan. The Appendix constitutes part of this Agreement.

14. INSIDER TRADING / MARKET ABUSE LAWS

Depending on the Executive’s country or the country in which the shares of Common Stock are listed, the Executive may be subject to insider trading restrictions and/or market abuse laws in the applicable jurisdictions which may affect the Executive’s ability to accept, acquire, sell, attempt to sell or otherwise dispose of shares of Common Stock or rights to shares of Common Stock (e.g., Awards) during such times as the Executive is considered to have “inside information” regarding the Company (as defined by the laws or regulations in applicable jurisdictions). Local insider trading laws and regulations may prohibit the cancellation or amendment of orders the Executive places before possessing the inside information. Furthermore, the Executive understands and agrees that such local laws may prohibit the Executive from (a) disclosing the inside information to any third party, including fellow employees (other than on a “need to know” basis) and (b) “tipping” third parties or causing them to otherwise buy or sell securities. Any restrictions under these laws or regulations are separate from and in addition to any restrictions that may be imposed under the Company’s then applicable Insider Trading Policy. The Executive understands that he or she is responsible for ensuring compliance with any applicable restrictions and should consult with his or her personal legal advisor on this matter.

15. FOREIGN ASSET / ACCOUNT, EXCHANGE CONTROL AND TAX REPORTING

Depending on the Executive’s country, the Executive may be subject to foreign asset or account, exchange control and/or tax reporting requirements as a result of the Executive’s right to acquire, hold, and/or transfer of shares of Common Stock or cash resulting from participation in the Plan and/or the opening and maintaining of a brokerage or bank account in connection with the Plan. The Executive may be required to report such assets, accounts, account balances and values, and/or related transactions to applicable authorities in the Executive’s country. The Executive also may be required to repatriate sale proceeds or other funds received as a result of the Executive’s participation in the Plan to the Executive’s country through a designated bank or broker and/or within a certain time after receipt. The Executive acknowledges that he or she is responsible for ensuring compliance with any applicable foreign asset or account, exchange control and tax reporting and other requirements. The Executive further understands that he or she should consult his or her personal tax and legal advisors, as applicable, on these matters.

16. LANGUAGE

The Executive acknowledges that he or she is sufficiently proficient in English or has consulted with an advisor who is sufficiently proficient in English, so as to allow the Executive to understand the terms and conditions of this Agreement. Furthermore, if the Executive has received this Agreement, the Appendix and/or any other document related to the Plan translated

into a language other than English and if the meaning of the translated version is different than the English version, the English version will control.

17. ELECTRONIC DELIVERY AND PARTICIPATION

The Executive acknowledges that the Company may, in its sole discretion, decide to deliver any documents related to the Executive’s current or future participation in the Plan by electronic means and/or may request the Executive’s consent to participate in the Plan by electronic means. The Executive hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an online or electronic system established and maintained by the Company or a third party designated by the Company.

18. WAIVER

The Executive acknowledges that a waiver by the Company of breach of any provision of this Agreement shall not operate or be construed as a waiver of any other provision of this Agreement, or of any subsequent breach by the Executive or any other participant in the Plan.

19. NO STRICT CONSTRUCTION

No rule of strict construction shall be implied against the Employer, the Company, the Committee or any other person in the interpretation of any of the terms of the Plan, Rules, this Agreement or any rule or procedure established by the Committee.

20. USE OF THE WORD “EXECUTIVE”

Wherever the word “Executive” is used in any provision of this Agreement under circumstances where the provision should logically be construed to apply to the executors, the administrators, or the person or persons to whom the Restricted Stock Units may be transferred by will or the laws of descent and distribution, the word “Executive” shall be deemed to include such person or persons.

21. FURTHER ASSURANCES

The Executive agrees, upon demand of the Employer, the Company or the Committee, to do all acts and execute, deliver and perform all additional documents, instruments and agreements which may be reasonably required by the Employer, the Company or the Committee, as the case may be, to implement the provisions and purposes of this Agreement, the Plan and any Rules.

22. CLAWBACK POLICY

The Award, including any shares of Common Stock or other payments in connection with the Award, shall be (a) subject to the provisions of any clawback policy implemented by the Company, as contemplated by the Plan, including, without limitation, the Compensation Recoupment Policy effective as of October 2, 2023, or any successor policy; and (b) subject to deduction, clawback or forfeiture to the extent required to comply with any recoupment requirement imposed under applicable laws, rules, regulations or stock exchange listing standards. In order to satisfy any recoupment obligation arising under the Compensation Recoupment Policy or otherwise under applicable laws, rules, regulations or stock exchange listing standards, among other things, the Executive expressly and explicitly authorizes the Company to issue instructions, on the Executive’s behalf, to any brokerage firm or stock plan service provider engaged by the Company to hold any shares of Common Stock or other amounts acquired pursuant to the Award to re-convey, transfer or otherwise return such shares

and/or other amounts to the Company upon the Company’s enforcement of the Compensation Recoupment Policy or any other applicable recoupment obligation.

Annex A

Performance Vesting Criteria

Except as otherwise provided int the Agreement, the Restricted Stock Units will vest only in the event, and to the extent, that the Committee determines and certifies that the Company has met the following total shareholder return performance criteria for the Performance Cycle. THE DETERMINATION OF THE COMMITTEE AS TO TOTAL SHAREHOLDER RETURN PERFORMANCE AND THE NUMBER OF RESTRICTED STOCK UNITS THAT VEST IS FINAL AND BINDING.

•The percentage of the Restricted Stock Units that vest will be determined as follows, based on the percentile ranking for the Performance Cycle (as measured based on the twenty-day average closing stock price immediately preceding the start of the Performance Cycle compared to the twenty-day average closing stock price immediately preceding the end of the Performance Cycle) of the Company’s cumulative total shareholder return (consisting of per share appreciation in Common Stock plus reinvested dividends and other distributions paid on Common Stock) among the companies (ranked by cumulative total shareholder returns consisting of per share appreciation in each company’s equity plus reinvested dividends and other distributions paid on equity) in the S&P 500 Index, as determined and certified by the Committee, subject to adjustment as described below. For the avoidance of doubt, the twenty-day average preceding the beginning of the performance period shall be based on the twenty trading days prior to and excluding the first day of the Performance Cycle and the twenty-day average preceding the end of the Performance Cycle shall be based on the twenty trading days prior to and including the last trading day of the Performance Cycle.

| | | | | |

Company Total Shareholder Return

Percentile Ranking | Percentage of Restricted Stock Units that Vest |

50th | 100% |

25th | 50% |

Below 25th | 0% |

If the percentile ranking does not equal a ranking shown in the above table, the percentage of the Restricted Stock Units that vest will be determined by a linear interpolation between the next lowest percentile shown in the table and the next highest percentile shown on the table.

•If the percentile ranking is below the 25th percentile, none of the Restricted Stock Units will vest.

For purpose of this Agreement, “S&P 500 Index” means the comparison group consisting of each of the companies that comprise the S&P 500 as of the beginning of the Performance Cycle, excluding any companies that have been removed from the Index during the Performance Cycle.

As soon as reasonably practicable following the end of the Performance Cycle, the Committee will determine and certify the extent to which the Company has met the total shareholder return

performance criteria and the extent to which, if any, the Restricted Stock Units have then vested. Following the vesting date as set forth in Section 1.3(a) of the Agreement and the Committee’s determination and certification of the performance criteria, Executive will receive the number of shares of Common Stock equal to the number of vested Restricted Stock Units. The Restricted Stock Units (vested and unvested) will terminate once the shares of Common Stock are issued.

APPENDIX

TELEDYNE TECHNOLOGIES INCORPORATED

RESTRICTED STOCK UNIT AWARD AGREEMENT

ADDITIONAL TERMS AND PROVISIONS

FOR NON-U.S. EXECUTIVES

Certain capitalized terms used but not defined in this Appendix have the meanings set forth in the Plan and/or the Agreement.

Terms and Conditions

This Appendix includes different or additional terms and conditions that govern the Award granted to the Executive under the Plan if he or she resides and/or works in one of the countries listed below. If the Executive is a citizen or resident (or is considered as such for local law purposes) of a country other than the country in which the Executive is currently residing and/or working, or if the Executive relocates to another country after the Award is granted, the Company shall, in its discretion, determine to what extent the terms and conditions contained herein shall be applicable to the Executive.

Notifications

This Appendix may also include information regarding securities, exchange controls and certain other issues of which the Executive should be aware with respect to participation in the Plan. The information is based on the securities, exchange control, and other laws in effect in the respective countries as of [insert date]. Such laws are often complex and change frequently. As a result, the Company strongly recommends that the Executive not rely on the information in this Appendix as the only source of information relating to the consequences of his or her participation in the Plan because the information may be out of date at the time the Executive vests in the Restricted Stock Units or sells shares of Common Stock acquired under the Plan.

In addition, the information contained herein is general in nature and may not apply to the Executive’s particular situation, and the Company is not in a position to assure the Executive of a particular result. Accordingly, the Executive should seek appropriate professional advice as to how the relevant laws in his or her country may apply to the Executive’s individual situation.

Finally, if the Executive is a citizen or resident (or is considered as such for local law purposes) of a country other than the country in which the Executive is currently residing and/or working, or if the Executive relocates to another country after the Award is granted, the notifications contained herein may not be applicable to the Executive in the same manner.

Teledyne Technologies Incorporated Performance Plan

(under the Amended and Restated 2014 Incentive Award Plan)

[Insert Date of Award]

The Performance Plan (“PP”) is a long-term incentive plan designed to reward executives and certain key employees (“Participants”) for the Company’s achievement of pre-specified financial goals over a three-fiscal-year period (the “Performance Period”). A new Performance Period cycle is established each fiscal year with overlapping Performance Period cycles, subject to the approval of the Personnel and Compensation Committee.

Performance Measurement

Company performance is measured using the following weighted financial metrics and aligns Participants with stockholder interests:

| | | | | | | | | | | |

| Financial Metric | Three-year aggregate corporate operating profit | Three-year aggregate corporate revenue | Three-year relative Total Shareholder Return (TSR) versus the S&P 500 Index |

| Weighting | 40% | 30% | 30% |

At the beginning of each Performance Period, a matrix setting the three-year performance goals for the financial metrics above will be established and submitted for the Personnel and Compensation Committee’s approval. Depending on actual performance against the pre-determined goals, payouts under the PP after the conclusion of a Performance Period may be from 0% to 200% of Target. Awards will be denominated 100% cash during the Performance Period. Income before taxes and revenue generally includes contributions from acquisitions during the performance cycle and may be adjusted to reflect the impact of significant changes in accounting principles, discontinued operations, unusual or extraordinary corporate transactions, events or developments, and unusual tax benefits, at the sole discretion of the Personnel and Compensation Committee.

| | | | | | | | | | | | | | | | | | | | |

| Goal as Percent of Target | | | Payout |

| Three-year aggregate corporate operating profit | Three-year aggregate corporate revenue | Three-year relative Total Shareholder Return (TSR) as a percentile of the S&P 500 Index | TSR Component Payout at Percentile |

| Maximum | 120% | 120% | 75% | 200% | 200% |

| Target | 100% | 100% | 50% | 100% | 100% |

| Threshold | 75%* | 67% | 25% | 50% | 15% |

* No awards are made if the three-year aggregate operating profit is less than 75% of Target, unless otherwise determined by the Personnel and Compensation Committee.

Note that results between anchor points in the table above are interpolated on a linear basis.

Relative TSR will be determined by the Personnel and Compensation Committee based on the percentile ranking for the Performance Period (as measured based on the twenty-day average closing stock price immediately preceding the start of the Performance Period compared to the twenty-day average closing stock price immediately preceding the end of the Performance Period) of the Company’s cumulative total shareholder return (consisting of per share appreciation in Common Stock plus reinvested dividends and other distributions paid on Common Stock) among the companies (ranked by cumulative total shareholder returns consisting of per share appreciation in each company’s equity plus reinvested dividends and other distributions paid on equity) in the S&P 500 Index, as determined and certified by the Personnel and Compensation Committee. For the avoidance of doubt, the twenty-day average preceding the beginning of the performance period shall be based on the twenty trading days prior to and excluding the first day of the Performance Period and the twenty-day average preceding the end of the Performance Period shall be based on the twenty trading days prior to and including the last trading day of the Performance Period.

For purpose of this Agreement, “S&P 500 Index” means the comparison group consisting of each of the companies that comprise the S&P 500 as of the beginning of the Performance Period, excluding any companies that have been removed from the Index during the Performance Period.

THE DETERMINATION OF THE PERSONNEL AND COMPENSATION COMMITTEE AS TO THE PERFORMANCE MEASUREMENT AND PAYOUT PERCENTAGE IS FINAL AND BINDING.

Participation

This Plan is intended to be restricted to Participants whose actions most directly affect the long-term success of the Company. Participation will be determined based on nomination by the Executive Chairman or Chief Executive Officer and approval by the Personnel and Compensation Committee. A Participant’s target award is based on a stated percent of the Participant’s annual base salary at the time

the Performance Plan award for a particular Performance Period is set (referred to as a Participant’s “Participation Percentage”). Participation Percentage varies by position from 10% to 120%. Participation in one cycle does not guarantee participation in any subsequent Performance Period.

Calculation of Performance Award at Target

The Personnel and Compensation Committee shall have full power to revise and adjust the Target Performance Award for a three-year cycle and the positions eligible to participate in the Plan at any time during the three-year performance period.

Timing of Payment

Payments will be made as soon as practicable following the closing of the Performance Period and approval of the award amounts by the Personnel and Compensation Committee. Payments will be made in cash through local payroll.

Clawback Policy

Any award under this plan is subject to the provisions of any claw-back policy implemented by Teledyne, as contemplated by the Amended and Restated Teledyne Technologies Incorporated 2014 Incentive Award Plan, including, without limitation, the Executive Compensation Recoupment (Clawback) Policy effective as of October 2, 2023 or any successor policy.

Non-Transferability

Performance Awards are non-transferable.

Termination of Employment

If a Participant terminates employment because of retirement or disability, such Participant’s PP participation will be prorated based on the number of full months of employment, divided by 36. Awards will be paid at the same time as Awards are paid to active Participants. Whether the termination was because of retirement or disability will be determined by the Company in its sole discretion.

If a Participant’s employment terminates for any other reason prior to the conclusion of the Performance Period, the current cycle’s payment will be forfeited unless deemed otherwise by the Personnel and Compensation Committee.

Change of Control

In the event of a change in control, a Participant’s participation will be pro-rated based on the number of full months of employment during the cycle, divided by 36, assuming applicable goals are met at 100% of performance targets. On a change in control, awards are paid thirty days following the change in control event.

Tax Consequences

For U.S. Federal income tax purposes, the cash payment made to a Participant under the PP is taxable as wages at ordinary income tax rates in the year in which it is received. State and local income tax laws generally provide for the same treatment. The Company is required to withhold applicable taxes at the time it makes any payment.

Canada

For Canada income tax purposes, the cash payment made to a Participant under the PP is taxable as wages at marginal federal and provincial income tax rates, plus social taxes, in the year in which it is received. The Company is required to withhold applicable taxes at the time it makes any payment.

Denmark

For Danish income tax purposes, the cash payment made to a Participant under the PP is taxable as wages at marginal income tax rates, plus social taxes, in the year in which it is received. The Company is required to withhold applicable taxes at the time it makes any payment.

France

For France income tax purposes, the cash payment made to a Participant under the PP is taxable as wages at marginal income tax rates, plus social taxes (including CSG and CRDS), in the year in which it is received. The Company is required to withhold applicable taxes at the time it makes any payment.

Netherlands

For Netherlands income tax purposes, the cash payment made to a Participant under the PP is taxable as wages at marginal income tax rates, plus social taxes, in the year in which it is received. The Company is required to withhold applicable taxes at the time it makes any payment.

Norway

For Norway income tax purposes, the cash payment made to a Participant under the PP is taxable as wages at marginal income tax rates, plus social taxes, in the year in which it is received. The Company is required to withhold applicable taxes at the time it makes any payment.

Spain

For Spain income tax purposes, the cash payment made to a Participant under the PP is taxable as wages at marginal income tax rates, plus social taxes (if the threshold has not been met), in the year in which it is received. The Company is required to withhold applicable taxes at the time it makes any payment.

Sweden

For Sweden income tax purposes, the cash payment made to a Participant under the PP is taxable as wages at marginal income tax rates (including municipal taxes), plus social taxes (if the threshold has not been met), in the year in which it is received. The Company is required to withhold applicable taxes (with the exception of social tax, as there is no employee social tax due in payroll) at the time it makes any payment; however, the Company cannot withhold more than the Participant’s cash salary in the month of withholding. If the Participant’s salary is not sufficient to meet the income tax arising, the Participant must make a supplementary payment to the tax authorities (i.e., the withholding obligation

cannot be rolled over into a subsequent month). Note that 100% of the employee social tax can be credited against the income tax liability, making the effective social tax rate 0%.

United Kingdom

For UK income tax purposes, the cash payment made to a Participant under the PP is taxable as wages at marginal income tax rates, plus National Insurance Contributions (NIC), in the year in which it is received. The Company is required to withhold applicable taxes via the PAYE system at the time it makes any payment.

Plan Risk

Although the PP is a cash-only plan, a portion of the formula for calculating any potential payments under the plan considers Teledyne’s three-year relative Total Shareholder Return (TSR) versus the S&P 500 Index. Teledyne’s stock price has fluctuated, and it may continue to do so. Many factors could affect our stock price, including variations in our operating results and acquisitions and other strategic actions taken by Teledyne, as well as factors beyond our control. Other factors include, general economic factors, our ability to service our indebtedness and comply with covenants in our debt agreements, energy prices and availability, exchange rate fluctuations, the impact of inflation, supply chain constraints, the policies of the U.S. Presidential Administration, the possibility of a government shutdown, the upcoming elections in the U.S. in 2024, international and domestic unrest and terrorism, the impacts of the war between Russia and Ukraine and the war between Israel and Hamas, increasing tensions and trading constraints between the U.S. and China, extreme weather and natural disasters, including those caused by climate change, and our ability to respond to risks and opportunities associated with artificial intelligence.

Additional Information

If you have any questions, please contact:

Melanie S. Cibik

Executive Vice President, General Counsel, Chief Compliance Officer and Secretary

Teledyne Technologies Incorporated

1049 Camino Dos Rios

Thousand Oaks, CA 91360

Telephone: 805-373-4605

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

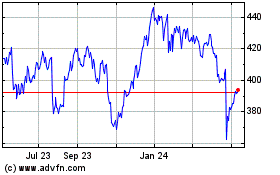

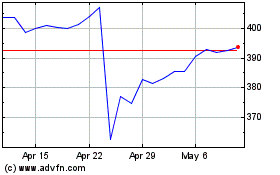

Teledyne Technologies (NYSE:TDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Teledyne Technologies (NYSE:TDY)

Historical Stock Chart

From Apr 2023 to Apr 2024