- Continued Operational Momentum Drives

Strongest Levels of Quarterly Revenue, Gross Profit and Adjusted

EBITDA in Company History -

- Recently Completed Debt Refinancing and

Strategic Investment in CSS to Accelerate Digital Initiatives and

Bolster Foundation for Growth -

Startek, Inc. (NYSE:SRT) ("Startek" or the "Company"), a global

provider of customer experience management solutions, is reporting

financial results for the fourth quarter and full year ended

December 31, 2020.

Fourth Quarter 2020 Financial Highlights ($ in millions,

excl. margin items)

Q4 2020

Q3 2020

Q4 2019

Net Revenue

$

174.5

$

162.7

$

171.6

Gross Profit

$

30.9

$

22.9

$

27.6

Gross Margin

17.7

%

14.1

%

16.1

%

SG&A Expenses

$

15.3

$

14.9

$

19.4

Net Income/(Loss)[1]

$

(7.6

)

$

0.4

$

(5.3

)

Adjusted Net Income[2]

$

8.8

$

3.3

$

5.8

Adjusted EBITDA[2]

$

23.3

$

15.6

$

16.8

[1] Reflects net income (loss)

attributable to Startek shareholders. [2] Refer to the note below about Non-GAAP

financial measures.

Full Year 2020 Financial Highlights ($ in millions, excl.

margin items)

2020

2019

Net Revenue

$

640.2

$

657.9

Gross Profit

$

89.6

$

110.9

Gross Margin

14.0

%

16.9

%

SG&A Expenses

$

62.1

$

91.4

Net Income/(Loss)

$

(39.0

)

$

(15.0

)

Adjusted Net Income

$

8.5

$

4.7

Adjusted EBITDA

$

58.2

$

52.1

Management Commentary

“We generated record results during the fourth quarter with

solid growth across nearly every key financial metric,” said Aparup

Sengupta, Executive Chairman and Global CEO of Startek. “While Q4

is historically our strongest quarter of the year, we further

benefitted from seasonality trends within our existing client base,

including robust e-commerce tailwinds around the holiday season.

This performance, coupled with our consistent focus on cost

management, allowed us to drive sequential and year-over-year

improvements in gross margin and adjusted EBITDA, which also

benefitted from $2.7 million of government grants in Q4. Overall,

our team demonstrated incredible adaptability and execution in 2020

despite one of the most challenging global operating environments

we have ever faced.

“As we entered 2021, we further strengthened our commitment to

enhancing the flexibility of our platform. Subsequent to the fourth

quarter, we completed a $185 million debt refinancing that allows

us to extend our debt maturities and enhance our overall liquidity

position. With this reinforced balance sheet, we can

comprehensively support our current operations while capitalizing

on strategic opportunities to drive long-term, accretive

growth.

“The recent minority investment we made in CSS Corp. (CSS)

represents one such accretive opportunity that will also advance

our ramping digital initiatives. CSS is a robust IT services

company providing mission-critical AI, automation, analytics, cloud

and digital solutions to a growing technology customer base across

five continents. Given the success of our Startek Cloud omnichannel

platform in 2020, we continue to view our digital services as a key

long-term driver of both future revenue growth and margin

expansion. Our investment in CSS accelerates our digitization

initiatives and marks an important inflection point for

Startek.

“Looking ahead to the rest of 2021, we are proud to have built

such a strong foundation to continue driving operational

efficiencies and enhancing our suite of services around the globe.

We are grateful for the dedication of our team and the deep support

of our shareholders as we further execute on our strategic growth

plans.”

Fourth Quarter 2020 Financial Results

Net revenue in the fourth quarter increased to $174.5 million

compared to $171.6 million in the year-ago quarter. The increase

was driven by elevated demand and seasonal strength within the

Company’s existing client network. On a constant currency basis,

net revenue increased 4.7% compared to the prior year period.

Gross profit in the fourth quarter increased by 11.7% to $30.9

million compared to $27.6 million in the year-ago quarter. Gross

margin increased 160 basis points to 17.7% compared to 16.1% in the

year-ago quarter. The increase was primarily driven by the

aforementioned strength within Startek’s existing client base and a

greater revenue mix of high-margin digital services. The margin

expansion was also aided by incremental grants of $2.7 million

received in the fourth quarter.

Selling, general and administrative (SG&A) expenses in the

fourth quarter decreased to $15.3 million compared to $19.4 million

in the year-ago quarter. As a percentage of revenue, SG&A

improved 250 basis points to 8.8% compared to 11.3% in the year-ago

quarter as a result of the continued cost reductions the Company

has implemented over the past several quarters and in response to

COVID-19.

Net loss attributable to Startek shareholders in the fourth

quarter was $7.6 million or $(0.19) per share, compared to a net

loss of $5.3 million or $(0.14) per share in the year-ago quarter.

Net loss in the fourth quarter of 2020 included an approximate

$13.2 million goodwill impairment from COVID-19 related forecasted

declines in the Company’s business in India, South Africa, and

Australia and in Argentina owing primarily to the devaluation of

the local currency.

Adjusted net income* in the fourth quarter increased 50% to $8.8

million or $0.22 per diluted share, compared to adjusted net

income* of $5.8 million or $0.15 per diluted share in the year-ago

quarter.

Adjusted EBITDA* in the fourth quarter increased 38.5% to $23.3

million compared to $16.8 million in the year-ago quarter. The

increase was primarily driven by the aforementioned revenue growth

and margin expansion, cost reductions, and approximately $2.7

million in incremental benefits related to government grants.

On December 31, 2020, cash and restricted cash was $50.6 million

compared to $56.6 million at September 30, 2020. The decrease was

largely driven by increased capital expenditures in this quarter

relative to previous quarters. Total debt at December 31, 2020

remained flat at $136.0 million compared to September 30, 2020, and

net debt at December 31, 2020 was $85.4 million compared to $79.4

million at September 30, 2020.

Full Year 2020 Financial Results

Net revenue in 2020 was $640.2 million compared to $657.9

million in 2019. The decrease was driven by adverse movements in

foreign currency during the year. On a constant currency basis, net

revenue increased 0.9% compared to the prior year. The COVID-19

impact on revenue during the first half of 2020 was offset by new

wins and elevated seasonal demand in the second half of the

year.

Gross profit in 2020 was $89.6 million compared to $110.9

million in 2019. Gross margin was 14.0% compared to 16.9% in 2019.

The decrease was primarily driven by higher costs relative to

revenues in geographies that were heavily impacted by COVID-19

related lockdowns.

Selling, general and administrative (SG&A) expenses in 2020

decreased significantly to $62.1 million compared to $91.4 million

in 2019. As a percentage of revenue, SG&A improved 420 basis

points to 9.7% compared to 13.9% in 2019 as a result of the

company’s sustained cost reductions over the last 12 months and in

response to COVID-19.

Net loss attributable to Startek shareholders in 2020 was $39.0

million or $(0.99) per share, compared to a net loss of $15.0

million or $(0.39) per share in 2019. Net loss in 2020 included an

approximate $35.9 million goodwill impairment charge accounted in

the first quarter and in the fourth quarter due to COVID-19 related

forecasted declines in the Company’s business in India, South

Africa, Australia and in Argentina owing primarily to the

devaluation of the local currency.

Adjusted net income* in 2020 increased to $8.5 million or $0.22

per diluted share, compared to adjusted net income* of $4.7 million

or $0.12 per diluted share in 2019.

Adjusted EBITDA* in 2020 increased 11.7% to $58.2 million

compared to $52.1 million in 2019. The increase was primarily

driven by the Company’s aforementioned cost reductions and

continued focus on prudent expense management, as well as the $2.7

million incremental grant benefit in Q4.

*A non-GAAP measure defined below.

Debt Refinancing and Capital Allocation

Subsequent to the fourth quarter, CSP Alpha Holdings Pte. Ltd.,

a wholly-owned subsidiary of Startek, successfully completed a debt

refinancing with a newly secured $185 million senior debt facility,

comprising a $165 million term loan and a $20 million revolving

credit facility. The term loan bears a moratorium on principal

repayment for 21 months and will amortize quarterly thereafter,

beginning in November 2022. The loan is subject to certain

standardized financial covenants. The proceeds of this loan was

used to repay in full the previous senior debt facility and to also

make the strategic investment in CSS.

On February 25, 2021, Startek announced a strategic investment

in CSS, comprising a $30 million contribution in a limited

partnership managed by Startek’s majority shareholder, Capital

Square Partners, to acquire both an indirect beneficial interest of

approximately 26% in CSS, as well as an option to acquire a

controlling stake. The option to acquire a majority stake in CSS is

at the sole discretion of Startek, and the Company has no

obligation to do so.

Conference Call and Webcast Details

Startek management will hold a conference call today at 5:00

p.m. Eastern time to discuss its financial results. The conference

call will be followed by a question and answer period.

Date: Monday, March 15, 2021 Time: 5:00 p.m. Eastern time

Toll-free dial-in number: (844) 239-5283 International dial-in

number: (574) 990-1022 Conference ID: 4245717

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at (949)

574-3860.

The conference call will be broadcast live and available for

replay here, as well as in the investor relations section of the

company’s website at www.startek.com.

A telephonic replay of the conference call will also be

available after 8:00 p.m. Eastern time on the same day through

March 22, 2021.

Toll-free replay number: (855) 859-2056 International replay

number: (404) 537-3406 Replay ID: 4245717

About Startek

Startek is a global provider of tech-enabled business process

management solutions. The company provides omni-channel customer

experience, digital transformation, and technology services to some

of the finest brands globally. Startek is committed to impacting

clients’ business outcomes by focusing on enhancing customer

experience and digital & AI enablement across all touch points

and channels. Startek has more than 42,000 CX experts spread across

46 delivery campuses in 13 countries. The company services over 220

clients across a range of industries such as Banking and Financial

Services, Insurance, Technology, Telecom, Healthcare, Travel &

Hospitality, Ecommerce, Consumer Goods, Retail, and Energy &

Utilities. To learn more about Startek’s global solutions, please

visit www.startek.com.

Forward-Looking Statements

The matters regarding the future discussed in this news release

include forward-looking statements as defined in the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are intended to be identified in this document by the

words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “objective,” “outlook,” “plan,” “project,” “possible,”

“potential,” “should” and similar expressions. As described below,

such statements are subject to a number of risks and uncertainties

that could cause Startek's actual results to differ materially from

those expressed or implied by any such forward-looking statements.

Readers are encouraged to review risk factors and all other

disclosures appearing in the Company's Form 10-K for the fiscal

year ended December 31, 2019, as filed with the Securities and

Exchange Commission (SEC) on March 12, 2020, as well as other

filings with the SEC, for further information on risks and

uncertainties that could affect Startek's business, financial

condition and results of operation. Copies of these filings are

available from the SEC, the Company’s website or the Company’s

investor relations department. Startek assumes no obligation to

update or revise any forward-looking statements as a result of new

information, future events or otherwise. Readers are cautioned not

to place undue reliance on these forward-looking statements that

speak only as of the date herein.

STARTEK, INC. AND

SUBSIDIARIES

Condensed Consolidated

Statements of Income (loss)

(In thousands, except per share

amounts)

Unaudited

Audited

Three Months Ended December

31,

Year Ended December

31,

2020

2019

2020

2019

Revenue

174,918

172,151

641,844

659,205

Warrant contra revenue

(449

)

(565

)

(1,622

)

(1,295

)

Net Revenue

174,469

171,586

640,222

657,910

Cost of services

(143,598

)

(143,950

)

(550,601

)

(547,014

)

Gross profit

30,871

27,636

89,621

110,896

Selling, general and administrative

expenses

(15,341

)

(19,425

)

(62,116

)

(91,363

)

Impairment losses and restructuring/exit

cost

(13,254

)

(7,758

)

(37,799

)

(9,827

)

Acquisition related cost

-

-

-

11

Operating Income (Loss)

2,276

453

(10,294

)

9,717

Share of loss of equity-accounted

investees

(6

)

(1,214

)

(31

)

(226

)

Interest expense, net

(2,692

)

(3,960

)

(13,376

)

(15,824

)

Exchange gain / (loss), net

(1,853

)

401

(2,183

)

(2,157

)

Loss before income taxes

(2,275

)

(4,320

)

(25,884

)

(8,490

)

Tax expense

(1,951

)

(241

)

(7,760

)

(4,791

)

Net Loss

(4,226

)

(4,561

)

(33,644

)

(13,281

)

Net Income (Loss)

Net income attributable to noncontrolling

interests

3,351

730

5,341

1,737

Net loss attributable to Startek

shareholders

(7,577

)

(5,291

)

(38,985

)

(15,018

)

(4,226

)

(4,561

)

(33,644

)

(13,281

)

Net loss per common share:

Basic net loss attributable to Startek

shareholders

(0.19

)

(0.14

)

(0.99

)

(0.39

)

Diluted net loss attributable to Startek

shareholders

(0.19

)

(0.14

)

(0.99

)

(0.39

)

Weighted average common shares

outstanding:

Basic

40,333

38,492

39,442

38,132

Diluted

40,333

38,492

39,442

38,132

STARTEK, INC. AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(Audited)

(In thousands, except share and

per share data)

December 31, 2020

December 31, 2019

Assets

Current assets

Cash and cash equivalents

44,507

20,464

Restricted cash

6,052

12,162

Trade accounts receivables, net

83,560

108,479

Unbilled revenue

49,779

41,449

Prepaid and other current assets

14,542

12,008

Total current assets

198,440

194,562

Non-current assets

Property, plant and equipment, net

34,225

37,507

Operating lease right-of-use assets

69,376

73,692

Intangible assets, net

100,440

110,807

Goodwill

183,397

219,341

Investment in equity accounted

investees

111

553

Deferred tax assets, net

5,294

5,251

Prepaid expenses and other non-current

assets

13,370

16,370

Total non-current assets

406,213

463,521

Total assets

604,653

658,083

Liabilities and Stockholders’

Equity

Current liabilities

Trade accounts payables

20,074

25,449

Accrued expenses

57,118

45,439

Short term debt

15,505

26,491

Current maturity of long term debt

2,180

18,233

Current maturity of operating lease

liabilities

19,327

19,677

Other current liabilities

39,987

37,159

Total current liabilities

154,191

172,448

Non-current liabilities

Long term debt

118,315

130,144

Operating lease liabilities

52,052

54,341

Other non-current liabilities

15,498

11,140

Deferred tax liabilities, net

17,715

18,226

Total non-current liabilities

203,580

213,851

Total liabilities

357,771

386,299

Stockholders’ equity

Common stock, 60,000,000 non-convertible

shares, $0.01 par value, authorized; 40,453,462 and 38,525,636

shares issued and outstanding at December 31, 2020 and December 31,

2019

405

385

Additional paid-in capital

288,700

276,827

Accumulated deficit

(85,543

)

(46,145

)

Accumulated other comprehensive loss

(7,286

)

(6,022

)

Equity attributable to Startek

shareholders

196,276

225,045

Noncontrolling interest

50,606

46,739

Total stockholders’ equity

246,882

271,784

Total liabilities and stockholders’

equity

604,653

658,083

STARTEK, INC. AND

SUBSIDIARIES

Condensed Consolidated

Statements of Cash Flows

(Audited)

(In thousands, except per share

amounts)

Year Ended December

31,

2020

2019

Operating activities

Net loss

(33,644

)

(13,281

)

Adjustments to reconcile net income to

net cash provided by operating activities

Depreciation and amortization

28,201

29,723

Impairment of goodwill

35,944

7,146

Loss on sale of property, plant and

equipment

167

-

Provision for doubtful accounts

2,662

1,640

Amortisation of debt issuance cost

1,454

1,414

Warrant contra revenue

1,622

1,295

Share-based compensation expense

832

1,516

Deferred income taxes

(276

)

(1,101

)

Share of loss of equity accounted

investees

31

226

Changes in operating assets and

liabilities

Trade accounts receivables, net

19,971

(4,492

)

Prepaid and other assets

(11,376

)

4,199

Trade accounts payables

(4,635

)

(734

)

Income taxes, net

2,668

(542

)

Accrued expenses and other liabilities

22,432

962

Net cash generated from operating

activities

66,053

27,971

Investing activities

Purchase of property, plant and

equipment

(17,414

)

(15,564

)

Proceeds from equity accounted

investees

395

1,308

Net cash used in investing

activities

(17,019

)

(14,256

)

Financing activities

Proceeds from issuance of common stock

9,026

6,710

Payments on long term debt

(8,400

)

(9,800

)

Payments on line of credit, net

(24,529

)

(6,623

)

(Payments on) / proceeds from other

borrowings, net

(7,304

)

4,351

Net cash used in from financing

activities

(31,207

)

(5,362

)

Net increase in cash and cash

equivalents

17,827

8,353

Effect of exchange rate changes on cash

and cash equivalents and restricted cash

106

(296

)

Cash and cash equivalents and restricted

cash at the beginning of period

32,626

24,569

Cash and cash equivalents and

restricted cash at the end of period

50,559

32,626

Components of cash and cash equivalents

and restricted cash

Balances with banks

44,507

20,464

Restricted cash

6,052

12,162

Total cash and cash equivalents and

restricted cash

50,559

32,626

Supplemental disclosure of Cash Flow

Information

Cash paid for interest and other finance

cost

13,080

15,329

Cash paid for income taxes

4,795

6,379

Government grants/subsidy received

2,689

-

Non cash warrant contra revenue

1,622

1,295

Non cash share-based compensation

expenses

832

1,516

STARTEK, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (In thousands)

(Unaudited)

This press release contains references to the non-GAAP financial

measure of Adjusted EBITDA. Reconciliation of this non-GAAP measure

to its comparable GAAP measure is included below. This non-GAAP

information should not be construed as an alternative to the

reported results determined in accordance with GAAP. It is provided

solely to assist in an investor’s understanding of these items on

the comparability of the Company’s operations.

Adjusted EBITDA:

The Company defines non-GAAP Adjusted EBITDA as Net loss plus

Income tax expense, Interest and other expense, net, Depreciation

and amortization expense, Restructuring and other acquisition

related cost, Share-based compensation expense and Warrant contra

revenue (if applicable). Management uses Adjusted EBITDA as a

performance measure to analyze the performance of our business.

Management believes that excluding these non-cash and other

non-recurring items permits a more meaningful comparison and

understanding of our strength and performance of our ongoing

operations for our investors and analysts.

Adjusted EPS:

Adjusted EPS is a non-GAAP financial measure presenting the

earnings generated by our ongoing operations that we believe is

useful to investors in making meaningful comparisons to other

companies, although our measure of Adjusted EPS may not be directly

comparable to similar measures used by other companies, and

period-over-period comparisons. Adjusted EPS is defined as our

diluted earnings per common share attributable to StarTek

shareholders adjusted to exclude the effects of the amortization of

acquisition-related intangible assets, investments that investors

may want to evaluate separately (such as based on fair value) and

the impact of certain events, gains, losses or other charges that

affect period-over-period comparisons. Acquisition-related

intangible assets are recognized as a result of the application of

Accounting Standards Codification Topic (“ASC”) 805, Business

Combinations (such as customer relationships and Brand), and their

amortization is significantly affected by the size and timing of

our acquisitions.

Adjusted EBITDA:

Three Months Ended December

31,

Year Ended December

31,

2020

2019

2020

2019

Net Loss

(4,226

)

(4,561

)

(33,644

)

(13,281

)

Income tax expense

1,951

241

7,760

4,791

Interest and other expense, net

2,699

5,174

13,407

16,050

Exchange gain/(loss), net

1,853

(401

)

2,183

2,157

Depreciation and amortization expense

6,922

7,667

28,201

29,723

Impairment losses and restructuring

cost

13,254

7,758

37,799

9,817

Share-based compensation expense

385

365

832

1,516

Warrant contra revenue

449

565

1,622

1,295

Adjusted EBITDA

23,287

16,808

58,160

52,068

Adjusted EPS:

Three Months Ended December

31,

Year Ended December

31,

2020

2019

2020

2019

Profit attributable to Startek

shareholders

(7,577

)

(5,291

)

(38,985

)

(15,018

)

Add: Share based compensation expense

385

365

832

1,516

Add: Amortization of intangible assets,

net of tax

2,277

2,279

9,078

8,956

Add: Warrant contra revenue

449

565

1,622

1,295

Add: Goodwill impairment loss

13,236

7,146

35,944

7,146

Add: Deferred tax adjustments

-

780

-

780

Adjusted net income / (loss)

(non-GAAP)

8,770

5,844

8,491

4,675

Weighted average common shares outstanding

- Basic

40,333

38,492

39,442

38,132

Weighted average common shares outstanding

- Diluted

40,333

38,492

39,442

38,132

Adjusted EPS - Basic

0.22

0.15

0.22

0.12

Adjusted EPS - Diluted

0.22

0.15

0.22

0.12

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210315005787/en/

Investor Relations Sean Mansouri, CFA Gateway Investor

Relations (949) 574-3860 SRT@gatewayir.com

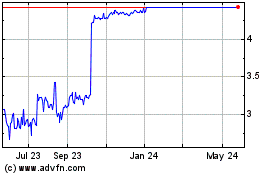

StarTek (NYSE:SRT)

Historical Stock Chart

From Feb 2025 to Mar 2025

StarTek (NYSE:SRT)

Historical Stock Chart

From Mar 2024 to Mar 2025