Amended Statement of Ownership (sc 13g/a)

February 14 2019 - 5:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Sea Limited

(Name of Issuer)

Class A ordinary shares, par value $0.0005 per share

(Title of Class of Securities)

81141R100**

(CUSIP Number)

December 31, 2018

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule is filed:

|

|

☐

|

Rule 13d-1(b)

|

|

|

☐

|

Rule 13d-1(c)

|

|

|

☒

|

Rule 13d-1(d)

|

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

**This CUSIP number applies to the Company’s American Depositary Shares, each representing one Class A ordinary share of the Company.

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 2 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

General Atlantic Singapore Fund Pte. Ltd.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b)

☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Singapore

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

CO

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 3 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

General Atlantic Singapore Fund Interholdco Ltd.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Bermuda

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

CO

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 4 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

General Atlantic Partners (Bermuda) III, L.P.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Bermuda

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

PN

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 5 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

General Atlantic GenPar (Bermuda), L.P.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Bermuda

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

PN

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 6 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

GAP (Bermuda) Limited

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Bermuda

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

CO

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 7 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

General Atlantic LLC

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

OO

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 8 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

GAP Coinvestments III, LLC

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

OO

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 9 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

GAP Coinvestments IV, LLC

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

OO

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 10 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

GAP Coinvestments V, LLC

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

OO

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 11 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

GAP Coinvestments CDA, L.P.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

PN

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 12 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

GAPCO Management GmbH

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Germany

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

CO

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 13 of 22

|

|

1

|

NAME OF

REPORTING

PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

GAPCO GmbH & Co. KG

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Germany

|

|

|

NUMBER OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

7,361,555

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

7,361,555

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,361,555

|

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.0%

|

|

|

12

|

TYPE OF REPORTING PERSON

PN

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 14 of 22

|

|

Item 1.

|

(a)

|

NAME OF ISSUER

|

|

|

|

|

|

|

|

Sea Limited (the “

Company

”).

|

|

|

|

|

|

|

(b)

|

ADDRESS OF ISSUER’S PRINCIPAL EXECUTIVE OFFICES

|

|

|

|

|

|

|

|

1 Fusionopolis Place, #17-10

Galaxis, Singapore 138522

|

|

|

|

|

|

Item 2.

|

(a)

|

NAMES OF PERSONS FILING

|

This Statement is being filed on behalf of each of the following persons (collectively, the “

Reporting Persons

”):

|

|

(i)

|

General Atlantic Singapore Fund Pte. Ltd. (“

GASF

”);

|

|

|

|

|

|

|

(ii)

|

General Atlantic Singapore Fund Interholdco Ltd. (“

GASF Interholdco

”);

|

|

|

|

|

|

|

(iii)

|

General Atlantic Partners (Bermuda) III, L.P. (“

GAP Bermuda III

”);

|

|

|

|

|

|

|

(iv)

|

General Atlantic GenPar (Bermuda), L.P. (“

GenPar Bermuda

”);

|

|

|

|

|

|

|

(v)

|

GAP (Bermuda) Limited (“

GAP (Bermuda) Limited

”);

|

|

|

|

|

|

|

(vi)

|

General Atlantic LLC (“

GA LLC

”);

|

|

|

|

|

|

|

(vii)

|

GAP Coinvestments III, LLC (“

GAPCO III

”);

|

|

|

|

|

|

|

(viii)

|

GAP Coinvestments IV, LLC (“

GAPCO IV

”);

|

|

|

|

|

|

|

(ix)

|

GAP Coinvestments V, LLC (“

GAPCO V

”);

|

|

|

|

|

|

|

(x)

|

GAP Coinvestments CDA, L.P. (“

GAPCO CDA

”).

|

|

|

|

|

|

|

(xi)

|

GAPCO Management GmbH (“

GmbH

”); and

|

|

|

|

|

|

|

(xii)

|

GAPCO GmbH & Co. KG (“

KG

”).

|

GAP Bermuda III, GAPCO III, GAPCO IV, GAPCO V, GAPCO CDA and KG are collectively referred to as the “

GA Funds

.”

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 15 of 22

|

|

|

(b)

|

ADDRESS OF PRINCIPAL BUSINESS OFFICE

|

The principal address of each of the Reporting Persons (other than GASF, GmbH and KG) is c/o General Atlantic Service Company, L.P., 55 East 52nd Street, 32nd Floor, New York, NY 10055. The principal address of GASF is Asia Square Tower 1, 8 Marina View, #41-04, Singapore 018960. The principal address of GmbH and KG is c/o General Atlantic GmbH, Maximilianstrasse 35b, 80539 Munich, Germany.

|

|

(i)

|

GASF - Singapore

|

|

|

|

|

|

|

(ii)

|

GASF Interholdco - Bermuda

|

|

|

|

|

|

|

(iii)

|

GAP Bermuda III - Bermuda

|

|

|

|

|

|

|

(iv)

|

GenPar Bermuda - Bermuda

|

|

|

|

|

|

|

(v)

|

GAP (Bermuda) Limited - Bermuda

|

|

|

|

|

|

|

(vi)

|

GA LLC - Delaware

|

|

|

|

|

|

|

(vii)

|

GAPCO III - Delaware

|

|

|

|

|

|

|

(viii)

|

GAPCO IV - Delaware

|

|

|

|

|

|

|

(ix)

|

GAPCO V - Delaware

|

|

|

|

|

|

|

(x)

|

GAPCO CDA - Delaware

|

|

|

|

|

|

|

(xi)

|

GmbH - Germany

|

|

|

|

|

|

|

(xii)

|

KG - Germany

|

|

|

(d)

|

TITLE OF CLASS OF SECURITIES

|

Class A ordinary shares, par value US$0.0005 per share (“

Class A Ordinary Shares

”).

81141R 100*

*This CUSIP number applies to the Company’s American Depositary Shares, each representing one Class A Ordinary Share.

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 16 of 22

|

|

Item 3.

|

|

IF THIS STATEMENT IS FILED PURSUANT TO RULES 13d-1(b) OR 13d-2(b) OR (c), CHECK WHETHER THE PERSON FILING IS:

|

Not applicable.

As of December 31 2018, the Reporting Persons owned the following number of the Company’s American Depositary Shares (the “

ADSs

”), evidenced by American Depositary Receipts, each representing one Class A Ordinary Share:

|

|

(i)

|

GASF owned of record 7,361,555 ADSs, representing 7,361,555 Class A Ordinary Shares, or 4.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(ii)

|

GASF Interholdco owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(iii)

|

GAP Bermuda III owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(iv)

|

GenPar Bermuda owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(v)

|

GAP (Bermuda) Limited owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(vi)

|

GA LLC owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(vii)

|

GAPCO III owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(viii)

|

GAPCO IV owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(ix)

|

GAPCO V owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(x)

|

GAPCO CDA owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(xi)

|

GmbH owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

|

|

|

|

|

(xii)

|

KG owned of record no ADSs or 0.0% of the issued and outstanding Class A Ordinary Shares.

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 17 of 22

|

The majority shareholder of GASF is GASF Interholdco. The members of GASF Interholdco that share beneficial ownership of the ADSs held of record by GASF are the GA Funds. The general partner of GAP Bermuda III is GenPar Bermuda, and the general partner of GenPar Bermuda is GAP (Bermuda) Limited. GA LLC is the managing member of GAPCO III, GAPCO IV and GAPCO V and the general partner of GAPCO CDA. The general partner of KG is GmbH and the GA Managing Directors control the investment and voting decisions of GmbH. The GA Managing Directors are also the directors and voting shareholders of GAP (Bermuda) Limited. By virtue of the foregoing, the Reporting Persons may be deemed to share voting power and the power to direct the disposition of the Shares that each owns of record. GASF, GASF Interholdco, GAP Bermuda III, GenPar Bermuda, GAP (Bermuda) Limited, GA LLC, GAPCO III, GAPCO IV, GAPCO V, GAPCO CDA, GmbH and KG are a “group” within the meaning of Rule 13d-5 promulgated under the Securities Exchange Act of 1934, as amended and may be deemed to beneficially own the number of Class A Ordinary Shares indicated below. There are 29 managing directors of GA LLC (the “

GA Managing Directors

”). Each of the GA Managing Directors disclaims ownership of the Class A Ordinary Shares except to the extent he or she has a pecuniary interest therein. The name, the business address and the citizenship of each of the GA Managing Directors as of the date hereof is attached hereto as

Schedule A

and is hereby incorporated by reference.

Amount Beneficially Owned

:

By virtue of the relationship described above, each of the Reporting Persons may be deemed to beneficially own 7,361,555 ADSs, representing 7,361,555 underlying Class A Ordinary Shares.

Percentage Owned

:

All calculations of percentage ownership herein are based on an aggregate of 182,009,760 Class A Ordinary Shares reported to be outstanding in the Company’s Form 20-F filed with the Securities and Exchange Commission on April 11, 2018.

Number of Shares as to Which Such Person Has Sole/Shared Power to Vote or to Direct the Vote and Sole/Shared Power to Dispose or to Direct the Disposition of

:

|

|

(i)

|

Each of the Reporting Persons may be deemed to have the sole power to direct the voting and dispositions of the Class A Ordinary Shares as indicated on such Reporting Person’s cover page included herein.

|

|

|

(ii)

|

Each of the Reporting Persons may be deemed to share the power to direct the voting and dispositions of the 7,361,555 underlying Class A Ordinary Shares that may be deemed to be owned beneficially by each of them.

|

|

Item 5.

|

OWNERSHIP OF FIVE PERCENT OR LESS OF A CLASS

|

If this statement is being filed to report the fact that as of the date hereof the Reporting Person has ceased to be the beneficial owner of more than 5 percent of the class of securities, check the following ☒.

|

Item 6.

|

OWNERSHIP OF MORE THAN FIVE PERCENT ON BEHALF OF ANOTHER PERSON

|

Not applicable.

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 18 of 22

|

|

Item 7.

|

IDENTIFICATION AND CLASSIFICATION OF THE SUBSIDIARY WHICH ACQUIRED THE SECURITY BEING REPORTED ON BY THE PARENT HOLDING COMPANY

|

Not applicable.

|

Item 8.

|

IDENTIFICATION AND CLASSIFICATION OF MEMBERS OF THE GROUP

|

See Item 4, which states the identity of the members of the group filing this Schedule 13G.

|

Item 9.

|

NOTICE OF DISSOLUTION OF GROUP

|

Not applicable.

Not applicable.

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 19 of 22

|

Exhibit Index

|

Exhibit 1.

|

Joint Filing Agreement as required by Rule 13d-1(k)(1) under the Securities Exchange Act of 1934, as amended (previously filed).

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 20 of 22

|

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated as of February 14, 2019

|

|

GENERAL ATLANTIC SINGAPORE FUND PTE. LTD.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ong Yu Huat

|

|

|

|

|

Name:

|

Ong Yu Huat

|

|

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

|

|

|

GENERAL ATLANTIC SINGAPORE FUND INTERHOLDCO LTD.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Director

|

|

|

|

GENERAL ATLANTIC PARTNERS (BERMUDA) III, L.P.

|

|

|

|

|

|

|

|

|

By:

|

General Atlantic GenPar (Bermuda), L.P., its General Partner

|

|

|

|

By:

|

GAP (Bermuda) Limited, its General Partner

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Vice President

|

|

|

|

GENERAL ATLANTIC GENPAR (BERMUDA), L.P.

|

|

|

|

|

|

|

|

|

|

By:

|

GAP (Bermuda) Limited, its General Partner

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Vice President

|

|

|

|

|

|

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 21 of 22

|

|

|

GAP (BERMUDA) LIMITED

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Vice President

|

|

|

|

|

|

|

|

|

|

GENERAL ATLANTIC LLC

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Managing Director

|

|

|

|

GAP COINVESTMENTS III, LLC

|

|

|

|

|

|

|

|

|

|

By:

|

General Atlantic LLC, its Managing Member

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Managing Director

|

|

|

|

|

|

|

|

|

|

GAP COINVESTMENTS IV, LLC

|

|

|

|

|

|

|

|

|

|

By:

|

General Atlantic LLC, its Managing Member

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Managing Director

|

|

|

|

|

|

|

|

|

|

GAP COINVESTMENTS V, LLC

|

|

|

|

|

|

|

|

|

|

By:

|

General Atlantic LLC, its Managing Member

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Managing Director

|

|

|

CUSIP No. 81141R100

|

SCHEDULE 13G

|

Page 22 of 22

|

|

|

GAP COINVESTMENTS CDA, L.P.

|

|

|

|

|

|

|

|

By:

|

General Atlantic LLC., its General Partner

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Managing Director

|

|

|

|

GAPCO MANAGEMENT GMBH

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Managing Director

|

|

|

|

GAPCO GMBH & CO. KG

|

|

|

|

|

|

|

|

|

|

By:

|

GAPCO Management GmbH,

|

|

|

|

|

Its general partner

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas J. Murphy

|

|

|

|

|

Name:

|

Thomas J. Murphy

|

|

|

|

|

Title:

|

Managing Director

|

|

|

|

|

|

|

|

SCHEDULE A

GA Managing Directors (as of the date hereof)

|

Name

|

Business Address

|

Citizenship

|

|

William E. Ford

(Chief Executive Officer)

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

J. Frank Brown

(Chief Operating Officer)

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Thomas J. Murphy

(Chief Financial Officer)

|

600 Steamboat Road

Greenwich, Connecticut 06830

|

United States

|

|

Gabriel Caillaux

|

23 Savile Row

London W1S 2ET

United Kingdom

|

France

|

|

Chris Caulkin

|

23 Savile Row

London W1S 2ET

United Kingdom

|

United States

|

|

Andrew Crawford

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Alex Crisses

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Steven A. Denning

(Chairman)

|

600 Steamboat Road

Greenwich, Connecticut 06830

|

United States

|

|

Michelle Dipp

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Roni Elchahal

|

23 Savile Row

London W1S 2ET

United Kingdom

|

United States

|

|

Martin Escobari

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

Bolivia and Brazil

|

|

Pamela Fang

|

Suite 5704 - 5706, 57F

Two IFC, 8 Finance Street

Central, Hong Kong, China

|

United States

|

|

Andrew Ferrer

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Wai Hoong Fock

|

Asia Square Tower 1

8 Marina View, #41-04

Singapore 018960

|

Singapore

|

|

Name

|

Business Address

|

Citizenship

|

|

Aaron Goldman

|

23 Savile Row

London W1S 2ET

United Kingdom

|

United States

|

|

David C. Hodgson

(Vice Chairman)

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Christopher G. Lanning

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Anton J. Levy

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Peter Munzig

|

228 Hamilton Avenue

Palo Alto, CA 94301

|

United States

|

|

Sandeep Naik

|

Level 19, Birla Aurora

Dr. Annie Besant Road

Worli, Mumbai 400 030

India

|

United States

|

|

Joern Nikolay

|

Maximilianstrasse 35b

80539 Munich

Germany

|

Germany

|

|

Name

|

Business Address

|

Citizenship

|

|

Shantanu Rastogi

|

Level 19, Birla Aurora

Dr. Annie Besant Road

Worli

Mumbai 400 030

India

|

India

|

|

David A. Rosenstein

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Ashish Saboo

|

General Atlantic Singapore Fund Management Pte. Ltd. (Representative Office)

Unit # 2817, 28th Floor,

DBS Bank Tower,

Ciputra World One,

Jl Prof. Dr. Satrio Kav. 3-5,

Kel. Karet Kuningan, Kec. Setiabudi,

Jakarta Selatan 12940, Indonesia

|

India

|

|

Paul Stamas

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Tanzeen Syed

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States and Bangladesh

|

|

Graves Tompkins

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Robbert Vorhoff

|

55 East 52nd Street

33rd Floor

New York, New York 10055

|

United States

|

|

Chi Eric Zhang

|

Unit 2707 Tower S2

Bund Finance Centre

No. 600

Zhongshan Dong Er Road

Huangpu District

Shanghai, 200010

China

|

Hong Kong SAR

|

Directors of General Atlantic Singapore Fund Pte. Ltd.

(as of the date hereof)

|

Name

|

Business Address

|

Citizenship

|

|

Ong Yu Huat

|

Asia Square Tower 1

8 Marina View, #41-04

Singapore 018960

|

Singapore

|

|

Wai Hoong Fock

|

Asia Square Tower 1

8 Marina View, #41-04

Singapore 018960

|

Singapore

|

Directors of General Atlantic Singapore Fund Interholdco Ltd.

(as of the date hereof)

|

Name

|

Business Address

|

Citizenship

|

|

Thomas J. Murphy

(Chief Financial Officer)

|

600 Steamboat Road

Greenwich, Connecticut 06830

|

United States

|

|

David A. Rosenstein

|

55 East 52nd Street

32nd Floor

New York, New York 10055

|

United States

|

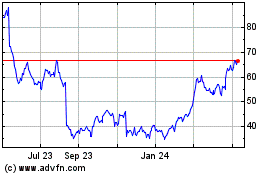

Sea (NYSE:SE)

Historical Stock Chart

From Mar 2024 to Apr 2024

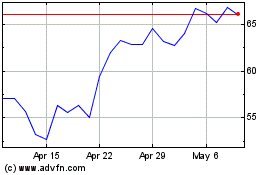

Sea (NYSE:SE)

Historical Stock Chart

From Apr 2023 to Apr 2024