Questar Corp. (NYSE:STR) net income grew 35% in 2008 to $683.8

million, or $3.88 per diluted share, compared to $507.4 million, or

$2.88 per diluted share, for the prior year. In the fourth quarter

of 2008, Questar net income was $121.2 million, or $0.69 per

diluted share, compared to $130.8 million, or $0.74 per diluted

share, for the 2007 period, a 7% decrease. Reported 2008 and

fourth-quarter net income included net mark-to-market losses on

natural gas basis-only swaps of $49.7 million, or $0.28 per diluted

share and $54.3 million or $0.31 per diluted share, respectively.

Questar net income included $40.6 million of after-tax gains on

asset sales during 2008, including $1.4 million in the fourth

quarter. Excluding the effect of net mark-to-market losses on

natural gas basis-only swaps and after-tax gains on asset sales,

Questar�s net income was $692.9 million or $3.93 per diluted share

for 2008 and $174.1 million or $0.99 per diluted share in the

fourth quarter.

NET INCOME BY

SUBSIDIARY

(in millions, except earnings per

share)

� � � � 3 Months Ended

December 31,

�

12 Months Ended

December 31,

�

2008 �

2007 Change

2008 �

2007 Change Market

Resources Questar E&P $47.9 $65.2 (27 )% $408.0 $285.5 43 %

Wexpro 18.5 15.8 17 73.9 59.2 25 Gas Management 16.8 14.7 14 81.5

55.3 47 Energy Trading and other

3.3 4.8

(31 )

22.1 20.8 6

Market Resources

Total 86.5 100.5 (14 ) 585.5 420.8 39 �

Questar Pipeline

14.0 11.8 19 58.0 45.0 29

Questar Gas 20.4 17.9 14 40.2 37.4

7

Corporate 0.3 0.6 (50 )

0.1 4.2 (98 )

QUESTAR CORPORATION

TOTAL $121.2 $130.8

(7 )% $683.8

$507.4 35 % � Earnings per

diluted share $0.69 $0.74 $3.88 $2.88 Average diluted shares 175.7

176.0 176.1 175.9

�Questar posted double-digit net income growth for the

sixth-straight year � driven by a 22% increase in natural gas and

oil-equivalent production in Questar E&P and record net income

in all six Questar business units,� said Keith O. Rattie, Questar

Chairman, President and CEO. �But 2009 shapes up to be a very tough

year for the U.S. economy, the natural gas industry, and thus for

our company. We�re well positioned to weather the storm, but we�ve

lowered 2009 earnings and production guidance to reflect

significantly lower energy prices, and lower capital spending,�

Rattie added.

2008 Highlights

- Questar E&P grew natural

gas, oil and natural gas liquids (NGL) production 22% to 171.4

billion cubic feet of natural gas equivalent (Bcfe) compared to

140.2 Bcfe in 2007. Natural gas comprised 89% of reported

production volumes. Questar E&P replaced 304% of 2008

production and grew proved reserves 19% to 2,218 Bcfe at year-end

2008.

- Average realized natural gas

prices at Questar E&P increased $1.11 per thousand cubic feet

(Mcf), or 17%, and average realized crude oil and NGL prices

increased $18.97 per barrel (bbl), or 35%. Natural gas hedges

increased reported revenues by $125.8 million, while oil hedges

decreased revenues by $31.9 million.

- Net mark-to-market losses on

natural gas basis-only hedges decreased net income $49.7 million in

2008 compared to a gain of $3.6 million a year-earlier.

- Sales of non-core assets at

Questar E&P increased net income $37.9 million in 2008 compared

to a net loss of $0.4 million in the year-earlier period.

- Wexpro grew its investment base

37% to $410.6 million at December 31, 2008. Wexpro produced 46.1

Bcf of cost-of-service gas for delivery to affiliate Questar Gas,

up 32% from 34.9 Bcf in 2007. In 2007 Questar Gas elected to defer

some Wexpro production and purchased replacement gas at low

regional prices.

- Gas Management net income grew

47%, driven by higher gathering and processing margins. Net

processing revenues increased 36% to $88.4 million due to a 59%

increase in fee-based processing volumes and higher keep-whole

processing margins.

- Questar Pipeline grew net income

to $58.0 million in 2008, a 29% increase from 2007, driven by

higher transportation revenues from expansion projects completed in

the fourth quarter of 2007 and higher NGL sales.

- Questar Gas earned $40.2

million, 7% more than a year ago, driven by customer growth.

- Questar earned a 16.2% return on

assets (ROA � defined as earnings before interest and income taxes

divided by average total assets) for the trailing 12-month period

ended December 31, 2008. Market Resources ROA was 19.4%; Questar

Pipeline ROA was 10.8%; and Questar Gas ROA was 7.2%.

Questar Updates 2009 EPS and Production Guidance

Questar now expects full-year 2009 net income to range from

$2.50 to $2.70 per diluted share compared to previous guidance of

$3.05 to $3.25 per diluted share. The company now estimates that

Questar E&P 2009 production will range from 180 to 186 Bcfe,

compared to 185 to 193 Bcfe in prior guidance, up about 5 to 9%

from 2008. This revised guidance assumes significantly lower

natural gas and oil prices than reflected in prior guidance.

Revised 2009 guidance also assumes capital expenditures of $1.3

billion, versus $1.6 billion in prior guidance, with most of the

reduction at Questar E&P. Questar capital expenditures totaled

$2.5 billion in 2008, including about $700 million associated with

gas and oil property acquisitions.

The company�s guidance assumes hedges in place on the date of

this release and excludes mark-to-market gains and losses on

basis-only swaps and any net gains and losses on asset sales. These

and other assumptions are summarized in the table below:

Guidance Assumptions

� �

�

2009 2009

Current

Previous

Earnings per diluted share $2.50-$2.70 $3.05-$3.25 Average diluted

shares (millions) 177.3 177.3 Questar E&P capital spending

(millions) $841 $1,050 Questar E&P production � Bcfe 180-186

185-193 Pinedale well completions 93-95 93-95 NYMEX gas price per

MMBtu(a) $4.50-$5.50 $6.50-$7.50 NYMEX crude oil price per bbl(a)

$45.00-$55.00 $70.00-$80.00 NYMEX/Rockies basis differential per

MMBtu(a) $3.00-$1.50 $3.50-$2.00 NYMEX/Midcontinent basis

differential per MMBtu(a) $2.00-$1.00 $2.00-$1.00

(a)For 2009 unhedged volumes

- Questar E&P has hedged about

72% of forecast natural gas and oil-equivalent production for 2009

with fixed-price swaps. Additionally, the company has hedged about

14% of forecast 2009 production with natural gas basis-only swaps

(see table at the end of this release).

- The company estimates that a

$1.00 per MMBtu change in the average NYMEX price of natural gas

for 2009 would result in about an $0.08 change in earnings per

diluted share.

- The company also estimates that

a $10.00 per barrel change in the average NYMEX price of oil for

2009 would result in about a $0.07 change in earnings per diluted

share.

Questar E&P Grows Production 22% in 2008; Net Income Up

43%

Questar E&P � a Market Resources subsidiary that acquires,

explores for, develops and produces natural gas and oil � reported

production of 171.4 Bcfe in 2008 compared to 140.2 Bcfe in 2007, a

22% increase. Higher realized natural gas, crude oil and NGL prices

and growing production more than offset a 17% increase in average

production costs. Increased production costs were driven by higher

production taxes, interest expense and depreciation, depletion and

amortization expense. Net mark-to-market losses on natural gas

basis-only swaps decreased net income $49.7 million in 2008

compared to a $3.6 million gain in 2007. Sales of non-core assets

increased net income $37.9 million in 2008 compared to a $0.4

million loss in 2007.

In the fourth quarter of 2008, Questar E&P net income

decreased 27% to $47.9 million compared to $65.2 million a year

earlier. Net mark-to-market losses on natural gas basis-only swaps

decreased fourth-quarter 2008 net income $54.3 million, offsetting

the benefit of a 28% increase in production volumes and higher

realized gas prices. Impairment expense increased $29.9 million in

the quarter-to-quarter comparison as a result of higher total

production costs combined with lower gas and oil prices.

Questar E&P � Production by

Region

� � 3 Months Ended 12 Months Ended December 31, December 31,

2008 �

2007 �

Change

2008 �

2007 �

Change (Bcfe)

(Bcfe) Pinedale Anticline 15.6 12.4 26 % 56.8 47.4 20 % Uinta Basin

7.2 6.7 7 26.9 25.4 6 Rockies Legacy

4.9

3.2 53

19.9 16.4 21 Subtotal

� Rocky Mountains 27.7 22.3 24 103.6 89.2 16 Midcontinent

18.3 13.6 35

67.8

51.0 33

Total Questar E&P

46.0 35.9 28

% 171.4 140.2

22 %

Questar E&P � Realized

Prices and Hedging Impact

� � � � 3 Months Ended 12 Months Ended December 31, December 31,

2008 �

2007 �

Change

2008 �

2007 �

Change �

Realized natural gas price ($ per Mcf) $7.70 $6.57 17 % $7.56 $6.45

17 % Natural gas hedging impact ($ per Mcf) 3.38 2.32 0.83 2.01 �

Realized oil and NGL price ($ per bbl) $52.08 $60.66 (14 )% $72.96

$53.99 35 % Oil and NGL hedging impact ($ per bbl) 6.03 (13.40 )

(9.78 ) (5.66 ) � Net mark-to-market gains (losses) on natural gas

basis-only swaps ($ millions) Pre-tax ($86.7 ) ($8.5 ) ($79.2 )

$5.7 After-tax ($54.3 ) ($5.3 ) ($49.7 ) $3.6

Questar may enter into derivative transactions on up to 100% of

forecast production from proved reserves to lock in acceptable

returns on invested capital and to protect cash flow and net income

from a decline in commodity prices. The company uses natural gas

basis-only swaps to protect cash flows and net income from widening

natural gas-price basis differentials that may result from capacity

constraints on regional gas pipelines.

Questar E&P production costs (the sum of depreciation,

depletion and amortization expense, lease operating expense,

general and administrative expense, allocated interest expense, and

production taxes) per unit of gas-equivalent production increased

17% compared to 2007, due primarily to increased depreciation,

depletion and amortization expense, production taxes and allocated

interest expense.

Questar E&P � Production

Costs

� � 3 Months Ended 12 Months Ended December 31, December 31, (per

Mcfe) � (per Mcfe) �

2008 �

2007

Change 2008 �

2007

Change Depreciation, depletion and amortization $2.14

$1.80 19 % $1.93 $1.74 11 % Lease operating expense 0.76 0.64 19

0.73 0.63 16 General and administrative expense 0.30 0.37 (19 )

0.33 0.40 (18 ) Allocated interest expense 0.35 0.18 94 0.34 0.18

89 Production taxes

0.37 0.48 (23 )

0.61 0.43 42

Production costs

$3.92 $3.47 13

% $3.94 $3.38

17 %

- Production volume-weighted

average depreciation, depletion and amortization per Mcfe (the

DD&A rate) increased due to higher costs for drilling,

completion and related services, increased cost of steel casing,

other tubulars and wellhead equipment. The DD&A rate also

increased due to the ongoing depletion of older, lower-cost

reserves and the increasing component of Questar E&P production

derived from recently acquired, higher-cost fields in the

Midcontinent.

- Lease operating expense per Mcfe

increased due to higher costs of materials and consumables,

increased produced-water disposal costs and increased well-workover

activity.

- General and administrative

expense per Mcfe decreased as the result of increased

production.

- Allocated interest expense per

unit of production increased primarily due to financing costs

related to the first quarter 2008 acquisition of natural gas

development properties in northwest Louisiana.

- Production taxes per Mcfe

increased in 2008 as the result of higher natural gas and oil sales

prices. The company pays production taxes based on a percentage of

sales prices, excluding the impact of hedges. Production taxes per

Mcfe decreased in the fourth quarter compared to the 2007 quarter

due to lower natural gas and oil sales prices.

Wexpro Net Income Up 25% in 2008

Wexpro � a Market Resources subsidiary that develops and

produces cost-of-service reserves for affiliate Questar Gas �

benefited from a higher average investment base compared to the

prior-year period. Wexpro investment base at December 31, 2008, was

$410.6 million compared to $300.4 million a year ago, a 37%

increase. In the fourth quarter of 2008, Wexpro net income was

$18.5 million compared to $15.8 million for the prior year, a 17%

increase, primarily due to a higher investment base.

Under a long-standing agreement with the states of Utah and

Wyoming, Wexpro recovers its costs and earns an unlevered after-tax

return of about 19 to 20% on its investment base � the investment

in commercial wells and related facilities, adjusted for working

capital and reduced for deferred income taxes and accumulated

depreciation.

Gas Management Net Income Up 47% in 2008

Questar Gas Management (Gas Management) � Market Resources�

gas-gathering and processing-services business � grew net income

47% in 2008, driven by increased gathering and processing margins.

Gathering margin increased $49.8 million or 74%, and processing

margin increased $22.7 million or 41%. Net processing revenues rose

36% to $88.4 million due to increased fee-based processing volumes

and a greater frac-spread � the difference between the market value

of the NGL extracted from the gas stream and the cost of the

Btu-equivalent volume of natural gas required to replace the

extracted liquids. Gas Management grew fee-based gas-processing

volumes 59% in 2008 to 201.5 million MMBtu. Fee-based

gas-processing revenues grew 57% compared to a year ago, while

keep-whole processing margin increased 28% or $12.4 million.

Approximately 76% of Gas Management net operating revenue (total

revenue less processing plant-shrink) was derived from fee-based

contracts compared to 74% in 2007. In the fourth quarter of 2008,

Gas Management net income increased 14% to $16.8 million compared

to $14.7 million in 2007, driven by higher gathering margins.

Questar Pipeline Net Income Up 29% in 2008

Questar Pipeline � which provides interstate natural gas

transportation and storage services � grew net income 29% in 2008.

Revenues increased $42.7 million or 21%, driven by higher

transportation volumes related to system expansion projects placed

into service in late 2007, and higher NGL prices. NGL prices

increased 43% and sales volumes increased 18% in the year over year

comparison. Operating and maintenance expense increased $5.8

million due to additional operating costs for new transportation

facilities. Operating, maintenance, general and administrative

expenses totaled $0.10 per decatherm transported, down from $0.14

in the year earlier, the net result of a 53% increase in

transportation volumes and a 7% increase in these expenses. 2008

net income was reduced by $1.9 million for asset impairments,

offset by net gains on the sale of assets and other one-time

items.

Questar Pipeline net income rose 19% to $14.0 million in the

fourth quarter of 2008 compared to $11.8 million in the year-ago

period, primarily due to system expansions placed in service late

in 2007.

Questar Gas Net Income Up 7% in 2008

Questar Gas � which provides retail natural gas distribution

services in Utah, Wyoming and Idaho � reported higher net income,

driven by customer growth and an increase in Utah general rates

effective August 2008, partially offset by higher expenses,

primarily bad-debt expense, demand-side management costs and

interest expense. Operating, maintenance, general and

administrative expenses totaled $142 per customer in 2008, compared

to $136 per customer in 2007. At December 31, 2008, Questar Gas

served 888,602 customers, up 14,995 or 1.7% from December 31,

2007.

Questar Gas net income was $20.4 million in the fourth quarter

of 2008, 14% higher than the year-earlier period, primarily as a

result of customer growth.

2008 Earnings Teleconference

Questar management will discuss 2008 results and the outlook for

2009 in a conference call with investors Thursday, February 12,

beginning at 9:30 a.m. EST. The call can be accessed on the company

Internet site at www.questar.com.

About Questar

Questar Corp. (NYSE:STR) is a natural gas-focused energy company

with an enterprise value of about $8.5 billion. Questar finds,

develops, produces, gathers, processes, transports, stores and

distributes natural gas.

Forward-Looking Statements

This release includes forward-looking statements within the

meaning of Section 27(a) of the Securities Act of 1933, as amended,

and Section 21(e) of the Securities Exchange Act of 1934, as

amended. Such statements are based on management�s current

expectations, estimates and projections, which are subject to a

wide range of uncertainties and business risks. Factors that could

cause actual results to differ from those anticipated are discussed

in the company�s periodic filings with the Securities and Exchange

Commission, including its annual report on Form 10-K for the year

ended December 31, 2007. Questar undertakes no obligation to

publicly correct or update the forward-looking statements in this

news release, in other documents, or on the Web site to reflect

future events or circumstances. All such statements are expressly

qualified by this cautionary statement.

For more information, visit Questar�s Internet site at:

www.questar.com.

Hedge Positions � February 11,

2009

� � � � � � Time Periods �

Rocky

Mountains

� Midcontinent � Total � Rocky

Mountains

� Midcontinent � Total �

Estimated Gas (Bcf) fixed-price

swaps Average price per Mcf, net to the well 2009

First half 34.5 29.5 64.0 $7.24 $8.12 $7.65 Second half 35.0 � 30.0

� 65.0 7.24 8.12 7.65 12 months 69.5 59.5 129.0 7.24 8.12 7.65 �

2010 First half 11.7 26.2 37.9 $5.46 $8.09 $7.27 Second half

12.0 � 26.6 � 38.6 5.46 8.09 7.27 12 months 23.7 52.8 76.5 5.46

8.09 7.27 �

Estimated Gas (Bcf) basis-only swaps

Average basis per Mcf vs. NYMEX 2009 First half 9.3

3.3 12.6 $2.94 $1.22 $2.49 Second half 9.4 � 3.4 � 12.8 2.94 1.22

2.49 12 months 18.7 6.7 25.4 2.94 1.22 2.49 �

2010 First

half 25.2 6.6 31.8 $3.54 $0.95 $3.00 Second half 25.5 � 6.8 � 32.3

3.54 0.95 3.00 12 months 50.7 13.4 64.1 3.54 0.95 3.00 �

2011 First half 45.3 6.9 52.2 $2.29 $0.79 $2.09 Second half

46.1 � 6.9 � 53.0 2.29 0.79 2.09 12 months 91.4 13.8 105.2 2.29

0.79 2.09

Hedge Positions � February 11,

2009

� � � � � � Time Periods � Rocky

Mountains

� Midcontinent � Total � Rocky

Mountains

� Midcontinent Total

Estimated Oil (Mbbl) fixed-price

swaps Average price per Bbl, net to the well �

2009 First half 217 145 362 $60.55 $66.55 $62.95 Second half

221 � 147 � 368 60.55 66.55 62.95 12 months 438 292 730 60.55 66.55

62.95 QUESTAR CORPORATION CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) � � 3 Months Ended December 31, � 12 Months Ended

December 31,

2008 � 2007

2008 � 2007 � � � � Restated

� � � � (in millions, except per share amounts) REVENUES Market

Resources (1)

$507.6 $423.1

$2,297.2 $1,671.3 Questar

Pipeline

41.9 33.7

173.7 127.7 Questar Gas �

329.3 � � 286.7 � �

994.2 � � 927.6 � Total Revenues

(1)

878.8 743.5

3,465.1 2,726.6 � OPERATING EXPENSES

Cost of natural gas and other products sold (excluding operating

expenses shown separately) (1)

245.8 259.0

1,007.6

917.1 Operating and maintenance

97.6 76.7

374.0 298.6

General and administrative

43.1 46.5

159.7 165.4

Production and other taxes

27.2 22.8

164.9 101.0

Depreciation, depletion and amortization

142.5 95.7

494.4 369.1 Exploration

14.6 15.3

29.3 22.0

Abandonment and impairment �

38.5 � � 4.8 � �

59.4 �

� 11.2 � Total Operating Expenses (1)

609.3 520.8

2,289.3 1,884.4 Net gain (loss) from asset sales �

2.3 � � (1.2 ) �

64.7 � � (0.9 ) Operating Income

271.8 221.5

1,240.5 841.3 Interest and other income

9.7 4.7

26.7 14.3 Minority interest

(2.1

) (9.0 ) Income from unconsolidated affiliates

1.0 2.1

2.3 8.9 Net mark-to-market gain (loss) on

basis-only swaps

(86.7 ) (8.5 )

(79.2 )

5.7 Interest expense �

(28.6 ) � (19.2 ) �

(119.5 ) � (72.2 ) Income Before Income Taxes

165.1 200.6

1,061.8 798.0 Income taxes �

43.9

� � 69.8 � �

378.0 � � 290.6 � Net Income �

$121.2 �

� $130.8 � �

$683.8 � � $507.4 � � EARNINGS PER COMMON SHARE

Basic

$0.70 $0.76

$3.96 $2.95 Diluted

0.69

0.74

3.88 2.88 Weighted-Average Common Shares Outstanding

Basic

173.0 172.3

172.8 172.0 Diluted

175.7

176.0

176.1 175.9 Dividends Per Common Share

$0.125

$0.1225

$0.4925 $0.485 � (1) Disclosures with respect to

operations by line of business have been restated to correct for

errors related to intercompany elimination of natural gas and crude

oil sales between Questar E&P and Energy Trading. The

restatement did not impact net income, operating income, the

Condensed Consolidated Balance Sheets or the Condensed Consolidated

Statement of Cash Flows. QUESTAR CORPORATION OPERATIONS BY LINE OF

BUSINESS (Unaudited) � � 3 Months Ended December 31, 12 Months

Ended December 31,

2008 � 2007

2008 � 2007 � � � �

Restated � � � � (in millions)

Revenues from Unaffiliated

Customers Questar E&P

$362.0 $254.0

$1,392.1

$956.0 Wexpro

2.3 4.2

31.1 21.6 Gas Management

56.8 51.5

265.9 189.3 Energy Trading and other (1) �

86.5 � � 113.4 � �

608.1 � � 504.4 Market Resources

(1)

507.6 423.1

2,297.2 1,671.3 Questar Pipeline

41.9 33.7

173.7 127.7 Questar Gas �

329.3 � �

286.7 � �

994.2 � � 927.6 Total (1) �

$878.8 � �

$743.5 � �

$3,465.1 � � $2,726.6 �

Revenues from

Affiliated Companies Wexpro

$56.5 $37.3

$209.9

$155.7 Gas Management

6.9 4.9

24.3 17.0 Energy

Trading and other (1) �

121.2 � � 140.5 � �

834.5 � �

484.1 Market Resources (1)

184.6 182.7

1,068.7 656.8

Questar Pipeline

18.5 19.2

74.9 78.2 Questar Gas � �

� 0.5 � �

6.1 � � 4.9 Total (1) �

$203.1 � � $202.4 �

�

$1,149.7 � � $739.9 �

Operating Income (Loss)

Questar E&P

$150.8 $115.6

$762.0 $472.6 Wexpro

28.0 23.0

111.3 89.3 Gas Management

25.9 22.8

139.4 84.6 Energy Trading and other �

3.6 � � 5.7 � �

31.8 � � 26.9 Market Resources

208.3 167.1

1,044.5 673.4 Questar Pipeline

25.2 21.6

112.9

91.0 Questar Gas

39.4 33.0

84.2 76.1 Corporate �

(1.1 ) � (0.2 ) �

(1.1 ) � 0.8 Total �

$271.8 � � $221.5 � �

$1,240.5 � � $841.3 �

Net

Income Questar E&P

$47.9 $65.2

$408.0 $285.5

Wexpro

18.5 15.8

73.9 59.2 Gas Management

16.8

14.7

81.5 55.3 Energy Trading and other �

3.3 � � 4.8

� �

22.1 � � 20.8 Market Resources

86.5 100.5

585.5 420.8 Questar Pipeline

14.0 11.8

58.0

45.0 Questar Gas

20.4 17.9

40.2 37.4 Corporate �

0.3 � � 0.6 � �

0.1 � � 4.2 Total �

$121.2 � �

$130.8 � �

$683.8 � � $507.4 � (1) Disclosures with respect

to operations by line of business have been restated to correct for

errors related to intercompany elimination of natural gas and crude

oil sales between Questar E&P and Energy Trading. The

restatement did not impact net income, operating income, the

Condensed Consolidated Balance Sheets or the Condensed Consolidated

Statement of Cash Flows. QUESTAR CORPORATION SELECTED OPERATING

STATISTICS (Unaudited) � � 3 Months Ended December 31, � 12 Months

Ended December 31, � �

2008 � 2007 �

2008 � 2007

MARKET RESOURCES � � Questar E&P production volumes

Natural gas (Bcf)

40.9 30.9

151.9 121.9 Oil and

natural gas liquids (MMbbl)

0.9 0.8

3.3 3.0 Total

production (Bcfe)

46.0 35.9

171.4 140.2 Average daily

production (MMcfe)

500.2 389.8

468.3 384.1 Questar

E&P average realized price, net to the well (including hedges)

Natural gas (per Mcf)

$7.70 $6.57

$7.56 $6.45 Oil and

NGL (per bbl)

$52.08 $60.66

$72.96 $53.99 Wexpro

investment base at Dec. 31, net of depreciation and deferred income

taxes (millions)

$410.6 $300.4 Natural gas processing

volumes NGL sales (MMgal)

23.6 22.0

89.5 76.5 NGL

sales price (per gal)

$0.64 $1.07

$1.18 $0.98

Fee-based processing (millions of MMBtu) (1) For unaffiliated

customers

17.1 9.2

87.4 44.1 For affiliated customers

�

33.5 � � 19.7 � �

114.1 � � 82.5 � Total fee-based

processing volumes �

50.6 � � 28.9 � �

201.5 � �

126.6 � Fee-based processing (per MMBtu)

$0.16 $0.15

$0.14 $0.15 Natural gas gathering volumes (millions of

MMBtu) (1) For unaffiliated customers

60.4 35.1

224.0

162.1 For affiliated customers �

46.8 � � 30.9 � �

168.5 � � 128.1 � Total gathering �

107.2 � � 66.0 �

�

392.5 � � 290.2 � Gathering revenue (per MMBtu) (1)

$0.29 $0.36

$0.31 $0.32 Natural gas and oil marketing

volumes (MMdthe)

49.2 51.2

195.2 201.4

QUESTAR

PIPELINE Natural gas transportation volumes (MMdth) For

unaffiliated customers

153.2 100.6

608.1 352.3 For

Questar Gas

32.5 32.1

120.9 113.8 For other

affiliated customers �

4.0 � � 4.1 � �

9.2 � � 16.0 �

Total transportation �

189.7 � � 136.8 � �

738.2 � �

482.1 � Transportation revenue (per dth)

$0.23 $0.25

$0.23 $0.26 Firm-daily transportation demand at Dec. 31,

(including White River Hub of 1,005 Mdth in 2008)

4,155

3,112 Natural gas processing NGL sales (MMgal)

2.1 1.1

8.5 7.2 NGL sales price (per gal)

$0.83 $1.64

$1.70 $1.19

QUESTAR GAS Natural gas volumes (MMdth)

Residential and commercial �

33.9 � � 36.0 � �

112.3

� � 106.1 � Industrial

0.4 0.5

1.7 1.6 Transportation

for industrial customers �

16.4 � � 18.9 � �

62.2 � �

53.8 � Total industrial �

16.8 � � 19.4 � �

63.9 � �

55.4 � Total deliveries �

50.7 � � 55.4 � �

176.2 � �

161.5 � Natural gas revenue (per dth) Residential and commercial

sales

$9.27 $7.65

$8.25 $8.26 Industrial

6.96

5.93

6.99 6.18 Transportation for industrial customers

$0.19 $0.16

$0.16 $0.18 Temperatures - colder

(warmer) than normal

(2 %) 5 %

8 % 2 %

Temperature-adjusted usage per customer (dth)

36.0 37.6

109.9 110.8 Customers at Dec. 31, (thousands)

888.6

873.6 (1) one MMBtu = one dth QUESTAR CORPORATION PRELIMINARY

CONDENSED CONSOLIDATED BALANCE SHEETS � �

December 31,

December 31,

2008 2007 � �

(Unaudited) � � (in

millions) ASSETS Current Assets Cash and cash equivalents

$23.9 $14.2 Accounts receivable, net

482.4 417.8 Fair

value of derivative contracts

431.3 78.1 Inventories

192.4

115.0 Prepaid expenses and other �

55.0 � � 33.8 � Total

Current Assets �

1,185.0

� � 658.9 � Property, Plant and Equipment

10,235.5 7,741.9

Accumulated depreciation, depletion and amortization �

(3,096.8 ) � (2,643.3 ) Net Property, Plant and

Equipment �

7,138.7 � � 5,098.6 � Investment in

unconsolidated affiliates

68.4 52.8 Goodwill

70.0

70.7 Fair value of derivative contracts

106.3 7.8 Other

noncurrent assets, net �

68.0 � � 55.4 � Total Assets �

$8,636.4

� � $5,944.2 � � LIABILITIES AND SHAREHOLDERS' EQUITY Current

Liabilities Short-term debt

$231.1 $260.6 Accounts payable

and accrued expenses

681.6

564.5 Fair value of derivative contracts

0.5 9.3

Purchased-gas adjustment

45.8 58.1 Deferred income taxes -

current

130.6 4.9 Current portion of long-term debt �

42.0 � � 101.3 � Total Current Liabilities �

1,131.6

� � 998.7 � Long-term debt, less current portion

2,078.9

1,021.2 Deferred income taxes

1,334.1 942.4 Fair value of

derivative contracts

69.0 22.1 Other long-term liabilities

575.3 381.9 Minority interest

29.5 Common

Shareholders' Equity �

3,418.0 � � 2,577.9 � Total

Liabilities and Common Shareholders' Equity �

$8,636.4

� � $5,944.2 � QUESTAR CORPORATION PRELIMINARY CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) � � � 12 Months

Ended December 31, � �

2008 � � 2007 � (in millions)

OPERATING ACTIVITIES Net income

$683.8 $507.4 Adjustments to

reconcile net income to net cash provided from operating

activities: Depreciation, depletion and amortization

502.1

375.8 Deferred income taxes

377.1 191.2 Share-based

compensation

16.7 12.9 Abandonment and impairment

59.4 11.2 Dry exploratory well expense

9.7 12.3 Net

(gain) loss from asset sales

(64.7 ) 0.9 Minority

interest

9.0

�

(Income) from unconsolidated affiliates

(2.3 ) (8.9 )

Distributions from unconsolidated affiliates

0.5 10.4 Net

mark-to-market (gain) loss on basis-only swaps

79.2 (5.7 )

Other

(2.0 ) (1.0 ) Changes in operating assets and

liabilities �

(172.3 ) � 34.5 � Net Cash Provided

From Operating Activities �

1,496.2 � � 1,141.0 � �

INVESTING ACTIVITIES Capital expenditures

(2,485.7 )

(1,398.3 ) Cash used in disposition of assets

(3.7 )

(1.3 ) Proceeds from disposition of assets �

130.7 � � 14.5

� Net Cash Used In Investing Activities �

(2,358.7 )

� (1,385.1 ) � FINANCING ACTIVITIES Common stock

(8.2

) (4.3 ) Long-term debt issued, net of issuance costs

1,741.7 100.0 Long-term debt repaid

(751.3 )

(10.0 ) Change in short-term debt

(29.5 ) 220.6

Distribution to minority interest

(9.3 ) Excess tax

benefits from share-based compensation

13.2 11.1 Dividends

paid

(85.4 ) (83.7 ) Other �

1.0 � � � Net

Cash Provided From Financing Activities �

872.2 � � 233.7 �

� Change in cash and cash equivalents

9.7 (10.4 ) Beginning

cash and cash equivalents �

14.2 � � 24.6 � Ending Cash and

Cash Equivalents �

$23.9 � � $14.2 �

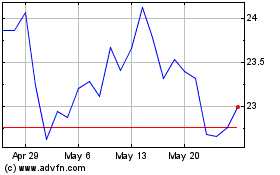

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From May 2024 to Jun 2024

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Jun 2023 to Jun 2024