Quanex Announces Fiscal First Quarter 2004 Results Engineered

Products Reports Record First Quarter Operating Income; Integration

of MACSTEEL Monroe and TruSeal Technologies Proceeding Well

HOUSTON, Feb. 26 /PRNewswire-FirstCall/ -- Quanex Corporation

announced fiscal first quarter results for the period ending

January 31, 2004. Net sales for the quarter were $281.2 million,

23% higher than a year ago. Net sales included one month's results

from the Company's acquisitions of MACSTEEL Monroe and TruSeal

Technologies of $27.4 million. The Company commented that first

quarter demand at its Vehicular Products and Building Products

segments was very strong and that backlogs for the second quarter

remained at high levels. Net income for Quanex was $6.4 million,

down 6% compared to last year's record first quarter. Diluted

earnings per share were $.39, the Company's second best first

quarter. Monroe and TruSeal contributed about $.05 (after interest

expense) to the diluted earnings per share figure in January and

the first quarter. Net sales for the first quarter 2003 were $229.5

million. Net income and diluted earnings per share for the first

quarter 2003 were $6.8 million and $.41, respectively. Highlights

Regarding the Company's results, Raymond A. Jean, chairman and

chief executive officer stated, "We delivered near record first

quarter results, driven by very strong customer demand across most

product lines. During the quarter, we continued to be challenged by

runaway steel scrap costs and the severe impact those costs had on

the otherwise solid operating results at MACSTEEL. North American

light vehicle builds were about flat compared to a year ago. Heavy

duty truck builds continue to post gains, with builds up some 25%

duringthe quarter versus a year ago. Housing activity remained

brisk through calendar year-end, which allowed Engineered Products,

excluding TruSeal, to post record first quarter operating income,"

Jean said. "We have made excellent progress to date integrating

Monroe and TruSeal into Quanex. We are very impressed by the

quality of the management teams and are excited by the long term

earnings potential of both businesses. We are comfortable with our

previous guidance that the two acquisitions will contribute $.40 to

$.50 to our fiscal 2004 diluted earnings per share." Quarterly

Financials ($ in millions, except per share data) 1st qtr 2004 1st

qtr 2003 inc/dcr Net Sales $281.2 $229.5 23% Operating Income 10.7

10.1 6% Net Income 6.4 6.8 -6% EPS: Basic $ .39 $ .41 -5% EPS:

Diluted .39 .41 -5% Segment Commentary VEHICULAR PRODUCTS ($ in

millions) 1st qtr 2004 1st qtr 2003 Net Sales $141.0 $108.9

Operating Income 8.7 9.9 The Vehicular Products segment includes

MACSTEEL, along with the newly acquired North Star Steel Monroe

facility, Piper Impact and Temroc Metals. The segment's main

drivers are North American light vehicle builds and heavy duty

truck builds. "North American light vehicle builds remained at

healthy levels during the quarter, and MACSTEEL benefited from

improving heavy duty truck production. Excluding Monroe, MACSTEEL

shipments were up about 10% for the quarter, while operating income

was down some 20%. Skyrocketing steel scrap costs were an issue

during the quarter as MACSTEEL's scrap costs were up some $65 per

ton over a year ago. Offsetting part of this cost increase was

MACSTEEL's higher scrap surcharge effective January 1, 2004,

productivity gains from lean initiatives and higher value added

product sales. Further bolstering demand has been a strengthening

of the secondary markets from the oil patch to defense. We see real

strength in MACSTEEL's business going forward with our backlog some

50% higher than a year ago," Jean said. "Piper Impact continues to

struggle with the reduction of their base business. They narrowed

the loss during the quarter versus the year ago period, and we are

getting closer to finalizing a review of our strategic options,"

said Jean. BUILDING PRODUCTS ($ in millions) 1st qtr 2004 1st qtr

2003 Net Sales $140.2 $120.6 Operating Income 5.5 4.2 The Building

Products segment includes Engineered Products, including the recent

acquisition of TruSeal Technologies, and Nichols Aluminum. The main

drivers of the segment are residential housing starts and

remodeling expenditures. "Engineered Products, excluding TruSeal's

excellent first month results, reported record income in our first

quarter even though January's inclement winter did begin to slow

the business," continued Jean. "Housing starts and remodeling

activity ended the calendar year at very high levels and the

momentum has clearly carried over into 2004. This level of activity

is an excellent indicator of the underlying strength in this

business segment." "Nichols Aluminum had a good sales quarter and

operating income was slightly improved from a year ago. Shipments

remained strong to our traditional building and construction

markets and our higher margin coated sheet was sold out in the

quarter. The Golden facility, which supplies food packaging and

container products, also reported good customer activity. As with

Engineered Products, Nichols' first quarter is seasonally their

slowest sales period. Currently, we have a good backlog of business

and customer activity in the secondary markets is improving," said

Jean. Outlook Demand in the Company's two target markets, vehicular

products and building products, continues to be bolstered by a

rebounding economy and favorable interest rates. Business

conditions and the economy are expected to continue to gain

strength throughout 2004. In Quanex's Vehicular Products segment,

business activity looks very promising going forward; however, the

unprecedented sharp spikes in scrap prices remain an ongoing

concern at MACSTEEL. The January and February cost increases have

been particularly painful because of their sheer magnitude, and are

well in excess of our current scrap surcharge. This situation will

result in a temporary, yet significant reduction in margins at

MACSTEEL in the second quarter. In the Building Productssegment,

order activity remains strong, and while weather sensitive, the

Company expects better second quarter results, excluding TruSeal,

compared to a year ago. At Nichols Aluminum, both rising London

Metal Exchange (LME) ingot prices and scrap prices remain an issue,

however, sales prices have also increased, mitigating part of an

expected second quarter margin squeeze. Housing starts for 2004 are

expected to moderate only slightly from last year's record 1.85

million units. Building Products' other driver, remodeling

expenditures, is also expected to remain at healthy levels. Taken

together, the sales outlook remains positive. However,

uncertainties surrounding the cost of steel and aluminum scrap in

the second quarter and their eventual recovery complicates the

Company's ability to accurately forecast its earnings for both the

second quarter and the year. At this time, Quanex expects its

fiscal second quarter 2004 diluted earnings per share to be down

significantly from the year ago period. The Company will publish

second quarter diluted earnings per share guidance when it releases

its second quarter update in April. Guidance for the year will be

provided once the Company has a better sense of its annualized cost

of steel scrap. Other The Company continues to account for stock

options using the current transition provisions of SFAS No. 123.

Accordingly, Quanex does not reflect the option expense in its

income statement or diluted earnings per share. However, the

Company does disclose the impact on net income and diluted earnings

per share in the footnotes to its SEC financial statements.

Expensing stock options would have reduced net income by about

$563,000 and $357,000 for the first quarter of 2004 and 2003

respectively, and would have reduced diluted earnings per share by

$.03 and $.02, respectively. Dividend Declared The Board of

Directors declared the Company's quarterly cash dividend of $.17

per share on the Company's common stock, payable March 31, 2004 to

shareholders of record on March 15, 2004. Corporate Profile Quanex

is a $1.3 billion industry-leading manufacturer of value-added

engineered materials and components serving the Vehicular Products

and Building Products markets. Financial Statistics as of 1/31/04

Book value per common share: $27.74; Total debt to capitalization:

33.51%; Return on invested capital: 8.32%; Return on common equity:

9.78%; Actual number of common shares outstanding: 16,421,724

Definitions Book value per common share -- calculated as total

stockholders' equity as of balance sheet date divided by actual

number of common shares outstanding; Total debt to capitalization

-- calculated as the sum of both the current and long term portion

of debt, as of balance sheet date, divided by the sum of both the

current and long term portion of debt plus total stockholders'

equity as of balance sheet date; Return on invested capital --

calculated as the total of the prior 12 months net income plus

prior 12 months after-tax interest expense and capitalized

interest, the sum of which is divided by the trailing five quarters

average total debt (current and long term) and total stockholders'

equity; Return on common equity -- calculated as the prior 12

months net income, divided by the trailing five quarters average

common stockholders' equity. Statements that use the words

"expect," "should," "will," "might," or similar words reflecting

future expectations or beliefs are forward-looking statements.

Thestatements found above are based on current expectations. Actual

results or events may differ materially from this release. Factors

that could impact future results may include, without limitation,

the effect of both domestic and global economic conditions, the

impact of competitive products and pricing, and the availability

and cost of raw materials. For a more complete discussion of

factors that may affect the Company's future performance, please

refer to the Company's most recent 10-K filing (December 29, 2003)

under the Securities Exchange Act of 1934, in particular the

sections titled, "Private Securities Litigation Reform Act"

contained therein. For further information, visit the Company's

website at http://www.quanex.com/ . Financial Contact: Jeff Galow,

713/877-5327 Media Contact: Valerie Calvert, 713/877-5305 QUANEX

CORPORATION CONSOLIDATED STATEMENTS OF INCOME (In thousands, except

per share data) (Unaudited) Three months ended January 31, 2004

2003 Net sales $281,156 $229,509 Cost of sales245,086 194,525

Selling, general and administrative expense 13,108 12,855

Depreciation and amortization 12,730 12,014 Gain on sale of land

(454) --- Operating income 10,686 10,115 Interest expense (820)

(975) Other, net 335 1,459 Income before income taxes 10,201 10,599

Income tax expense (3,774) (3,816) Net income $6,427 $6,783

Weighted average common shares outstanding: Basic 16,318 16,406

Diluted 16,589 16,648 Earnings per common share: Basic $0.39 $0.41

Diluted $0.39 $0.41 Cash dividends per share $0.17 $0.17 QUANEX

CORPORATION INDUSTRY SEGMENT INFORMATION (In thousands) (Unaudited)

Three months ended January 31, 2004 2003 Net sales: Vehicular

Products $140,979 $108,932 Building Products 140,177 120,577 Net

sales $281,156 $229,509 Operating income: Vehicular Products $8,680

$9,887 Building Products 5,511 4,167 Corporate and Other (3,505)

(3,939) Operating income $10,686 $10,115 QUANEX CORPORATION

CONSOLIDATED BALANCE SHEETS (In thousands) (Unaudited) January 31,

October 31, 2004 2003 2003 2002 Assets $10,182 $5,425 Cash and

equivalents $22,108 $18,283 Accounts and notes receivable, 165,393

103,710 net 123,185 116,122 125,436 100,797 Inventories 79,322

90,756 16,609 12,600 Other current assets 8,116 10,640 317,620

222,532 Total current assets 232,731 235,801 Property, plant and

equipment, 408,315 349,674 net 335,904 353,132 137,730 66,436

Goodwill, net 66,436 66,436 60,121 35,604 Other assets 30,792

33,771 $923,786 $674,246 Total assets $665,863 $689,140 Liabilities

and stockholders' equity $117,728 $79,219 Accounts payable $89,435

$76,588 47,647 39,512 Accrued liabilities 39,209 48,973 7,043 7,180

Income taxes payable 7,381 4,839 --- 2,746 Other current

liabilities 46 3,970 3,727 445 Current portion of long-term debt

3,877 434 176,145 129,102 Total current liabilities 139,948 134,804

225,902 70,051 Long-term debt 15,893 75,131 945 2,176 Deferred

pension credits 8,323 4,960 Deferred postretirement welfare 7,824

8,152 benefits 7,845 7,928 41,446 30,464 Deferred income taxes

34,895 29,210 15,962 14,196 Other liabilities 13,800 15,712 468,224

254,141 Total liabilities 220,704 267,745 455,562 420,105 Total

stockholders' equity 445,159 421,395 Total liabilities and $923,786

$674,246 stockholders' equity $665,863 $689,140 QUANEX CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOW (In thousands) (Unaudited)

Three months ended January 31, 2004 2003 Operating activities: Net

income $6,427 $6,783 Adjustments to reconcile net income to cash

provided by operating activities: Gain on sale of land (454) ---

Depreciation and amortization 12,838 12,107 Deferred income taxes

1,501 1,254 Deferred pension and postretirement benefits (7,399)

(2,560) 12,913 17,584 Changes in assets and liabilities, net of

effects from acquisitions and dispositions: Decrease (Increase) in

accounts and notes receivable (1,790) 12,412 Increase in inventory

(6,416) (10,041) Increase in accounts payable 6,370 2,631 Increase

(Decrease) in accrued liabilities 2,380 (9,461) Increase (Decrease)

in income taxes payable (487) 2,341 Other, net (2,078) (3,476) Cash

provided by operating activities 10,892 11,990 Investment

activities: Acquisitions, net of cash acquired (231,913) ---

Proceeds from sale of land 637 --- Capital expenditures, net of

retirements (4,166) (8,520) Other, net (602) (1,147) Cash used for

investment activities (236,044) (9,667) Financing activities: Bank

revolver and note repayments, net 210,000 (5,000) Purchases of

Quanex common stock --- (6,711) Common dividends paid (2,789)

(2,638) Issuance of common stock, net 6,715 810 Other, net (709)

(1,642) Cash used for financing activities 213,217 (15,181) Effect

of exchange rate changes on cash and equivalents 9 --- Decrease in

cash (11,926) (12,858) Beginning of period cash and equivalents

22,108 18,283 End of period cash and equivalents $10,182 $5,425

http://www.newscom.com/cgi-bin/prnh/20031231/QUANEXLOGO

http://www.newscom.com/cgi-bin/prnh/20010522/DATU048 DATASOURCE:

Quanex Corporation CONTACT: financial, Jeff Galow, +1-713-877-5327,

or media, Valerie Calvert, +1-713-877-5305, both of Quanex

Corporation Web site: http://www.quanex.com/

Copyright

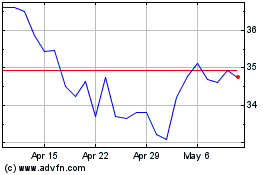

Quanex (NYSE:NX)

Historical Stock Chart

From Jun 2024 to Jul 2024

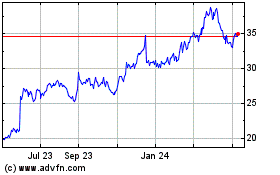

Quanex (NYSE:NX)

Historical Stock Chart

From Jul 2023 to Jul 2024