Procter & Gamble Posts $8 Billion Charge on Gillette Carrying Value

July 30 2019 - 7:51AM

Dow Jones News

By Colin Kellaher

Procter & Gamble Co. (PG) Tuesday said it booked an $8

billion charge to reduce the carrying values of its Gillette

shave-care business amid increased competition and lower

foreign-currency values.

The consumer-products giant said it took the non-cash charge to

adjust the U.S.-dollar carrying values of Gillette's goodwill and

trade-name intangible assets.

P&G reported a fiscal fourth-quarter loss of $5.24 billion

as a result of the charge.

P&G said the impairment mainly reflects significant currency

devaluations that have occurred since it initially established the

carrying values in 2005.

However, the company said its shave-care business has also been

hurt by a contraction in the market for blades and razors and by

increased competition.

P&G said Gillette "has consistently generated significant

earnings and cash flow and continues to be a strategic business

with attractive earnings, cash flow and growth opportunities."

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

July 30, 2019 07:36 ET (11:36 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

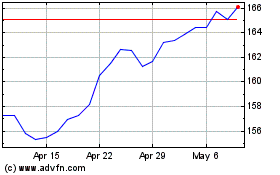

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2024 to May 2024

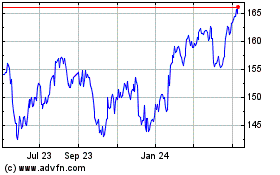

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From May 2023 to May 2024