Protective to Acquire United Investors Life

September 14 2010 - 8:30AM

Business Wire

Protective Life Corporation (NYSE: PL) (“Protective”) today

announced that its principal subsidiary, Protective Life Insurance

Company (“Protective Life”), has signed an agreement to acquire

United Investors Life Insurance Company from Liberty National Life

Insurance Company (“Liberty National”) for a purchase price of

approximately $316 million, including statutory capital and surplus

of approximately $130 million at closing. Liberty National is a

subsidiary of Torchmark Corporation (NYSE: TMK). The acquisition

and related transactions, including pre-closing distributions and

reinsurance agreements, are subject to the final negotiation of

related agreements and receipt of various regulatory approvals and

other customary conditions to closing. The expected closing date is

December 31, 2010.

The initial capital invested by Protective Life is projected to

be approximately $260 million, excluding excess capital of

approximately $56 million held by United Investors Life Insurance

Company at closing. The acquisition is expected to contribute

between $0.15 and $0.20 to Protective’s earnings per diluted share

in 2011, net of the effect of integration and transition costs. The

earnings per diluted share impact is expected to be between $0.18

and $0.22 in 2012.

“We are very pleased to announce this transaction,” said John D.

Johns, Protective’s Chairman, President and Chief Executive

Officer. “It leverages our extensive experience and capabilities in

acquiring closed blocks of business and is entirely consistent with

our strategy to augment earnings growth by deploying excess capital

through acquisitions.”

The Company will host a brief conference call for management to

discuss the transaction with analysts and professional investors on

September 14, 2010 at 10:00 a.m. Eastern. Analysts and professional

investors may access this call by dialing 1-866-783-2137

(international callers 1-857-350-1596) and entering the conference

passcode: 37088882. A recording of the call will be available from

12:00 p.m. Eastern September 14, 2010 until midnight September

28, 2010. The recording may be accessed by calling 1-888-286-8010

(international callers 1-617-801-6888) and entering the passcode:

26768943.

The public may access a live webcast of the call, along with a

call presentation, on the Company’s website at

www.protective.com.

Protective Life Corporation provides financial services through

the production, distribution and administration of insurance and

investment products throughout the United States. It has annual

revenues of approximately $3.1 billion and as of December 31,

2009 had assets of approximately $42.3 billion.

FORWARD-LOOKING STATEMENTS

This release includes “forward-looking statements” that may

express expectations of future events and results regarding the

proposed transactions, including but not limited to statements

regarding the expected benefits and costs of the proposed

transactions, the ability to complete the proposed transactions,

and the expected timing of the completion of the proposed

transactions. All statements that express expectations for and

results of future events rather than historical facts are

forward-looking statements that may involve certain risks and

uncertainties. Protective cannot give assurance that such

statements will prove to be correct. The factors that could affect

the future events include, but are not limited to, general economic

conditions and the following known trends and uncertainties:

Protective Life may not be able to complete the transactions due

to, among other things, the failure of the parties to satisfy the

various closing conditions, including the receipt of required

regulatory approvals; completion of the transactions may be more

costly or may take longer than expected; the financing structure of

the transactions may be different than currently contemplated; the

actual financial results of the transactions could differ

materially from Protective’s expectations and may be impacted by

items not taken into account in its forecasts and/or its earnings

per share calculations; and Protective Life’s expectations

regarding its ability to successfully integrate and transition the

acquired operations and satisfy its legal and compliance

obligations in relation to the transactions may prove to be

incorrect. In addition, please refer to Part I, Item 1A, Risk

Factors and Cautionary Factors that may Affect Future Results of

Protective’s most recent Form 10-K; Part II, Item 1A, Risk Factors,

of Protective’s subsequent quarterly reports on Form 10-Q; and

Protective’s reports filed on Form 8-K for more information about

risk factors. Protective assumes no obligation and does not intend

to update these forward-looking statements.

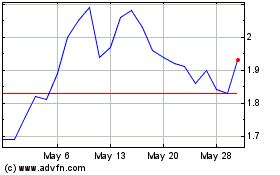

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2024 to Jul 2024

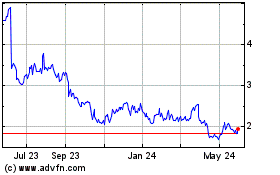

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jul 2023 to Jul 2024