Falling demand spurs the Marlboro makers to consider reuniting

in an all-stock deal

By Jennifer Maloney and Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 28, 2019).

Marlboro makers Philip Morris International Inc. and Altria

Group Inc. are in advanced talks to merge, a potential blockbuster

deal that would reunite two tobacco giants struggling with

shrinking demand.

The two businesses -- which were split apart in 2008 -- hold the

same portfolio of cigarettes, including industry leader Marlboro,

one of the world's best known brands. The products are sold by

Altria in the U.S. and Philip Morris elsewhere. A combination would

create a company with a market value of roughly $200 billion.

Both companies have been struggling with declining cigarette

consumption and new electronic cigarettes such as those made by

Juul Labs Inc., which are stealing away some smokers. Altria

invested $12.8 billion to take a large stake in Juul last year.

The talks were partly sparked by U.S. authorization this year of

a cigarette alternative that Altria and Philip Morris will jointly

start selling in September, according to people familiar with the

matter, and the realization that it could be easier to sell as one

company rather than through an existing distribution deal.

The discussions are also motivated by the risks -- and

opportunities -- that Juul presents for both companies as the

startup expands outside the U.S., the people said.

Philip Morris is the bigger of the two companies both in terms

of revenue and market value. Based on share prices before the

companies disclosed their talks early Tuesday, Philip Morris had a

market capitalization of about $121 billion and Altria sported a

market value of roughly $88 billion.

The two sides are discussing an all-stock deal with no premium

based on where the two companies' shares have been trading

recently, people familiar with the matter said. Philip Morris would

control about 59% of the combined company under the terms currently

being discussed, some of the people said.

The companies are describing it as a merger of equals because

other elements such as the name, board and management team are

expected to be more balanced, including a roughly evenly split

board, some of the people said. Altria Chief Executive Howard

Willard is unlikely to lead the combined company given that he has

limited experience running international businesses, those people

said.

The two sides could reach a deal within weeks, the people

said.

Philip Morris said the companies were discussing an all-stock

merger but could give no assurance that the talks would lead to any

agreement. Altria issued a similar statement.

After initially jumping on the news, shares of Altria fell 4% to

close Tuesday at $45.25. Philip Morris declined 7.8% to $71.70.

The potential combination would bring the industry full circle

from the 2000s, when global players distanced themselves from the

U.S. market amid legal concerns. British American Tobacco PLC

pulled out in 2004, and Altria spun off its overseas business in

2008 as Philip Morris International. But the litigation risks for

cigarette makers in the U.S. have receded since then.

Two years ago, BAT took over full control of Reynolds American

Inc., the second-largest competitor in the U.S. and maker of brands

such as Camel and Newport.

While Philip Morris and Altria's businesses have traditionally

been divided between the U.S. and the rest of the world, those

lines have been blurring in recent years as each company searches

for growth beyond Marlboros. Philip Morris had nearly $30 billion

in annual sales last year, while Altria brought in nearly $20

billion.

Both companies have warned that cigarette shipments were

declining faster than expected, both in the U.S. and other big

markets such as Japan and Russia. Last month, Altria said more

people were using e-cigarettes exclusively than it had expected.

Philip Morris, meanwhile, earlier this year lowered its earnings

forecast for 2019.

Juul, with Altria's backing, has been launched in over a dozen

international markets where it threatens to hurt Philip Morris's

cigarette sales.

Philip Morris and Altria have also forged a partnership on their

own cigarette alternative, a device called IQOS that heats but

doesn't burn tobacco. Philip Morris sells it in Japan, the U.K. and

other markets, while Altria is set to launch the device in the U.S.

in September.

Philip Morris has spent $6 billion since 2008 developing IQOS

and other next-generation products. Philip Morris Chief Executive

André Calantzopoulos has said the company is shifting its focus to

"a smoke-free future" and could someday stop selling traditional

cigarettes.

Altria's Mr. Willard has gambled that investing in Juul, a

startup whose sleek, nicotine-packed vaporizers are popular with

teens, will help the company keep up with a changing market even if

it cannibalizes sales of Marlboros. "Ten years from now the

majority of the tobacco products that are sold could very well be

noncombustible products," he said in an interview earlier this

year.

That would mark a major consumer shift. U.S. sales of

cigarettes, cigars and smoking tobacco were nearly $107 billion

last year, compared with about $15 billion in sales of smokeless

tobacco and vaping products, according to Euromonitor International

estimates, which include web sales. Vaping products such as Juul

made up $5.6 billion of those sales.

Although fewer people are smoking and cigarette shipments are

falling, U.S. tobacco profits have grown steadily as Altria and

Reynolds regularly push up prices. The U.S. generates the most

tobacco profits of any market outside of China, where tobacco is

controlled by the state.

In the U.S., the companies must navigate an overhaul of U.S.

regulatory policy in which the Food and Drug Administration is

pushing to reduce nicotine in cigarettes to nonaddictive levels and

recently proposed putting graphic warning labels on cigarette

packs. At the same time, the agency is trying to combat a surge in

teen vaping.

U.S. regulators and lawmakers have threatened to ban Juul

devices entirely if underage use continues to increase. The San

Francisco company recently opened Juul-branded retail stores in

Seoul and Toronto and is considering a sales launch of its

vaporizers in China as early as September.

Bonnie Herzog, a tobacco analyst at Wells Fargo, said Altria is

attractive to Philip Morris because of its 35% stake in Juul and

the possibility of capturing all profits from IQOS sales in the

U.S. Likewise, she said, Philip Morris could help with Juul's

overseas expansion.

Jefferies analyst Ryan Tomkins called the deal's timing strange

given Juul's regulatory hurdles but said that a merger would make

the IQOS business in the U.S. more efficient while accelerating the

international expansion of Juul through Philip Morris's sprawling

distribution network, which covers 180 markets.

However, cost savings between the two companies would be limited

to corporate spending and better buying power for tobacco leaves,

he said. And a focus on Juul could cannibalize the market for IQOS,

he added.

--Saabira Chaudhuri contributed to this article.

Write to Jennifer Maloney at jennifer.maloney@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

August 28, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

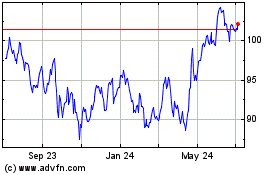

Philip Morris (NYSE:PM)

Historical Stock Chart

From Mar 2024 to Apr 2024

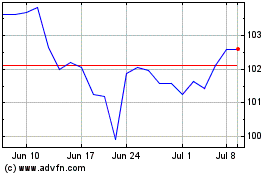

Philip Morris (NYSE:PM)

Historical Stock Chart

From Apr 2023 to Apr 2024