Cannabis ETFs Aren't the Same -- Journal Report

July 08 2019 - 10:33PM

Dow Jones News

By Simon Constable

A burning desire for pot stocks may leave unwary cannabis

investors with more speculative investments than they realize.

Take two exchange-traded funds focused on the cannabis industry:

ETFMG Alternative Harvest (MJ) and the recently launched

AdvisorShares Pure Cannabis (YOLO). While they both purport to

track the same industry, they are actually quite different.

"One is much broader and expansive; the other one is at the

extreme end of what is already extreme," says Ben Johnson, director

of global ETF research at Morningstar. "Less than half of their

holdings are common across the two portfolios."

More specifically, the Alternative Harvest (AH) fund includes

companies that will indirectly prosper from the cannabis industry,

such as plant-food firm Scotts Miracle-Gro and tobacco companies

such as Philip Morris International. Both are leaders in their

fields and could quickly profit from the burgeoning marijuana

business.

"We want to own everything in the space because trying to pick

winners is extremely difficult," says Chris Yeagley, managing

partner of Prime Indexes -- the index provider for the AH fund. He

likens it to investing in the 1848-1855 California gold rush, where

some miners did well, but so did the sellers of picks and shovels,

the tools required for mining.

The Pure Cannabis (PC) fund, meanwhile, focuses on more direct

beneficiaries of the industry such as WeedMD, which is a federally

licensed grower and distributor of medical-grade cannabis, and

Charlotte's Web Holding, which makes and distributes hemp-derived

cannabidiol (or CBD) wellness products.

"The Pure Cannabis fund goes much further down the market-cap

spectrum into microcap," says Mr. Johnson. In other words, the

stocks are tiny.

This different focus also means that the PC fund has more

speculative securities than the Alternative Harvest fund. For

instance, as of July 2, Pure Cannabis had a mere four stocks in its

top 25 holdings that had earnings, according to data from

Morningstar. That compares to 14 of the top 25 holdings for the

Alternative Harvest ETF. Note that the PC fund is actively managed,

while the AH fund tracks an index.

Having unprofitable firms in funds can be a red flag, some

experts say.

"There is greater risk in investing in a portfolio of companies

where profitability doesn't exist and where you are investing on

potential," says Todd Rosenbluth, senior director of ETF and

mutual-fund research at New York-based CFRA.

Dan Ahrens, the Dallas-based portfolio manager of the Pure

Cannabis ETF, says he isn't worried about the lack of net income

from the companies in the fund's holdings. "Old-fashioned analysis

doesn't work for these startups," he says. "Instead we want to know

that they are reinvesting on future production and scaling up

capacity."

He also notes that while the ETF invests in startups, it doesn't

"invest in Bobby on the street corner; these stocks are listed on

the Nasdaq, NYSE and the Toronto exchanges, not the more

speculative pink-sheets," he says.

The two ETFs are similar in at least one way: Annual fees are

0.75% for the Alternative Harvest fund and 0.74% for the Pure

Cannabis fund.

Mr. Constable is a writer in Edinburgh, Scotland. He can be

reached at reports@wsj.com.

(END) Dow Jones Newswires

July 08, 2019 22:18 ET (02:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

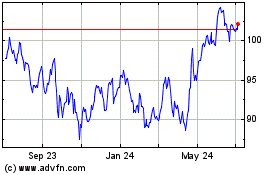

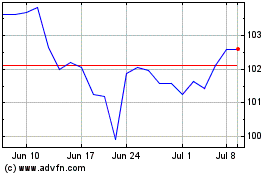

Philip Morris (NYSE:PM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Philip Morris (NYSE:PM)

Historical Stock Chart

From Apr 2023 to Apr 2024