UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

November, 2021

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras completes sale of the Landulpho Alves Refinery (RLAM)

—

Rio de Janeiro, November 30, 2021 – Petróleo

Brasileiro SA – Petrobras, following up on the release disclosed on 03/24/2021, informs that today it has completed the sale of

the Landulpho Alves Refinery (RLAM) and its associated logistical assets, located in the state of Bahia, for MC Brazil Downstream Participações,

a company of the Mubadala Capital group.

After the fulfillment of all the conditions precedent,

the operation was concluded with the payment of US$ 1.8 billion to Petrobras, an amount that reflects the purchase price of US$ 1.65 billion,

preliminarily adjusted for monetary correction and variations in working capital, net debt and investments until the closing of the transaction.

The contract also provides for a final adjustment to the purchase price, which is expected to be determined in the coming months.

This sale is in line with Resolution No. 9/2019 of the

National Energy Policy Council, which established guidelines for the promotion of free competition in the refining activity in Brazil

and is part of the commitment signed by Petrobras with the Administrative Council for Economic Defense (CADE) for the opening of the refining

sector in the country.

According to Petrobras’ CEO, Joaquim Silva e Luna,

the conclusion of the sale reflects the importance of the portfolio management and strengthens the company's strategy. “This sale

is an important milestone for Petrobras and the fuel sector in the country. We believe that, with new companies operating in refining,

the market will be more competitive and we will have more investments, which tends to strengthen the economy and generate benefits for

society. It is also part of the commitment signed by Petrobras with CADE to open up the refining market. From the company's point of view,

it is a step forward in its resource reallocation strategy. In the refining segment, Petrobras will focus on five refineries in the Southeast,

with investment plans that will place it among the best refiners in the world in terms of efficiency and operational performance.”

Acelen, a company created by Mubadala Capital for the

operation, will take over the management of RLAM as of 12/01/2021, which will be renamed Mataripe Refinery. Petrobras will continue to

support Acelen in the refinery operations during a transition period. This will happen under a service provision agreement, avoiding any

operational interruption. Petrobras and Mubadala Capital reaffirm their strict commitment to operational safety at the refinery in all

phases of the operation.

This disclosure to the market is in accordance with Petrobras'

internal rules and with the special regime for divestment of assets by federal mixed capital companies, provided for in Decree 9,188/2017.

This operation is in line with the company's portfolio

management strategy and capital allocation improvement, aiming at maximizing value and greater return to society.

About RLAM

RLAM, located in São Francisco do Conde in the

state of Bahia, has a processing capacity of 333,000 barrels/day (14% of Brazil's total oil refining capacity), and its assets include

four storage terminals and a set of pipelines connecting the refinery and terminals totaling 669 km in length.

About Mubadala Capital

Mubadala Capital is the asset management subsidiary

of Mubadala Investment Company, a global sovereign investor based in Abu Dhabi. In addition to managing its own investment

portfolio, Mubadala Capital manages $9 billion of third-party capital on behalf of institutional investors across all of its

businesses, including two special situations focused funds in Brazil, three private equity funds, two funds a venture capital

focused on early stage companies, and a fund with investments in liquid assets.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 19 Andar – 20231-030

– Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 30, 2021

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Rodrigo Araujo Alves

______________________________

Rodrigo Araujo Alves

Chief Financial Officer and Investor Relations

Officer

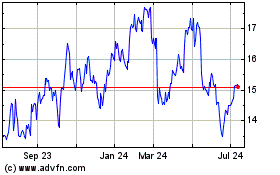

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Aug 2024 to Sep 2024

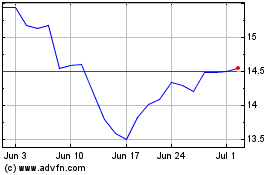

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Sep 2023 to Sep 2024