Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

October 28 2020 - 7:27AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities

Exchange Act of 1934

For

the month of October, 2020

Commission

File Number 1-15106

PETRÓLEO

BRASILEIRO S.A. – PETROBRAS

(Exact

name of registrant as specified in its charter)

Brazilian

Petroleum Corporation – PETROBRAS

(Translation

of Registrant's name into English)

Avenida

República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

_______ No___X____

Petrobras on revision of

the Shareholders Compensation Policy

—

Rio de Janeiro, October 28,

2020 - Petróleo Brasileiro S.A. - Petrobras informs that its Board of Directors, in a meeting held yesterday, approved the

revision of the Shareholders Compensation Policy in order to enable the Management to propose the payment of dividends compatible

with the company's cash generation, even in years with accounting losses.

With the changes approved, in

the scenario which the company's gross debt is above US$ 60 billion, the proposal for the distribution of dividends could be presented,

with accounting losses, when there is a reduction in net debt in the last twelve-month period, if the Management believes that

the company's financial sustainability will be preserved. The distribution proposal should be limited to the value of the net debt

reduction.

The company may also, in exceptional

cases, propose the payment of extraordinary dividends, exceeding the minimum legal mandatory dividend or the annual amount calculated

from the formula (Remuneration = 60% x (Operating Cash Flow - CAPEX), when its gross debt is less than US$ 60 billion, even with

accounting losses.

In all cases, the dividends

distribution must comply with the provisions of the applicable legislation, including article 201 of the Corporation Law (Law No.

6404/76).

The policy review is available

on the Investor Relations website (www.petrobras.com.br/ir) or the CVM website (www.cvm.gov.br).

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Phone: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section

21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that merely reflect the expectations of the Company’s

management. Such terms as “anticipate”, “believe”, “expect”, “forecast”, “intend”,

“plan”, “project”, “seek”, “should”, along with similar or analogous expressions,

are used to identify such forward-looking statements. These predictions evidently involve risks and uncertainties, whether foreseen

or not by the Company. Therefore, the future results of operations may differ from current expectations, and readers must not

base their expectations exclusively on the information presented herein.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: October 28, 2020

PETRÓLEO BRASILEIRO

S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea

Marques de Almeida

Chief Financial Officer and

Investor Relations Officer

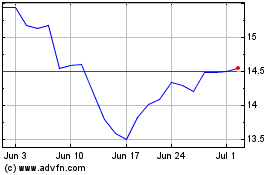

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

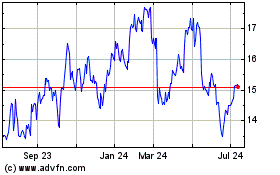

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024