UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

February, 2021

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras

signs contract for sale of E&P

assets in Espírito Santo

—

Rio de Janeiro, February 1, 2021 - Petróleo

Brasileiro S.A. - Petrobras, following up on the release disclosed on August 5, 2019, informs that it has signed with the companies

OP Energia Ltda. and DBO Energia S.A. a contract for the sale of the totality of its participations in the production fields of

Peroá and Cangoá, and in the concession BM-ES-21 (Malombe Discovery Evaluation Plan), jointly named Peroá

Cluster, located in the Espírito Santo Basin. OP Energia and DBO Energia will form a consortium to acquire the Peroá

Cluster, with a 50% stake each, with the first company as operator.

The sale value is US$ 55 million, being

(a) US$ 5 million paid at the present date; (b) US$ 7.5 million at the closing of the transaction and (c) US$ 42.5 million in contingent

payments foreseen in contract, related to factors as commerciality declaration of Malombe, future oil prices and extension of the

concessions term. The amounts do not consider due adjustments until the closing of the transaction, which is subject to the fulfillment

of previous conditions, such as approval by the National Agency of Petroleum, Natural Gas and Biofuels (ANP).

This disclosure complies with the Petrobras'

internal rules and with the provisions of the special procedure for assignment of rights to exploration, development and production

of oil, natural gas and other fluid hydrocarbons, provided for in Decree 9,355/2018.

This operation is aligned with the strategy

of portfolio optimization and the improvement of the allocation of the company's capital, concentrating increasingly its resources

on world-class assets in deep and ultra-deep waters, where Petrobras has shown great competitive edge over the years.

About Peroá Cluster

Petrobras holds 100% interest in the

Peroá and Cangoá fields, located in shallow waters, whose average production in 2020 was around 658,000 m3/day of

non-associated gas, and 100% interest in the BM-ES-21 exploratory block, located in deep waters, where the Malombe discovery is

located.

About OP Energia and DBO Energia

OP Energia is a wholly owned subsidiary

of 3R Petroleum Óleo e Gás S.A., a company listed on the Novo Mercado of the Brazilian Stock Exchange, whose

strategy is to revitalize mature onshore and offshore fields.

DBO Energia is an upstream oil and gas company

with focus on increasing the recovery factor and efficiency of mature fields in Brazil applying expertise and technology from the

North Sea.

www.petrobras.com.br/ri

Para mais informações:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Relações com Investidores

e-mail: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

Este documento pode conter

previsões segundo o significado da Seção 27A da Lei de Valores Mobiliários de 1933, conforme alterada

(Lei de Valores Mobiliários) e Seção 21E da lei de Negociação de Valores Mobiliários

de 1934 conforme alterada (Lei de Negociação) que refletem apenas expectativas dos administradores da Companhia.

Os termos: “antecipa”, “acredita”, “espera”, “prevê”, “pretende”,

“planeja”, “projeta”, “objetiva”, “deverá”, bem como outros termos similares,

visam a identificar tais previsões, as quais, evidentemente, envolvem riscos ou incertezas, previstos ou não, pela

Companhia. Portanto, os resultados futuros das operações da Companhia podem diferir das atuais expectativas, e, o

leitor não deve se basear exclusivamente nas informações aqui contidas.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 1, 2021

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea

Marques de Almeida

Chief Financial Officer and Investor Relations

Officer

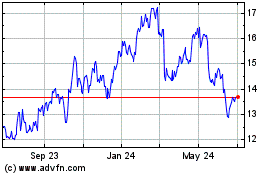

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Aug 2024 to Sep 2024

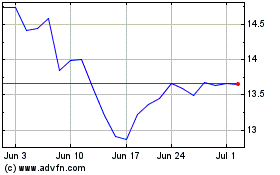

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Sep 2023 to Sep 2024