UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

December, 2020

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras starts non-binding phase of Bahia Terra Cluster

—

Rio de Janeiro, December 23, 2020 - Petróleo

Brasileiro S.A. – Petrobras, following up on the release disclosed on November 4, 2020, informs the beginning of the non-binding

phase, referring to the sale of all of its stakes in a set of 28 onshore production field concessions, with integrated facilities,

located in the Recôncavo and Tucano Basins, in different municipalities of the state of Bahia, jointly called the Bahia Terra

Cluster.

Potential buyers qualified for this phase

will receive instructions on the divestment process, including guidelines for the preparation and submission of non-binding proposals,

as well as access to a virtual data room containing additional information about the Cluster.

The main subsequent stages of the project

will be reported to the market in due course.

This disclosure is in accordance with Petrobras'

internal rules and with the provisions of the special procedure for assignment of rights to exploration, development and production

of oil, natural gas and other fluid hydrocarbons, provided for in Decree 9,355/2018.

This transaction is aligned

with the strategy of portfolio optimization and the improvement of the company's capital allocation, concentrating increasingly

its resources on world-class assets in deep and ultra-deep waters, where Petrobras has demonstrated great competitive edge over

the years.

About Bahia Terra Cluster

The Bahia Terra Cluster comprises

28 onshore production concessions, located in different municipalities of the state of Bahia, and includes access to processing,

logistics, storage, transportation and outflow infrastructure for oil and natural gas.

The Cluster has about 1,700

wells in operation, collection and treatment stations, oil storage and handling facilities, gas and oil pipelines, as well as the

natural gas processing unit (NGPU) Catu and other infrastructure associated with the Cluster's production process.

The average production of

the Cluster from January to November 2020 was around 14 thousand barrels of oil per day and 618 thousand m3/day of gas.

Petrobras is the operator of these fields, with 100% stake.

It is important to note that

the concessions corresponding to the Miranga Cluster (referenced in the releases of August 28, 2017 may be included in the sale

process of the Bahia Terra Cluster, which will be disclosed in due course.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities

Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 23, 2020

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea

Marques de Almeida

Chief Financial Officer and Investor Relations

Officer

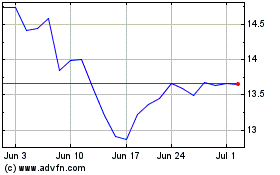

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

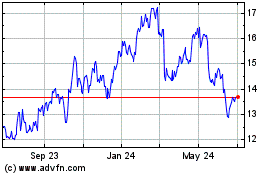

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024