UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of

December, 2020

Commission File

Number 001-15106

PETRÓLEO

BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation - PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

PETROBRAS ANNOUNCES REDEMPTION PRICES

FOR FIVE SERIES OF NOTES

RIO DE JANEIRO, BRAZIL – December 18, 2020 –

Petróleo Brasileiro S.A. – Petrobras (“Petrobras”) (NYSE: PBR) announces that its wholly-owned

subsidiary Petrobras Global Finance B.V. (“PGF”) has delivered notices to the holders of the outstanding 5.375%

Global Notes due 2021 (“5.375% Notes”), 8.375% Global Notes due 2021 (“8.375% Notes”), 3.750%

Global Notes due 2021 (“3.750% Notes”), 6.125% Global Notes due 2022 (“6.125% Notes”), and

5.875% Global Notes due 2022 (“5.875% Notes” and, together with the 5.375% Notes, the 8.375% Notes, the 3.750%

Notes and the 6.125% Notes, the “Notes”) announcing the redemption prices for the Notes. As previously announced,

the redemption date for the Notes will be December 23, 2020 (the “Redemption Date”).

|

Title

of Security

|

CUSIP

/ ISIN

|

Common

Code

|

Aggregate

Principal Amount to be Redeemed

|

Make-Whole

Premium(1)

|

Redemption

Price(1) (2)

|

Interest(1)

|

|

5.375% Global Notes due 2021

|

71645W AR2 / US71645WAR25

|

N/A

|

US$960,699,000

|

US$4.71

|

US$1,004.71

|

US$21.80(3)

|

|

8.375% Global Notes due 2021

|

71647N AP4 / US71647NAP42

|

N/A

|

US$463,276,000

|

US$32.37

|

US$1,032.37

|

US$6.98(4)

|

|

3.750% Global Notes due 2021

|

N/A / XS0982711987

|

098271198

|

€185,036,000

|

€2.49

|

€1,002.49

|

€35.25(5)

|

|

6.125% Global Notes due 2022

|

71647N AR0 / US71647NAR08

|

N/A

|

US$222,607,000

|

US$58.57

|

US$1,058.57

|

US$26.54(6)

|

|

5.875% Global Notes due 2022

|

N/A / XS0716979595

|

071697959

|

€154,172,000

|

€73.07

|

€1,073.07

|

€46.84(7)

|

_________________________________________________________

(1) Per US$1,000 or €1,000, as applicable. Figures

have been rounded for ease of presentation.

(2) Redemption price includes make-whole premium.

(3) Accrued interest on the principal amount from July

27, 2020 to (but not including) the Redemption Date.

(4) Accrued interest on the principal amount from November 23, 2020 to (but not including) the Redemption Date.

(5) Accrued interest on the principal amount from January 14, 2020 to (but not including) the Redemption Date.

(6) Accrued interest on the principal amount from July

17, 2020 to (but not including) the Redemption Date.

(7) Accrued interest on the principal amount from March

7, 2020 to (but not including) the Redemption Date.

Payment on the 5.375% Notes, the 8.375% Notes and the 6.125%

Notes will be made prior to 3:00 pm New York time on the business day preceding the Redemption Date by credit to the account of

The Bank of New York Mellon (the “Trustee”), the trustee and paying agent for the 5.375% Notes, the 8.375% Notes

and the 6.125% Notes. Payment on the 3.750% Notes and the 5.875% Notes will be made prior to 12:00 pm London time on the business

day preceding the Redemption Date by credit to the account of The Bank of New York Mellon, London Branch, as principal paying agent

for the 3.750% Notes and the 5.875% Notes (the “Principal Paying Agent”).

For the 5.375% Notes, the Trustee will cause funds to be

paid to The Depository Trust Company for further payment to its participants in the aggregate amount of US$965,223,892.29 (or approximately

US$1,004.71 per US$1,000 principal amount of the 5.375% Notes), which constitutes the redemption price of the 5.375% Notes. The

redemption price includes a make-whole premium of US$4,524,892.29 (or approximately US$4.71 per US$1,000 principal amount of the

5.375% Notes). In addition to the redemption price, holders will receive accrued and unpaid interest on the principal amount of

the 5.375% Notes from July 27, 2020 to (but not including) the Redemption Date in the amount of US$20,941,903.90 (or approximately

US$21.80 per US$1,000 principal amount of the 5.375% Notes).

For the 8.375% Notes, the Trustee will cause funds to be

paid to The Depository Trust Company for further payment to its participants in the aggregate amount of US$478,272,244.12 (or

approximately US$1,032.37 per US$1,000 principal amount of the 8.375% Notes), which constitutes the redemption price of the 8.375%

Notes. The redemption price includes a make-whole premium of US$14,996,244.12 (or approximately US$32.37 per US$1,000 principal

amount of the 8.375% Notes). In addition to the redemption price, holders will receive accrued and unpaid interest on the principal

amount of the 8.375% Notes from November 23, 2020 to (but not including) the Redemption Date in the amount of US$3,233,280.42

(or approximately US$6.98 per US$1,000 principal amount of the 8.375% Notes).

For the 3.750% Notes, the Principal Paying Agent, as common

depositary for Clearstream and Euroclear, will cause funds to be paid to its participants in the aggregate amount of €185,496,739.64

(or approximately €1,002.49 per €1,000 principal amount of the 3.750% Notes), which constitutes the redemption price

for the 3.750% Notes. The redemption price includes a make-whole premium of €460,739.64 (or approximately €2.49 per €1,000

principal amount of the 3.750% Notes). In addition to the redemption price, holders will receive accrued and unpaid interest on

the principal amount of the 3.750% Notes from January 14, 2020 to (but not including) the Redemption Date in the amount of €6,521,760.66

(or approximately €35.25 per €1,000 principal amount of the 3.750% Notes).

For the 6.125% Notes, the Trustee will cause funds to be

paid to The Depository Trust Company for further payment to its participants in the aggregate amount of US$235,645,091.99 (or approximately

US$1,058.57 per US$1,000 principal amount of the 6.125% Notes), which constitutes the redemption price of the 6.125% Notes. The

redemption price includes a make-whole premium of US$13,038,091.99 (or approximately US$58.57 per US$1,000 principal amount of

the 6.125% Notes). In addition to the redemption price, holders will receive accrued and unpaid interest on the principal amount

of the 6.125% Notes from July 17, 2020 to (but not including) the Redemption Date in the amount of US$5,908,360.79 (or approximately

US$26.54 per US$1,000 principal amount of the 6.125% Notes).

For the 5.875% Notes, the Principal Paying Agent, as common

depositary for Clearstream and Euroclear, will cause funds to be paid to its participants in the aggregate amount of €165,437,348.04

(or approximately €1,073.07 per €1,000 principal amount of the 5.875% Notes), which constitutes the redemption price

for the 5.875% Notes. The redemption price includes a make-whole premium of €11,265,348.04 (or approximately €73.07 per

€1,000 principal amount of the 5.875% Notes). In addition to the redemption price, holders will receive accrued and unpaid

interest on the principal amount of the 5.875% Notes from March 7, 2020 to (but not including) the Redemption Date in the amount

of €7,221,268.64 (or approximately €46.84 per €1,000 principal amount of the 5.875% Notes).

On the Redemption Date, the redemption prices, including

accrued and unpaid interest, will become due and payable. Interest on the Notes will cease to accrue on and after the Redemption

Date. Upon the redemption, the 5.375% Notes, the 8.375% Notes and the 6.125% Notes will cease to be listed on the New York Stock

Exchange, the 3.750% Notes and the 5.875% Notes will cease to be listed on the Luxembourg Stock Exchange, and the Notes and the

related guarantees by Petrobras will be cancelled and any obligation thereunder extinguished.

Because all of the Notes are held in book-entry form, payment

of the redemption prices will be made directly to the registered holders.

PGF intends to fund the amounts necessary to redeem the Notes

with available cash on hand.

For more information, please contact PGF by contacting Guilherme

Saraiva, Finance Department, Manager of Capital Markets and Special Operations (telephone: +55 21 3224 3825; fax: +55 21 3224 4222;

e-mail: petroinvest@petrobras.com.br) if you have any questions regarding this notice.

Forward-Looking Statements

This press release contains forward-looking statements.

Forward-looking statements are information of a non-historical nature or which relate to future events and are subject to

risks and uncertainties. Petrobras undertakes no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information or future events or for any other reason.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS

|

|

|

|

|

|

|

By:

|

/s/ Guilherme Rajime T. Saraiva

|

|

|

|

Guilherme Rajime T. Saraiva

|

|

|

|

Attorney-in-Fact

|

|

|

By:

|

/s/ Lucas Tavares de Mello

|

|

|

|

Lucas Tavares de Mello

|

|

|

|

|

Attorney-in-Fact

|

Date: December 18, 2020

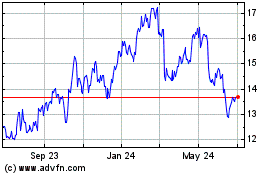

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Aug 2024 to Sep 2024

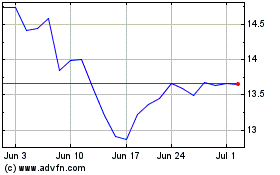

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Sep 2023 to Sep 2024