0001383414 False 0001383414 2023-07-26 2023-07-26 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 26, 2023

_______________________________

PennantPark Investment Corporation

(Exact name of registrant as specified in its charter)

_______________________________

| Maryland | 814-00736 | 20-8250744 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1691 Michigan Avenue

Miami Beach, Florida 33139

(Address of Principal Executive Offices) (Zip Code)

(786) 297-9500

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | PNNT | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On July 26, 2023, PennantPark Investment Corporation (the "Company") issued a press release, a copy of which is furnished as Exhibit 99.1 to this report on Form 8-K.

The information in this report on Form 8-K, including Exhibits 99.1 furnished herewith, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of such section. The information in this report on Form 8-K shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Act, or under the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements

This report on Form 8-K, including Exhibits 99.1 furnished herewith, may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You should understand that under Section 27A(b)(2)(B) of the Securities Act and Section 21E(b)(2)(B) of the Exchange Act, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 do not apply to forward-looking statements made in periodic reports PennantPark Investment Corporation files under the Exchange Act. All statements other than statements of historical facts included in this report on Form 8-K, including Exhibits 99.1, are forward-looking statements and are not guarantees of future performance or results, and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in filings with the Securities and Exchange Commission as well as changes in the economy and risks associated with possible disruption in the Company’s operations or the economy generally due to terrorism, natural disasters or pandemics such as COVID-19. PennantPark Investment Corporation undertakes no duty to update any forward-looking statement made herein. You should not place undue influence on such forward-looking statements as such statements speak only as of the date on which they are made.

PennantPark Investment Corporation may use words such as “anticipates,” “believes,” “expects,” “intends,” “seeks,” “plans,” “estimates” and similar expressions to identify forward-looking statements. Such statements are based on currently available operating, financial and competitive information and are subject to various risks and uncertainties that could cause actual results to differ materially from its historical experience and present expectations.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | PennantPark Investment Corporation |

| | | |

| | | |

| Date: July 26, 2023 | By: | /s/ Richard T. Allorto, Jr. |

| | | Richard T. Allorto, Jr. |

| | | Chief Financial Officer & Treasurer |

| | | |

EXHIBIT 99.1

PennantPark Investment Corporation’s Unconsolidated Joint Venture, PennantPark Senior Loan Fund, LLC Completes $300 Million CLO

Marking Continued Growth in PennantPark’s Middle Market CLO Platform with Seven CLOs Under Management

MIAMI, July 26, 2023 (GLOBE NEWSWIRE) -- PennantPark Investment Corporation (the “Company”) (NYSE: PNNT) today announced that PennantPark Senior Loan Fund, LLC (“PSLF”) through its wholly-owned and consolidated subsidiary, PennantPark CLO VII, LLC (“CLO VII”), has closed a $300 million debt securitization in the form of a collateralized loan obligation (“CLO”) with a four-year reinvestment period and twelve-year final maturity.

The notes issued in the CLO (the “CLO Notes”) are structured in the following manner:

Class | Par Amount

($ in millions) |

% of Capital Structure |

Coupon | Expected Rating

(S&P) |

Issuance Price |

| A-1A Notes | $151,000,000 | 50.3% | | 3 Mo SOFR + 2.70% | AAA | 100.0% | |

| A-1B Loans | | 20,000,000 | 6.7% | | 6.5490% | AAA | 100.0% | |

| A-2 | | 12,000,000 | 4.0% | | 3 Mo SOFR + 3.20% | AAA | 100.0% | |

| B | | 21,000,000 | 7.0% | | 3 Mo SOFR + 4.05% | AA | 100.0% | |

| C | | 24,000,000 | 8.0% | | 3 Mo SOFR + 4.70% | A | 100.0% | |

| D | | 18,000,000 | 6.0% | | 3 Mo SOFR + 7.00% | BBB- | 100.0% | |

| Sub Notes | | 54,000,000 | 18.0% | | | NR | NA | |

| Total | $300,000,000 | | | | |

| |

“This transaction demonstrates PennantPark’s continued ability to raise attractive long-term financing, even during challenging markets.” said Arthur Penn, Chief Executive Officer. “We are pleased to enhance the capital position of both PSLF and our platform and to participate in today’s excellent vintage of both primary and secondary opportunities. With the closing of CLO VII, PennantPark now manages approximately $2.1 billion in CLO middle market assets, and we look forward to continued growth with the support of our current and new investors.”

PSLF will retain all the Subordinated Notes through a consolidated subsidiary. The reinvestment period for the term debt securitization ends in July 2027 and the CLO Notes are scheduled to mature in July 2035. The proceeds from the CLO Notes will be used to repay a portion of PSLF’s $325 million secured credit facility. In addition, PSLF acts as retention holder in the transaction to retain exposure to the performance of the securitized assets. BNP Paribas acted as lead placement agent in the CLO transaction.

The CLO Notes offered as part of the term debt securitization have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state “blue sky” laws, and may not be offered or sold in the United States absent registration under Section 5 of the Securities Act or an applicable exemption from applicable registration requirements. The CLO is a form of secured financing incurred and consolidated by PSLF. This press release shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of the notes in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

ABOUT PENNANTPARK INVESTMENT CORPORATION

PennantPark Investment Corporation is a business development company which primarily invests in U.S. middle market private companies in the form of first lien secured debt, second lien secured debt, subordinated debt and equity investments. PennantPark Investment Corporation is managed by PennantPark Investment Advisers, LLC.

ABOUT PENNANTPARK SENIOR LOAN FUND, LLC

PennantPark Senior Loan Fund, LLC, is a joint venture between PennantPark Investment Corporation and Pantheon Ventures (UK), LLP and primarily invests in middle-market and other corporate debt securities with PennantPark Investment Corporation’s strategy.

ABOUT PENNANTPARK INVESTMENT ADVISERS, LLC

PennantPark is a leading middle market credit platform, managing approximately $6.2 billion of investable capital, including potential leverage. Since its inception in 2007, PennantPark has provided investors access to middle market credit by offering private equity firms and their portfolio companies as well as other middle market borrowers a comprehensive range of creative and flexible financing solutions. PennantPark is headquartered in Miami, and has offices in New York, Chicago, Houston, and Los Angeles.

FORWARD-LOOKING STATEMENTS

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You should understand that under Section 27A(b)(2)(B) of the Securities Act and Section 21E(b)(2)(B) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 do not apply to forward-looking statements made in periodic reports PennantPark Investment Corporation files under the Exchange Act. All statements other than statements of historical facts included in this press release are forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in filings with the Securities and Exchange Commission. PennantPark Investment Corporation undertakes no duty to update any forward-looking statement made herein. You should not place undue influence on such forward-looking statements as such statements speak only as of the date on which they are made.

CONTACT:

Richard T. Allorto, Jr.

PennantPark Investment Corporation

(212) 905-1000

www.pennantpark.com

Source: PennantPark Investment Corporation

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

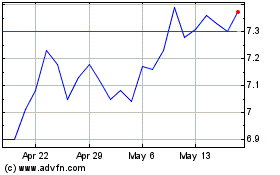

PennantPark Investment (NYSE:PNNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

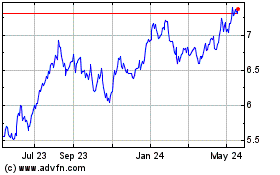

PennantPark Investment (NYSE:PNNT)

Historical Stock Chart

From Apr 2023 to Apr 2024