National Fuel Gas Supply Corporation (“Supply”) and Empire

Pipeline, Inc. (“Empire”), the companies that comprise the Pipeline

and Storage segment of National Fuel Gas Company (NYSE: NFG)

(“National Fuel”), have reached major milestones on two pipeline

expansion projects that are the first in the industry designed to

receive natural gas produced from the Marcellus Shale and transport

it to key markets of Canada and the Northeast U.S. Supply has

entered into a binding precedent agreement with Statoil Natural Gas

LLC (“Statoil”) for 100 percent of the capacity on Supply’s

“Northern Access” expansion project. Empire also has a binding

precedent agreement in place with anchor shipper East Resources,

Inc. (“East”) for Empire’s “Tioga County Extension” project, and is

concluding negotiations for additional capacity with a second

shipper. The precedent agreements provide for Statoil and East to

sign, after satisfaction of conditions, firm transportation service

agreements under which Supply and Empire will transport natural gas

for Statoil and East.

“The market dynamics generated by the Marcellus Shale

development have created a unique opportunity to move gas away from

the increasingly competitive Appalachian Basin and into the newly

expanding markets of Canada and the Northeast,” said David F.

Smith, Chairman, President and Chief Executive Officer of National

Fuel. “We are excited to provide the pathway to new markets for

Appalachian gas production and we look forward to executing our

plans while continuing to identify new opportunities to alleviate

regional infrastructure constraints. In addition to these projects,

we continue to implement the first phases of other Appalachian

infrastructure projects designed to transport 190,000 dekatherms

per day for a number of Marcellus producers, including Range

Resources Corporation, Seneca Resources Corporation and EOG

Resources, Inc.”

Supply’s Northern Access expansion project is designed to

transport 320,000 dekatherms per day of Marcellus Shale production

utilizing Supply’s existing pipelines to an existing

interconnection between Supply and TransCanada Pipeline (“TCPL”) at

the Niagara River near Lewiston, New York (“Niagara”), for delivery

to the diverse markets accessible on the TCPL system. The required

project facilities include bi-directional metering at Niagara and

at Supply’s interconnects with Tennessee Gas Pipeline (“TGP”) at

East Aurora, New York, along with incremental compression at

Supply’s interconnect with TGP at Ellisburg Station and at East

Aurora. Initial estimates place project costs at approximately $60

million, with an expected in-service date of June 1, 2012. The Open

Season for firm transportation capacity that concluded on February

17, 2010, received requests for transportation of more than 1.6

million dekatherms per day.

The Statoil agreement, which was executed today, includes a

20-year firm transportation commitment for all of the available

320,000 dekatherms per day of natural gas transportation service

from Ellisburg for delivery to Niagara. Statoil is currently a

partner in a joint venture with Chesapeake Energy Corporation for

the development of natural gas from the Marcellus Shale.

Empire’s Tioga County Extension project will stretch

approximately 16 miles south from its existing interconnection with

Millennium Pipeline at Corning, New York, into Tioga County,

Pennsylvania. The project will require the construction of 16 miles

of new 24-inch diameter pipeline. Additionally, Empire will replace

1.3 miles of pipeline near Victor, New York, and construct a new

interconnection with TGP’s Line 200 in Ontario County, New York.

Project costs are estimated to be approximately $45 million and the

facilities are expected to be operational by September 1, 2011. The

Open Season for the project offered pipeline capacity of at least

300,000 dekatherms per day and concluded on November 25, 2009.

Earlier this year, East executed a precedent agreement that

contains a 10-year firm transportation service commitment with

Empire for 200,000 dekatherms per day. East’s contracted capacity

allows for gas produced in both the Marcellus Shale and

Trenton-Black River formations to be delivered to an interconnect

with TCPL at the Canadian border between Grand Island, New York,

and Chippawa, Ontario, Canada. Based on this anchor shipper

support, on January 28, 2010, Empire began the FERC National

Environmental Policy Act pre-filing process. Additionally, Empire

expects to conclude negotiations with another shipper for an

additional 150,000 dekatherms per day.

“These two projects are the most recent examples of our

continued progress in executing on our Appalachian development

strategy across multiple subsidiaries of our Company,” said Smith.

“From Seneca Resources Corporation’s accelerating Marcellus Shale

drilling program, to our ongoing investment in National Fuel Gas

Midstream Corporation’s gathering assets, to market broadening

projects like these from Supply and Empire, our Company is

positioned to be a key player in the increasingly important

Appalachian market.”

National Fuel is an integrated energy company with $4.8 billion

in assets comprised of the following four operating segments:

Exploration and Production, Pipeline and Storage, Utility, and

Energy Marketing. Additional information about National Fuel is

available at http://www.nationalfuelgas.com or through its investor

information service at 1-800-334-2188.

Certain statements contained herein, including those that are

identified by the use of the words “anticipates,” “estimates,”

“expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,”

“believes,” “seeks,” “will,” “may” and similar expressions, are

“forward-looking statements” as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

risks and uncertainties, which could cause actual results or

outcomes to differ materially from those expressed in the

forward-looking statements. The Company’s expectations, beliefs and

projections contained herein are expressed in good faith and are

believed to have a reasonable basis, but there can be no assurance

that such expectations, beliefs or projections will result or be

achieved or accomplished. In addition to other factors, the

following are important factors that could cause actual results to

differ materially from those discussed in the forward-looking

statements: financial and economic conditions, including the

availability of credit, and their effect on the Company’s ability

to obtain financing on acceptable terms for working capital,

capital expenditures and other investments; occurrences affecting

the Company’s ability to obtain financing under credit lines or

other credit facilities or through the issuance of commercial

paper, other short-term notes or debt or equity securities,

including any downgrades in the Company’s credit ratings and

changes in interest rates and other capital market conditions;

changes in economic conditions, including global, national or

regional recessions, and their effect on the demand for, and

customers’ ability to pay for, the Company’s products and services;

the creditworthiness or performance of the Company’s key suppliers,

customers and counterparties; economic disruptions or uninsured

losses resulting from terrorist activities, acts of war, major

accidents, fires, hurricanes, other severe weather, or other

natural disasters; changes in the availability and/or price of

natural gas, and the effect of such changes on natural gas

production levels; significant differences between projected and

actual natural gas production levels; uncertainty of natural gas

reserve estimates; inability to obtain or retain sufficient

customers or commitments for planned projects; factors affecting

the Company’s ability to complete expansion projects as planned,

including among others geography, weather conditions, shortages or

unavailability of equipment and services required in construction

operations, unanticipated project delays or changes in project

costs or plans, and the need to obtain governmental approvals and

permits and comply with environmental laws and regulations; changes

in laws and regulations to which the Company is subject, including

energy, environmental, tax, safety and employment laws and

regulations; governmental/regulatory actions, initiatives and

proceedings, including those involving expansion projects,

financings, rate cases, affiliate relationships, industry

structure, and environmental/safety requirements; significant

changes in the Company’s relationship with its employees or

contractors and the potential adverse effects if labor disputes,

grievances or shortages were to occur; or the cost and effects of

legal and administrative claims against the Company. The Company

disclaims any obligation to update any forward-looking statements

to reflect events or circumstances after the date hereof.

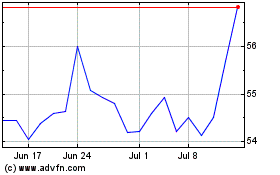

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From May 2024 to Jun 2024

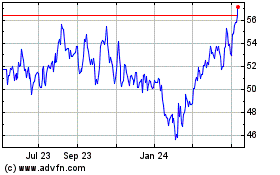

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Jun 2023 to Jun 2024