- Current report filing (8-K)

November 18 2008 - 9:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 18, 2008

NATIONAL FUEL GAS COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

New Jersey

(State or other jurisdiction

of incorporation)

|

|

1-3880

(Commission File Number)

|

|

13-1086010

(IRS Employer

Identification No.)

|

|

|

|

|

6363 Main Street, Williamsville, New York

(Address of principal executive offices)

|

|

14221

(Zip Code)

|

Registrant’s telephone number, including area code: (716) 857-7000

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions (

see

General

Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

Item 7.01 Regulation FD Disclosure.

National Fuel Gas Company (the “Company”) plans to hold meetings with certain shareholders,

industry analysts, money managers and other members of the financial community beginning November

18, 2008. A copy of presentation materials to be provided to participants in the meetings is

furnished as part of this Current Report as Exhibit 99.

Neither the furnishing of the presentation as an exhibit to this Current Report nor the inclusion

in such presentation of any reference to the Company’s internet address shall, under any

circumstances, be deemed to incorporate the information available at such internet address into

this Current Report. The information available at the Company’s internet address is not part of

this Current Report or any other report filed or furnished by the Company with the Securities and

Exchange Commission.

In addition to financial measures calculated in accordance with generally accepted accounting

principles (“GAAP”), the presentation furnished as part of this Current Report as Exhibit 99

contains certain non-GAAP financial measures. The Company believes that such non-GAAP financial

measures are useful to investors because they provide an alternative method for assessing the

Company’s operating results in a manner that is focused on the performance of the Company’s ongoing

operations. The Company’s management uses these non-GAAP financial measures for the same purpose,

and for planning and forecasting purposes. The presentation of non-GAAP financial measures is not

meant to be a substitute for financial measures prepared in accordance with GAAP.

Certain statements contained herein or in the presentation furnished as part of this Current

Report, including statements regarding expected future natural gas and oil production, estimated

future earnings, future prospects, plans and capital structure, anticipated capital expenditures,

and completion of construction projects, as well as statements that are identified by the use of

the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,”

“projects,” “believes,” “seeks,” “will,” “may,” and similar expressions, are “forward-looking”

statements” as defined by the Private Securities Litigation Reform Act of 1995. There can be no

assurance that the Company’s projections will in fact be achieved nor do these projections reflect

any acquisitions or divestitures that may occur in the future. While the Company’s expectations,

beliefs and projections are expressed in good faith and are believed to have a reasonable basis,

actual results may differ materially from those projected in forward-looking statements.

Furthermore, each forward-looking statement speaks only as of the date on which it is made. In

addition to other factors, the following are important factors that could cause actual results to

differ materially from those discussed in the forward-looking statements: financial and economic

conditions, including the availability of credit, and their effect on the Company’s ability to

obtain financing on acceptable terms for working capital, capital expenditures and other

investments; occurrences affecting the Company’s ability to obtain financing under credit lines or

other credit facilities or through the issuance of commercial paper, other short-term notes or debt

or equity securities, including any downgrades in the Company’s credit ratings and changes in

interest rates and other capital market conditions; changes in economic conditions, including

global, national or regional recessions, and their effect on the demand for, and customers’ ability

to pay

for, the Company’s products and services; economic disruptions caused by terrorist activities, acts

of war or major accidents; changes in actuarial assumptions, the interest rate environment and the

return on assets for the Company’s retirement plan and post-retirement benefit plans, which can

affect future funding obligations and costs and plan liabilities; changes in demographic patterns

and weather conditions, including the occurrence of severe weather such as hurricanes; changes in

the availability and/or price of natural gas or oil and the effect of such changes on the

accounting treatment of derivative financial instruments or the valuation of the Company’s natural

gas and oil reserves; uncertainty of oil and natural gas reserve estimates; ability to successfully

identify, drill for and produce economically viable natural gas and oil reserves, including

shortages, delays or unavailability of equipment and services required in drilling operations;

significant changes from expectations in the Company’s actual production levels for natural gas or

oil; changes in the availability and/or price of derivative financial instruments; changes in the

price differentials between various types of oil; inability to obtain new customers or retain

existing ones; significant changes in competitive factors affecting the Company; changes in laws

and regulations to which the Company is subject, including tax, environmental, safety and

employment laws and regulations; governmental/regulatory actions, initiatives and proceedings,

including those involving acquisitions, financings, rate cases (which address, among other things,

allowed rates of return, rate design and retained natural gas), affiliate relationships, industry

structure, franchise renewal, and environmental/safety requirements; unanticipated impacts of

restructuring initiatives in the natural gas and electric industries; significant changes from

expectations in actual capital expenditures and operating expenses and unanticipated project delays

or changes in project costs or plans; the nature and projected profitability of pending and

potential projects and other investments, and the ability to obtain necessary governmental

approvals and permits; ability to successfully identify and finance acquisitions or other

investments and ability to operate and integrate existing and any subsequently acquired business or

properties; impairments under the Securities and Exchange Commission’s full cost ceiling test for

natural gas and oil reserves; changes in the market price of timber and the impact such changes

might have on the types and quantity of timber harvested by the Company; significant changes in tax

rates or policies or in rates of inflation or interest; significant changes in the Company’s

relationship with its employees or contractors and the potential adverse effects if labor disputes,

grievances or shortages were to occur; changes in accounting principles or the application of such

principles to the Company; the cost and effects of legal and administrative claims against the

Company or activist shareholder campaigns to effect changes at the Company; increasing health care

costs and the resulting effect on health insurance premiums and on the obligation to provide

post-retirement benefits; or increasing costs of insurance, changes in coverage and the ability to

obtain insurance. The Company disclaims any obligation to update any forward-looking statements to

reflect events or circumstances after the date hereof.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

|

|

Exhibit 99

|

|

Presentation materials for meetings to be held beginning November

18, 2008

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

NATIONAL FUEL GAS COMPANY

|

|

|

|

By:

|

/s/ James R. Peterson

|

|

|

|

|

James R. Peterson

|

|

|

|

|

Assistant Secretary

|

|

Dated: November 18, 2008

EXHIBIT INDEX

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

99

|

|

Presentation materials for meetings to be held beginning

November 18, 2008

|

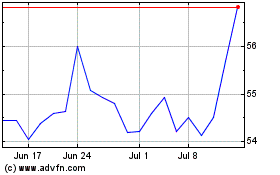

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Oct 2024 to Nov 2024

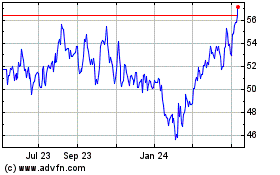

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Nov 2023 to Nov 2024