National Fuel Gas Company (�National Fuel� or the �Company�)

(NYSE:NFG) today announced results for the quarter and six months

ended March 31, 2007. HIGHLIGHTS 1 Reported GAAP earnings per share

for the quarter of $0.92 increased $0.01 per share from the prior

year's second quarter. Earnings were higher in the Utility segment,

the Energy Marketing segment and the Timber segment. Lower earnings

in the Exploration and Production segment and the Pipeline and

Storage segment offset those increases. 2 Quarterly operating

results before items impacting comparability were $0.89 per share,

an increase of $0.04 from the prior year's second quarter. 3 The

Company is increasing and narrowing its GAAP guidance range for

fiscal 2007 earnings. The revised earnings guidance range is now

$2.25 to $2.40 per share.* It had previously been $2.15 to $2.35

per share.* 4 A conference call is scheduled for Tuesday, May 8,

2007, at 11:00 am Eastern Time. MANAGEMENT COMMENTS Philip C.

Ackerman, Chairman and Chief Executive Officer of National Fuel Gas

Company stated: �We have just had another very solid quarter. In

particular, extremes of weather with weekly temperatures ranging

from 46% warmer than normal to 30% colder than normal emphasized

the importance of storage capacity and the talents of our employees

in meeting customer needs. An increase in gas production and an

increase in realized oil prices were offset by a higher effective

tax rate, but our Exploration and Production segment continues to

make progress with increasing emphasis on Appalachia, the hiring of

a new exploration and production manager and the possible sale of

our Canadian operations.� SUMMARY OF RESULTS National Fuel had

consolidated earnings for the quarter ended March 31, 2007, of

$78.4 million, a decrease of $0.2 million from the prior year�s

second quarter of $78.6 million. Consolidated earnings per share of

$0.92 increased $0.01 due to a lower number of weighted average

shares outstanding compared to the prior year. The decrease in

weighted average shares outstanding is a result of the Company�s

share repurchase program (note: all references to earnings per

share are to diluted earnings per share and all amounts are stated

in U.S. dollars). Consolidated earnings for the six months ended

March 31, 2007, of $133.0 million or $1.57 per share decreased $3.0

million or $0.01 per share from the prior year�s earnings. The

Company�s consolidated earnings per share would have been $0.02 per

share lower if not for the fact that the weighted average shares

outstanding have decreased compared to the prior year, mostly due

to the share repurchase program. Three Months Six Months Ended

March 31, Ended March 31, (in thousands except per share amounts)

2007� 2006� 2007� 2006� Reported GAAP earnings $ 78,447� $ 78,594�

$ 132,967� $ 136,013� Items impacting comparability: Resolution of

purchased gas contingency1 (2,344) (2,344) Discontinuance of hedge

accounting1 (1,888) Income tax adjustment1 (5,080) (5,080)

Out-of-period symmetrical sharing adjustment1 � � � � (2,551)

Operating results $ 76,103� $ 73,514� $ 128,735� $ 128,382� � � � �

Reported GAAP earnings per share $ 0.92� $ 0.91� $ 1.57� $ 1.58�

Items impacting comparability: Resolution of purchased gas

contingency1 (0.03) (0.03) Discontinuance of hedge accounting1

(0.02) Income tax adjustment1 (0.06) (0.06) Out-of-period

symmetrical sharing adjustment1 � � � � (0.03) Operating results $

0.89� $ 0.85� $ 1.52� $ 1.49� 1 See discussion of these items

below. As outlined in the table above, certain items included in

GAAP earnings impacted the comparability of the Company�s operating

results when comparing the second quarter and six months ended

March 31, 2007, to the comparable periods in fiscal 2006. Excluding

these items, operating results for the current second quarter of

$76.1 million or $0.89 per share increased $2.6 million or $0.04

per share. Excluding these items, operating results for the six

months ended March 31, 2007, of $128.7 million or $1.52 per share

increased $0.4 million or $0.03 per share. Items impacting

comparability will be discussed in more detail within the

discussion of segment earnings below. DISCUSSION OF RESULTS BY

SEGMENT (The following discussion of the earnings of each segment

is summarized in a tabular form in this report. It may be helpful

to refer to those tables while reviewing this discussion.) Utility

Segment The Utility segment operations are carried out by National

Fuel Gas Distribution Corporation (�Distribution�), which sells or

transports natural gas to customers located in western New York and

northwestern Pennsylvania. The Utility segment�s earnings of

approximately $33.4 million or $0.39 per share, for the quarter

ended March 31, 2007, increased $4.8 million or $0.06 per share

compared to the prior year�s second quarter. In the New York

division, earnings decreased $1.3 million mainly due to higher

operating expenses. In the Pennsylvania division, operating results

increased $6.1 million due to the impact of weather that was 16.5

percent colder than the prior year and the increase in base rates

taking effect early in this quarter. On January 1, 2007,

Distribution implemented the Settlement Agreement approved by the

Pennsylvania Public Utility Commission, which among other things

provided for a $14.3 million (before tax) annual base rate

increase. A lower effective tax rate also contributed to the

increase in this segment�s quarterly earnings. The Utility

segment�s earnings of $50.6 million or $0.60 per share for the six

months ended March 31, 2007, increased $0.2 million compared to the

six months ended March 31, 2006. Earnings in Distribution�s New

York Division for the six months ended March 31, 2007, of $35.1

million decreased $5.6 million compared to the prior year. The

comparability of the six month results is impacted by a $2.6

million positive out-of-period adjustment recorded in the first

quarter of fiscal 2006 to correct Distribution�s calculation of the

symmetrical sharing component of New York�s gas adjustment rate.

Excluding this item, operating results decreased $3.1 million or

$0.04 per share. This decrease is mainly due to higher bad debt and

other operating expenses and higher property taxes. For the six

months ended March 31, 2007, earnings in Distribution�s

Pennsylvania Division of $15.5 million or $0.18 per share,

increased $5.8 million, or $0.07 per share, compared to the prior

year. Earnings increased primarily due to the impact of weather

that was 5.8 percent colder than the prior year, the annual $14.3

million (before taxes) increase in base rates taking effect on

January 1, 2007, and a lower effective tax rate. Partially

offsetting the increase was higher intercompany interest expense.

Pipeline and Storage Segment The Pipeline and Storage segment

operations are carried out by National Fuel Gas Supply Corporation

(�Supply Corporation�) and Empire State Pipeline (�Empire�). These

companies provide natural gas transportation and storage services

to affiliated and non-affiliated companies through an integrated

system of pipelines and underground natural gas storage fields in

western New York and western Pennsylvania. The Pipeline and Storage

segment�s earnings of $13.9 million, or $0.16 per share, for the

quarter ended March 31, 2007, decreased $3.0 million, or $0.04 per

share, when compared with the same period in the prior fiscal year.

The decrease is primarily due to lower efficiency gas revenue

resulting from lower retained volumes and lower natural gas prices

compared to the prior year�s quarter. The lower volumes of

efficiency gas are part of a FERC approved settlement of a

complaint filed by various parties against Supply Corporation under

Sections 5(a) and 13 of the Natural Gas Act (the FERC settlement)

effective December 1, 2006. The FERC settlement also lowered Supply

Corporation�s depreciation rates, which resulted in lower

depreciation expense for the quarter. While the settlement

increased Supply Corporation�s expense for postretirement benefits,

this increase was substantially offset by decreases in the

depreciation expense and other operating expenses. Earnings of

$27.6 million, or $0.33 per share, for the six months ended March

31, 2007, decreased $5.1 million, or $0.05 per share, when compared

with the six months ended March 31, 2006. The comparability of the

results for the six months ended March 31, 2007, is impacted by a

$1.9 million gain associated with the prepayment in the first

quarter of 2007 of the project financing debt for the Empire State

Pipeline. Upon the payment of that debt, the corresponding interest

rate collar no longer qualified for hedge accounting, and gains and

losses could no longer be deferred. Excluding that gain, operating

results decreased $7.0 million for the six months ended March 31,

2007, mainly due to lower efficiency gas revenue resulting from

both lower natural gas prices and lower retained volumes due to the

FERC settlement discussed above. Higher throughput realized in the

first quarter of the prior year caused by the hurricanes in the

fall of 2005 did not recur this year. An increase in postretirement

benefits expense, also due to the FERC settlement, and higher

intercompany interest expense contributed to the decline in

earnings. The decrease was partially offset by lower depreciation

expense, resulting from the FERC settlement, and lower other

operating expenses. Exploration and Production Segment The

Exploration and Production segment operations are carried out by

Seneca Resources Corporation (�Seneca�). Seneca explores for,

develops and purchases natural gas and oil reserves in California,

in the Appalachian region, in the Gulf Coast region of Texas,

Louisiana and Alabama, and in the western provinces of Canada. The

Exploration and Production segment�s earnings in the second quarter

of fiscal 2007 decreased $6.0 million or $0.07 per share to $19.8

million or $0.23 per share, when compared with the same period in

the prior fiscal year. The comparability of the quarterly results

is impacted by a positive tax adjustment of $5.1 million recorded

in the second quarter of fiscal 2006. This benefit to earnings

resulted from an adjustment to a deferred income tax balance. Under

generally accepted accounting principles, a company may recognize

the benefit of certain expected future income tax deductions as a

deferred tax asset only if it anticipates sufficient future taxable

income to utilize those deductions. As a result of changing

circumstances, Seneca increased its forecast of future taxable

income in the Canadian division and, consequently, recorded a

deferred tax asset for certain costs related to capital

expenditures that it now expects to deduct on future income tax

returns. Excluding this item, operating results in the Exploration

and Production segment decreased $1.0 million or $0.01 per share.

The decrease was mainly due to a higher effective tax rate as a

result of higher state income taxes. Partially offsetting this

decrease was a 19.3 percent increase in oil prices realized after

hedging that more than offset a drop in gas prices realized after

hedging of 7.0 percent. For the quarter ended March 31, 2007, the

weighted average oil price received by Seneca (after hedging) was

$48.09/barrel (�Bbl�), an increase of $7.79/Bbl from the prior

year�s quarter. This increase in the weighted average oil price was

mainly due to the expiration of older hedges. The weighted average

natural gas price received by Seneca (after hedging) for the

quarter ended March 31, 2007, was $6.87/thousand cubic feet

(�Mcf�), a decrease of $0.52/Mcf from the prior year�s quarter.

Overall production for the quarter was 12.2 Bcfe, an increase of

0.1 Bcfe over the prior year�s quarter. An increase in natural gas

production more than offset a drop in crude oil production. The

Exploration and Production segment�s earnings of $40.5 million, or

$0.48 per share, for the six months ended March 31, 2007, decreased

$2.8 million, or $0.02 per share, when compared with the six months

ended March 31, 2006. The comparability of the six month results is

impacted by a positive tax adjustment recorded in the second

quarter of fiscal 2006 as described above. Excluding this item,

operating results for the six months ended March 31, 2007, in the

Exploration and Production segment increased $2.3 million, or $0.04

per share, from the prior year. This increase is mainly due to a

nearly 1.0 Bcfe increase in production. A minor drop in oil

production was more than offset by an increase in gas production

while the drop in gas prices realized after hedging was more than

offset by the increase in oil prices realized after hedging. For

the six months ended March 31, 2007, the weighted average oil price

received by Seneca (after hedging) was $45.90/Bbl, an increase of

$9.20/Bbl from the prior year. This increase in the weighted

average oil price was mainly due to the expiration of older hedges.

The weighted average natural gas price received by Seneca (after

hedging) was $6.90/Mcf, a decrease of $0.98/Mcf from the prior

year. In addition a higher effective tax rate contributed to this

decline. Energy Marketing National Fuel Resources, Inc. (�NFR�)

comprises the Company�s Energy Marketing segment. NFR markets

natural gas to industrial, commercial, public authority and

residential customers in western and central New York and

northwestern Pennsylvania, offering competitively priced energy and

energy management services to its customers. The Energy Marketing

segment�s earnings for the quarter ended March 31, 2007, of $6.7

million or $0.08 per share increased $2.8 million or $0.04 per

share compared to the second quarter of last year. The

comparability of the quarterly results is impacted by a $2.3

million reversal of an accrual for purchased gas expense for which

a contingency was resolved during the quarter. Excluding this item

earnings for the quarter increased $0.5 million primarily due to a

15 percent increase in sales throughput during the quarter.

Earnings for the six months ended March 31, 2007, in the Energy

Marketing segment of $7.2 million, or $0.08 per share, increased

$2.3 million, or $0.02 per share. The comparability of the

quarterly results is impacted by a $2.3 million reversal of an

accrual for purchased gas expense noted above. Excluding this item

earnings for the six months ended March 31, 2007, were flat

compared to the prior year. Timber Segment The Timber segment

operations are carried out by Highland Forest Resources, Inc.

(�Highland�) and Seneca�s Northeast Division. This segment markets

high quality hardwoods from its New York and Pennsylvania land

holdings and owns two sawmill/dry kiln operations in northwestern

Pennsylvania. The Timber segment�s earnings for the quarter ended

March 31, 2007, of $3.2 million or $0.04 per share increased $1.0

million or $0.01 per share from the prior year�s second quarter.

Favorable weather conditions facilitated the harvesting of both

veneer and saw logs during the quarter. Although the overall volume

of log and lumber sales was down, most of the current quarter�s

harvest was from low or no basis Company-owned property thus

resulting in an increase in gross margins from the prior year�s

quarter. Earnings for the six months ended March 31, 2007, of $3.4

million decreased $0.3 million from the prior year�s earnings. The

decrease is due to unfavorable weather conditions in the first

quarter that hindered the harvesting of both veneer and saw logs.

This resulted in lower sales of both logs and lumber for the six

months ended March 31, 2007. Harvesting from Company-owned property

resulted in improved margins in the second quarter and offset some

of the decline in earnings experienced in the first quarter.

Corporate and All Other Other direct, wholly-owned subsidiaries of

the Company include Horizon Energy Development, Inc., a corporation

formerly engaged in the development of international power

projects, Horizon LFG, Inc., a corporation engaged, through

subsidiaries, in the purchase, processing, transportation and sale

of landfill gas, and Horizon Power, Inc., a corporation that

develops and owns independent electric generation facilities that

are fueled by natural gas or landfill gas. Earnings in the

Corporate and All Other category for the quarter ended March 31,

2007, were $1.4 million, an increase of $0.3 million when compared

to the prior year�s second quarter earnings of $1.1 million. The

increase is due to higher earnings in Horizon LFG, Inc. and higher

intercompany interest income partially offset by higher operating

costs and higher interest expense. Earnings in the Corporate and

All Other category for the six months ended March 31, 2007, were

$3.6 million, an increase of $2.6 million when compared to the

prior year�s earnings. The increase is mainly due to higher

earnings in Horizon LFG, Inc. and higher intercompany interest

income partially offset by higher operating costs and higher

interest expense. EARNINGS GUIDANCE The Company is increasing, and

narrowing, its guidance range for fiscal 2007 earnings. The revised

earnings guidance range is now $2.25 to $2.40 per share.* It had

previously been $2.15 to $2.35 per share.* The narrowing of the

range is possible because the most sensitivity to earnings variance

in the Utility segment typically occurs during the first two fiscal

quarters, which are now completed. The increase in the upper end of

the guidance range is made possible primarily due to the certainty

of pricing on planned gas sales in the Pipeline and Storage

segment, which are now hedged. This guidance is still based on the

September 21, 2006, commodity pricing incorporated in the Company�s

original guidance. To the extent that actual pricing during the

remainder of the fiscal year varies from those September 21, 2006,

prices, the fiscal year earnings will be affected as detailed in

the earnings sensitivity table on page 24 of this release.*

EARNINGS TELECONFERENCE The Company will host a conference call on

Tuesday, May 8, 2007, at 11 a.m. (Eastern Standard Time) to discuss

this announcement. There are two ways to access this call. For

those with Internet access, visit National Fuel�s Web site at

nationalfuelgas.com and click on the �For Investors� link at the

top of the homepage. For those without Internet access, access is

also provided by dialing (toll-free) 1-800-798-2796, and using the

passcode �74463473.� For those unable to listen to the live

conference call, a replay will be available approximately one hour

after the conclusion of the call at the same Web site link and by

phone at (toll free) 888-286-8010 using passcode �99121557.� Both

the webcast and telephonic replay will be available until the close

of business on Tuesday, May 15, 2007. National Fuel is an

integrated energy company with $4.0 billion in assets comprised of

the following five operating segments: Utility, Pipeline and

Storage, Exploration and Production, Energy Marketing, and Timber.

Additional information about National Fuel is available on its

Internet Web site: nationalfuelgas.com or through its investor

information service at 1-800-334-2188. * - Certain statements

contained herein, including those which are designated with an

asterisk ("*") and those which use words such as "anticipates,"

"estimates," "expects," "intends," "plans," "predicts," "projects,"

and similar expressions, are "forward-looking statements" as

defined by the Private Securities Litigation Reform Act of 1995.

Forward-looking statements involve risks and uncertainties, which

could cause actual results or outcomes to differ materially from

those expressed in the forward-looking statements. The Company's

expectations, beliefs and projections contained herein are

expressed in good faith and are believed to have a reasonable

basis, but there can be no assurance that such expectations,

beliefs or projections will result or be achieved or accomplished.

In addition to other factors, the following are important factors

that could cause actual results to differ materially from those

discussed in the forward-looking statements: changes in laws and

regulations to which the Company is subject, including changes in

tax, environmental, safety and employment laws and regulations;

changes in economic conditions, including economic disruptions

caused by terrorist activities, acts of war or major accidents;

changes in demographic patterns and weather conditions, including

the occurrence of severe weather, such as hurricanes; changes in

the availability and/or price of natural gas or oil and the effect

of such changes on the accounting treatment or valuation of

derivative financial instruments or the Company's natural gas and

oil reserves; impairments under the Securities and Exchange

Commission's full cost ceiling test for natural gas and oil

reserves; changes in the availability and/or price of derivative

financial instruments; changes in the price differentials between

various types of oil; inability to obtain new customers or retain

existing ones; significant changes in competitive factors affecting

the Company; governmental/regulatory actions, initiatives and

proceedings, including those involving acquisitions, financings,

rate cases (which address, among other things, allowed rates of

return, rate design and retained gas), affiliate relationships,

industry structure, franchise renewal, and environmental/safety

requirements; unanticipated impacts of restructuring initiatives in

the natural gas and electric industries; significant changes from

expectations in actual capital expenditures and operating expenses

and unanticipated project delays or changes in project costs or

plans, including changes in the plans of the sponsors of the

proposed Millennium Pipeline with respect to that project, and the

ability to obtain necessary environmental permits; the nature and

projected profitability of pending and potential projects and other

investments; occurrences affecting the Company's ability to obtain

funds from operations or from issuances of debt or equity

securities to finance needed capital expenditures and other

investments, including any downgrades in the Company's credit

ratings; uncertainty of oil and gas reserve estimates; ability to

successfully identify and finance acquisitions or other investments

and ability to operate and integrate existing and any subsequently

acquired business or properties; ability to successfully identify,

drill for and produce economically viable natural gas and oil

reserves; significant changes from expectations in the Company's

actual production levels for natural gas or oil; regarding foreign

operations, changes in trade and monetary policies, inflation and

exchange rates, taxes, operating conditions, laws and regulations

related to foreign operations, and political and governmental

changes; significant changes in tax rates or policies or in rates

of inflation or interest; significant changes in the Company's

relationship with its employees or contractors and the potential

adverse effects if labor disputes, grievances or shortages were to

occur; changes in accounting principles or the application of such

principles to the Company; the cost and effects of legal and

administrative claims against the Company; changes in actuarial

assumptions and the return on assets with respect to the Company�s

retirement plan and post retirement benefit plans; increasing

health care costs and the resulting effect on health insurance

premiums and on the obligation to provide post retirement benefits;

or increasing costs of insurance, changes in coverage and the

ability to obtain insurance. The Company disclaims any obligation

to update any forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. NATIONAL FUEL GAS COMPANY RECONCILIATION OF

CURRENT AND PRIOR YEAR GAAP EARNINGS QUARTER ENDED MARCH 31, 2007 �

Pipeline & Energy Corporate / (Thousands of Dollars) Utility �

Storage � E&P � Marketing � Timber � All Other � Consolidated �

Second quarter 2006 GAAP earnings $ 28,654� $ 16,892� $ 25,845� $

3,877� $ 2,242� $ 1,084� $ 78,594� Items impacting comparability:

Income tax adjustment � � � � � � (5,080) � � � � � � � � (5,080)

Second quarter 2006 operating results 28,654� 16,892� 20,765�

3,877� 2,242� 1,084� 73,514� � Drivers of operating results Colder

weather in Pennsylvania 1,843� 1,843� Base rate increase in

Pennsylvania 3,034� 3,034� � Lower efficiency gas revenues (3,170)

(3,170) Higher operating costs (1,719) (516) (542) (2,777) Lower

depreciation / depletion 1,048� 484� 1,532� � Higher crude oil

prices 4,380� 4,380� Lower natural gas prices (2,369) (2,369)

Higher natural gas production 1,518� 1,518� Lower crude oil

production (914) (914) Lower (higher) effective tax rate 1,301�

(3,829) (2,528) � Higher margins 752� 629� 274� 1,655� � Higher

interest income (expense) (900) 1,038� 138� � All other / rounding

� 331� � � 582� � � 250� � � (267) � � (155) � � (494) � � 247� �

Second quarter 2007 operating results 33,444� 13,936� 19,801�

4,362� 3,200� 1,360� 76,103� Items impacting comparability:

Resolution of a purchased gas contingency � � � � � � � 2,344� � �

� � � � 2,344� Second quarter 2007 GAAP earnings $ 33,444� � $

13,936� � $ 19,801� � $ 6,706� � $ 3,200� � $ 1,360� � $ 78,447�

NATIONAL FUEL GAS COMPANY RECONCILIATION OF CURRENT AND PRIOR YEAR

GAAP EARNINGS PER SHARE QUARTER ENDED MARCH 31, 2007 � Pipeline

& Energy Corporate / Utility � Storage � E&P � Marketing �

Timber � All Other � Consolidated � Second quarter 2006 GAAP

earnings $ 0.33� $ 0.20� $ 0.30� $ 0.04� $ 0.03� $ 0.01� $ 0.91�

Items impacting comparability: Income tax adjustment � � � � �

(0.06) � � � � � � � � (0.06) Second quarter 2006 operating results

0.33� 0.20� 0.24� 0.04� 0.03� 0.01� 0.85� � Drivers of operating

results Colder weather in Pennsylvania 0.02� 0.02� Base rate

increase in Pennsylvania 0.04� 0.04� � Lower efficiency gas

revenues (0.04) (0.04) Higher operating costs (0.02) (0.01) (0.01)

(0.04) Lower depreciation / depletion 0.01� -� 0.01� � Higher crude

oil prices 0.05� 0.05� Lower natural gas prices (0.03) (0.03)

Higher natural gas production 0.02� 0.02� Lower crude oil

production (0.01) (0.01) Lower (higher) effective tax rate 0.02�

(0.04) (0.02) � Higher margins 0.01� 0.01� -� 0.02� � Higher

interest income (expense) (0.01) 0.01� -� � All other / rounding �

-� � � 0.01� � � -� � � -� � � -� � � 0.01� � � 0.02� � Second

quarter 2007 operating results 0.39� 0.16� 0.23� 0.05� 0.04� 0.02�

0.89� Items impacting comparability: Resolution of a purchased gas

contingency � � � � � � � 0.03� � � � � � � 0.03� Second quarter

2007 GAAP earnings $ 0.39� � $ 0.16� � $ 0.23� � $ 0.08� � $ 0.04�

� $ 0.02� � $ 0.92� NATIONAL FUEL GAS COMPANY RECONCILIATION OF

CURRENT AND PRIOR YEAR GAAP EARNINGS SIX MONTHS ENDED MARCH 31,

2007 � Pipeline & Energy Corporate / (Thousands of Dollars)

Utility � Storage � E&P � Marketing � Timber � All Other �

Consolidated � Six months ended March 31, 2006 GAAP earnings $

50,407� $ 32,742� $ 43,280� $ 4,864� $ 3,706� $ 1,014� $ 136,013�

Items impacting comparability: Out-of-period adjustment to

symmetrical sharing (2,551) (2,551) Income tax adjustment � � � � �

(5,080) � � � � � � � � (5,080) Six months ended March 31, 2006

operating results 47,856� 32,742� 38,200� 4,864� 3,706� 1,014�

128,382� � Drivers of operating results Colder weather in

Pennsylvania 2,111� 2,111� Base rate increase in Pennsylvania

3,034� 3,034� Higher operating costs (2,400) (421) (2,821) Higher

property taxes (554) (554) � Lower transportation and storage

revenues (1,025) (1,025) Lower efficiency gas revenues (5,823)

(5,823) Lower depreciation / depletion 977� 902� 1,879� � Higher

crude oil prices 10,412� 10,412� Lower natural gas prices (8,784)

(8,784) Higher natural gas production 6,397� 6,397� Lower crude oil

production (1,137) (1,137) Lower (higher) effective tax rate 1,447�

(4,090) (2,643) � Higher (lower) margins 303� (1,035) 727� (5) �

Higher interest income (expense) (677) (2,030) 2,017� (690) � All

other / rounding � (199) � � 895� � � (475) � � (313) � � (156) � �

250� � � 2� � Six months ended March 31, 2007 operating results

50,618� 25,736� 40,523� 4,854� 3,417� 3,587� 128,735� Items

impacting comparability: Resolution of a purchased gas contingency

2,344� 2,344� Discontinuance of hedge accounting � � � 1,888� � � �

� � � � � � � 1,888� Six months ended March 31, 2007 GAAP earnings

$ 50,618� � $ 27,624� � $ 40,523� � $ 7,198� � $ 3,417� � $ 3,587�

� $ 132,967� NATIONAL FUEL GAS COMPANY RECONCILIATION OF CURRENT

AND PRIOR YEAR GAAP EARNINGS PER SHARE SIX MONTHS ENDED MARCH 31,

2007 � Pipeline & Energy Corporate / Utility Storage E&P

Marketing Timber All Other Consolidated � Six months ended March

31, 2006 GAAP earnings $ 0.58� $ 0.38� $ 0.50� $ 0.06� $ 0.04� $

0.02� $ 1.58� Items impacting comparability: Out-of-period

adjustment to symmetrical sharing (0.03) (0.03) Income tax

adjustment � � � (0.06) � � � � (0.06) Six months ended March 31,

2006 operating results 0.55� 0.38� 0.44� 0.06� 0.04� 0.02� 1.49� �

Drivers of operating results Colder weather in Pennsylvania 0.02�

0.02� Base rate increase in Pennsylvania 0.04� 0.04� Higher

operating costs (0.03) -� (0.03) Higher property taxes (0.01)

(0.01) � Lower transportation and storage revenues (0.01) (0.01)

Lower efficiency gas revenues (0.07) (0.07) Lower depreciation /

depletion 0.01� 0.01� 0.02� � Higher crude oil prices 0.12� 0.12�

Lower natural gas prices (0.10) (0.10) Higher natural gas

production 0.07� 0.07� Lower crude oil production (0.01) (0.01)

Lower (higher) effective tax rate 0.02� (0.05) (0.03) � Higher

(lower) margins -� (0.01) 0.01� -� � Higher interest income

(expense) (0.01) (0.02) 0.02� (0.01) � All other / rounding /

impact of lower shares outstanding � 0.02� � 0.02� � 0.01� � (0.01)

� -� � (0.01) � 0.03� � Six months ended March 31, 2007 operating

results 0.60� 0.31� 0.48� 0.05� 0.04� 0.04� 1.52� Items impacting

comparability: Resolution of a purchased gas contingency 0.03�

0.03� Discontinuance of hedge accounting � � 0.02� � � � � � 0.02�

Six months ended March 31, 2007 GAAP earnings $ 0.60� $ 0.33� $

0.48� $ 0.08� $ 0.04� $ 0.04� $ 1.57� NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES � (Thousands of Dollars, except per share amounts)

Three Months Ended Six Months Ended March 31, March 31, (Unaudited)

(Unaudited) SUMMARY OF OPERATIONS 2007 2006 2007 2006 Operating

Revenues $ 812,156� $ 890,981� $ 1,316,396� $ 1,601,737� �

Operating Expenses: Purchased Gas 476,904� 566,540� 719,843�

1,003,317� Operation and Maintenance 125,539� 121,076� 224,913�

224,704� Property, Franchise and Other Taxes 20,233� 20,120�

37,345� 37,302� Depreciation, Depletion and Amortization � 42,061�

� 44,278� � 84,886� � 87,324� 664,737� 752,014� 1,066,987�

1,352,647� � Operating Income 147,419� 138,967� 249,409� 249,090� �

Other Income (Expense): Income from Unconsolidated Subsidiaries

942� 720� 2,173� 1,985� Interest Income 885� 965� 2,248� 2,098�

Other Income 2,526� 248� 3,241� 989� Interest Expense on Long-Term

Debt (17,888) (18,149) (33,931) (36,367) Other Interest Expense �

(1,516) � (1,465) � (3,366) � (3,240) � Income Before Income Taxes

132,368� 121,286� 219,774� 214,555� � Income Tax Expense � 53,921�

� 42,692� � 86,807� � 78,542� � Net Income Available for Common

Stock $ 78,447� $ 78,594� $ 132,967� $ 136,013� � Earnings Per

Common Share: Basic $ 0.95� $ 0.93� $ 1.61� $ 1.61� Diluted $ 0.92�

$ 0.91� $ 1.57� $ 1.58� � Weighted Average Common Shares: Used in

Basic Calculation � 82,895,087� � 84,346,733� � 82,786,027� �

84,385,140� Used in Diluted Calculation � 85,033,127� � 86,253,597�

� 84,891,742� � 86,256,515� NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Unaudited) � March 31,

September 30, (Thousands of Dollars) � 2007� � 2006� � ASSETS

Property, Plant and Equipment $4,820,700� $4,703,040� Less -

Accumulated Depreciation, Depletion and Amortization 1,893,449� �

1,825,314� Net Property, Plant and Equipment 2,927,251� �

2,877,726� � Current Assets: Cash and Temporary Cash Investments

121,809� 69,611� Hedging Collateral Deposits 2,034� 19,676�

Receivables - Net 335,666� 144,254� Unbilled Utility Revenue

58,850� 25,538� Gas Stored Underground 17,021� 59,461� Materials

and Supplies - at average cost 31,853� 36,693� Unrecovered

Purchased Gas Costs 13,962� 12,970� Prepaid Pension and

Post-Retirement Benefit Costs 68,483� 64,125� Other Current Assets

30,700� 63,723� Deferred Income Taxes 23,951� � 23,402� Total

Current Assets 704,329� � 519,453� � Other Assets: Recoverable

Future Taxes 79,177� 79,511� Unamortized Debt Expense 14,482�

15,492� Other Regulatory Assets 85,427� 76,917� Deferred Charges

5,234� 3,558� Other Investments 80,866� 88,414� Investments in

Unconsolidated Subsidiaries 15,850� 11,590� Goodwill 5,476� 5,476�

Intangible Assets 30,423� 31,498� Fair Value of Derivative

Financial Instruments 1,866� 11,305� Deferred Income Taxes 4,627�

9,003� Other 6,010� � 4,388� Total Other Assets 329,438� � 337,152�

Total Assets $3,961,018� � $3,734,331� � CAPITALIZATION AND

LIABILITIES Capitalization: Comprehensive Shareholders' Equity

Common Stock, $1 Par Value Authorized - 200,000,000 Shares; Issued

and Outstanding - 83,132,149 Shares and 83,402,670 Shares,

Respectively $83,132� $83,403� Paid in Capital 565,809� 543,730�

Earnings Reinvested in the Business 834,902� � 786,013� Total

Common Shareholder Equity Before Items of Other Comprehensive

Income 1,483,843� 1,413,146� Accumulated Other Comprehensive Income

21,733� � 30,416� Total Comprehensive Shareholders' Equity

1,505,576� 1,443,562� Long-Term Debt, Net of Current Portion

999,000� � 1,095,675� Total Capitalization 2,504,576� � 2,539,237�

� Current and Accrued Liabilities: Notes Payable to Banks and

Commercial Paper -� -� Current Portion of Long-Term Debt 96,393�

22,925� Accounts Payable 166,990� 133,034� Amounts Payable to

Customers 10,596� 23,935� Dividends Payable 24,927� 25,008�

Interest Payable on Long-Term Debt 18,419� 18,420� Other Accruals

and Current Liabilities 176,307� 27,040� Fair Value of Derivative

Financial Instruments 32,122� � 39,983� Total Current and Accrued

Liabilities 525,754� � 290,345� � Deferred Credits: Deferred Income

Taxes 556,115� 544,502� Taxes Refundable to Customers 10,433�

10,426� Unamortized Investment Tax Credit 5,743� 6,094� Cost of

Removal Regulatory Liability 87,986� 85,076� Other Regulatory

Liabilities 70,842� 75,456� Post-Retirement Liabilities 26,953�

32,918� Asset Retirement Obligations 79,609� 77,392� Other Deferred

Credits 93,007� � 72,885� Total Deferred Credits 930,688� �

904,749� Commitments and Contingencies -� � -� Total Capitalization

and Liabilities $3,961,018� � $3,734,331� � NATIONAL FUEL GAS

COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) � Six Months Ended March 31, (Thousands of Dollars) �

2007� � 2006� � Operating Activities: Net Income Available for

Common Stock $132,967� $136,013� Adjustments to Reconcile Net

Income to Net Cash Provided by Operating Activities: Depreciation,

Depletion and Amortization 84,886� 87,324� Deferred Income Taxes

21,803� (1,435) Income from Unconsolidated Subsidiaries, Net of

Cash Distributions (960) 1,166� Excess Tax Benefits Associated with

Stock-Based Compensation Awards (13,689) (6,515) Other 3,818�

(5,297) Change in: Hedging Collateral Deposits 17,642� 60,894�

Receivables and Unbilled Utility Revenue (225,511) (249,466) Gas

Stored Underground and Materials and Supplies 47,243� 33,486�

Unrecovered Purchased Gas Costs (992) 14,817� Prepayments and Other

Current Assets 28,659� 24,372� Accounts Payable 34,417� (9,951)

Amounts Payable to Customers (13,339) 11,492� Other Accruals and

Current Liabilities 163,928� 139,020� Other Assets (3,765) (11,837)

Other Liabilities � (2,434) � 19,107� Net Cash Provided by

Operating Activities � $274,673� � $243,190� � Investing

Activities: Capital Expenditures ($132,313) ($134,961) Investment

in Partnership (3,300) -� Net Proceeds from Sale of Oil and Gas

Producing Properties 2,330� 4� Other � (339) � (1,396) Net Cash

Used in Investing Activities � ($133,622) � ($136,353) � Financing

Activities: Excess Tax Benefits Associated with Stock-Based

Compensation Awards $13,689� $6,515� Shares Repurchased under

Repurchase Plan (43,344) (26,577) Reduction of Long-Term Debt

(23,207) (4,529) Dividends Paid on Common Stock (49,808) (48,933)

Proceeds From Issuance of Common Stock � 14,604� � 7,164� Net Cash

Used In Financing Activities � ($88,066) � ($66,360) Effect of

Exchange Rates on Cash � (787) � 15� Net Increase in Cash and

Temporary Cash Investments $52,198� $40,492� Cash and Temporary

Cash Investments at Beginning of Period � 69,611� � 57,607� Cash

and Temporary Cash Investments at March 31 � $121,809� � $98,099�

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES SEGMENT OPERATING

RESULTS AND STATISTICS (UNAUDITED) � Three Months EndedMarch 31,

Six Months EndedMarch 31, (Thousands of Dollars, except per share

amounts) UTILITY SEGMENT 2007 2006 Variance 2007 2006 Variance

Revenues from External Customers $ 501,473� $ 536,235� $ (34,762) $

790,256� $ 967,714� $ (177,458) Intersegment Revenues � 5,941� �

5,681� � 260� � 9,970� � 9,803� � 167� Total Operating Revenues �

507,414� � 541,916� � (34,502) � 800,226� � 977,517� � (177,291) �

Operating Expenses: Purchased Gas 352,864� 394,803� (41,939)

539,225� 715,360� (176,135) Operation and Maintenance 67,448�

65,496� 1,952� 118,215� 117,209� 1,006� Property, Franchise and

Other Taxes 14,107� 14,259� (152) 25,298� 25,773� (475)

Depreciation, Depletion and Amortization � 10,321� � 10,027� � 294�

� 20,100� � 20,004� � 96� � 444,740� � 484,585� � (39,845) �

702,838� � 878,346� � (175,508) � Operating Income 62,674� 57,331�

5,343� 97,388� 99,171� (1,783) � Other Income (Expense): Interest

Income 177� 179� (2) 462� 380� 82� Other Income 368� 192� 176� 653�

404� 249� Other Interest Expense � (7,269) � (6,880) � (389) �

(14,646) � (13,603) � (1,043) � Income Before Income Taxes 55,950�

50,822� 5,128� 83,857� 86,352� (2,495) Income Tax Expense � 22,506�

� 22,168� � 338� � 33,239� � 35,945� � (2,706) Net Income $ 33,444�

$ 28,654� $ 4,790� $ 50,618� $ 50,407� $ 211� � Net Income Per

Share (Diluted) $ 0.39� $ 0.33� $ 0.06� $ 0.60� $ 0.58� $ 0.02� � �

Three Months Ended Six Months Ended March 31, March 31, PIPELINE

AND STORAGE SEGMENT � 2007 � 2006 Variance � 2007 � 2006 Variance

Revenues from External Customers $ 34,952� $ 39,346� $ (4,394) $

64,761� $ 74,085� $ (9,324) Intersegment Revenues � 20,884� �

19,711� � 1,173� � 41,252� � 41,006� � 246� Total Operating

Revenues � 55,836� � 59,057� � (3,221) � 106,013� � 115,091� �

(9,078) � Operating Expenses: Purchased Gas 2� 78� (76) (11) 62�

(73) Operation and Maintenance 17,744� 16,949� 795� 32,647� 32,265�

382� Property, Franchise and Other Taxes 4,335� 4,010� 325� 8,613�

7,966� 647� Depreciation, Depletion and Amortization � 7,563� �

9,176� � (1,613) � 16,855� � 18,359� � (1,504) � 29,644� � 30,213�

� (569) � 58,104� � 58,652� � (548) � Operating Income 26,192�

28,844� (2,652) 47,909� 56,439� (8,530) � Other Income (Expense):

Interest Income 39� 144� (105) 123� 196� (73) Other Income 80� 60�

20� 264� 268� (4) Interest Expense on Long-Term Debt (10) (274)

264� 1,829� (592) 2,421� Other Interest Expense � (2,741) � (1,093)

� (1,648) � (5,028) � (2,389) � (2,639) � Income Before Income

Taxes 23,560� 27,681� (4,121) 45,097� 53,922� (8,825) Income Tax

Expense � 9,624� � 10,789� � (1,165) � 17,473� � 21,180� � (3,707)

Net Income $ 13,936� $ 16,892� $ (2,956) $ 27,624� $ 32,742� $

(5,118) � Net Income Per Share (Diluted) $ 0.16� $ 0.20� $ (0.04) $

0.33� $ 0.38� $ (0.05) NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES �

SEGMENT OPERATING RESULTS AND STATISTICS (UNAUDITED) � Three Months

EndedMarch 31, Six Months EndedMarch 31, (Thousands of Dollars,

except per share amounts) EXPLORATION AND PRODUCTION SEGMENT 2007

2006 Variance 2007 2006 Variance Operating Revenues $ 92,610� $

88,719� $ 3,891� $ 181,318� $ 170,806� $ 10,512� � Operating

Expenses: Purchased Gas -� 4� (4) -� 98� (98) Operation and

Maintenance: General and Administrative Expense 5,949� 6,381� (432)

11,520� 12,682� (1,162) Lease Operating Expense 14,945� 13,155�

1,790� 28,401� 26,694� 1,707� All Other Operation and Maintenance

Expense 2,070� 2,021� 49� 4,711� 3,992� 719� Property, Franchise

and Other Taxes (Lease Operating Expense) 1,241� 1,528� (287)

2,391� 2,736� (345) Depreciation, Depletion and Amortization �

22,914� � 23,118� � (204) � 44,922� � 44,658� � 264� � 47,119� �

46,207� � 912� � 91,945� � 90,860� � 1,085� � Operating Income

45,491� 42,512� 2,979� 89,373� 79,946� 9,427� � Other Income

(Expense): Interest Income 2,644� 1,940� 704� 5,188� 3,781� 1,407�

Other Interest Expense � (12,949) � (12,521) � (428) � (25,897) �

(24,950) � (947) � Income Before Income Taxes 35,186� 31,931�

3,255� 68,664� 58,777� 9,887� Income Tax Expense � 15,385� � 6,086�

� 9,299� � 28,141� � 15,497� � 12,644� Net Income $ 19,801� $

25,845� $ (6,044) $ 40,523� $ 43,280� $ (2,757) � Net Income Per

Share (Diluted) $ 0.23� $ 0.30� $ (0.07) $ 0.48� $ 0.50� $ (0.02) �

� � � Three Months Ended Six Months Ended March 31, March 31,

ENERGY MARKETING SEGMENT � 2007� � 2006� Variance � 2007� � 2006�

Variance Operating Revenues $ 163,338� $ 206,061� $ (42,723) $

246,656� $ 351,620� $ (104,964) � Operating Expenses: Purchased Gas

151,027� 198,562� (47,535) 232,282� 341,391� (109,109) Operation

and Maintenance 1,218� 1,259� (41) 2,512� 2,489� 23� Property,

Franchise and Other Taxes 24� (249) 273� 35� (240) 275�

Depreciation, Depletion and Amortization � 7� � 16� � (9) � 14� �

37� � (23) � 152,276� � 199,588� � (47,312) � 234,843� � 343,677� �

(108,834) � Operating Income 11,062� 6,473� 4,589� 11,813� 7,943�

3,870� � Other Income (Expense): Interest Income 78� 43� 35� 140�

169� (29) Other Income 181� 121� 60� 317� 219� 98� Other Interest

Expense � (125) � (129) � 4� � (252) � (191) � (61) � Income Before

Income Taxes 11,196� 6,508� 4,688� 12,018� 8,140� 3,878� Income Tax

Expense � 4,490� � 2,631� � 1,859� � 4,820� � 3,276� � 1,544� Net

Income $ 6,706� $ 3,877� $ 2,829� $ 7,198� $ 4,864� $ 2,334� � Net

Income Per Share (Diluted) $ 0.08� $ 0.04� $ 0.04� $ 0.08� $ 0.06�

$ 0.02� NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES � SEGMENT

OPERATING RESULTS AND STATISTICS (UNAUDITED) � Three Months

EndedMarch 31, Six Months EndedMarch 31, (Thousands of Dollars,

except per share amounts) TIMBER SEGMENT 2007 2006 Variance 2007

2006 Variance Revenues from External Customers $ 18,184� $ 19,157�

$ (973) $ 29,947� $ 36,066� $ (6,119) Intersegment Revenues � -� �

(23) � 23� � -� � -� � -� Total Operating Revenues � 18,184� �

19,134� � (950) � 29,947� � 36,066� � (6,119) � Operating Expenses:

Operation and Maintenance 10,969� 12,746� (1,777) 20,111� 24,430�

(4,319) Property, Franchise and Other Taxes 426� 478� (52) 819�

859� (40) Depreciation, Depletion and Amortization � 883� � 1,627�

� (744) � 2,251� � 3,638� � (1,387) � 12,278� � 14,851� � (2,573) �

23,181� � 28,927� � (5,746) � Operating Income 5,906� 4,283� 1,623�

6,766� 7,139� (373) � Other Income (Expense): Interest Income 296�

164� 132� 612� 301� 311� Other Income -� 35� (35) 21� 52� (31)

Other Interest Expense � (791) � (758) � (33) � (1,594) � (1,521) �

(73) � Income Before Income Taxes 5,411� 3,724� 1,687� 5,805�

5,971� (166) Income Tax Expense � 2,211� � 1,482� � 729� � 2,388� �

2,265� � 123� Net Income $ 3,200� $ 2,242� $ 958� $ 3,417� $ 3,706�

$ (289) � Net Income Per Share (Diluted) $ 0.04� $ 0.03� $ 0.01� $

0.04� $ 0.04� $ -� � � � Three Months Ended Six Months Ended March

31, March 31, ALL OTHER 2007 2006 Variance 2007 2006 Variance

Revenues from External Customers $ 1,403� $ 1,075� $ 328� $ 3,079�

$ 1,058� $ 2,021� Intersegment Revenues � 2,090� � 2,057� � 33� �

4,287� � 6,584� � (2,297) Total Operating Revenues � 3,493� �

3,132� � 361� � 7,366� � 7,642� � (276) � Operating Expenses:

Purchased Gas 1,822� 1,866� (44) 3,650� 4,972� (1,322) Operation

and Maintenance 950� 922� 28� 1,755� 1,795� (40) Property,

Franchise and Other Taxes 28� 23� 5� 48� 42� 6� Depreciation,

Depletion and Amortization � 197� � 197� � -� � 393� � 397� � (4) �

2,997� � 3,008� � (11) � 5,846� � 7,206� � (1,360) � Operating

Income 496� 124� 372� 1,520� 436� 1,084� � Other Income (Expense):

Income from Unconsolidated Subsidiaries 942� 720� 222� 2,173�

1,985� 188� Interest Income 4� 7� (3) 7� 13� (6) Other Income 12�

14� (2) 25� 16� 9� Other Interest Expense � (667) � (616) � (51) �

(1,337) � (1,206) � (131) � Income Before Income Taxes 787� 249�

538� 2,388� 1,244� 1,144� Income Tax Expense � 320� � 203� � 117� �

935� � 628� � 307� Net Income $ 467� $ 46� $ 421� $ 1,453� $ 616� $

837� � Net Income Per Share (Diluted) $ 0.01� $ -� $ 0.01� $ 0.02�

$ 0.01� $ 0.01� NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES �

SEGMENT OPERATING RESULTS AND STATISTICS (UNAUDITED) � Three Months

EndedMarch 31, Six Months EndedMarch 31, (Thousands of Dollars,

except per share amounts) CORPORATE 2007 2006 Variance 2007 2006

Variance Revenues from External Customers $ 196� $ 388� $ (192) $

379� $ 388� $ (9) Intersegment Revenues � 912� � 782� � 130� �

1,764� � 1,475� � 289� Total Operating Revenues � 1,108� � 1,170� �

(62) � 2,143� � 1,863� � 280� � Operating Expenses: Operation and

Maintenance 5,262� 1,582� 3,680� 7,011� 3,450� 3,561� Property,

Franchise and Other Taxes 72� 71� 1� 141� 166� (25) Depreciation,

Depletion and Amortization � 176� � 117� � 59� � 351� � 231� � 120�

� 5,510� � 1,770� � 3,740� � 7,503� � 3,847� � 3,656� � Operating

Loss (4,402) (600) (3,802) (5,360) (1,984) (3,376) � Other Income

(Expense): Interest Income 22,138� 19,979� 2,159� 44,067� 39,703�

4,364� Other Income 1,885� (174) 2,059� 1,961� 30� 1,931� Interest

Expense on Long-Term Debt (17,878) (17,875) (3) (35,760) (35,775)

15� Other Interest Expense � (1,465) � (959) � (506) � (2,963) �

(1,825) � (1,138) � Income Before Income Taxes 278� 371� (93)

1,945� 149� 1,796� Income Tax Benefit � (615) � (667) � 52� � (189)

� (249) � 60� Net Income $ 893� $ 1,038� $ (145) $ 2,134� $ 398� $

1,736� � Net Income Per Share (Diluted) $ 0.01� $ 0.01� $ -� $

0.02� $ 0.01� $ 0.01� � � � Three Months Ended Six Months Ended �

March 31, March 31, INTERSEGMENT ELIMINATIONS 2007 2006 Variance

2007 2006 Variance Intersegment Revenues $ (29,827) $ (28,208) $

(1,619) $ (57,273) $ (58,868) $ 1,595� � Operating Expenses:

Purchased Gas (28,811) (28,773) (38) (55,303) (58,566) 3,263�

Operation and Maintenance � (1,016) � 565� � (1,581) � (1,970) �

(302) � (1,668) � (29,827) � (28,208) � (1,619) � (57,273) �

(58,868) � 1,595� � Operating Income -� -� -� -� -� -� � Other

Income (Expense): Interest Income (24,491) (21,491) (3,000)

(48,351) (42,445) (5,906) Other Interest Expense � 24,491� �

21,491� � 3,000� � 48,351� � 42,445� � 5,906� � Net Income $ -� $

-� $ -� $ -� $ -� $ -� � Net Income Per Share (Diluted) $ -� $ -� $

-� $ -� $ -� $ -� NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES �

SEGMENT INFORMATION (Continued) (Thousands of Dollars) � � Three

Months Ended Six Months Ended March 31, March 31, (Unaudited)

(Unaudited) � Increase Increase 2007� 2006� (Decrease) 2007� 2006�

(Decrease) � Capital Expenditures: Utility $ 12,679� $ 13,006� $

(327) $ 25,558� $ 25,360� $ 198� Pipeline and Storage 5,201� 4,165�

1,036� 10,153� 10,328� (175) Exploration and Production 49,277�

45,401� 3,876� 95,866� 96,324� (458) Energy Marketing 8� 1� 7� 17�

6� 11� Timber � 401� � 257� � 144� � 1,207� � 752� � 455� Total

Reportable Segments 67,566� 62,830� 4,736� 132,801� 132,770� 31�

All Other 55� 56� (1) 84� 56� 28� Corporate � (610) � 1,707� �

(2,317) � (572) � 2,135� � (2,707) Total Consolidated $ 67,011� $

64,593� $ 2,418� $ 132,313� $ 134,961� $ (2,648) DEGREE DAYS �

Percent Colder � (Warmer) Than: Three Months Ended March 31 Normal

2007� 2006� Normal Last Year � Buffalo, NY 3,327� 3,327� 2,875� -�

15.7� Erie, PA 3,142� 3,152� 2,705� 0.3� 16.5� � Six Months Ended

March 31 � Buffalo, NY 5,587� 5,274� 5,085� (5.6) 3.7� Erie, PA

5,223� 5,030� 4,753� (3.7) 5.8� NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES � EXPLORATION AND PRODUCTION INFORMATION � � Three

Months Ended Six Months Ended March 31, March 31, Increase Increase

2007� 2006� (Decrease) 2007� 2006� (Decrease) � Gas Production

/Prices: Production (MMcf) Gulf Coast 2,893� 2,752� 141� 5,616�

4,419� 1,197� West Coast 920� 933� (13) 1,865� 1,951� (86)

Appalachia 1,339� 1,246� 93� 2,732� 2,499� 233� Canada � 1,856� �

1,761� � 95� � 3,577� � 3,672� � (95) � 7,008� � 6,692� � 316�

13,790� 12,541� � 1,249� Average Prices (Per Mcf) Gulf Coast $

6.42� $ 8.47� $ (2.05) $ 6.48� $ 9.33� $ (2.85) West Coast 6.95�

8.02� (1.07) 6.51� 9.62� (3.11) Appalachia 7.39� 10.03� (2.64)

7.30� 11.83� (4.53) Canada 5.87� 7.21� (1.34) 6.12� 9.06� (2.94)

Weighted Average 6.53� 8.37� (1.84) 6.56� 9.79� (3.23) Weighted

Average after Hedging 6.87� 7.39� (0.52) 6.90� 7.88� (0.98) � Oil

Production /Prices: Production (Thousands of Barrels) Gulf Coast

174� 181� (7) 376� 288� 88� West Coast 599� 639� (40) 1,190� 1,324�

(134) Appalachia 31� 12� 19� 58� 22� 36� Canada � 61� � 68� � (7) �

117� � 155� � (38) � 865� � 900� � (35) � 1,741� � 1,789� � (48) �

Average Prices (Per Barrel) Gulf Coast $ 57.21� $ 58.69� $ (1.48) $

56.84� $ 58.39� $ (1.55) West Coast 49.99� 53.65� (3.66) 50.55�

52.46� (1.91) Appalachia 57.88� 60.28� (2.40) 58.76� 60.84� (2.08)

Canada 49.98� 48.63� 1.35� 46.45� 45.57� 0.88� Weighted Average

51.73� 54.37� (2.64) 51.91� 52.92� (1.01) Weighted Average after

Hedging 48.09� 40.30� 7.79� 45.90� 36.70� 9.20� � Total Production

(Mmcfe) 12,198� 12,092� � 106� 24,236� 23,275� � 961� � Selected

Operating Performance Statistics: General & Administrative

Expense per Mcfe (1) $ 0.49� $ 0.53� $ (0.04) $ 0.48� $ 0.54� $

(0.06) Lease Operating Expense per Mcfe (1) $ 1.33� $ 1.21� $ 0.12�

$ 1.27� $ 1.26� $ 0.01� Depreciation, Depletion & Amortization

per Mcfe (1) $ 1.88� $ 1.91� $ (0.03) $ 1.85� $ 1.92� $ (0.07) �

(1) Refer to page 17 for the General and Administrative Expense,

Lease Operating Expense and Depreciation, Depletion, and

Amortization Expense for the Exploration and Production segment.

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES � EXPLORATION AND

PRODUCTION INFORMATION � � Hedging Summary for Fiscal 2007 � SWAPS

Volume Average Hedge Price Oil 0.4 MMBBL $37.86 / BBL Gas 6.3 BCF

$7.38 / MCF � No-cost Collars Volume Floor Price Ceiling Price Oil

0.1 MMBBL $70.00 / BBL $77.00 / BBL Gas 2.5 BCF $7.42 / MCF $16.42

/ MCF � Hedging Summary for Fiscal 2008 � SWAPS Volume Average

Hedge Price Oil 0.6 MMBBL $52.45 / BBL Gas 7.9 BCF $8.38 / MCF �

No-cost Collars Volume Floor Price Ceiling Price Gas 1.4 BCF $8.83

/ MCF $16.45 / MCF � Hedging Summary for Fiscal 2009 � SWAPS Volume

Average Hedge Price Oil 0.2 MMBBL $54.70 / BBL Gross Wells in

Process of Drilling Six Months Ended March 31, 2007 Total Total

Gulf West East U.S. Canada Company � Wells in Process - Beginning

Period Exploratory 4.00� 1.00� 10.00� 15.00� 5.00� 20.00�

Developmental 1.00� 5.00� 44.00� 50.00� 0.00� 50.00� Wells

Commenced Exploratory 4.00� 0.00� 9.00� 13.00� 6.00� 19.00�

Developmental 0.00� 36.00� 46.00� 82.00� 3.00� 85.00� Wells

Completed Exploratory 1.00� 1.00� 2.00� 4.00� 4.00� 8.00�

Developmental 0.00� 36.00� 67.00� 103.00� 2.00� 105.00� Wells

Plugged & Abandoned Exploratory 3.00� 0.00� 0.00� 3.00� 0.00�

3.00� Developmental 0.00� 0.00� 1.00� 1.00� 0.00� 1.00� Wells in

Process - End of Period Exploratory 4.00� 0.00� 17.00� 21.00� 7.00�

28.00� Developmental 1.00� 5.00� 22.00� 28.00� 1.00� 29.00� � � Net

Wells in Process of Drilling Six Months Ended March 31, 2007 Total

Total Gulf West East U.S. Canada Company � Wells in Process -

Beginning Period Exploratory 2.02� 0.50� 10.00� 12.52� 2.13� 14.65�

Developmental 0.67� 5.00� 44.00� 49.67� 0.00� 49.67� Wells

Commenced Exploratory 1.90� 0.00� 8.10� 10.00� 3.95� 13.95�

Developmental 0.00� 36.00� 44.00� 80.00� 1.80� 81.80� Wells

Completed Exploratory 0.35� 0.50� 1.60� 2.45� 2.75� 5.20�

Developmental 0.00� 36.00� 65.00� 101.00� 0.80� 101.80� Wells

Plugged & Abandoned Exploratory 1.42� 0.00� 0.00� 1.42� 0.00�

1.42� Developmental 0.00� 0.00� 1.00� 1.00� 0.00� 1.00� Wells in

Process - End of Period Exploratory 2.15� 0.00� 16.50� 18.65� 3.33�

21.98� Developmental 0.67� 5.00� 22.00� 27.67� 1.00� 28.67�

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES � � Utility Throughput -

(millions of cubic feet - MMcf) Three Months Ended Six Months Ended

March 31, March 31, Increase Increase 2007� 2006� (Decrease) 2007�

2006� (Decrease) Retail Sales: Residential Sales 29,372� 26,807�

2,565� 46,050� 46,331� (281) Commercial Sales 5,428� 5,038� 390�

8,296� 8,481� (185) Industrial Sales 323� 459� (136) 514� 786�

(272) 35,123� 32,304� 2,819� 54,860� 55,598� (738) Transportation

24,723� 22,119� 2,604� 40,576� 36,461� 4,115� 59,846� 54,423�

5,423� 95,436� 92,059� 3,377� � Pipeline & Storage Throughput -

(MMcf) Three Months Ended Six Months Ended March 31, March 31,

Increase Increase 2007� 2006� (Decrease) 2007� 2006� (Decrease)

Firm Transportation - Affiliated 51,016� 43,637� 7,379� 80,746�

76,862� 3,884� Firm Transportation - Non-Affiliated 69,615� 71,191�

(1,576) 114,312� 140,788� (26,476) Interruptible Transportation

932� 1,831� (899) 1,927� 5,554� (3,627) 121,563� 116,659� 4,904�

196,985� 223,204� (26,219) � Energy Marketing Volumes Three Months

Ended Six Months Ended March 31, March 31, Increase Increase 2007�

2006� (Decrease) 2007� 2006� (Decrease) Natural Gas (MMcf) 19,935�

17,332� 2,603� 31,049� 27,306� 3,743� � � Timber Board Feet

(Thousands) Three Months Ended Six Months Ended March 31, March 31,

Increase Increase 2007� 2006� (Decrease) 2007� 2006� (Decrease) Log

Sales 3,025� 3,282� (257) 4,734� 5,774� (1,040) Green Lumber Sales

2,380� 2,982� (602) 3,910� 4,956� (1,046) Kiln Dry Lumber Sales

3,794� 4,512� (718) 6,952� 8,998� (2,046) 9,199� 10,776� (1,577)

15,596� 19,728� (4,132) NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES

FISCAL 2007 EARNINGS GUIDANCE AND SENSITIVITIES � Fiscal 2007

(Diluted earnings per share guidance*) � � Range � Consolidated

Earnings $2.25� -� $2.40� Earnings per share sensitivity to changes

from NYMEX prices used in guidance* ^ � � � � $1 change per MMBtu

gas $5 change per Bbl oil Increase Decrease Increase Decrease � +

$0.06� - $0.05� + $0.05� - $0.05� NYMEX Settlement Prices at

September 21, 2006 � � Natural Gas Oil ($ per MMBtu) ($ per Bbl) �

Apr-07 $7.166� $65.18� May-07 $7.126� $65.61� Jun-07 $7.221�

$65.96� Jul-07 $7.311� $66.25� Aug-07 $7.391� $66.49� Sep-07

$7.476� $66.67� � Average $7.282� $66.03� * Please refer to forward

looking statement footnote at page 8 of this document. � ^ This

sensitivity table is current as of May 1, 2007 and only considers

revenue from the Exploration and Production segment's crude oil and

natural gas sales. The sensitivities will become obsolete with the

passage of time, changes in Seneca's production forecast, changes

in basis differential, as additional hedging contracts are entered

into, and with the settling of NYMEX hedge contracts at their

maturity. NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES � � � �

Quarter Ended March 31 (unaudited) � 2007� 2006� � Operating

Revenues $ 812,156,000� $ 890,981,000� � Net Income Available for

Common Stock $ 78,447,000� $ 78,594,000� � Earnings Per Common

Share: Basic $ 0.95� $ 0.93� Diluted $ 0.92� $ 0.91� � Weighted

Average Common Shares: Used in Basic Calculation � 82,895,087� �

84,346,733� Used in Diluted Calculation � 85,033,127� � 86,253,597�

� � Six Months Ended March 31 (unaudited) � Operating Revenues $

1,316,396,000� $ 1,601,737,000� � Net Income Available for Common

Stock $ 132,967,000� $ 136,013,000� � Earnings Per Common Share:

Basic $ 1.61� $ 1.61� Diluted $ 1.57� $ 1.58� � Weighted Average

Common Shares: Used in Basic Calculation � 82,786,027� �

84,385,140� Used in Diluted Calculation � 84,891,742� � 86,256,515�

� � Twelve Months Ended March 31 (unaudited) � Operating Revenues $

2,026,317,000� $ 2,289,160,000� � Income from Continuing Operations

$ 135,045,000� $ 180,717,000� Income from Discontinued Operations,

Net of Tax � -� � 23,663,000� Net Income Available for Common Stock

$ 135,045,000� $ 204,380,000� � Earnings Per Common Share: Basic:

Income from Continuing Operations $ 1.62� $ 2.15� Income from

Discontinued Operations � -� � 0.28� Net Income Available for

Common Stock $ 1.62� $ 2.43� � Diluted: Income from Continuing

Operations $ 1.58� $ 2.11� Income from Discontinued Operations � -�

� 0.27� Net Income Available for Common Stock $ 1.58� $ 2.38� �

Weighted Average Common Shares: Used in Basic Calculation �

83,232,743� � 84,116,896� Used in Diluted Calculation � 85,352,796�

� 85,810,270�

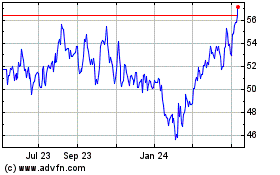

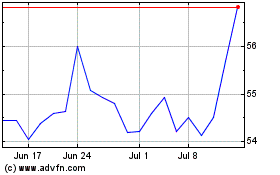

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Sep 2024 to Oct 2024

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Oct 2023 to Oct 2024