~ Quarterly Revenue Grows to $200 Million

~

~ Same-Store Sales Growth Increases 16%

~

~ Quarterly Pretax Earnings Increases

Ten-fold ~

~ Raises 2016 Annual Guidance ~

MarineMax, Inc. (NYSE:HZO), the nation’s largest recreational

boat and yacht retailer, today announced results for its second

quarter ended March 31, 2016.

Revenue grew 16% to $199.6 million for the quarter ended March

31, 2016 from $172.1 million for the comparable quarter last year.

Same-store sales grew more than 16% which is on top of 27% growth

in the same period a year ago. The Company’s pretax earnings were

$4.0 million compared with $390,000 for the same period a year ago,

an increase of more than 10 times. The Company reported net income

of $2.4 million, or $0.10 per diluted share for the quarter ended

March 31, 2016 compared to net income of $390,000, or $0.02 per

diluted share for the comparable quarter last year. In the same

period last year, the Company was not required to provide an income

tax provision.

Revenue increased 12% to $369.1 million for the six months ended

March 31, 2016 compared with $330.3 million for the comparable

period last year. Same-store sales grew more than 12% on top of 35%

growth for the comparable period last year. The Company’s pretax

earnings were $5.4 million compared with $604,000 for the same

period a year ago. Net income for the six months ended March 31,

2016 was $3.3 million or $0.13 per diluted share, compared to net

income of $604,000, or $0.02 per diluted share for the comparable

period last year. In the same period last year, the Company was not

required to provide an income tax provision.

William H. McGill, Jr., Chairman, President, and Chief Executive

Officer, stated, “We are excited by our results in the quarter and

through the first half of the year. Our performance continues to be

driven by new products from our premium manufacturing partners as

well as great execution by our team on our customer centric

strategies. Our same-store sales growth this quarter provides

additional evidence that the pace of the boating recovery is

continuing to build, especially for MarineMax.”

Mr. McGill continued, “With our product line expansions over the

past few years, combined with new models from our partners, we

expect to continue our ongoing market share gains and improved

earnings performance. We are certainly encouraged by our backlog of

orders, the right inventory mix, a broader geographic reach with

our recent Northeast coastal acquisition of Russo Marine, and the

fact that we are entering the busiest selling season of the year.

Our team is fully engaged as they execute on our strategy to

maximize our customers’ enjoyment of the boating lifestyle, as we

create long-term shareholder value and happy customers.”

2016 Guidance

Based on current business conditions, retail trends and other

factors, the Company is raising annual guidance expectations for

fully taxed earnings per diluted share to be in the range of $0.68

to $0.75 for fiscal 2016 from its previous guidance of $0.60 to

$0.70. This compares to an adjusted, but fully taxed, diluted

earnings per share of $0.47 in fiscal 2015. The adjustments to

fiscal 2015 are the removal of certain gains and a deferred tax

asset valuation allowance reversal noted in previous earnings

releases. These expectations do not take into account, or give

effect, for possible material acquisitions that may potentially be

completed by the Company during the fiscal year or other unforeseen

events.

About MarineMax

Headquartered in Clearwater, Florida, MarineMax is the nation’s

largest recreational boat and yacht retailer. Focused on premium

brands, such as Sea Ray, Boston Whaler, Meridian, Hatteras, Azimut

Yachts, Ocean Alexander, Galeon, Grady-White, Harris, Crest, Scout,

Sailfish, Sea Pro, Scarab Jet Boats, Aquila, and Nautique,

MarineMax sells new and used recreational boats and related marine

products and services as well as provides yacht brokerage and

charter services. MarineMax currently has 56 retail locations in

Alabama, California, Connecticut, Florida, Georgia, Maryland,

Massachusetts, Minnesota, Missouri, New Jersey, New York, North

Carolina, Ohio, Oklahoma, Rhode Island, and Texas and operates

MarineMax Vacations in Tortola, British Virgin Islands. MarineMax

is a New York Stock Exchange-listed company. For more information,

please visit www.marinemax.com.

Certain statements in this press release are forward-looking as

defined in the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include the Company's anticipated

financial results for the second quarter ended March 31, 2016; our

expectation to continue our ongoing market share gains and improved

earnings performance; our belief that we are entering the time of

the year that is typically our busiest selling season; and our

creation of long-term shareholder value. These statements involve

certain risks and uncertainties that may cause actual results to

differ materially from expectations as of the date of this release.

These risks include the Company’s abilities to reduce inventory,

manage expenses and accomplish its goals and strategies, the

quality of the new product offerings from the Company's

manufacturing partners, general economic conditions, as well as

those within our industry, and the level of consumer spending, the

Company’s ability to integrate acquisitions into existing

operations, and numerous other factors identified in the Company’s

Form 10-K for the fiscal year ended September 30, 2015 and other

filings with the Securities and Exchange Commission.

MarineMax, Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations

(Amounts in thousands, except share and

per share data)

(Unaudited)

Three Months Ended March 31, Six Months

Ended March 31, 2016

2015 2016 2015

Revenue $ 199,566 $ 172,143 $ 369,103 $ 330,269 Cost of sales

150,539 129,943 278,462 250,614 Gross

profit 49,027 42,200 90,641 79,655 Selling, general, and

administrative expenses 43,459 40,557 82,410

76,652 Income from operations 5,568 1,643 8,231 3,003

Interest expense 1,582 1,253 2,809

2,399 Income before income tax provision 3,986 390 5,422 604

Income tax provision 1,564 — 2,111 —

Net income $ 2,422 $ 390 $ 3,311 $ 604 Basic net income per

common share $ 0.10 $ 0.02 $ 0.14 $ 0.02 Diluted net income

per common share $ 0.10 $ 0.02 $ 0.13 $ 0.02 Weighted

average number of common shares used in computing net income per

common share: Basic 24,154,397 24,544,272

24,183,926 24,409,969 Diluted 24,696,881

25,265,857 24,699,601 25,105,262

MarineMax, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(Amounts in thousands)

(Unaudited)

March 31, 2016 March 31, 2015

ASSETS CURRENT ASSETS: Cash and cash equivalents $ 43,974 $

42,695 Accounts receivable, net 31,855 23,046 Inventories, net

346,411 277,030 Prepaid expenses and other current assets 10,858

3,876 Deferred tax assets, net 7,644 —

Total current assets 440,742 346,647 Property and equipment,

net 113,012 108,100 Other long-term assets, net 3,850 5,257

Deferred tax assets, net 17,572 — Total

assets $ 575,176 $ 460,004

LIABILITIES AND

STOCKHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable $

26,998 $ 11,928 Customer deposits 19,707 17,157 Accrued expenses

22,505 20,741 Short-term borrowings 219,030

165,287 Total current liabilities 288,240 215,113

Long-term liabilities 651 345 Total

liabilities 288,891 215,458 STOCKHOLDERS' EQUITY: Preferred

stock — — Common stock 26 25 Additional paid-in capital 236,885

232,586 Retained earnings 78,744 27,745 Treasury stock

(29,370 ) (15,810 ) Total stockholders’ equity

286,285 244,546 Total liabilities and

stockholders’ equity $ 575,176 $ 460,004

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160426005299/en/

MarineMax, Inc.Michael H. McLambChief Financial OfficerAbbey

HeimensenPublic Relations727-531-1700orIntegrated Corporate

Relations, Inc.Investor Relations:Brad Cohen,

203-682-8211Media:Susan Hartzell, 203-682-8238

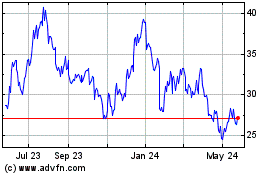

MarineMax (NYSE:HZO)

Historical Stock Chart

From Jun 2024 to Jul 2024

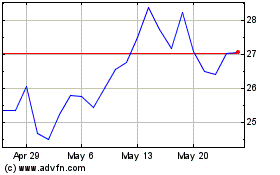

MarineMax (NYSE:HZO)

Historical Stock Chart

From Jul 2023 to Jul 2024