UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

Manchester United

plc

(Name of Subject Company)

Manchester United

plc

(Names of Person Filing Statement)

CLASS A ORDINARY SHARES, PAR VALUE $0.0005

PER SHARE

(Title of Class of Securities)

G5784H106

(CUSIP Number of Class of Securities)

Patrick Stewart

Chief Executive Officer, General Counsel

Manchester United plc

Old Trafford

Sir Matt Busby Way

Manchester M16 0RA

United Kingdom

+44 (0) 161 868 8000

With copies to:

|

Marc Jaffe, Esq.

Justin G. Hamill, Esq.

Ian D. Schuman, Esq.

Latham & Watkins LLP

1271 Avenue of the Americas

New York, New York 10020

(212) 906-1200 |

Mitchell S. Nusbaum, Esq.

Christopher R. Rodi, Esq.

Woods Oviatt Gilman LLP

2 State Street

700 Crossroads Building

Rochester, NY 14614

(585) 987-2800 |

(Name, address, and telephone numbers of person

authorized to receive notices and communications

on behalf of the persons filing statement)

| x |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This filing on Schedule 14D-9 contains the following

pre-commencement communication relating to a planned tender offer (the “Offer”) by Trawlers Limited

(“Purchaser”), a company limited by shares incorporated under the Isle of Man’s Companies Act 2006 with company number 021222V and wholly owned by James A.

Ratcliffe, a natural person (together with the Purchaser, the “Offerors”), for up to 13,237,834 Class A ordinary

shares, par value $0.0005 per share (“Class A Shares”), of Manchester United plc (the “Company”), an

exempted company with limited liability incorporated under the Companies Act (as amended) of the Cayman Islands, at a price of

$33.00 per Class A Share, in cash (subject to certain adjustments described in the Transaction Agreement (as defined below)),

without interest thereon, less any required tax withholding, as contemplated by the transaction agreement, dated as of

December 24, 2023 (together with any amendments or supplements thereto, the “Transaction Agreement”), by and among

Purchaser, the sellers party thereto, and the Company, which is incorporated herein by reference:

Cautionary Notice Regarding Forward-Looking Statements

This Schedule 14D-9 and the materials incorporated by reference herein

contain forward-looking statements. These forward-looking statements are based on the current beliefs, expectations and assumptions of

the Company’s management with respect to future events and are subject to a number of significant risks and uncertainties. It is

important to note that the Company’s performance, and actual results, financial condition and business could differ materially from

those expressed in such forward-looking statements. All statements other than statements of historical fact are forward-looking statements.

The words “may,” “might,” “will,” “could,” “would,” “should,”

“expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,”

“predict,” “potential,” “continue,” “contemplate,” “possible,” or the negative

of these words, variations thereof or similar expressions are intended to identify such forward-looking statements. These forward-looking

statements include, but are not limited to, statements about the expected timing of the Offer and the other transactions contemplated

by the Transaction Agreement (the “Transactions”), the timing and procedures for the Offer and the shareholder vote, the consideration

to be received in connection with the Transactions, the payment of any fees in connection with the Transactions, the satisfaction or waiver

of any conditions to the Transactions, the Company’s and Purchaser’s beliefs and expectations, the benefits sought to be achieved

by the Transactions, and the potential effects of the completed Transactions on both the Company and Purchaser.

You should understand that forward-looking statements are not guarantees

of performance or results. They involve known and unknown risks, uncertainties and assumptions. Although the Company believes that these

forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect the Company’s

actual financial results or results of operations and could otherwise cause actual results to differ materially from those in these forward-looking

statements. Factors that could cause or contribute to such differences include, but are not limited to, risks and uncertainties relating

to the satisfaction of the conditions precedent to the consummation of the Transactions, including (without limitation) the receipt of

shareholder approval for the amendment to the Company’s amended and restated memorandum and articles of association and the receipt

of required regulatory approvals (including the approval of the FA, the Premier League and the German Federal Cartel Office); unanticipated

difficulties or expenditures relating to the Transactions; legal proceedings, judgments or settlements, including those that may be instituted

against the Company, the board of directors and executive officers of the Company and others following

the announcement of the Transactions; disruptions of current plans and operations caused by the announcement and pendency of the Transactions;

potential difficulties in employee retention due to the announcement and pendency of the Transactions; the response of fans, business

partners, sponsors and regulators to the announcement of the Transactions; other risks that may imperil the consummation of the Transactions,

which may result in the Transactions not being consummated within the expected time period or at all; as well as the various factors discussed

in the “Risk Factors” section and elsewhere in the Company’s Registration Statement on Form F-1, as amended (File No. 333-182535), and in the Company’s Annual Report on Form 20-F (File No. 001-35627), as supplemented by the risk

factors contained in the Company’s other filings with the Securities and Exchange Commission (the “SEC”). All forward-looking

statements contained or incorporated by reference herein are qualified by these cautionary statements. Except as required by law, the

Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Except

as required by law, the Company is not under any duty to update any of the information contained or incorporated by reference herein.

About the Offer and Additional Information

The Offer has not yet commenced. This communication is for informational

purposes only, is not a recommendation, and is neither an offer to purchase nor a solicitation of an offer to sell Class A Shares

or any other securities, nor is it a substitute for the tender offer materials that the Offerors will file with the SEC upon commencement

of the Offer. The solicitation and offer to purchase Class A Shares will only be made pursuant to the tender offer materials that

the Offerors and the Company intend to file with the SEC upon commencement of the Offer. At the time the Offer is commenced, the Offerors

will file with the SEC a tender offer statement on Schedule TO (the “Tender Offer Statement”), and the Company will file with

the SEC a solicitation/recommendation statement on Schedule 14D-9 (“Solicitation/Recommendation Statement”) with respect to

the Offer. THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE TENDER OFFER STATEMENT (INCLUDING AN OFFER TO PURCHASE, A RELATED

LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WHEN SUCH DOCUMENTS BECOME

AVAILABLE (AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD

BE READ AND CONSIDERED CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. When filed, the Company’s shareholders

and other investors can obtain the Tender Offer Statement, the Solicitation/Recommendation Statement and other filed documents for free

at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of charge

on the Investors page of the Company’s website, https://ir.manutd.com/. In addition, the Company’s shareholders may obtain

free copies of the tender offer materials by contacting the information agent for the Offer that will be named in the Tender Offer Statement.

EXHIBIT INDEX

Exhibit 99.1

Email to All Manchester United Staff

From: On behalf of Joel Glazer and Avram Glazer

To: All Manchester United Staff

Subject: Manchester United plc reaches agreement for Sir Jim

Ratcliffe, Chairman of INEOS, to acquire up to a 25% shareholding in the Company

This email is for: all Colleagues

Dear Colleagues,

We are pleased to share the news that the Board has agreed a deal for

INEOS Chairman, Sir Jim Ratcliffe, to acquire up to 25% of A & B shares of Manchester United.

This follows the strategic review over the past year in which we have

explored a number of different options to help strengthen the Club and ensure additional funds intended for investment in infrastructure.

We know Manchester United has great strengths – not least its

people. This deal will help to unlock more of the potential that you have helped build in this great Club. As part of the partnership,

the Board has asked INEOS, with their agreement, to have oversight and responsibility for the Club’s football operations. This will

include all aspects of the men's and women's football operation and the Academies, with the aim of delivering a world-class, high-performance

environment supporting success on the pitch. This will build on the Club’s many existing strengths, including industry-leading success

off the pitch.

INEOS brings expertise and experience from inside and outside the game

that we believe can benefit Manchester United. We know from our conversations that they share our ambition and aspiration to ensure that

the Club returns to the top of English, European and world football and together we will work hard to help make that happen.

The transaction is subject to the usual regulatory and Premier League

approvals, and we hope it will be completed as soon as possible. During this period Sir Jim and INEOS do not plan to make any public statements.

Moving forward, they will work closely with Patrick Stewart, as interim

CEO, and the Executive Leadership Team as they integrate into the Club. We understand this process has taken time and has inevitably created

some uncertainty for colleagues. But it has been important to conduct the strategic review thoroughly and to find the right partner to

take us forward. Thank you for your patience.

We are excited about the opportunity ahead and realistic about the

hard work and commitment that it will require from everyone at Manchester United to help realise it. However, we know from more than 18

years’ experience working with you, that we can count on your diligence, dedication, and ability.

Please note that there are certain legal rules that govern permissible

communications during this process. Accordingly, please avoid commenting on this transaction on any social media channels. If you are

approached by the media, please refrain from commenting, and refer all inquiries to Ellie Norman, Chief Communications Officer. In addition,

if you are asked about this transaction by friends or family, you may refer to the information that is publicly available on the Manchester

United website, but please do not make any speculative comments or insert your own opinions or beliefs regarding the transaction.

Thank you again for everything you do for Manchester United and if

you have any further questions about today’s announcement, please contact your line manager or email communications@manutd.co.uk.

Best wishes,

Joel Glazer & Avram Glazer

On behalf of the MUFC Board

Cautionary Notice Regarding Forward-Looking Statements

This communication contains “forward-looking statements”

relating to the proposed acquisition of Class A ordinary shares, par value $0.0005 per share ("Class A Shares”),

and Class B ordinary shares, par value $0.0005 per share, of Manchester United plc, a Cayman Islands exempted company (the “Company”)

by Trawlers Limited (“Purchaser”), a company incorporated under the laws of the Isle of Man and wholly owned by James A. Ratcliffe,

a natural person (an “Offeror” and, together with Purchaser, the “Offerors”). Such forward-looking statements

include, but are not limited to, statements about the parties’ ability to satisfy the conditions to the consummation of the Offer

(as defined below), the expected timetable for completing the Offer and the other transactions contemplated by the Transaction Agreement

(as defined below) and the ancillary agreements thereto (collectively, the “Transactions”), the Company’s and Offerors’

beliefs and expectations, the benefits sought to be achieved by the Transactions, and the potential effects of the completed Transactions

on both the Company and the Offerors. In some cases, forward-looking statements may be identified by terminology such as “believe,”

“may,” “will,” “should,” “predict,” “goal,” “strategy,” “potentially,”

“estimate,” “continue,” “anticipate,” “intend,” “could,” “would,”

“project,” “plan,” “expect,” “seek” and similar expressions and variations thereof. These

words are intended to identify forward-looking statements. These forward-looking statements are based on current expectations and projections

about future events, but there can be no guarantee that such expectations and projections will prove accurate in the future. All statements

other than statements of historical fact are forward-looking statements. Actual results may differ materially from current expectations

due to a number of factors, including (but not limited to) risks associated with uncertainties as to the timing of the Transactions; uncertainties

as to how many of the Company’s shareholders will tender their shares in the Offer; the risk that competing offers will be made;

the possibility that various conditions to the Transactions may not be satisfied or waived; and the risk that shareholder litigation in

connection with the Transactions may result in significant costs of defense, indemnification and liability. Undue reliance should not

be placed on these forward-looking statements, which speak only as of the date they are made. Except as required by law, the Company and

the Offerors undertake no obligation to publicly release any revisions to the forward-looking statements after the date hereof to conform

these statements to actual results or revised expectations.

About the Offer and Additional Information

The Offerors expect to commence a tender offer (such tender offer,

the “Offer”) for up to 13,237,834 Class A Shares of the Company representing 25.0% of the issued and outstanding Class A

Shares as of the commencement of the Offer, rounded up to the nearest whole Class A Share, at a price of $33.00 per Class A

Share, in cash (subject to certain adjustments), without interest thereon, less any required tax withholding. The Offer is being made

pursuant to the transaction agreement, dated as of 24th December 2023, by and among Purchaser, the sellers party thereto, who are

Glazer family members and affiliates, and the Company (the “Transaction Agreement”). The Offer has not yet commenced. This

communication is for informational purposes only, is not a recommendation and is neither an offer to purchase nor a solicitation of an

offer to sell Class A Shares of the Company or any other securities. This communication is also not a substitute for the tender offer

materials that the Offerors will file with the United States Securities and Exchange Commission (the “SEC”) upon commencement

of the Offer. At the time the Offer is commenced, the Offerors will file with the SEC a Tender Offer Statement on Schedule TO (the “Tender

Offer Statement”) and the Company will file with the SEC a solicitation/recommendation statement on Schedule 14D-9 (the “Solicitation/Recommendation

Statement”). THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE TENDER OFFER STATEMENT (INCLUDING AN OFFER TO PURCHASE, A RELATED

LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION / RECOMMENDATION STATEMENT WHEN SUCH DOCUMENTS BECOME

AVAILABLE (AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME), BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD

BE READ AND CONSIDERED CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE OFFER. When filed, the Company’s shareholders and

other investors can obtain the Tender Offer Statement, the Solicitation/Recommendation Statement and other filed documents for free at

the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of charge on

the Investors page of the Company’s website, https://ir.manutd.com/. In addition, the Company’s shareholders may obtain

free copies of the tender offer materials by contacting the information agent for the Offer that will be named in the Tender Offer Statement.

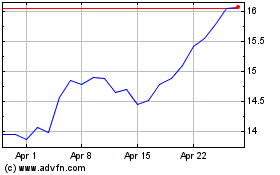

Manchester United (NYSE:MANU)

Historical Stock Chart

From Apr 2024 to May 2024

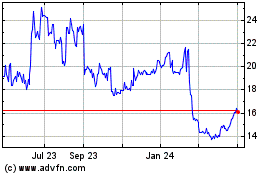

Manchester United (NYSE:MANU)

Historical Stock Chart

From May 2023 to May 2024