OMB APPROVAL

OMB Number: 3235-0570

Expires: September 30, 2025

Estimated average burden hours per response...7.8

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21582

Madison Covered Call & Equity Strategy Fund

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices) (Zip code)

Steven J. Fredricks

Chief Legal Officer & Chief Compliance Officer

Madison Asset Management, LLC

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Form N-CSRS is to be used by management investment companies to file reports

with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to

stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information

provided on Form N-CSRS in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form

N-CSRS, and the Commission will make this information public. A registrant is not required to respond to the collection of information

contained in Form N-CSRS unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number.

Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden

to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection

of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Certified Financial Statement

Semi-Annual Report

June 30, 2023

| |

MADISON COVERED CALL & EQUITY STRATEGY

FUND (MCN) |

| |

|

| |

Active Equity Management combined with a Covered Call Option Strategy |

MCN | Madison Covered Call & Equity Strategy Fund | June 30,

2023

Table of Contents

MCN | Madison Covered Call & Equity Strategy Fund | June 30,

2023

Review of Period

What happened in the market during the first half of 2023?

Since March of last year, the Federal Reserve (Fed) has raised its Fed

Funds target rate 10 times from 0.25% to 5.25% representing the most aggressive tightening regime since the hyper inflationary early 1980’s.

While the last three hikes of 25 basis points appear to signal that we may be nearing the end of the rate hike cycle, there is little

evidence yet to suggest that a “pivot” to lower rates is in the cards soon. Higher rates have certainly caused inflation to

recede but not yet down to acceptable levels. The immediate impact of the aggressive Fed action on the equity market was to depress price/earnings

multiples. Virtually all the market decline in 2022 can be attributed to compression of P/E multiples. However, the full economic impact

of the rate hikes has yet to show its fangs. There is typically a 15-to-18-month lag from the beginning of Fed rate changes to their impact

being felt in the real economy. We are now entering that period and are beginning to witness some of the negative repercussions. Employment

has generally remained resilient, but layoff announcements have significantly increased in recent months. The weight of the highest mortgage

rates in over 20 years has caused the real estate market to roll over. More recently, evidence of fractures in the banking system have

come to light. Rate hikes have contributed to and exposed weaknesses in our economy and things are beginning to break. As we approach

the point at which the impact of the severe tightening will bear its teeth, it is wishful thinking to believe that there will be no meaningful

negative impact to economic growth and corporate revenue growth going forward. And, the reversal of tightening that had been widely hoped

for has yet to transpire as the Federal Reserve has signaled that its interest rate policy will remain higher for longer.

Despite facing the potential of a meaningful economic slowdown or recession,

the S&P 500’s six month start to the year is its 2nd highest over the past 25 years. Granted, this comes on the heels of a significant

downturn in 2022, but typically a sustainable market rebound occurs when the “all clear” has been sounded and an environment

for a new bull market is in place. We do not believe that is the case right now. It has also been very evident that the strong returns

year-to-date have been driven by relatively few mega-cap growth companies which have dominated performance as they did in the 2021 bull

market run. Clearly, a “risk-on” market sentiment has been in vogue. The 2nd quarter of the year was actually plateauing through

late May but surged sharply after Nvidia announced higher earnings expectations centered around their new generation of computer chips

that targeted the artificial intelligence market … hence the “AI” boom began. It should be noted that “AI”

is not a new phenomenon but appears to have provided the spark to a market that was looking to be distracted from the “recession”

talk that was inconveniently dampening enthusiasm.

Can earning growth explain the strong market performance? S&P 500 earnings

expectations have actually declined but only slightly over the past few months. Large growth company expectations have remained slightly

positive while large value, mid-cap growth and value and small-cap growth and value companies are experiencing growth expectation declines.

The market’s overall performance is completely derived from the expansion of price to earnings multiples, not fundamental improvement.

In other words, the market, particularly in the growth sectors such as technology and consumer discretionary, is almost as expensive as

late 2021 while staring an economic slowdown/recession straight in the face. As the tightening lag becomes reality, earnings expectations

will likely be revised much lower making valuations even more expensive unless they re-adjust lower. At some point, something must give.

MCN | Madison Covered Call & Equity Strategy Fund | Review

of Period (unaudited) - continued | June 30, 2023

How did the Fund perform given the marketplace conditions

during the first six months of 2023?

With the S&P 500 increasingly dominated by a handful of mega-cap

growth stocks, the Fund was unable to keep up with the overall index during the first half of 2023 after very strong performance in 2022.

Over the full six months ending June 30, 2023, the Fund’s Net Asset Value (NAV) gained 7.1%, trailing the high-flying S&P 500’s

16.9% gain. The Fund also trailed the CBOE S&P BuyWrite Index (BXM) return of 10.5%. The Fund’s market price was conservatively

flat as its premium to NAV narrowed from 9.9% at the the beginning of the year to 2.9% on June 30.

The Fund entered the year defensively postured following a challenging

year for the market in 2022. High option coverage and a high cash level combined to create the defensive positioning, which we believe

is prudent in a slowing economic environment. While this partially limited upside in the first half of the year, it should help minimize

fund drawdowns if the market pulls back or goes lower due to recession concerns.

At last year end, the Fund had 82.3% of its equity exposure covered

by call options and remained significantly covered during most of the first half of the year. Despite a strong market rally in the first

half, we remained concerned about the potential for renewed downside. At period end, the Fund was 86.7% covered. With respect to cash

levels, the Fund began the period with 21% in cash and worked the level lower near the end of the period. At the end of June, the Fund’s

cash level was a little north of 18%. In such a strong market environment, both option coverage and cash levels were detractive to the

Fund’s relative performance.

During the period, sector allocation was a headwind while stock

selection was additive to relative performance. In terms of sector allocation, an overweight position in Energy was detractive to results.

We continue to maintain an overweight position with a favorable view of Energy sector prospects in the second half of the year and beyond.

For stock selection, on the positive side, Energy deepwater drilling firm Transocean was the most additive stock in the portfolio. It

benefitted from improving demand for its fleet of oil rigs. Within Technology, software company Adobe contributed nicely to results due

to an improving earnings outlook. In Consumer Discretionary, retailer Nordstrom was an outperforming stock. Other notable outperforming

stocks included airfreight and logistics firm FedEx in Industrials, and payment provider Fiserv in Financials. On the negative side, Energy

exploration and production firm Apache was the most detractive stock in the portfolio following a strong year in 2022. Lower oil prices

served as a short-term headwind. In Health Care, pharmacy retailed CVS Health trailed the market as it experienced slowing volume growth

at its pharmacies. Within Utilities, power generation and utility service provider AES underperformed the index. Other notable underperforming

stocks included Ciena in the Technology sector, along with tower owner and operator American Tower in Real Estate.

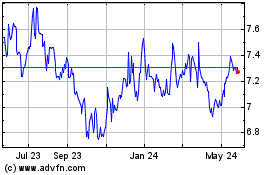

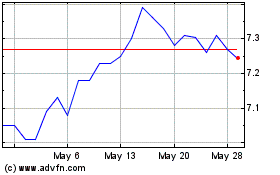

SHARE PRICE AND NAV PERFORMANCE FOR MADISON COVERED CALL &

EQUITY STRATEGY FUND

MCN | Madison Covered Call & Equity Strategy Fund | Review

of Period (unaudited) - continued | June 30, 2023

Describe the Fund’s portfolio equity and option structure:

As of June 30, 2023, the Fund held 38 equity securities and unexpired

call options had been written against 86.6% of the Fund’s stock holdings. It is the strategy of the Fund to write “out-of-the-money”

call options, as of June 30, 85.4% of the Fund’s call options (41 of 48 different options) remained “out-of-the-money.”

(Out-of-the-money means the stock price is below the strike price at which the shares could be called away by the option holder). On average,

the Fund’s call options had 43.3 days to expiration.

Which sectors are prevalent in the Fund?

From a sector perspective, MCN’s largest exposure as of

June 30, 2023 was to the Health Care sector followed by the Energy, Financial, Consumer Discretionary, Consumer Staples, Technology and

Materials sectors. This was followed by smaller exposures in the Utilities, Industrials, Communication Services and Real Estate sectors.

The Fund also had a small exposure to an industry specific Exchange Traded Fund.

Management’s Discussion of Fund Performance (unaudited)

| ALLOCATION AS A PERCENTAGE OF TOTAL INVESTMENTS AS OF 6/30/23 |

| Communication Services |

4.2% |

| Consumer Discretionary |

8.5% |

| Consumer Staples |

7.2% |

| Energy |

13.6% |

| Equity Real Estate Investment Trusts (REITs) |

2.6% |

| Exchange Traded Funds |

2.0% |

| Financials |

10.7% |

| Health Care |

13.7% |

| Industrials |

4.4% |

| Information Technology |

5.9% |

| Materials |

4.9% |

| Short Term Investments |

17.7% |

| Utilities |

4.6% |

| TOP TEN EQUITY HOLDINGS AS OF 6/30/23 |

|

| |

% of Total Investments |

| Las Vegas Sands Corp. |

4.6% |

| Transocean Ltd. |

4.3% |

| Adobe, Inc. |

3.8% |

| Baker Hughes Co. |

3.5% |

| T-Mobile U.S., Inc. |

3.1% |

| Medtronic PLC |

3.0% |

| JPMorgan Chase & Co. |

3.0% |

| CME Group, Inc. |

2.8% |

| Elevance Health, Inc. |

2.6% |

| American Tower Corp., REIT |

2.6% |

Discuss the Fund’s security and option selection process:

The Fund is managed by primarily focusing on active stock selection before

adding the call option overlay utilizing individual equity call options rather than index options. We use Fundamental analysis to select

solid companies with good growth prospects and attractive valuations. We then seek attractive call options to write on those stocks. It

is our belief that this partnership of active management of the equity and option strategies provides investors with an innovative, risk-moderated

approach to equity investing. The Fund’s portfolio managers seek to invest in a portfolio of common stocks that have favorable “PEG”

ratios (Price-Earnings ratio to Growth rate) as well as financial strength and industry leadership. As bottom-up investors, we focus on

the Fundamental businesses of our companies. Our stock selection philosophy strays away from the “beat the street” mentality,

as we seek companies that have sustainable competitive advantages, predictable cash flows, solid balance sheets and high-quality management

teams. By concentrating on long-term prospects and circumventing the “instant gratification” school of thought, we believe

we bring elements of consistency, stability and predictability to our shareholders.

Once we have selected attractive and solid names for the Fund, we employ

our call writing strategy. This procedure entails selling calls that are primarily out-of the-money, meaning that the strike price is

higher than the common stock price, so that the Fund can participate in some stock appreciation. By receiving option premiums, the Fund

receives a high level of investment income and adds an element of downside protection. Call options may be

MCN | Madison Covered Call & Equity Strategy Fund | Review

of Period (unaudited) - continued | June 30, 2023

written over a number of time periods and at differing strike

prices in an effort to maximize the protective value to the strategy and spread income evenly throughout the year.

What is the management’s outlook for the market and

Fund for the remainder of 2023?

If we are correct in our assessment that the fiscal and monetary

tightening that began in early 2022 will bear its teeth in the coming quarters, then our defensive stance is warranted, albeit, a little

early. We continue to ask ourselves, “What is the market currently discounting?”. At present, the S&P 500 trades at valuations

that are very near 2021 levels. That was a period when the massive post-Covid liquidity injections were having their peak effectiveness.

We now are facing a distinctly different liquidity environment, yet the market doesn’t yet seem to care. Investors appear to be

worried, but stocks keep going higher. If the market is discounting anything, it must be looking beyond the current wall of worry, toward

a time when the Fed potentially re-adopts a near-zero interest rate policy and government spending continues to spike higher. We are concerned

that in order to get to that point, a significant amount of pain must be exerted to the economy and markets. So, we wonder when investors

will start to care more about historically tightening financial conditions, high interest rates, industrial production data in recessionary

territory, weakening employment trends, weakening housing trends, recession, slowing corporate profits, and excessive market valuations.

We do not believe the market is discounting any of these issues and we also believe that these issues are too onerous to simply look beyond.

Missing a narrow “risk on” market rally is a small price to pay for protecting capital in an increasingly uncertain environment.

We remain defensively postured.

MCN | Madison Covered Call & Equity Strategy Fund | June 30,

2023

Portfolio of Investments (unaudited)

| | |

Shares | | |

Value (Note 2,3) | |

| COMMON STOCKS - 81.9% | |

| | | |

| | |

| Communication Services - 4.2% | |

| | | |

| | |

| Comcast Corp., Class A (A) | |

| 31,500 | | |

$ | 1,308,825 | |

| Lumen Technologies, Inc. | |

| 124,000 | | |

| 280,240 | |

| T-Mobile U.S., Inc. * (A) | |

| 34,500 | | |

| 4,792,050 | |

| | |

| | | |

| 6,381,115 | |

| Consumer Discretionary - 8.5% | |

| | | |

| | |

| Las Vegas Sands Corp. * (A) | |

| 123,900 | | |

| 7,186,200 | |

| Lowe's Cos., Inc. (A) | |

| 11,000 | | |

| 2,482,700 | |

| Nordstrom, Inc. (A) | |

| 156,000 | | |

| 3,193,320 | |

| | |

| | | |

| 12,862,220 | |

| Consumer Staples - 7.4% | |

| | | |

| | |

| Archer-Daniels-Midland Co. (A) | |

| 31,000 | | |

| 2,342,360 | |

| Colgate-Palmolive Co. (A) | |

| 30,000 | | |

| 2,311,200 | |

| Constellation Brands, Inc., Class A (A) | |

| 9,300 | | |

| 2,289,009 | |

| Keurig Dr Pepper, Inc. (A) | |

| 74,000 | | |

| 2,313,980 | |

| Target Corp. (A) | |

| 14,500 | | |

| 1,912,550 | |

| | |

| | | |

| 11,169,099 | |

| Energy - 14.0% | |

| | | |

| | |

| APA Corp. (A) | |

| 117,000 | | |

| 3,997,890 | |

| Baker Hughes Co. (A) | |

| 171,000 | | |

| 5,405,310 | |

| Diamondback Energy, Inc. (A) | |

| 20,500 | | |

| 2,692,880 | |

| EOG Resources, Inc. | |

| 21,000 | | |

| 2,403,240 | |

| Transocean Ltd. * (A) | |

| 940,000 | | |

| 6,589,400 | |

| | |

| | | |

| 21,088,720 | |

| Equity Real Estate Investment | |

| | | |

| | |

| Trusts (REITs) - 2.7% | |

| | | |

| | |

| American Tower Corp., REIT (A) | |

| 21,000 | | |

| 4,072,740 | |

| | |

| | | |

| | |

| Financials - 10.9% | |

| | | |

| | |

| BlackRock, Inc. (A) | |

| 5,700 | | |

| 3,939,498 | |

| CME Group, Inc. (A) | |

| 23,800 | | |

| 4,409,902 | |

| JPMorgan Chase & Co. (A) | |

| 31,700 | | |

| 4,610,448 | |

| PayPal Holdings, Inc. * (A) | |

| 53,800 | | |

| 3,590,074 | |

| | |

| | | |

| 16,549,922 | |

| Health Care - 14.1% | |

| | | |

| | |

| AmerisourceBergen Corp. (A) | |

| 13,500 | | |

| 2,597,805 | |

| CVS Health Corp. (A) | |

| 48,500 | | |

| 3,352,805 | |

| Danaher Corp. (A) | |

| 16,000 | | |

| 3,840,000 | |

| Elevance Health, Inc. (A) | |

| 9,200 | | |

| 4,087,468 | |

| Medtronic PLC (A) | |

| 53,300 | | |

| 4,695,730 | |

| Pfizer, Inc. (A) | |

| 74,000 | | |

| 2,714,320 | |

| | |

| | | |

| 21,288,128 | |

| Industrials - 4.5% | |

| | | |

| | |

| 3M Co. | |

| 12,500 | | |

| 1,251,125 | |

| Fastenal Co. (A) | |

| 28,100 | | |

| 1,657,619 | |

| Jacobs Solutions, Inc. (A) | |

| 13,000 | | |

| 1,545,570 | |

| United Parcel Service, Inc., Class B (A) | |

| 13,300 | | |

| 2,384,025 | |

| | |

| | | |

| 6,838,339 | |

| Information Technology - 6.0% | |

| | | |

| | |

| Adobe, Inc. * (A) | |

| 12,100 | | |

$ | 5,916,779 | |

| Ciena Corp. * (A) | |

| 75,000 | | |

| 3,186,750 | |

| | |

| | | |

| 9,103,529 | |

| Materials - 4.9% | |

| | | |

| | |

| Barrick Gold Corp. | |

| 233,500 | | |

| 3,953,155 | |

| Newmont Corp. (A) | |

| 80,000 | | |

| 3,412,800 | |

| | |

| | | |

| 7,365,955 | |

| Utilities - 4.7% | |

| | | |

| | |

| AES Corp. | |

| 195,000 | | |

| 4,042,350 | |

| NextEra Energy, Inc. (A) | |

| 42,000 | | |

| 3,116,400 | |

| | |

| | | |

| 7,158,750 | |

| | |

| | | |

| | |

| Total Common Stocks | |

| | | |

| | |

| (Cost $144,058,821) | |

| | | |

| 123,878,517 | |

| | |

| | | |

| | |

| EXCHANGE TRADED FUNDS - 2.1% | |

| | | |

| | |

| VanEck Gold Miners ETF (A) | |

| 104,000 | | |

| 3,131,440 | |

| | |

| | | |

| | |

| Total Exchange Traded Funds | |

| | | |

| 3,131,440 | |

| (Cost $3,417,867) | |

| | | |

| | |

| | |

| | | |

| | |

| SHORT-TERM INVESTMENTS - 18.2% | |

| | | |

| | |

| | |

| | | |

| | |

| State Street Institutional U.S. Government Money Market Fund, Premier Class, (B), 5.03% | |

| 27,501,790 | | |

| 27,501,790 | |

| | |

| | | |

| | |

| Total Short-Term Investments | |

| | | |

| | |

| (Cost $27,501,790) | |

| | | |

| 27,501,790 | |

| | |

| | | |

| | |

| TOTAL PUT OPTIONS PURCHASED - 0.6% | |

| | | |

| | |

| (Cost $1,234,700) | |

| | | |

| 839,550 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS - 102.8% | |

| | | |

| | |

| (Cost $176,213,178**) | |

| | | |

| 155,351,297 | |

| | |

| | | |

| | |

| TOTAL CALL & PUT OPTIONS WRITTEN - (2.4%) | |

| | | |

| (3,621,799 | ) |

| | |

| | | |

| | |

| NET OTHER ASSETS AND LIABILITIES - (0.4%) | |

| | | |

| (554,326 | ) |

| | |

| | | |

| | |

| TOTAL NET ASSETS - 100.0% | |

| | | |

$ | 151,175,172 | |

| ** | Aggregate cost for Federal tax purposes was $176,745,799 |

| (A) | All or a portion of these securities' positions, with a value of $115,079,847, represent covers (directly or through conversion rights)

for outstanding options written. |

| PLC | Public Limited Company. |

| REIT | Real Estate Investment Trust. |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | Portfolio

of Investments (unaudited) - continued | June 30, 2023

Purchased Option Contracts Outstanding at June 30, 2023

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Unrealized | |

| | |

Exercise | | |

Expiration | | |

Number of | | |

Notional | | |

| | |

Premiums | | |

Appreciation | |

| Description | |

Price | | |

Date | | |

Contracts | | |

Amount | | |

Market Value | | |

Paid | | |

(Depreciation) | |

| Put Option Purchased | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| S&P 500 Index | |

$ | 4,300.00 | | |

| 8/18/23 | | |

| 290 | | |

$ | 124,700,000 | $ | |

| 839,550 | $ | |

| 1,234,700 | | |

$ | (395,150 | ) |

| Total Put Options Purchased | |

| | | |

| | | |

| | | |

| | | |

$ | 839,550 | | |

$ | 1,234,700 | | |

$ | (395,150 | ) |

Written Option Contracts Outstanding at June 30, 2023

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Unrealized | |

| | |

Exercise | | |

Expiration | | |

Number of | | |

Notional | | |

Market | | |

Premiums | | |

Appreciation | |

| Description | |

Price | | |

Date | | |

Contracts | | |

Amount | | |

Value | | |

(Received) | | |

(Depreciation) | |

| Call Options Written | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adobe, Inc. | |

$ | 400.00 | | |

| 7/21/23 | | |

| (121 | ) | |

$ | (4,840,000 | ) | |

$ | (1,093,538 | ) | |

$ | (105,145 | ) | |

$ | (988,393 | ) |

| American Tower Corp., REIT | |

| 200.00 | | |

| 7/21/23 | | |

| (40 | ) | |

| (800,000 | ) | |

| (8,000 | ) | |

| (13,159 | ) | |

| 5,159 | |

| American Tower Corp., REIT | |

| 200.00 | | |

| 8/18/23 | | |

| (170 | ) | |

| (3,400,000 | ) | |

| (82,450 | ) | |

| (57,625 | ) | |

| (24,825 | ) |

| AmerisourceBergen Corp. | |

| 175.00 | | |

| 7/21/23 | | |

| (90 | ) | |

| (1,575,000 | ) | |

| (162,000 | ) | |

| (30,552 | ) | |

| (131,448 | ) |

| AmerisourceBergen Corp. | |

| 175.00 | | |

| 8/18/23 | | |

| (45 | ) | |

| (787,500 | ) | |

| (88,425 | ) | |

| (17,504 | ) | |

| (70,921 | ) |

| APA Corp. | |

| 40.00 | | |

| 8/18/23 | | |

| (613 | ) | |

| (2,452,000 | ) | |

| (23,907 | ) | |

| (27,567 | ) | |

| 3,660 | |

| Archer-Daniels-Midland Co. | |

| 80.00 | | |

| 8/18/23 | | |

| (310 | ) | |

| (2,480,000 | ) | |

| (26,350 | ) | |

| (43,081 | ) | |

| 16,731 | |

| Baker Hughes Co. | |

| 32.00 | | |

| 7/21/23 | | |

| (855 | ) | |

| (2,736,000 | ) | |

| (68,400 | ) | |

| (67,528 | ) | |

| (872 | ) |

| Baker Hughes Co. | |

| 32.00 | | |

| 8/18/23 | | |

| (400 | ) | |

| (1,280,000 | ) | |

| (48,000 | ) | |

| (33,588 | ) | |

| (14,412 | ) |

| Baker Hughes Co. | |

| 34.00 | | |

| 10/20/23 | | |

| (455 | ) | |

| (1,547,000 | ) | |

| (54,600 | ) | |

| (42,761 | ) | |

| (11,839 | ) |

| BlackRock, Inc. | |

| 720.00 | | |

| 7/21/23 | | |

| (57 | ) | |

| (4,104,000 | ) | |

| (32,775 | ) | |

| (78,524 | ) | |

| 45,749 | |

| Ciena Corp. | |

| 50.00 | | |

| 7/21/23 | | |

| (220 | ) | |

| (1,100,000 | ) | |

| — | | |

| (26,320 | ) | |

| 26,320 | |

| Ciena Corp. | |

| 55.00 | | |

| 7/21/23 | | |

| (530 | ) | |

| (2,915,000 | ) | |

| — | | |

| (104,804 | ) | |

| 104,804 | |

| CME Group, Inc. | |

| 190.00 | | |

| 8/18/23 | | |

| (135 | ) | |

| (2,565,000 | ) | |

| (39,825 | ) | |

| (44,224 | ) | |

| 4,399 | |

| CME Group, Inc. | |

| 200.00 | | |

| 9/15/23 | | |

| (103 | ) | |

| (2,060,000 | ) | |

| (11,072 | ) | |

| (41,122 | ) | |

| 30,050 | |

| Colgate-Palmolive Co. | |

| 77.50 | | |

| 8/18/23 | | |

| (300 | ) | |

| (2,325,000 | ) | |

| (45,000 | ) | |

| (26,691 | ) | |

| (18,309 | ) |

| Comcast Corp., Class A | |

| 42.50 | | |

| 7/21/23 | | |

| (315 | ) | |

| (1,338,750 | ) | |

| (7,087 | ) | |

| (25,124 | ) | |

| 18,037 | |

| Constellation Brands, Inc., Class A | |

| 240.00 | | |

| 7/21/23 | | |

| (60 | ) | |

| (1,440,000 | ) | |

| (47,700 | ) | |

| (29,940 | ) | |

| (17,760 | ) |

| Constellation Brands, Inc., Class A | |

| 250.00 | | |

| 8/18/23 | | |

| (33 | ) | |

| (825,000 | ) | |

| (14,025 | ) | |

| (19,106 | ) | |

| 5,081 | |

| CVS Health Corp. | |

| 72.50 | | |

| 8/18/23 | | |

| (245 | ) | |

| (1,776,250 | ) | |

| (25,725 | ) | |

| (34,893 | ) | |

| 9,168 | |

| CVS Health Corp. | |

| 72.50 | | |

| 9/15/23 | | |

| (240 | ) | |

| (1,740,000 | ) | |

| (36,360 | ) | |

| (36,953 | ) | |

| 593 | |

| Danaher Corp. | |

| 250.00 | | |

| 8/18/23 | | |

| (120 | ) | |

| (3,000,000 | ) | |

| (56,400 | ) | |

| (87,476 | ) | |

| 31,076 | |

| Diamondback Energy, Inc. | |

| 145.00 | | |

| 7/21/23 | | |

| (205 | ) | |

| (2,972,500 | ) | |

| (4,612 | ) | |

| (60,376 | ) | |

| 55,764 | |

| Elevance Health, Inc. | |

| 480.00 | | |

| 7/21/23 | | |

| (42 | ) | |

| (2,016,000 | ) | |

| (5,670 | ) | |

| (44,044 | ) | |

| 38,374 | |

| Elevance Health, Inc. | |

| 460.00 | | |

| 8/18/23 | | |

| (50 | ) | |

| (2,300,000 | ) | |

| (45,000 | ) | |

| (46,448 | ) | |

| 1,448 | |

| Fastenal Co. | |

| 57.50 | | |

| 7/21/23 | | |

| (281 | ) | |

| (1,615,750 | ) | |

| (66,035 | ) | |

| (30,654 | ) | |

| (35,381 | ) |

| Jacobs Solutions, Inc. | |

| 120.00 | | |

| 7/21/23 | | |

| (130 | ) | |

| (1,560,000 | ) | |

| (19,500 | ) | |

| (37,149 | ) | |

| 17,649 | |

| JPMorgan Chase & Co. | |

| 145.00 | | |

| 7/21/23 | | |

| (317 | ) | |

| (4,596,500 | ) | |

| (84,798 | ) | |

| (81,810 | ) | |

| (2,988 | ) |

| Keurig Dr Pepper, Inc. | |

| 37.00 | | |

| 7/21/23 | | |

| (225 | ) | |

| (832,500 | ) | |

| — | | |

| (16,643 | ) | |

| 16,643 | |

| Las Vegas Sands Corp. | |

| 62.50 | | |

| 7/21/23 | | |

| (600 | ) | |

| (3,750,000 | ) | |

| (27,300 | ) | |

| (89,754 | ) | |

| 62,454 | |

| Las Vegas Sands Corp. | |

| 65.00 | | |

| 8/18/23 | | |

| (639 | ) | |

| (4,153,500 | ) | |

| (38,340 | ) | |

| (106,557 | ) | |

| 68,217 | |

| Lowe's Cos., Inc. | |

| 230.00 | | |

| 8/18/23 | | |

| (110 | ) | |

| (2,530,000 | ) | |

| (49,775 | ) | |

| (46,086 | ) | |

| (3,689 | ) |

| Medtronic PLC | |

| 90.00 | | |

| 8/18/23 | | |

| (183 | ) | |

| (1,647,000 | ) | |

| (26,993 | ) | |

| (32,070 | ) | |

| 5,077 | |

| Medtronic PLC | |

| 92.50 | | |

| 8/18/23 | | |

| (205 | ) | |

| (1,896,250 | ) | |

| (13,837 | ) | |

| (50,387 | ) | |

| 36,550 | |

| Medtronic PLC | |

| 90.00 | | |

| 9/15/23 | | |

| (145 | ) | |

| (1,305,000 | ) | |

| (35,960 | ) | |

| (28,959 | ) | |

| (7,001 | ) |

| Newmont Corp. | |

| 45.00 | | |

| 8/18/23 | | |

| (800 | ) | |

| (3,600,000 | ) | |

| (82,400 | ) | |

| (96,092 | ) | |

| 13,692 | |

| NextEra Energy, Inc. | |

| 77.50 | | |

| 7/21/23 | | |

| (120 | ) | |

| (930,000 | ) | |

| (3,600 | ) | |

| (21,477 | ) | |

| 17,877 | |

| NextEra Energy, Inc. | |

| 75.00 | | |

| 8/18/23 | | |

| (300 | ) | |

| (2,250,000 | ) | |

| (63,000 | ) | |

| (56,691 | ) | |

| (6,309 | ) |

| Nordstrom, Inc. | |

| 25.00 | | |

| 10/20/23 | | |

| (1,560 | ) | |

| (3,900,000 | ) | |

| (103,740 | ) | |

| (84,334 | ) | |

| (19,406 | ) |

| PayPal Holdings, Inc. | |

| 72.50 | | |

| 8/18/23 | | |

| (538 | ) | |

| (3,900,500 | ) | |

| (97,647 | ) | |

| (123,185 | ) | |

| 25,538 | |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | Portfolio

of Investments (unaudited) - continued | June 30, 2023

Written Option Contracts Outstanding at June 30, 2023 - continued

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Unrealized | |

| | |

Exercise | | |

Expiration | | |

Number of | | |

Notional | | |

Market | | |

Premiums | | |

Appreciation | |

| Description | |

Price | | |

Date | | |

Contracts | | |

Amount | | |

Value | | |

(Received) | | |

(Depreciation) | |

| Pfizer, Inc. | |

| 40.00 | | |

| 7/21/23 | | |

| (590 | ) | |

| (2,360,000 | ) | |

| (2,360 | ) | |

| (52,781 | ) | |

| 50,421 | |

| Pfizer, Inc. | |

| 37.50 | | |

| 8/18/23 | | |

| (150 | ) | |

| (562,500 | ) | |

| (10,500 | ) | |

| (9,600 | ) | |

| (900 | ) |

| T-Mobile U.S., Inc. | |

| 140.00 | | |

| 8/18/23 | | |

| (345 | ) | |

| (4,830,000 | ) | |

| (155,250 | ) | |

| (77,473 | ) | |

| (77,777 | ) |

| Target Corp. | |

| 145.00 | | |

| 8/18/23 | | |

| (145 | ) | |

| (2,102,500 | ) | |

| (31,030 | ) | |

| (42,788 | ) | |

| 11,758 | |

| Transocean Ltd. | |

| 8.00 | | |

| 8/18/23 | | |

| (9,400 | ) | |

| (7,520,000 | ) | |

| (225,600 | ) | |

| (225,325 | ) | |

| (275 | ) |

| United Parcel Service, Inc., Class B | |

| 180.00 | | |

| 8/18/23 | | |

| (133 | ) | |

| (2,394,000 | ) | |

| (89,443 | ) | |

| (67,294 | ) | |

| (22,149 | ) |

| VanEck Gold Miners ETF | |

| 33.00 | | |

| 7/21/23 | | |

| (840 | ) | |

| (2,772,000 | ) | |

| (6,720 | ) | |

| (69,695 | ) | |

| 62,975 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Call Options Written | |

| | | |

| | | |

| | | |

| | | |

$ | (3,260,749 | ) | |

$ | (2,591,359 | ) | |

$ | (669,390 | ) |

| Put Options Written | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| S&P 500 Index | |

$ | 4,100.00 | | |

| 8/18/23 | | |

| (290) | | |

$ | (118,900,000) | | |

$ | (361,050 | ) | |

$ | (579,531 | ) | |

$ | 218,481 | |

| Total Options Written, at Value | |

| | | |

| | | |

| | | |

| | | |

$ | (3,621,799 | ) | |

$ | (3,170,890 | ) | |

$ | (450,909 | ) |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | June 30,

2023

Statement of Assets and Liabilities

as of June 30, 2023 (unaudited)

| Assets: | |

| |

| Investments in unaffiliated securities, at fair value† | |

$ | 155,351,297 | |

| Receivables: | |

| | |

| Investments sold | |

| 345,893 | |

| Dividends and Interest | |

| 84,037 | |

| Total assets | |

| 155,781,227 | |

| | |

| | |

| Liabilities: | |

| | |

| Payables: | |

| | |

| Investments purchased | |

| 853,256 | |

| Advisory agreement fees | |

| 98,975 | |

| Administrative services agreement fees | |

| 32,015 | |

| Dividends | |

| 10 | |

| Options written, at value (premium received $3,170,890) | |

| 3,621,799 | |

| Total liabilities | |

| 4,606,055 | |

| Net assets | |

$ | 151,175,172 | |

| Net assets consist of: | |

| | |

| Common Stock/Shares: | |

| | |

| Paid-in capital in excess of par | |

$ | 173,677,965 | |

| Accumulated distributable earnings (loss) | |

| (22,502,793 | ) |

| Net Assets | |

$ | 151,175,172 | |

| | |

| | |

| Capital Shares Issued and Outstanding (Note 9) | |

| 21,035,499 | |

| Net Asset Value per share | |

$ | 7.19 | |

| | |

| | |

| † Cost of Investments in unaffiliated securities | |

$ | 176,213,178 | |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | June 30,

2023

Statement of Operations for

the Six Months Ended June 30, 2023 (unaudited)

| Investment Income: | |

| | |

| Interest | |

$ | 779,407 | |

| Dividends | |

| | |

| Unaffiliated issuers | |

| 1,088,538 | |

| Less: Foreign taxes withheld/reclaimed | |

| (7,005 | ) |

| Income from securities lending | |

| 1,004 | |

| Total investment income | |

| 1,861,944 | |

| Expenses (Note 4): | |

| | |

| Advisory agreement fees | |

| 606,183 | |

| Administrative services agreement fees | |

| 197,009 | |

| Trustee fees | |

| 18,348 | |

| Other expenses | |

| 205 | |

| Total expenses | |

| 821,745 | |

| Net Investment Income | |

| 1,040,199 | |

| Net Realized and Unrealized Gain (loss) on Investments | |

| | |

| Net realized gain (loss) on investments (including net realized gain (loss) on foreign currency related transactions) | |

| | |

| Options purchased | |

| (2,663,465 | ) |

| Options written | |

| 7,419,924 | |

| Unaffiliated issuers | |

| 1,065,151 | |

| Net change in unrealized appreciation (depreciation) on investments (including net unrealized appreciation (depreciation) on | |

| | |

| foreign currency related transactions) | |

| | |

| Options purchased | |

| (395,150 | ) |

| Options written | |

| (1,252,173 | ) |

| Unaffiliated issuers | |

| 5,232,391 | |

| Net Realized and Unrealized Gain on Investments | |

| 9,406,678 | |

| Net Increase in Net Assets from Operations | |

$ | 10,446,877 | |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | June 30,

2023

Statement of Changes in Net Assets

| | |

(unaudited) Six- | | |

Year | |

| | |

Months Ended | | |

Ended | |

| | |

6/30/23 | | |

12/31/22 | |

| Net Assets at beginning of period | |

$ | 148,156,022 | | |

$ | 156,219,786 | |

| Increase (decrease) in net assets from operations: | |

| | | |

| | |

| Net investment income | |

| 1,040,199 | | |

| 1,160,216 | |

| Net realized gain | |

| 5,821,610 | | |

| 13,325,566 | |

| Net change in unrealized appreciation (depreciation) | |

| 3,585,068 | | |

| (7,677,912 | ) |

| Net increase in net assets from operations | |

| 10,446,877 | | |

| 6,807,870 | |

| Distributions to shareholders from: | |

| | | |

| | |

| Accumulated earnings (combined net investment income and net realized gains) | |

| (7,567,594 | ) | |

| (15,115,784 | ) |

| Total distributions | |

| (7,567,594 | ) | |

| (15,115,784 | ) |

| Capital Stock transactions: | |

| | | |

| | |

| Newly issued to shareholders in reinvestment of distributions | |

| 139,867 | | |

| 244,150 | |

| Increase from capital stock transactions | |

| 139,867 | | |

| 244,150 | |

| Total increase (decrease) in net assets | |

| 3,019,150 | | |

| (8,063,764 | ) |

| Net Assets at end of period | |

$ | 151,175,172 | | |

$ | 148,156,022 | |

| Capital Share transactions: | |

| | | |

| | |

| Newly issued shares reinvested | |

| 18,993 | | |

| 34,956 | |

| Increase from capital shares transactions | |

| 18,993 | | |

| 34,956 | |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | June 30,

2023

Financial Highlights for a Share of Beneficial Interest Outstanding

| | |

(unaudited) | | |

| |

| | |

Six-Months | | |

| |

| | |

Ended | | |

Year Ended December 31, | |

| | |

6/30/23 | | |

2022 | | |

2021 | | |

2020 | | |

2019 | | |

2018 | |

| Net Asset Value at beginning of period | |

$ | 7.05 | | |

$ | 7.45 | | |

$ | 7.09 | | |

$ | 7.35 | | |

$ | 6.91 | | |

$ | 8.27 | |

| Income from Investment Operations: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net investment income | |

| 0.05 | | |

| 0.06 | | |

| 0.01 | | |

| 0.04 | | |

| 0.08 | | |

| 0.10 | |

| Net realized and unrealized gain (loss) on investments | |

| 0.45 | | |

| 0.26 | | |

| 1.07 | | |

| 0.42 | | |

| 1.08 | | |

| (0.74 | ) |

| Total from investment operations | |

| 0.50 | | |

| 0.32 | | |

| 1.08 | | |

| 0.46 | | |

| 1.16 | | |

| (0.64 | ) |

| Less Distributions From: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net investment income | |

| (0.36 | ) | |

| (0.65 | ) | |

| (0.60 | ) | |

| (0.50 | ) | |

| (0.47 | ) | |

| (0.51 | ) |

| Capital gains | |

| — | | |

| (0.07 | ) | |

| — | | |

| — | | |

| — | | |

| — | |

| Return of Capital | |

| — | | |

| — | | |

| (0.12 | ) | |

| (0.22 | ) | |

| (0.25 | ) | |

| (0.21 | ) |

| Total distributions | |

| (0.36 | ) | |

| (0.72 | ) | |

| (0.72 | ) | |

| (0.72 | ) | |

| (0.72 | ) | |

| (0.72 | ) |

| Net increase (decrease) in net asset value | |

| 0.14 | | |

| (0.40 | ) | |

| 0.36 | | |

| (0.26 | ) | |

| 0.44 | | |

| (1.36 | ) |

| Net Asset Value at end of period | |

$ | 7.19 | | |

$ | 7.05 | | |

$ | 7.45 | | |

$ | 7.09 | | |

$ | 7.35 | | |

$ | 6.91 | |

| Market Value at end of period | |

$ | 7.40 | | |

$ | 7.75 | | |

$ | 8.02 | | |

$ | 6.75 | | |

$ | 6.63 | | |

$ | 6.16 | |

| Total Return | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net asset value (%)1 | |

| 7.12 | 3 | |

| 4.90 | | |

| 15.36 | | |

| 7.72 | | |

| 17.39 | | |

| (8.37 | ) |

| Market value (%)2 | |

| 0.22 | 3 | |

| 7.12 | | |

| 30.44 | | |

| 15.22 | | |

| 19.83 | | |

| (11.79 | ) |

| Ratios/Supplemental Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Assets at end of period (in 000‘s) | |

$ | 151,175 | | |

$ | 148,156 | | |

$ | 156,220 | | |

$ | 148,475 | | |

$ | 153,963 | | |

$ | 144,686 | |

| Ratios of expenses to average net assets (%) | |

| 1.08 | 4 | |

| 1.08 | | |

| 1.08 | | |

| 1.07 | | |

| 1.07 | 5 | |

| 1.17 | 5 |

| Ratio of net investment income to average net assets (%) | |

| 1.37 | 4 | |

| 0.77 | | |

| 0.16 | | |

| 0.61 | | |

| 1.15 | | |

| 0.75 | |

| Portfolio turnover (%) | |

| 44 | 3 | |

| 104 | | |

| 178 | | |

| 128 | | |

| 114 | | |

| 114 | |

1 Total net asset value return is calculated based on changes

in the net asset value per share for the year reported on. Dividends and distributions, if any, are assumed, for purposes of this calculation,

to be reinvested at the net asset value amount on the date of the distribution.

2 Total market value return is calculated assuming a purchase

of a share of common stock at the market price on the first day and a sale of a share of common stock at the market price on the last

day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices

obtained under the dividend reinvestment plan. Total market value return does not reflect brokerage commissions or sales charges in connection

with the purchase or sale of Fund stock.

3 Not annualized.

4 Annualized

5 Includes Board-approved expenses related to special and annual

meetings that took place during the year.

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | June 30,

2023

Notes to Financial

Statements (unaudited)

1. ORGANIZATION

Madison Covered Call & Equity

Strategy Fund (the “Fund”) was organized as a Delaware statutory trust on May 6, 2004. The Fund is registered as a diversified,

closed-end management investment company under the Investment Company Act of 1940 (“1940 Act”), as amended, and the Securities

Act of 1933, as amended.

The Fund’s primary investment objective is to provide

a high level of current income and current gains, with a secondary objective of long-term capital appreciation. The Fund will pursue its

investment objectives by investing primarily in large and mid-capitalization common stocks that are, in the view of Madison Asset Management,

LLC, the Fund’s investment adviser (the “Adviser”), selling at a reasonable price in relation to their long-term earnings

growth rates. Under normal market conditions, the Fund will seek to generate current earnings from option premiums by writing (selling)

covered call options on a substantial portion of its portfolio securities. There can be no assurance that the Fund will achieve its investment

objectives. The Fund’s investment objectives are considered fundamental and may not be changed without shareholder approval.

2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company that applies the accounting

and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services

- Investment Companies (ASC 946). The following is a summary of significant accounting policies consistently followed by the Fund in the

preparation of its financial statements.

Use of Estimates: The preparation of financial statements

in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and

assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net

assets from operations during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Securities traded on a national

securities exchange are valued at their closing sale price, except for securities traded on the National Association of Securities Dealers

Automated Quotation System (“NASDAQ”), which are valued at the NASDAQ official closing price (“NOCP”). If no sale

occurs, equities traded on a U.S. exchange or on NASDAQ are valued at the bid price. Options are valued at the mean between the best bid

and best ask price across all option exchanges. Debt securities are valued on the basis of the last available bid prices or current market

quotations provided by dealers or pricing services approved by the Fund. Mutual funds are valued at their net asset value (“NAV”).

Securities for which market quotations are not readily available are valued at their fair value as determined in good faith under procedures

approved by the Board of Trustees. At times, the Fund maintains cash balances at financial institutions in excess of federally insured

limits. The Fund monitors this credit risk and has not experienced any losses related to this risk.

Investment Transactions and Investment Income: Investment

transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial

statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual

basis.

Covered Call and Put Options: An option on a security is a contract that gives the holder of the option, in return for a

premium, the right to buy from (in the case of a call) or sell to (in the case of a put) the writer of the option the security underlying

the option at a specified exercise or “strike” price. The writer of an option on a security has

MCN | Madison Covered Call & Equity Strategy Fund | Notes

to the Financial Statements (unaudited) - continued | June 30, 2023

an obligation upon exercise

of the option to deliver the underlying security upon payment of the exercise price (in the case of a call) or pay the exercise price

upon delivery of the underlying security (in the case of a put).

The number of call options the Fund can write (sell) is limited

by the amount of equity securities the Fund holds in its portfolio. The Fund will not write (sell) “naked” or uncovered call

options. The Fund seeks to produce a high level of current income and gains generated from option writing premiums and, to a lesser extent,

from dividends. Options on securities indices are designed to reflect price fluctuations in a group of securities or segment of the securities

market rather than price fluctuations in a single security and are similar to options on single securities, except that the exercise of

securities index options requires cash settlement payments and does not involve the actual purchase or sale of securities.

When an option is written, a liability is recorded equal to

the premium received. This liability for options written is marked-to-market on a daily basis to reflect the current market value of the

option written. These liabilities are reflected as options written in the Statement of Assets and Liabilities. Premiums received from

writing options that expire unexercised are recorded on the expiration date as a realized gain. The difference between the premium received

and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain,

or if the premium is less than the amount paid for the closing purchase transactions, as a realized loss. If a call option is exercised,

the premium is added to the proceeds from the sale of the underlying security in determining whether there has been a realized gain or

loss.

Distributions to Shareholders: The Fund declares and

pays quarterly distributions to shareholders. Distributions to shareholders are recorded on the ex-dividend date. The amount and timing

of distributions are determined in accordance with federal income tax regulations, which may differ from Generally Accepted Accounting

Principles (“GAAP”). These distributions consist of investment company taxable income, which generally includes qualified

dividend income, ordinary income and short-term capital gains, including premiums received on written options. Distributions may also

include a return of capital. Any net realized long-term capital gains are distributed annually to shareholders. The character of the distributions

are determined annually in accordance with federal income tax regulations.

Recently Issued Accounting Pronouncements: In June 2022,

the FASB issued Accounting Standards Update (“ASU”) No. 2022-03, Fair Value Measurement (Topic 820); Fair Value Measurement

of Equity Securities Subject to Contractual Sale Restrictions, which provides clarifying guidance that a contractual restriction on the

sale of an equity security is not considered part of the unit of account of the equity security and, therefore, is not considered in measuring

fair value. The ASU is effective for fiscal years beginning after December 15, 2023, and interim periods within those fiscal years. The

Trust expects the ASU will not have a material impact on the Funds’ financial statements.

3. FAIR VALUE MEASUREMENTS

The Fund has adopted FASB applicable guidance on fair value

measurements. Fair value is defined as the price that the fund would receive upon selling an investment in a timely transaction to an

independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of

observable market data “inputs” and minimize the use of unobservable “inputs” and to establish classification

of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing

the asset or liability, including assumptions about risk (for example, the risk inherent in a particular valuation technique used to measure

fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable

or unobservable.

MCN | Madison Covered Call & Equity Strategy Fund | Notes

to the Financial Statements (unaudited) - continued | June 30, 2023

Observable inputs are inputs that reflect the assumptions

market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the

reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market

participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The

three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| • | Level 1 - unadjusted quoted prices in active markets for identical

investments |

| • | Level 2 - other significant observable inputs (including quoted

prices for similar investments, interest rate volatilities, prepayment speeds, credit risk, benchmark yields, transactions, bids, offers,

new issues, spreads and other relationships observed in the markets among comparable securities, underlying equity of the issuer; and

proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and

other reference data, etc.) |

| • | Level 3 - significant unobservable inputs (including the Fund’s

own assumptions in determining the fair value of investments). |

The valuation techniques used by the Fund to measure fair

value for the period ended June 30, 2023, maximized the use of observable inputs and minimized the use of unobservable inputs.

There were no transfers between classifications levels during

the period ended June 30, 2023. As of and during the period ended June 30, 2023, the Fund did not hold securities deemed as a Level 3.

The following is a summary of the inputs used as of June 30, 2023, in valuing the Fund’s investments carried at fair value:

| Description | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Value at

6/30/22 | |

| Assets:1 | |

| | | |

| | | |

| | | |

| | |

| Common Stocks | |

$ | 123,878,517 | | |

$ | — | | |

$ | — | | |

$ | 123,878,517 | |

| Exchange Traded Funds | |

| 3,131,440 | | |

| — | | |

| — | | |

| 3,131,440 | |

| Options Purchased | |

| 839,550 | | |

| — | | |

| — | | |

| 839,550 | |

| Short-Term Investments | |

| 27,501,790 | | |

| — | | |

| — | | |

| 27,501,790 | |

| | |

$ | 155,351,297 | | |

$ | — | | |

$ | — | | |

$ | 155,351,297 | |

| Liabilities:1 | |

| | | |

| | | |

| | | |

| | |

| Options Written | |

$ | (3,621,799 | ) | |

$ | — | | |

$ | — | | |

$ | (3,621,799 | ) |

1 Please see the Portfolio of Investments for a listing of all

securities within each category.

4. ADVISORY, ADMINISTRATIVE SERVICES AND OTHER EXPENSES

Pursuant to an Investment Advisory Agreement with the Fund,

the Adviser, under the supervision of the Fund’s Board of Trustees, provides a continuous investment program for the Fund’s

portfolio; provides investment research and makes and executes recommendations for the purchase and sale of securities; and provides certain

facilities and personnel, including officers required for the Fund’s administrative management and compensation of all officers

and interested trustees of the Fund. For these services, the Fund pays the Adviser an advisory fee, payable monthly, in an amount equal

to an annualized rate of 0.80% of the Fund’s average daily net assets.

Under a separate Administrative Services Agreement, the

Adviser also provides or arranges to have a third party provide the Fund with such services as it may require in the ordinary course of

its business. Services to the Fund include: compliance services, custodial services, Fund administration services, Fund accounting services,

and such other services necessary to conduct the Fund’s business. In addition, the Adviser shall arrange and pay for independent

public accounting services for audit and tax purposes, legal services, a fidelity bond, and directors and officers/errors and omissions

insurance. In exchange for these services, the Fund pays the Adviser a service fee, payable monthly, equal to an annualized rate of 0.26%

of the Fund’s average daily net assets. Not included in

MCN | Madison Covered Call & Equity Strategy Fund | Notes

to the Financial Statements (unaudited) - continued | June 30, 2023

this fee and, therefore, the responsibility of the Fund are “excluded

expenses” and “transitional expenses.” Excluded expenses consist of (i) any fees and expenses relating to portfolio

holdings (e.g., brokerage commissions, interest on loans, etc.); (ii) extraordinary and non-recurring fees and expenses (e.g., costs relating

to any borrowing costs, overdrafts or taxes the Fund may owe, etc.); (iii) the costs associated with investment by the Fund in other investment

companies (i.e., acquired fund fees and expenses) ; and (iv) Independent Trustees compensation, including Lead Independent Trustee compensation.

Certain officers and Trustees of the Fund may also be officers,

directors and/or employees of the Adviser or its affiliates. The Fund does not compensate its officers or Trustees who are officers, directors

and/or employees of the Adviser or its affiliates.

5. SECURITIES LENDING

The Board of Trustees has authorized the Fund to engage

in securities lending with State Street Bank and Trust Company as securities lending agent pursuant to a Securities Lending Authorization

Agreement (the “Agreement”) and subject to the Fund’s securities lending policies and procedures. Under the terms of

the Agreement, and subject to the policies and procedures, the Fund may lend portfolio securities to qualified borrowers in order to generate

additional income, while managing risk associated with the securities lending program. The Agreement requires that loans are collateralized

at all times by cash or U.S.government securities, initially equal to at least 102% of the value of the domestic securities and 105% of

non-domestic securities, based upon the prior days market value for securities loaned. The loaned securities and collateral are marked

to market daily to maintain collateral at 102% of the total loaned portfolio. Amounts earned as interest on investments of cash collateral,

net of rebates and fees, if any, are included in the Statement of Operations. The primary risk associated with securities lending is loss

associated with investment of cash and non-cash collateral. A secondary risk is if the borrower defaults on its obligation to return the

securities loaned because of insolvency or other reasons. The Fund could experience delays and costs in recovering securities loaned or

in gaining access to the collateral. Under the Agreement, the securities lending agent has provided a limited indemnification in the event

of a borrower default. The Fund does not have a master netting agreement.

Cash collateral received for securities on loan are reinvested

into the State Street Navigator Securities Lending Government Money Market Portfolio. Non-cash collateral is invested in U.S.treasuries

or government securities. As of June 30, 2023, the Fund did not have any securities on loan to brokers/dealers.

6. DERIVATIVES

The FASB issued guidance intended to enhance financial statement

disclosure for derivative instruments and enable investors to understand: a) how and why a fund uses derivative investments, b) how derivative

instruments are accounted for, and c) how derivative instruments affect a fund’s financial position, and results of operations.

In addition, in November 2020, the SEC adopted Rule 18f-4 under the 1940 Act to govern the use of derivatives and certain related instruments

by registered investment companies. Rule 18f-4, which had a compliance date of August 19, 2022, replaced existing SEC and staff guidance

with a new framework for the use of derivatives by registered investment companies. Unless a fund qualifies as a “limited derivatives

user,” as defined in Rule 18f-4, Rule 18f-4 requires registered investment companies that trade derivatives and other instruments

that create future payment or delivery obligations to adopt a value at-risk leverage limit and implement a derivatives risk management

program. Because the Fund’s strategy involves investing in derivatives, and the Fund’s use of such derivatives does not meet

the conditions applicable to the “limited user exception” in Rule 18f-4, the Fund has adopted a derivatives program that complies

with the requirements of the rule. As part of this, certain officers of the Investment Adviser and the Fund serve as the “derivatives

risk manager” for the Fund.

MCN | Madison Covered Call & Equity Strategy Fund | Notes

to the Financial Statements (unaudited) - continued | June 30, 2023

The following table presents the types of derivatives in

the fund by location and as presented on the Statement of Assets and Liabilities as of June 30, 2023.

| | |

Statement of Asset & Liability Presentation of Fair Values of Derivative Instruments |

| | |

Asset Derivatives | |

Liability Derivatives |

| | |

Statement of Assets | |

| | |

Statement of Assets | |

| |

| Underlying Risk | |

and Liabilities Location | |

Fair Value | | |

and Liabilities Location | |

Fair Value | |

| Equity | |

Options purchased | |

$ | 839,550 | | |

Options written | |

$ | (3,621,799 | ) |

The following table presents the effect of derivative instruments

on the Statement of Operations for the period ended June 30, 2023.

| | |

| |

Realized Gain | | |

Change in Unrealized Appreciation | |

| Statement of Operations | |

Underlying Risk | |

(Loss)

on Derivatives | | |

(Depreciation) on Derivatives | |

| Options Purchased | |

Equity | |

$ | (2,663,465 | ) | |

$ | (395,150 | ) |

| Options Written | |

Equity | |

| 7,419,924 | | |

| (1,252,173 | ) |

| | |

| |

$ | 4,756,459 | | |

$ | (1,647,323 | ) |

The average volume (based on the open positions at each month-end)

of derivative activity during the period ended June 30, 2023.

| | |

Options

Purchased Contracts(1) | | |

Options

Written Contracts(1) | |

| Madison Covered Call & Equity Strategy Fund | |

| 136 | | |

| 8,584 | |

7. FEDERAL INCOME TAX INFORMATION

No provision is made for federal income taxes since it is the

intention of the Fund to comply with the provisions of Subchapter M of the Internal Revenue Code of 1986 as amended, applicable to regulated

investment companies and to make the requisite distribution to shareholders of taxable income, which will be sufficient to relieve it

from all or substantially all federal income taxes.

At June 30, 2023, the aggregate gross unrealized appreciation

(depreciation) and net unrealized depreciation for all securities, as computed on a federal income tax basis for the fund were as follows:

| Cost | |

$ | 176,745,799 | |

| Gross appreciation | |

| 4,481,942 | |

| Gross depreciation | |

| (26,327,353 | ) |

| Net depreciation | |

$ | (21,845,411 | ) |

Net realized gains or losses may differ for financial reporting

and tax purposes primarily as a result of the deferral of losses relating to wash sale transactions and certain market-to-market investments.

8. INVESTMENT TRANSACTIONS

During the period ended June 30, 2023, the cost of purchases

and proceeds from sales of investments, excluding short-term investments, were $56,650,817 and $53,067,165 respectively. No long-term

U.S. government securities were purchased or sold during the period.

9. CAPITAL

The Fund has an unlimited amount of common shares, $0.01 par

value, authorized and 21,035,499 shares issued and outstanding as of June 30, 2023. During the period ended June 30, 2023, and the year

ended December 31,

MCN | Madison Covered Call & Equity Strategy Fund | Notes

to the Financial Statements (unaudited) - continued | June 30, 2023

2022, 18,993 and 34,956 shares were issued and reinvested,

respectively, per the Dividend Reinvestment Plan, since the Fund was trading at a premium.

10. INDEMNIFICATIONS

In the normal course of business, the Fund enters into

contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent upon claims that

may be made against the Fund in the future and therefore cannot be estimated; however, the Fund considers the risk of material loss from

such claims as remote.

11. DISCUSSION OF RISKS

Equity Risk: The value of the securities held by

the Fund may decline due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities

held by the Fund participate, or factors relating to specific companies in which the Fund invests.

Option Risk: There are several risks associated

with transactions in options on securities. For example, there are significant differences between the securities and options markets

that could result in an imperfect correlation between these markets, causing a given transaction not to achieve its objectives. A decision

as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful

to some degree because of market behavior or unexpected events.

As the writer of a covered call option, the Fund forgoes,

during the option’s life, the opportunity to profit from increases in the market value of the security covering the call option

above the sum of the premium and the strike price of the call, but retains the risk of loss should the price of the underlying security

decline. The writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option.

Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation

under the option and must deliver the underlying security at the exercise price. When the Fund writes covered put options, it bears the

risk of loss if the value of the underlying stock declines below the exercise price. If the option is exercised, the Fund could incur

a loss if it is required to purchase the stock underlying the put option at a price greater than the market price of the stock at the

time of exercise. While the Fund’s potential gain in writing a covered put option is limited to the interest earned on the liquid

assets securing the put option plus the premium received from the purchaser of the put option, the Fund risks a loss equal to the entire

value of the stock.

Derivatives Risk: The risk that loss may result

from investments in options, forwards, futures, swaps and other derivatives instruments. These instruments may be illiquid, difficult

to price and leveraged so that small changes in the value of the underlying instruments may produce disproportionate losses to the fund.

Derivatives are also subject to counterparty risk, which is the risk that the other party to the transaction will not fulfill its contractual

obligations.

Industry Concentration Risk: To the extent that the

Fund makes substantial investments in a single industry, the Fund will be more susceptible to adverse economic or regulatory occurrences

affecting those sectors.

Fund Distribution Risk: In order to make regular

quarterly distributions on its common shares, the Fund may have to sell a portion of its investment portfolio at a time when independent

investment judgment may not dictate such action. In addition, the Fund’s ability to make distributions more frequently than annually

from any net realized capital gains by the Fund is subject to the Fund obtaining exemptive relief from the SEC, which cannot be assured.

To the extent the total quarterly distributions for a year exceed the Fund’s net investment company

MCN | Madison Covered Call & Equity Strategy Fund | Notes

to the Financial Statements (unaudited) - continued | June 30, 2023

income and net realized capital gain for that year, the

excess will generally constitute a return of the Fund’s capital to its common shareholders. Such return of capital distributions

generally are tax-free up to the amount of a common shareholder’s tax basis in the common shares (generally, the amount paid for

the common shares). In addition, such excess distributions will decrease the Fund’s total assets and may increase the Fund’s

expense ratio.

Cybersecurity Risk: The Fund is also subject to cybersecurity risk, which includes the risks associated with computer

systems, networks and devices to carry out routine business operations. These systems, networks and devices employ a variety of protections

that are designed to prevent cyberattacks. Despite the various cyber protections utilized by the Fund, the Adviser, and other service

providers, their systems, networks, or devices could potentially be breached. The Fund, its shareholders, and the Adviser could be negatively

impacted as a result of a cybersecurity breach. The Fund cannot control the cybersecurity plans and systems put in place by service providers

or any other third parties whose operations may affect the Fund.

Foreign Investment Risk: Investing

in non-U.S. issuers may involve unique risks such as currency, political, and economic risks, as well as lower market liquidity, generally

greater market volatility and less complete financial information than for U.S. issuers.

Mid-Cap Company Risk: Mid-Cap companies often are

newer or less established companies than larger companies. Investments in mid-cap companies carry additional risks because earnings of

these companies tend to be less predictable; they often have limited product lines, markets, distribution channels or financial resources;

and the management of such companies may be dependent upon one or a few key people. The market movements of equity securities of mid-cap

companies may be more abrupt or erratic than the market movements of equity securities of larger, more established companies or the stock

market in general.

Financial Leverage Risk: The Fund is authorized

to utilize leverage through the issuance of preferred shares and/ or the Fund may borrow or issue debt securities for financial leveraging

purposes and for temporary purposes such as settlement of transactions. Although the use of any financial leverage by the Fund may create

an opportunity for increased net income, gains and capital appreciation for common shares, it also results in additional risks and can

magnify the effect of any losses. If the income and gains earned on securities purchased with financial leverage proceeds are greater

than the cost of financial leverage, the Fund’s return will be greater than if financial leverage had not been used. Conversely,

if the income or gain from the securities purchased with such proceeds does not cover the cost of financial leverage, the return to the

Fund will be less than if financial leverage had not been used. Financial leverage also increases the likelihood of greater volatility

of the NAV and market price of, and dividends on, the common shares than a comparable portfolio without leverage.

U.S. and international markets have experienced and may

continue to experience significant periods of volatility in recent years and months due to a number of economic, political and global

macro factors including rising inflation, uncertainty regarding central banks’ interest rate increases, the possibility of a national

or global recession, trade tensions, political events, the war between Russia and Ukraine and the impact of the coronavirus (COVID-19)

global pandemic. As a result of continuing political tensions and armed conflicts, including the war between Ukraine and Russia, the U.S.

and the European Union imposed sanctions on certain Russian individuals and companies, including certain financial institutions, and have

limited certain exports and imports to and from Russia. These developments, as well as other events, could result in further market volatility

and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and

other markets, despite government efforts to address market disruptions.

Additional Risks: While investments in securities

have been keystones in wealth building and management, at times these investments have produced surprises. Those who enjoyed growth and

income of their investments

MCN | Madison Covered Call & Equity Strategy Fund | Notes

to the Financial Statements (unaudited) - continued | June 30, 2023

generally were rewarded for the risks they took by investing in the markets. Although the Adviser seeks to

appropriately address and manage the risks identified and disclosed to you in connection with the management of the securities in the

Fund, you should understand that the very nature of the securities markets includes the possibility that there may be additional risks

of which we are not aware. We certainly seek to identify all applicable risks and then appropriately address them, take appropriate action

to reasonably manage them and to make you aware of them so you can determine if they exceed your risk tolerance. Nevertheless, the often

volatile nature of the securities markets and the global economy in which we work suggests that the risk of the unknown is something to

consider in connection with an investment in securities. Unforeseen events could under certain circumstances produce a material loss of

the value of some or all of the securities we manage for you in the Fund.

12. SUBSEQUENT EVENTS

Management has evaluated all subsequent

events through the date the financial statements were available for issue. No events have taken place that meet the definition of a subsequent

event that requires adjustment to, or disclosure in the financial statements.

MCN | Madison Covered Call & Equity Strategy Fund | June 30,

2023

Other Information (unaudited)

ADDITIONAL INFORMATION

Notice is hereby given in accordance with Section 23(c) of the

1940 Act that from time to time, the Fund may purchase shares of its common stock in the open market at prevailing market prices.

This report is sent to shareholders of the Fund for their information.

It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or any securities mentioned

in this report.

AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULES

The funds file their complete schedule

of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form NPORT-P. Form NPORT-P is available upon

request to shareholders on the ...SEC’s website at www.sec.gov and on our website. Form NPORT-P may also be reviewed and copied

at the SEC’s Public Reference Room in Washington, DC. More information on the operation of the Public Reference Room may be obtained

by calling 1-800-SEC-0330.

PROXY VOTING POLICIES, PROCEDURES AND RECORDS

A description of the policies and procedures used by the funds

to vote proxies related to portfolio securities is available to shareholders on the funds’ website at www.madisonfunds.com. The

proxy voting records for the funds for the most recent twelve-month period ended June 30 are available to shareholders on the SEC’s

website at www.sec.gov.

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as investment company