Macerich Announces Tax Treatment of 2011 Dividends

January 17 2012 - 4:15PM

PR Newswire (US)

SANTA MONICA, Calif.,

Jan. 17, 2012 /PRNewswire/ -- The

Macerich Company (NYSE: MAC) today announced the tax treatment for

dividend distributions taxable in 2011 on its Common Stock.

The 2011 dividend of $2.05 per

share is classified for income tax purposes as follows:

The Macerich Company, Common Stock, CUSIP # 554382101

|

Record

Date

|

Payable

Date

|

Total

Distribution per Share

|

2011

Taxable Ordinary Dividends

|

2011 Total

Capital Gain Distribution

|

2011

Return of Capital

|

|

02/22/11

|

03/08/11

|

$0.50

|

$0.2073900

|

$0.0113184

|

$0.2812916

|

|

05/10/11

|

06/08/11

|

$0.50

|

$0.2073900

|

$0.0113184

|

$0.2812916

|

|

08/19/11

|

09/08/11

|

$0.50

|

$0.2073900

|

$0.0113184

|

$0.2812916

|

|

11/11/11

|

12/08/11

|

$0.55

|

$0.2281291

|

$0.0124502

|

$0.3094207

|

Macerich is a fully integrated self-managed and

self-administered real estate investment trust, which focuses on

the acquisition, leasing, management, development and redevelopment

of regional malls throughout the United

States. Macerich now owns approximately 66 million

square feet of gross leaseable area consisting primarily of

interests in 65 regional shopping centers. Additional

information about Macerich can be obtained from the Company's Web

site at www.macerich.com.

SOURCE Macerich

Copyright 2012 PR Newswire

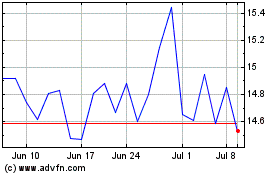

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

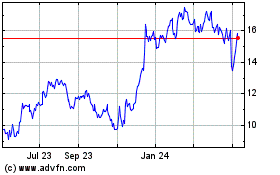

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024