Simon Opens First Outlet in SE Asia - Analyst Blog

December 05 2011 - 9:00AM

Zacks

Simon Property Group

Inc. (SPG), a leading real estate investment trust (REIT),

has recently opened its first Premium Outlet Center in South East

Asia with the inauguration of Johor Premium Outlets in Johor Bahur,

Malaysia. The Premium Outlet is a 50-50 joint venture partnership

with Genting Berhad – the investment holding and management company

of Asian conglomerate Genting Group.

Spanning 173,000 square feet of

gross leasable area (GLA) featuring 80 stores, Johor Premium

Outlets is strategically located in close proximity to Senai

Airport and the city center of Singapore and is about three hours

from Kuala Lumpur. The mall offers an unrivaled mix of leading

designer and name-brand products at significant discounts of

25-65%, and is set up in an architecturally distinct village-style

setting with charm and ambiance.

Simon Property is also reportedly

in talks with various reputed Chinese retailers to set up its

premium outlet division in China - one of the fastest growing

economic regions of the world. The growing popularity of several

European and American retailer brands in China has further made

Simon Property overtly optimistic about its success in the country

as it intends to capitalize on the increasing fervor of premium

shopping buzz spurred by an improvement in market fundamentals.

The company presently has 70

Premium Outlet Centers in its kitty across the globe, including 57

in the U.S., 8 in Japan, 2 in South Korea and 1 each in Malaysia,

Mexico and Puerto Rico. Premium Outlet Centers in the U.S. are

strategically located in close proximity to major metropolitan

markets such as New York, Los Angeles, Boston and Chicago and

visitor markets such as Orlando, Las Vegas and Palm Springs.

Simon Property is the largest

publicly traded retail real estate company in North America with

assets in almost all retail distribution channels. The company

generally enters into long-term leases with its tenants, which

insulate it from short-term market swings that have weighed on

other players in the industry.

Furthermore, Simon Property’s

international presence gives it a more sustainable long-term growth

story than its domestically focused peers. The geographic and

product diversity of the company safeguards it from market

volatility and provides a steady source of income.

We maintain our ‘Neutral’ rating on

Simon Property, which presently has a Zacks #2 Rank translating

into a short-term ‘Buy’ rating. We also have a ‘Neutral’

recommendation and a Zacks #3 Rank (short-term ‘Hold’) for

Macerich Co. (MAC), one of the competitors of

Simon Property.

MACERICH CO (MAC): Free Stock Analysis Report

SIMON PROPERTY (SPG): Free Stock Analysis Report

Zacks Investment Research

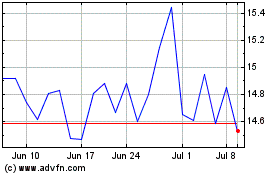

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

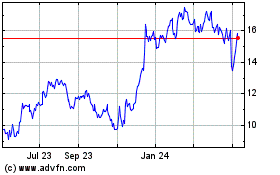

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024