Earnings Scorecard: Simon Property - Analyst Blog

November 02 2011 - 1:28PM

Zacks

Simon Property Group Inc (SPG) reported third

quarter 2011 FFO (funds from operations) of $606.2 million or $1.71

per share compared with $318.5 million or 90 cents per share in the

year-earlier quarter. The quarterly FFO exceeded the Zacks

Consensus Estimate by 4 cents.

Funds from operations, a widely used metric to gauge the

performance of REITs, is obtained after adding depreciation and

amortization and other non-cash expenses to net income.

We cover below the results of the recent earnings announcement,

as well as the subsequent analysts’ estimate revisions and the

Zacks ratings for the short and long-term outlook on the stock.

Third Quarter Review

Total revenue in the reported quarter increased to $1074.4

million from $979.3 million in the year-ago quarter. Total revenue

in the reported quarter was also ahead of the Zacks Consensus

Estimate of $1024 million.

Occupancy in the regional malls and premium outlet centers

combined portfolio stood at 93.9% at quarter end compared with

93.8% in the year-ago period – an increase of 10 basis points (bps)

year over year. Comparable sales for the combined portfolio

increased to $517 per square foot versus $473 in the prior-year

quarter.

Average rent per square foot for the combined portfolio

increased during the reported quarter to $38.87 from $37.58 in the

year-ago period.

Comparable property net operating income during the quarter for

regional malls and premium outlet centers combined portfolio

expanded 3.8%.

Earnings Estimate Revisions - Overview

The company’s earnings estimates for fiscal 2011 have moved in

both directions since the earnings release, implying that the

analysts are cautious about the current fiscal performance of the

company. Let’s dig into the earnings estimate in details.

Agreement of Estimate Revisions

In the last 7 days, 10 out of the 19 analysts covering the stock

increased their earnings estimates for the upcoming quarter and 15

out of the 19 analysts increased the same for fiscal 2011. In the

last 7 days, 3 out of 19 analysts covering the stock trimmed their

earnings estimates for the upcoming quarter and none decreased the

same for fiscal 2011.This indicates a positive directional movement

for fiscal earnings.

Magnitude of Estimate Revisions

Earnings estimates for the upcoming quarter have increased from

$1.88 per share to $1.90 per share over the last 7 days and from

$6.81 per share to $6.87 per share for fiscal 2011, which indicates

that the analysts are optimistic about the fiscal

earnings.

Moving Forward

Headquartered in Indianapolis, Indiana, Simon Property is the

largest publicly traded retail real estate company in North

America, engaged in acquiring, owning and leasing a diverse

portfolio of shopping malls. Furthermore, the company’s

international presence gives it a more sustainable long-term growth

story compared to its domestically focused peers. The geographic

and product diversity of the company insulates it from market

volatility to a great extent and provides a steady source of

income.

Simon Property generally enters into long-term leases with

companies, which insulate it from short-term market swings that

have weighed on other players in the industry.

However, the company’s properties consist primarily of community

shopping centers making its performance dependent upon general

economic conditions of the market for retail space. Excess retail

space in a number of markets and the increase in consumer purchases

through catalogs and the Internet could hurt demand for Simon

Property properties.

Simon Property currently retains a Zacks #2 Rank, which

translates into a short-term Buy rating. We are also maintaining

our long-term Neutral recommendation on the stock. One of its

competitors, Macerich Co. (MAC) holds a Zacks #3

Rank.

MACERICH CO (MAC): Free Stock Analysis Report

SIMON PROPERTY (SPG): Free Stock Analysis Report

Zacks Investment Research

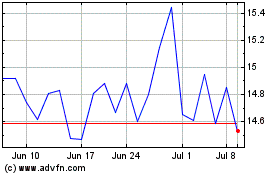

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

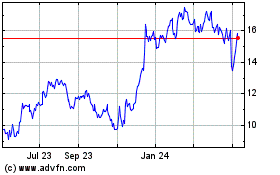

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024