LTC Properties, Inc. (NYSE: LTC), a real estate investment trust

that primarily invests in seniors housing and health care

properties, today announced operating results for its first quarter

ended March 31, 2015.

Funds from Operations (“FFO”) increased 4.5% to

$23.4 million for the 2015 first quarter, up from

$22.4 million for the comparable 2014 period. FFO per diluted

common share was $0.65 and $0.63, respectively, for the quarters

ended March 31, 2015 and 2014. Net income available to common

stockholders increased to $16.6 million, or $0.47 per diluted

share, for the 2015 first quarter, up from $16.1 million, or

$0.46 per diluted share, for the same period in 2014. The increase

in FFO and net income available to common stockholders was

primarily due to higher revenues from mortgage loan originations

and completed development projects, partially offset by higher

interest expense resulting from the sale of senior unsecured notes

and utilization of our line of credit as well as additional general

and administrative expenditures related to investment activity and

vesting of restricted stock.

During the 2015 first quarter, LTC made a preferred equity

investment in an unconsolidated joint venture that owns a 29-acre,

436-unit, three-building campus in Peoria, Arizona providing

independent, assisted living and memory care services, and a

149-unit property in Yuma, Arizona providing assisted living and

memory care services. At closing, the Company funded an initial

capital contribution of $20.1 million, and has committed to

contributing an additional $5.5 million, for a total potential

preferred equity investment of $25.6 million. LTC is entitled to

receive a 15% preferred return, a portion of which is required to

be paid in cash as a preferred, priority distribution with the

balance being deferred if the cash flow of the joint venture is

insufficient to pay the accrued preferred return in its entirety.

In addition, LTC has been granted a fair-market value purchase

option to acquire the properties owned by the joint venture

beginning in 2018.

Subsequent to the end of the quarter, LTC reached an agreement

with Prudential to amend and increase its existing private shelf

facility to $200.0 million, affording immediate access up to $102.0

million. The senior unsecured notes issued under the facility will

bear fixed interest at a spread over applicable U.S. Treasury rates

with maturities of up to 15 years from the date of issuance.

“The first quarter reflected continued progress as we executed

on our strategic initiatives,” said Wendy Simpson, LTC’s Chairman

and Chief Executive Officer. “We are successfully developing new

communities, expanding relationships with existing partners and

diversifying our asset base by property type and geography. Our new

shelf agreement will provide LTC with even greater financial

flexibility to achieve our long-term goals.”

Conference Call

Information

LTC will conduct a conference call on Friday, May 1, 2015, at

8:00 a.m. Pacific Time (11:00 a.m. Eastern Time), to provide

commentary on the Company’s performance and operating results for

the quarter ended March 31, 2015. The conference call is accessible

by telephone and the internet. Telephone access will be available

by dialing 877-510-2862 (domestically) or 412-902-4134

(internationally). To participate in the webcast, log on to LTC’s

website at www.LTCreit.com 15 minutes before the call to download

the necessary software.

An audio replay of the conference call will be available from

May 1 through May 16, 2015 and may be accessed by dialing

877-344-7529 (domestically) or 412-317-0088 (internationally) and

entering conference number 10064303. Additionally, an audio archive

will be available on the Company’s website on the “Presentations”

page of the “Investor Information” section, which is under the

“Investors” tab. The Company’s earnings release and supplemental

information package for the current period will be available on its

website on the “Press Releases” and “Presentations” pages,

respectively, of the “Investor Information” section which is under

the “Investors” tab.

About LTC

LTC is a self-administered real estate investment trust that

primarily invests in seniors housing and health care properties

through lease transactions, mortgage loans and other investments.

At March 31, 2015, LTC had 199 investments located in 29 states

comprising 98 skilled nursing properties, 93 assisted living

properties, 7 range of care properties, 1 school, 3 parcels of land

under development and 5 parcels of land held-for-use. Assisted

living properties, independent living properties, memory care

properties and combinations thereof are included in the assisted

living property type. Range of care properties consist of

properties providing skilled nursing and any combination of

assisted living, independent living and/or memory care services.

For more information on LTC Properties, Inc., visit the Company’s

website at www.LTCreit.com.

Forward Looking

Statements

This press release includes statements that are not purely

historical and are “forward looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding the Company’s expectations, beliefs,

intentions or strategies regarding the future. All statements other

than historical facts contained in this press release are forward

looking statements. These forward looking statements involve a

number of risks and uncertainties. Please see LTC’s most recent

Annual Report on Form 10-K, its subsequent Quarterly Reports on

Form 10-Q, and its other publicly available filings with the

Securities and Exchange Commission for a discussion of these and

other risks and uncertainties. All forward looking statements

included in this press release are based on information available

to the Company on the date hereof, and LTC assumes no obligation to

update such forward looking statements. Although the Company’s

management believes that the assumptions and expectations reflected

in such forward looking statements are reasonable, no assurance can

be given that such expectations will prove to have been correct.

The actual results achieved by the Company may differ materially

from any forward looking statements due to the risks and

uncertainties of such statements.

LTC PROPERTIES, INC.

CONSOLIDATED STATEMENTS OF

INCOME

(amounts in thousands, except per share

amounts)

Three Months EndedMarch 31,

2015 2014 (unaudited) Revenues: Rental income

$ 26,678 $ 25,252 Interest income from mortgage loans 4,607 4,093

Interest and other income 195 93 Total

revenues 31,480 29,438 Expenses:

Interest expense 3,766 3,187 Depreciation and amortization 6,779

6,298 General and administrative expenses 3,499

2,949 Total expenses 14,044

12,434 Operating income 17,436 17,004 Income

from unconsolidated joint ventures 116 —

Net income 17,552 17,004 Income allocated to

participating securities (123 ) (103 ) Income allocated to

preferred stockholders (818 ) (818 ) Net income

available to common stockholders $ 16,611 $ 16,083

Earnings per common share:

Basic $ 0.47 $ 0.47 Diluted $ 0.47 $ 0.46

Weighted average shares used to

calculate earnings per common share:

Basic 35,277 34,586 Diluted

37,292 36,611 Dividends declared and

paid per common share $ 0.51 $ 0.51

Supplemental Reporting

Measures

FFO, adjusted FFO (“AFFO”), and Funds Available for Distribution

(“FAD”) are supplemental measures of a real estate investment

trust’s (“REIT”) financial performance that are not defined by U.S.

generally accepted accounting principles (“GAAP”). Investors,

analysts and the Company use FFO, AFFO and FAD as supplemental

measures of operating performance. The Company believes FFO, AFFO

and FAD are helpful in evaluating the operating performance of a

REIT. Real estate values historically rise and fall with market

conditions, but cost accounting for real estate assets in

accordance with U.S. GAAP assumes that the value of real estate

assets diminishes predictably over time. We believe that by

excluding the effect of historical cost depreciation, which may be

of limited relevance in evaluating current performance, FFO, AFFO

and FAD facilitate like comparisons of operating performance

between periods.

FFO, as defined by the National Association of Real Estate

Investment Trusts (“NAREIT”), means net income available to common

stockholders (computed in accordance with U.S. GAAP) excluding

gains or losses on the sale of real estate and impairment

write-downs of depreciable real estate, plus real estate

depreciation and amortization, and after adjustments for

unconsolidated partnerships and joint ventures. The Company’s

computation of FFO may not be comparable to FFO reported by other

REITs that do not define the term in accordance with the current

NAREIT definition or have a different interpretation of the current

NAREIT definition from that of the Company; therefore, caution

should be exercised when comparing our Company’s FFO to that of

other REITs.

We define AFFO as FFO excluding the effects of straight-line

rent, amortization of lease inducement and effects of effective

interest income. U.S. GAAP requires rental revenues related to

non-contingent leases that contain specified rental increases over

the life of the lease to be recognized evenly over the life of the

lease. This method results in rental income in the early years of a

lease that is higher than actual cash received, creating a

straight-line rent receivable asset included in our consolidated

balance sheet. At some point during the lease, depending on its

terms, cash rent payments exceed the straight-line rent which

results in the straight-line rent receivable asset decreasing to

zero over the remainder of the lease term. Effective interest

method, as required by U.S. GAAP, is a technique for calculating

the actual interest rate for the term of a mortgage loan based on

the initial origination value. Similar to the accounting

methodology of straight-line rent, the actual interest rate is

higher than the stated interest rate in the early years of the

mortgage loan thus creating an effective interest receivable asset

included in the interest receivable line item in our consolidated

balance sheet and reduces down to zero when, at some point during

the mortgage loan, the stated interest rate is higher than the

actual interest rate. By excluding the non-cash portion of

straight-line rental revenue, amortization of lease inducement and

non-cash portion of effective interest income, investors, analysts

and our management can compare AFFO between periods.

We define FAD as AFFO excluding the effects of non-cash

compensation charges, capitalized interest and non-cash interest

charges. FAD is useful in analyzing the portion of cash flow that

is available for distribution to stockholders. Investors, analysts

and the Company utilize FAD as an indicator of common dividend

potential. The FAD payout ratio, which represents annual

distributions to common shareholders expressed as a percentage of

FAD, facilitates the comparison of dividend coverage between

REITs.

While the Company uses FFO, AFFO and FAD as supplemental

performance measures of our cash flow generated by operations and

cash available for distribution to stockholders, such measures are

not representative of cash generated from operating activities in

accordance with U.S. GAAP, and are not necessarily indicative of

cash available to fund cash needs and should not be considered an

alternative to net income available to common stockholders.

Reconciliation of FFO, AFFO and

FAD

The following table reconciles each of net income, FFO available

to common stockholders, as well as AFFO and FAD (unaudited, amounts

in thousands, except per share amounts):

Three Months EndedMarch 31,

2015 2014 Net income available to common

stockholders $ 16,611 $ 16,083 Add: Depreciation and amortization

6,779 6,298 FFO available to common

stockholders 23,390 22,381 Less: Non-cash rental income, net

(1,923 ) (474 ) (Less) add: Non-cash effective interest income (551

) 20 Less: Non-cash deferred investment from unconsolidated joint

venture (77 ) — Adjusted FFO (AFFO) 20,839

21,927 Add: Non-cash compensation charges 982 666 Add:

Non-cash interest related to earn-out liabilities 54 — Less:

Capitalized interest (147 ) (307 ) Funds available

for distribution (FAD) $ 21,728 $ 22,286

Basic FFO

available to common stockholders per share $ 0.66 $ 0.65

Diluted FFO available to common stockholders per share $

0.65 $ 0.63 Diluted FFO available to common

stockholders $ 24,331 $ 23,302 Weighted average

shares used to calculate diluted FFO per share available to common

stockholders 37,529 36,806

Basic AFFO per share $

0.59 $ 0.63 Diluted AFFO per share $ 0.58 $

0.62 Diluted AFFO $ 21,780 $ 22,848

Weighted average shares used to calculate diluted AFFO per share

37,529 36,806

Basic FAD per share $ 0.62 $

0.64 Diluted FAD per share $ 0.60 $ 0.63

Diluted FAD $ 22,669 $ 23,207 Weighted average

shares used to calculate diluted FAD per share 37,529

36,806

LTC PROPERTIES, INC.

CONSOLIDATED BALANCE SHEETS

(amounts in thousands, except per

share)

March 31, 2015

December 31, 2014

ASSETS (unaudited) (audited)

Investments: Land $ 83,858 $ 80,024 Buildings and improvements

899,727 869,814 Accumulated depreciation and amortization

(230,071 ) (223,315 ) Real estate properties, net 753,514

726,523

Mortgage loans receivable, net of loan

loss reserves:2015 — $1,653; 2014 — $1,673

163,647 165,656 Real estate

investments, net 917,161 892,179 Investment in unconsolidated joint

ventures 20,220 — Investments, net

937,381 892,179 Other assets: Cash and cash equivalents

3,417 25,237 Debt issue costs, net 3,561 3,782 Interest receivable

1,167 597 Straight-line rent receivable, net of allowance for

doubtfulaccounts: 2015 — $754; 2014 — $731 34,903 32,651 Prepaid

expenses and other assets 12,657 9,931 Notes receivable

2,334 1,442 Total assets $ 995,420 $

965,819

LIABILITIES Bank borrowings $ 36,500 $

— Senior unsecured notes 277,467 281,633 Accrued interest 2,472

3,556 Earn-out liabilities 3,313 3,258 Accrued expenses and other

liabilities 16,284 17,251 Total

liabilities 336,036 305,698

EQUITY Stockholders'

equity:

Preferred stock $0.01 par value; 15,000

shares authorized; shares issued andoutstanding: 2015 — 2,000; 2014

— 2,000

38,500 38,500

Common stock: $0.01 par value; 60,000

shares authorized;shares issued and outstanding: 2015 — 35,541;

2014 — 35,480

355 355 Capital in excess of par value 718,050 717,396 Cumulative

net income 872,799 855,247 Accumulated other comprehensive income

73 82 Cumulative distributions (970,393 ) (951,459 )

Total equity 659,384 660,121 Total liabilities and

equity $ 995,420 $ 965,819

LTC Properties, Inc.Wendy L. SimpsonPam Kessler805-981-8655

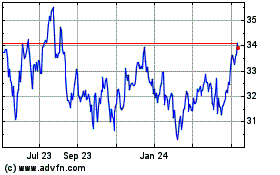

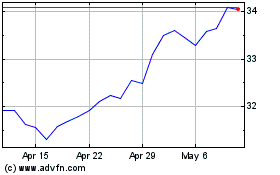

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jul 2023 to Jul 2024