LTC Properties Hikes Dividend - Analyst Blog

January 06 2012 - 9:00AM

Zacks

LTC Properties

Inc. (LTC), a healthcare real estate investment trust

(REIT), has recently increased its monthly dividend for first

quarter 2012 by about 3.6% compared to the last dividend payout in

the previous months of the earlier quarter. The common stock

dividend of 14.5 cents per share per month is payable on the last

working day of each of the respective month in the quarter.

A steady dividend payout

facilitates the long-term strategy of LTC Properties to provide

attractive risk-adjusted returns to its stockholders. Investors

looking for high dividend yields are increasingly favoring REITs

like LTC Properties. Solid dividend payouts are arguably the

biggest enticement for REIT investors as the U.S. law requires

REITs to distribute 90% of their annual taxable income in the form

of dividends to shareholders.

LTC Properties primarily invests in

long-term care and other healthcare-related properties through

mortgage loans, property lease transactions, and other investments.

The company usually leases its healthcare facilities under "triple

net" leases, under which the tenant pays all taxes, insurance, and

maintenance for the properties, in addition to rent. This insulates

the company from short-term market swings that may adversely affect

the operations of a particular facility, and provides a relatively

steady source of income.

Healthcare is also relatively

immune to the economic problems faced by office, retail and

apartment companies. Consumers will continue to spend on healthcare

while cutting out discretionary purchases. The healthcare industry

is the single largest industry in the U.S. based on Gross Domestic

Product (GDP), and an aging Baby Boomer generation’s demand for

assisted and independent living facilities should increase in the

coming years.

Consequently, healthcare REITs like

LTC Properties are well poised to benefit from the long-term

positive dynamics of the industry. We presently have a ‘Neutral’

recommendation on LTC Properties, which currently has a Zacks #3

Rank that translates into a short-term ‘Hold’ rating. We also have

a ‘Neutral’ recommendation and a Zacks #3 Rank for Health

Care REIT Inc. (HCN), one of the competitors of LTC

Properties.

HEALTH CR REIT (HCN): Free Stock Analysis Report

LTC PROPERTIES (LTC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

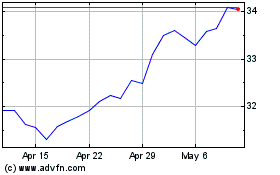

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

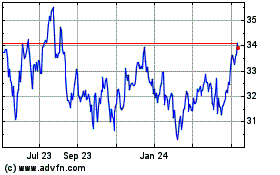

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jul 2023 to Jul 2024